Why Too Much Cash Is a Bad Idea and What You Could Do Instead

Could holding onto too much cash be doing you more harm than good? Here’s why it’s a bad idea, and what you could be doing to make it work for you.

We’re all familiar with the saying “Cash is king” – but is it, really? What if we told you that holding too much cash might actually be hurting you in the long run? While having some cash reserves is essential, especially for emergencies, sitting on mountains of cash can be a silent wealth killer.

Many people keep extra cash because it “feels” safe. But it’s an illusion. If your money isn’t growing, it’s actually shrinking in real value. Plus, unexpected expenses – medical bills, car repairs, inflation spikes – can erode your cash pile faster than you think. Smart money management means putting your excess funds in safe but productive places, not just stashing them away.

We’ll be upfront in saying that there is no fixed amount of cash that you should hold. It all depends on what you want and how you want to get there. The secret is finding the right balance between cash and other assets based on your needs, risks, and financial goals.

Most people do this (are you one of them?)

Many people unknowingly sabotage their own financial growth by holding excessive amounts of cash.

These are some common mistakes we’ve seen:

- Keeping large sums in low-interest/profit savings accounts – While savings accounts are useful for liquidity, most banks offer low-interest/profit rates that barely keep up with inflation. Over time, your purchasing power erodes, meaning your money loses value even though the number in your account stays the same or grows slightly.

- Using Fixed Deposit/Commodity Murabahah Deposit-i (FD/CMD-i) the WRONG way – Fixed Deposit/Commodity Murabahah Deposit-i (FD/CMD-i) are a reliable and low-risk way to earn steady returns, and they play a role in a balanced financial plan – when used correctly. While they offer higher rates than your typical savings account, parking your money in long-term Fixed Deposit/Commodity Murabahah Deposit-i (FD/CMD-i) won’t allow you to outpace inflation. Instead, use short-tenure Fixed Deposit/Commodity Murabahah Deposit-i (FD/CMD-i) for emergency funds or short-term goals, where stability and liquidity matter more than high returns.

- Having high-interest loans/financing that haven’t been paid off – Many people keep large cash reserves while carrying high-interest/profit debts, such as credit card balances. This doesn’t make financial sense. If you’re earning 2-3% on your savings but paying 15-18% in credit card interest/profit, you’re effectively losing money. Prioritising debt repayment/payment should come before excessive cash savings.

- Waiting for the “right time” to invest – The idea of timing the market is appealing, but in reality, it’s almost impossible to predict highs and lows consistently. Those who wait for the ‘perfect’ time often miss out on compounding growth.

- Holding an emergency fund equivalent to 2-3 years’ worth of expenses – While an emergency fund is important, holding too much cash is a missed opportunity. Most financial advisors recommend 3–6 months of expenses for young professionals and up to 12 months for those closer to retirement. Excess cash beyond that should be invested in assets that generate returns.

- Spending on depreciating assets like cars – Many people prioritise buying expensive cars, forgetting that vehicles lose value the moment they leave the showroom. Instead of tying up cash in a rapidly depreciating asset, consider balancing your spending with investments in appreciating assets like stocks or real estate.

- Saving cash for retirement but not building income-generating assets – If you rely solely on cash savings for retirement, you risk running out of money due to inflation. Instead, investing in dividend-paying stocks, bonds/sukuk, or real estate can provide income streams that keep up with or exceed inflation.

- Inflation eats away your buying power Keeping too much cash is like watching your money shrink right in front of you – it’s robbery! Imagine you put RM10,000 under your mattress today. In 10 years, that RM10,000 will still be there (if it hasn’t gone missing), but thanks to inflation, it won’t buy you nearly as much. If inflation averages 3% per year, your money effectively loses 30% of its value in a decade. Your purchasing power is eroded. RM10,000 today is worth RM7,000 in a decade.

- You really don’t need that much cash How much is too much? To identify excess cash, it’s important to estimate how much you need in your emergency fund based on your life stage and career path:

- Business Owners: 3–6 months of operating expenses

- Salaried Professionals: 6–12 months of living expenses (considering you have financial dependents and other commitments)

- Young Adults: 3–6 months of expenses (invest aggressively, if you do not have any financial dependents)

- Retirees: 1–2 years of expenses, with the rest in low-risk income-generating assets

- Missed opportunities Leaving excess cash idle is like refusing to let your plants grow in fertile soil. You’re shooting yourself in the foot. Instead of earning you more money, it just sits there doing absolutely NOTHING. Put it to work! Investing even a portion of your cash in stocks, bonds/sukuk, or mutual funds can generate returns that outpace inflation.

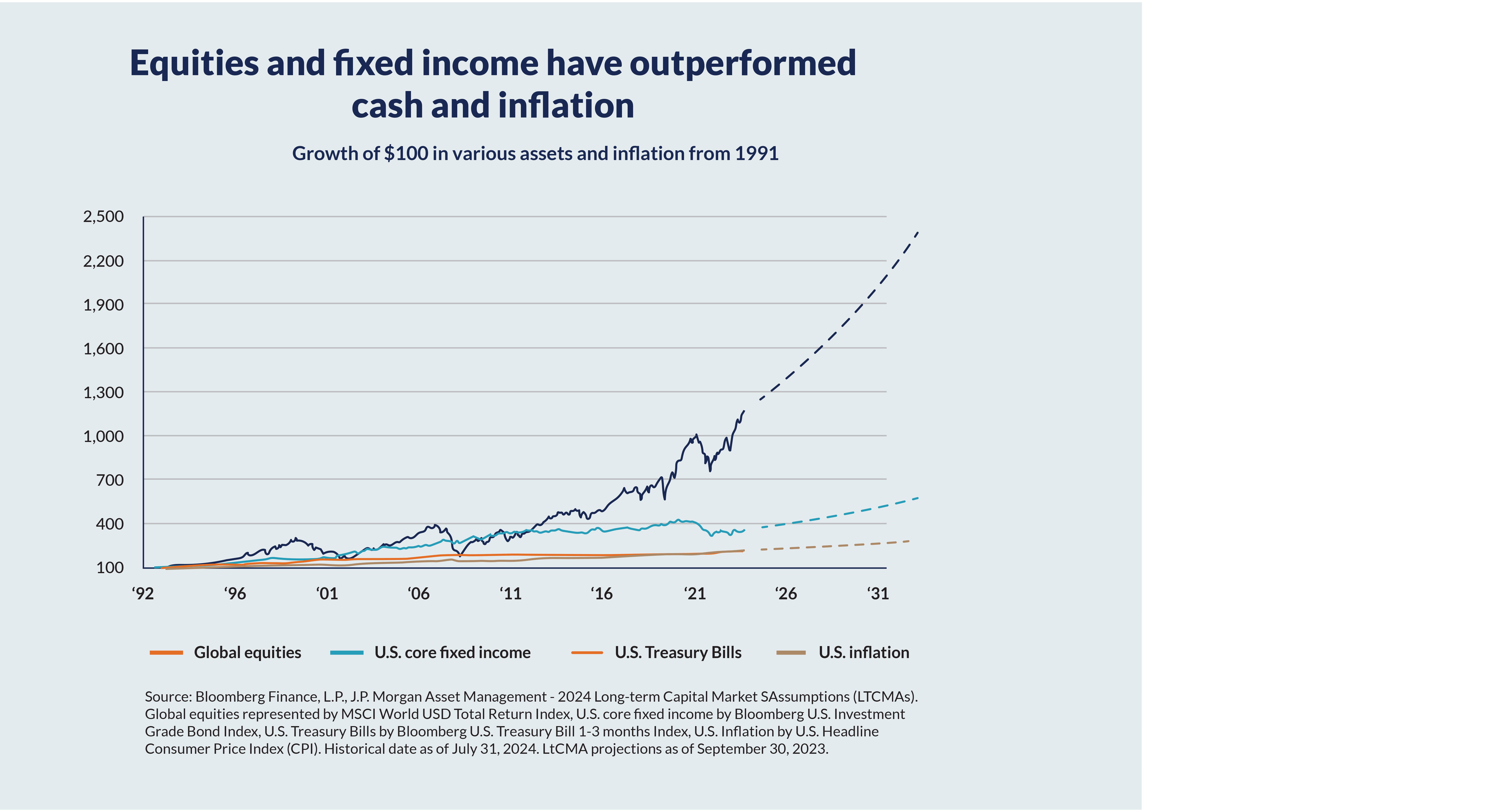

Let’s look at this example showing how equities and fixed income have outperformed cash and inflation, using an initial investment of USD100.

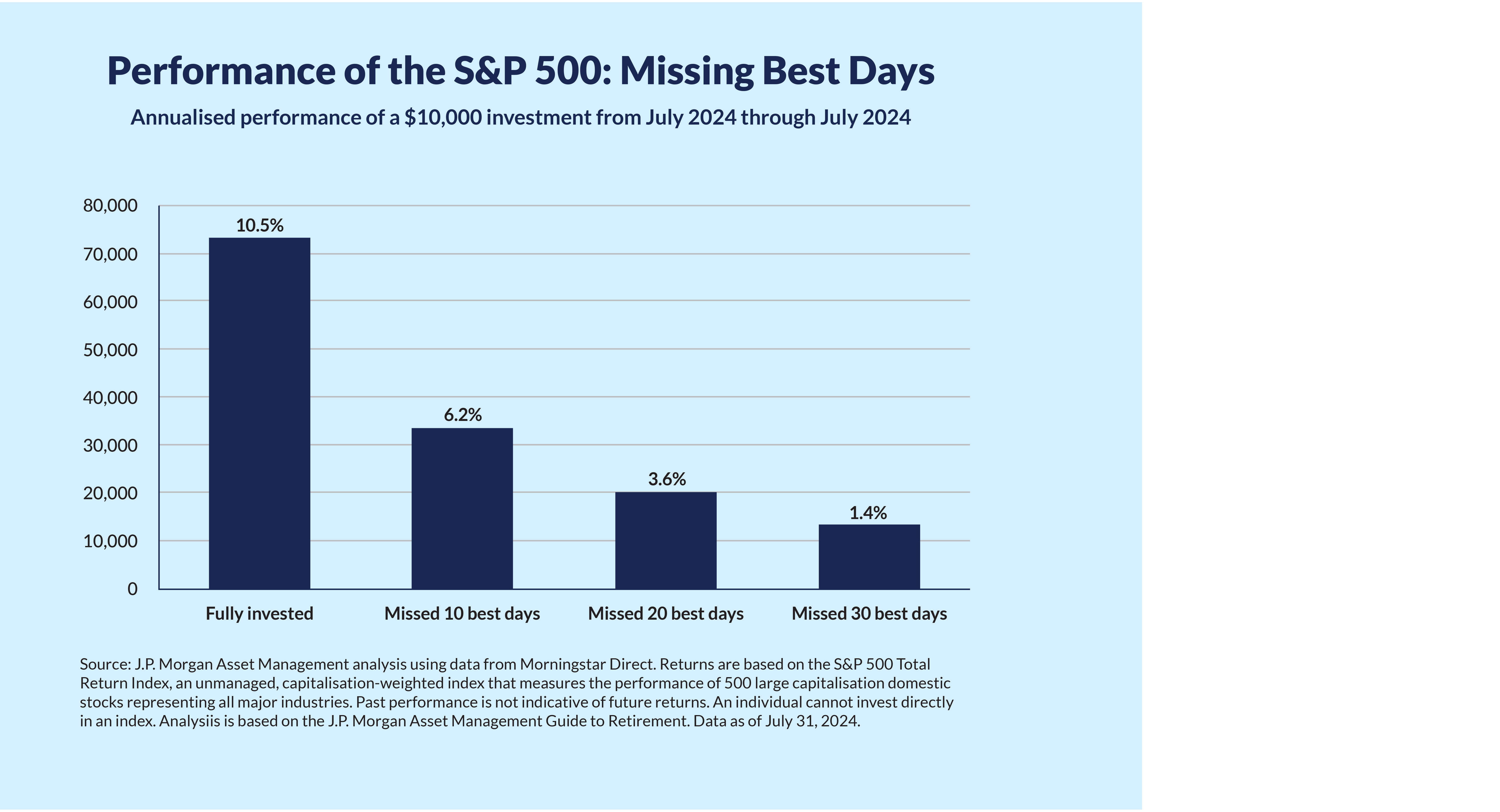

- There’s no such thing as the ‘perfect’ time to invest If we all waited for the ‘perfect’ time, we’d never invest. Small, consistent investments can grow significantly over time. Investing regularly through Dollar-Cost Averaging (DCA), regardless of market conditions, helps reduce the risk of market volatility and ensures that you don’t miss out on long-term gains. This chart shows you the importance of staying invested in the market – even during turbulent times.

- Emergency Fund: Keep 3–6 months of expenses in a high-yield savings account. This is money you can dip into only for emergencies.

- Invest Wisely: Look into high dividend stocks, ETFs, bonds/sukuk, or mutual funds for long-term growth, let’s say, between 5 – 10 years.

- Consider Term Deposits or Money Market Accounts: These give better returns than a standard savings account with minimal risk and should be part of a balanced portfolio, not all of it.

- Take Advantage of Other Currencies: Just like having a diverse portfolio, currency diversification spreads your risk. If one currency performs poorly, others may remain strong. In addition, some investments (such as unit trusts, direct bonds/sukuk, or FD/CMD-i) require you to hold a foreign currency. You’ll have direct access to these investments without needing to convert each time. RHB’s Multi Currency Account/-i allows you to hold, manage, and transact in 33 foreign currencies from a single account — making it easier to hedge against currency risks, travel, or invest internationally without constant conversions.

- Diversify: Don’t put all your eggs in one basket. A mix of assets can give you both security and growth.

The Facts: What most people don’t know

Timing the market is a game of luck, it’s just not worth it. Instead of waiting for the perfect time, consider starting with value-appreciating assets. These assets have the potential to generate wealth through capital gains, dividends, or even rental income. Unit trust (UT) funds that invest in real estate investment trusts (REITs) can be a good alternative to directly purchasing property, as they allow you to gain exposure to real estate without the risks and hassles of ownership.

For those looking for relatively lower-risk investments beyond stocks or entrepreneurship, structured investments, bonds/sukuk, and unit trusts can provide stable returns with little effort. Businesses, too, can benefit from diversification by investing in bonds/sukuk, money market funds, or fixed/term income instruments rather than solely relying on cash reserves. Additionally, exploring bundle campaigns like Unit Trust & Fixed Deposit/Commodity Murabahah Deposit-i (UTFD/CMD-i)* can help combine savings with investment benefits for a more balanced approach to wealth growth.

What you should do instead

Here’s a better way to handle your money, and these tips should be part of your strategic approach.

The key to financial security isn’t hoarding cash but striking a balance—maintaining enough cash for short-term needs while investing for long-term growth. By avoiding common pitfalls and making smart investment choices, you can ensure your money works for you, not against you. Think of your money as a football team you are managing —some players (cash) are there for defence (emergencies), but the rest should be playing offence (investments) to win the game of financial growth. Don’t let excessive cash holdings limit your wealth— contact your Relationship Manager to start breaking the cash barrier today!

*Terms & Conditions apply.

RHB Deposit Account/-i and RHB Multi Currency Account/-i are protected by Perbadanan Insurans Deposit Malaysia (PIDM) up to RM250,000 for each depositor. RHB Multi Currency Account Gold Investment and Multi Currency Account Silver Investment are not protected by PIDM. Member of PIDM.

Disclaimer:

This article has been prepared by RHB and is solely for your information only. This article is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party, without obtaining prior permission of RHB Bank/RHB Islamic Bank Berhad (“RHB”). In preparing this presentation, RHB has relied upon and assumed the accuracy and completeness of all information available from public sources or which was otherwise reviewed by RHB. Accordingly, whilst we have taken all reasonable care to ensure that the information contained in this presentation is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness and make no representation or warranty (whether expressed or implied) and accept no responsibility or liability for its accuracy or completeness. You should not act on the information contained in this article without first independently verifying its contents.

Any opinion, management forecast or estimate contained in this article is based on information available as the date of this article and are subject to change without notice. It does not constitute an offer or solicitation to deal in units of any RHB fund and does not have regard to the specific investment objectives, financial situation or the particular needs of any specific person who may receive this. Investors may wish to seek advice from a financial adviser/unit trust consultant before purchasing units of any funds. In the event that the investor chooses not to seek advice from a financial adviser/unit trust consultant, he should consider whether the fund in question is suitable for him. Past performance of the fund or the manager, and any economic and market trends or forecast, are not necessarily indicative of the future or likely performance of the fund or the manager. Investors are advised to read and understand content of the relevant documents including but not limited to prospectus or information memorandum that has been registered with Securities Commission and Product Highlight Sheet before investing. Investors should also consider all fees and charges involved before investing. Prices of units and income distribution, if any, may go down as well as up; where past performance is no guarantee of future performance. Units will be issued upon receipt of the registration form referred to and accompanying the Prospectus. The printed copy of prospectus and Product Highlight Sheet is available at RHB branches/Premier Centre and investors have the right to request for a Product Highlight Sheet.

This article has not been reviewed by the Securities Commission Malaysia (SC).

RHB Bank Berhad 196501000373 (6171-M) | RHB Islamic Bank Berhad 200501003283 (680329-V)