The best investment you can make is in yourself

Forget chasing the next hot stock. Forget trying to outsmart the market. The smartest investment right now, especially in a world of burnout, is yourself.

You’ve been taught to grow your net worth with stocks, property…but how often do you think about your self-worth? We’re not talking about the Instagram kind, but the kind that compounds over time, shapes our income, resilience, and ultimately our legacy.

If your life goal is to have freedom, purpose, and options, it’s time to rethink what “returns” really mean. You are your greatest asset, and no one can take that away from you. Investing in yourself is recession-proof and risk-free. And trust us, the returns on self-investment are exponential. Tak akan rugi, as we like to say.

Here’s a little roadmap to get started on investing in yourself:

Grow Your Intellectual Capital: Build a Money Printing Mindset

Malaysians are all about working hard and saving up, but the truth is, most of us don’t have a self-growth plan.

Did you know?

Malaysians score below the global average in financial literacy (S&P Global FinLit Survey1). We tend to rely on unreliable sources like TikTok and the uncle at the kopitiam for money advice.

Make it work:

- Build your financial literacy.Know what tools will work for you. Learn to read between the lines to become a shrewd investing machine who can sniff out the bad investments and scams.

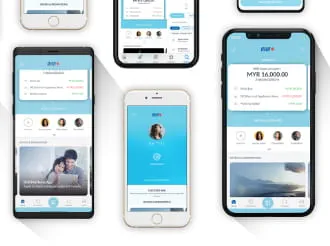

- Learn from real sources, and that does not include your friend who is “into crypto” but asks you to belanja him at the mamak. You can sign up for certified (and often subsidised) financial literacy workshops. Explore tools like MERGE by RHB (this very article you are reading), a free platform that offers practical financial tips and market insights in plain English.

- Plan ahead. No matter where you are in your financial journey, it’s always a good idea to set your goals in writing. RHB’s Goal Planner, equipped with a goal-based calculator, is a free tool designed to help you chart your path to success.

Skill Capital: The Asset That Never Depreciates

A fancy title won’t save you when industries shift, but your skillset will. Whether you’re in tech, education, sales or the gig economy, upskilling is your safety net and your growth engine.

Did you know?

Malaysia’s digital economy is projected to hit 25% of GDP by 2025, but on 19%2 of our workforce still lacks digital skills.

Make it work:

- Upskill with micro-certifications like Google, Coursera or HRDC-claimable courses. Some platforms even offer free courses to beef up your skills.

- Join freelance platforms to test new skills and develop them further, even if it’s just a side hustle. The challenge is an invaluable workout for your brain.

- Do something completely crazy and unexpected: learn to box, knit, play an instrument, or become a yoga instructor. These skills build confidence and health and could even become future income streams. And they’re fun.

Health is Wealth: Stop Ignoring Your Body

What’s the point of having buckets of money if you’re always exhausted and stressed?

Did you know?

Malaysia has one of the highest rates of diabetes3 and stress-related absenteeism4 in Southeast Asia. Both silently drain your bank account and your health.

Make it work:

- Book that check-up today — (your insurance or bank might even reward you).

- Normalise “stress buffers”. Take a break to go for a short walk or call a friend to chat. Protect your energy like you protect your cash. If your body says it’s tired, stop and listen.

- Adopt a budget for your energy. Don’t just track your ringgit, track your rest.

Build Your Personal Brand: Visibility is Value

You could be the most talented person in the room, but if no one knows what you do, you're invisible.

Did you know?

Having a polished LinkedIn profile with a clear summary and professional photo can boost job offers by 71%5, yet most Malaysians treat LinkedIn like a résumé graveyard.

Make it work:

- Start a blog to share your insights and tell it in your own voice. Authenticity is a superpower.

- Build a digital portfolio on the many free platforms available like Canva, Notion, or Carrd.

- Think of yourself as a brand. One that grows in value the more you refine and express it.

Mindset Capital: Your Inner OS

The world doesn’t need more productivity hacks — it needs better mindsets.

Did you know?

Studies in behavioural economics show that tiny shifts — like identifying as someone who “invests in life” — can radically change savings habits, motivation, and even happiness6. Change how you see yourself, and watch the world change around you.

Make it work:

- Try Kaizen: make 1% improvements every week in health, money, mindset, or skill.

- Build a “Personal Board of Advisors” comprising friends, mentors, or even your therapist, who will hold you accountable.

- Try reverse budgeting: save and invest first, then spend what’s left. It’s not sexy, but it works.

Network Capital: Who You Know Still Matters

Your next opportunity probably won’t come from a job board, but from a WhatsApp message, DM, or casual dinner.

Did you know?

In Southeast Asia, access and proximity often outweigh formal qualifications7. But many of us keep our networks strictly transactional.

Make it work:

- Host casual meetups or coffee chats. Strike up a conversation with a random person at an industry event. At the very least, you’ll make a new friend.

- Mentor someone younger. It strengthens your legacy and your reputation.

- Attend events like RHB Premier investor forums or curated succession planning sessions to meet like-minded professionals from other industries. It’s always refreshing to learn something new, and who knows, maybe you can draw some inspiration!

Final Thoughts: YOU Are the Asset

In a world where anyone can borrow money, start a business or buy stocks, the real advantage isn’t access to capital. It’s access to clarity, creativity, and community, and that only comes from conscious self-investment. Every ringgit and minute you put into becoming sharper, calmer, and stronger pays dividends for life.

Sources:

- Financial Literacy Around the World: Insights from the S&P Ratings Services Global Financial Literacy Survey (2014).

- PwC Hopes and Fears Survey (2021).

- International Journal of Environmental Research and Public Health, 2022.

- BMC Public Health, 2019.

- Statista, “How a Complete LinkedIn Profile Improves Job Prospects,” 2018.

- Behavioural economics highlights how identity-based “nudges” and subtle framing can significantly alter financial decisions, boosting long-term saving, engagement, and well-being.

- Bamboo Network and Guanxi studies highlight how personal ties often matter more than formal credentials in Southeast Asian business culture (Wikipedia, 2025).

Disclaimer:

This article has been prepared by RHB and is solely for your information only. This article is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party, without obtaining prior permission of RHB Bank/RHB Islamic Bank Berhad (“RHB”). In preparing this presentation, RHB has relied upon and assumed the accuracy and completeness of all information available from public sources or which was otherwise reviewed by RHB. Accordingly, whilst we have taken all reasonable care to ensure that the information contained in this presentation is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness and make no representation or warranty (whether expressed or implied) and accept no responsibility or liability for its accuracy or completeness. You should not act on the information contained in this article without first independently verifying its contents.