Please wait while the report is generating.

You are about to enter a third party website and RHB Banking Group's privacy policy will cease to apply.

This link is provided for your convenience only, and shall not be considered or construed as an endorsement or verification of such linked website or its contents by RHB Banking Group.

RHB Banking Group also makes no warranties as to the status of this link or information contained in the website you are about to access.

Please fill in the fields below so we can get in touch with you.

Disclaimer:

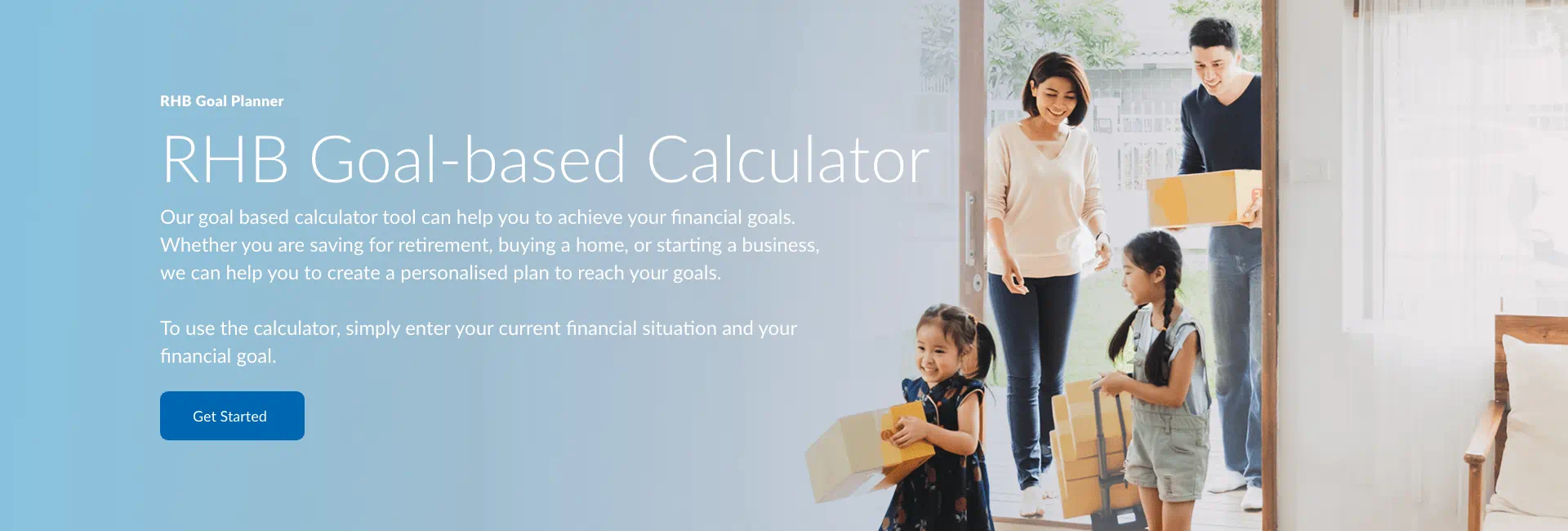

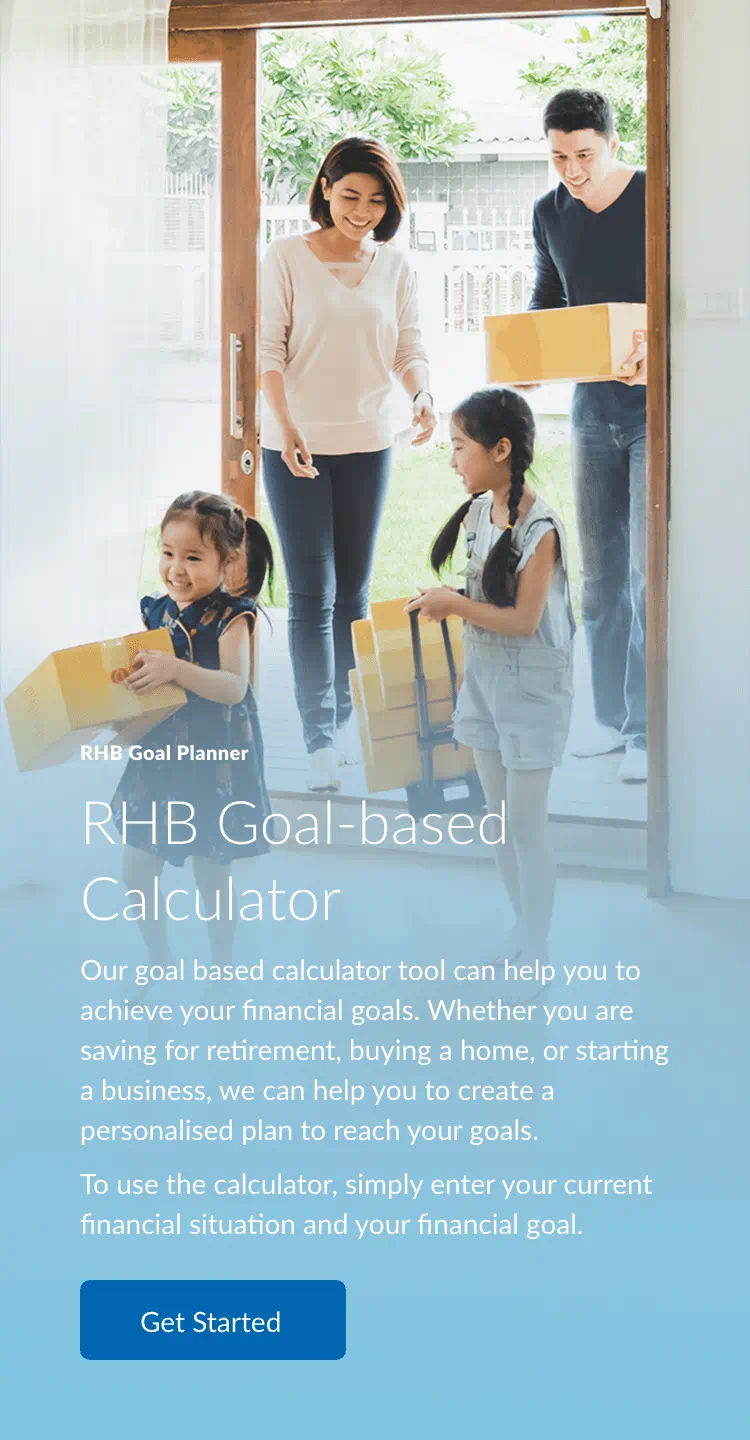

The RHB Goal Planner is for illustrative purposes only and not a

projection of what an investment may be worth. The RHB Goal Planner

does not analyze your financial position, investment objectives or

individual needs in coming up with the results. You shall not solely

rely on the goal planner to make any investment or financial

decisions.

Please consult your own professional advisors about the suitability

of any investment product/securities/instruments for your investment

objectives, financial situation and particular needs.

You are about to enter a third party website and RHB Banking Group's privacy policy will cease to apply.

This link is provided for your convenience only, and shall not be considered or construed as an endorsement or verification of such linked website or its contents by RHB Banking Group.

RHB Banking Group also makes no warranties as to the status of this link or information contained in the website you are about to access.

PIDM Membership Representation

You are about to enter a third party website and RHB Banking Group's privacy policy will cease to apply.

This link is provided for your convenience only, and shall not be considered or construed as an endorsement or verification of such linked website or its contents by RHB Banking Group.

RHB Banking Group also makes no warranties as to the status of this link or information contained in the website you are about to access.

We used cookies to improve your experience on our website. By continuing to use our website and/or accepting this message, you agree to our use of cookies. Please refer to our Privacy Policy for more information.