Despite double whammy of COVID-19 and oil price war, opportunities abound for discerning currency investors

Why do interest rates and currencies matter?

In modern economies, interest rates and currency exchange - or foreign exchange (forex/FX) - are two of the most vital indicators of a country’s financial and economic health.

Forex is important in facilitating a country’s trade with other nations. Typically, a stronger currency leads to cheaper imports and more expensive exports for a country. On the other hand, a weaker currency leads to more expensive imports and cheaper exports. Consequently, a stronger/weaker exchange rate could improve/worsen a country’s balance of trade (difference between a nation’s exports and imports over a certain period).

This could be a double-edged sword. For example, a strong Malaysian Ringgit (MYR) could lead to less expensive imported food items. On the other hand, it could affect our exports as they become more expensive for other trading countries.

Interest rates are what borrowers pay for loans on top of the principal amount, usually indicated as a percentage of the sum borrowed. Among other factors, interest rates and exchange rates are highly correlated. Central banks use interest rates to influence inflation and exchange rates. Changes in interest rates could affect inflation and forex.

In basic terms, higher interest rates may attract more foreign capital/funds and lead to stronger exchange rates. On the flip side, lower interest rates tend to weaken forex. These are the basic reasons why interest rates and forex are important tools in a government’s management on the economy.

How does the global downtrend of interest rates impact global currencies?

The world’s real interest rates for safe and liquid assets have fluctuated close to 2% for more than a century, but dropped significantly over the past three decades. This decline has been common among advanced economies, as trends in real interest rates across countries have converged over this period.

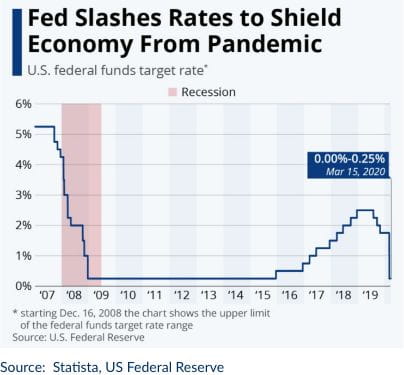

Central banks around the world have lowered interest rates to spur their respective economies. In a historic move to counter the impact of the ongoing COVID-19 pandemic on the US and global economy, on 16 March 2020 its central bank the Federal Reserve (US Fed) slashed interest rates to practically zero and announced a US$700 billion quantitative easing programme. The new rate is used as a benchmark for short term lending by financial institutions and as a peg to many consumer rates.

Fed issues emergency rate cut amid COVID-19 crisis

In quantitative easing, a central bank purchases government securities or other securities from the market to boost money supply and encourage lending and investments

The decline in the world’s real interest rates over the last few decades has been driven to a significant extent by an increase in convenience yields, which points to a growing imbalance between global demand for safety, liquidity and its supply.

The impact of interest rates will determine whether a currency remains attractive. Higher interest rates are seen as a strong proposition to hold the currency, and vice versa for lower interest rates. In the current context, currency attractiveness is based on relative value, in the sense of global growth differentials, safe haven factors and how idly it is used in international trade.'

How do interest rates impact currencies?

Central banks have often slashed interest rates to jumpstart economies. But how will these policies affect currencies? For example, if the US Fed cuts interest rates, how does it impact the market? In smaller countries like Malaysia, does a rate cut have any impact globally?

In simple terms, generally lower interest rates in the US would have two significant impacts on smaller economies such as Malaysia. Firstly, interest rate differentials. Lower interest rates in the US compared to Malaysia would make the MYR more attractive to hold. Secondly, the cost of borrowing the US Dollar (USD) becomes cheaper as it becomes a funding currency for trading and investment.

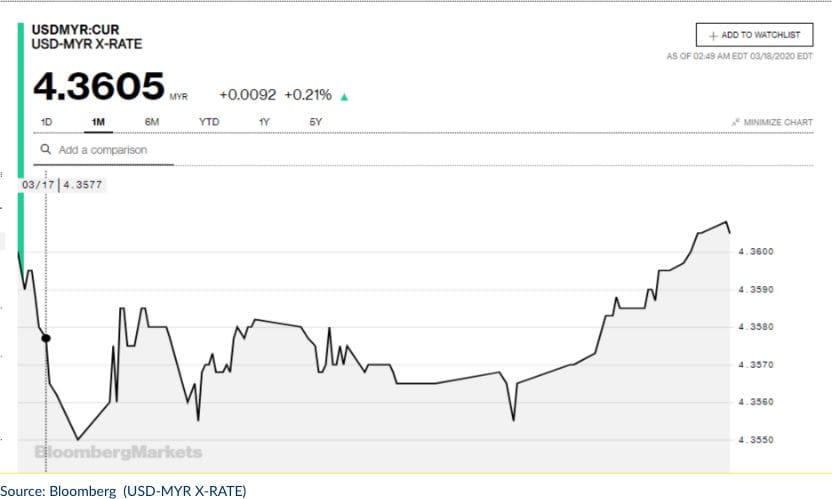

One-month MYR/USD overview

The ongoing COVID-19 pandemic has sent the global markets into a tailspin. Malaysia has not been exempted with cases and infections rising rapidly this month. On March 27, the Malaysian government announced a fiscal stimulus package worth MY250bn to cushion to negative impact expected on the country’s economy. Previously, Bank Negara Malaysia (BNM) announced a total of 50bps cut in its last two policy meetings and further Overnight Policy Rate (OPR) cuts could be in the pipeline in 2020.

How do lower/higher interest rates affect global trade?

Essentially, lower US interest rates make it cheaper for investors to borrow the USD, provided that the USD depreciates against the local currency. As of March 16 2020, the USD appreciated against the MYR to 4.30 up from around 4.14 in February. This can be attributed to the uncertain economic conditions caused by, among others, the COVID-19 pandemic and latest plunge of oil prices.

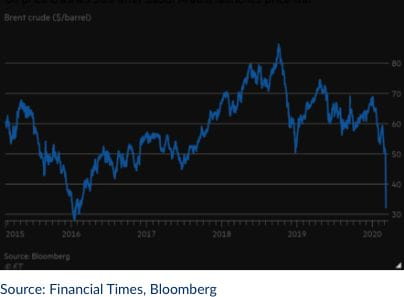

The fortunes of the MYR are often tied to the rise and fall of crude oil prices. As a major oil exporting country, the weakening of the MYR has often coincided with the fall of oil prices.

Most recently, a further plunge of oil prices has rattled the market further. On March 6, 2020, the alliance of the Organisation of the Petroleum Exporting Countries’ (OPEC+) meeting in Vienna led to Saudi Arabia and Russia disagreeing on further production cuts beyond March 31. Consequently, oil prices crashed by the highest single day decline since 1991. Combined with the COVID-19 outbreak, the latest oil price crash has dented market sentiment further.

Oil price crash 2020

Two oil giants Russia and Saudi Arabia are now involved in what is widely acknowledged as an all-out oil price war, with both parties offering price discounts and hinting at production increases that could depress oil prices further. The oil price war could have a significant impact on global oil demand in 1H2020 and beyond if it is prolonged.'

How can DCI/currency pairing help investors earn higher yields?

For dual currency investments (DCIs), it is pertinent to take into account various entry and exit levels. There are no exact high (expensive) or low (cheap) levels of entries. However, DCI investors must take into account the acceptable risk if their chosen currencies perform below expectations. That said, DCI investors earn decent returns via interest on their investments if the currencies move in their favour.

In the current FX environment, the Euro (EUR), Australian Dollar (AUD) and New Zealand Dollar (NZD) have been depreciating significantly vs USD and MYR. Therefore, it is one pair that does give decent returns if investors take opportunity of the current directional trend of depreciation of these currencies.

For investors with idle EUR, AUD or NZD funds, they can consider DCIs to convert into USD to avoid weakening of their holdings. For example, a 1 week DCI with AUD deposit and USD alternate currency, strike at spot of 0.6675 can yield up to 14.90% per annum return on the AUD amount. NZD deposit with USD alternate, at 1 week with strike at spot of 0.6393 could yield up to 16% per annum return. EUR deposit with USD alternate at 1 week with strike at spot of 1.0807 could yield up to 10% per annum. Investors looking to avoid further weakening of their EUR, AUD or NZD can take a 1 week view to convert into USD whilst obtaining more than 10% per annum deposit returns.

DCIs are summarily short term structures that allow users to obtain enhancement on their deposits, as well as potential conversions to required currencies at better rates. They are used strategically to capture short windows of opportunities.

How have COVID-19, trade wars and other recent global events affected global currencies?

The COVID-19 pandemic has induced interest rate cuts among the major global and regional central banks. Primarily, the rate cuts are meant to cushion against potential risks and impact of the outbreak on the economy with global supply chains severely impacted. This comes on the heels of a bruising US-China trade war that has prolonged market uncertainties. For currencies, two back-to-back global events have induced a rush to safe haven instruments such as the USD, Japanese Yen (JPY) and Swiss Franc (CHF). However, recent US Fed cuts have taken the wind out of the USD and provided some positives on risk-taking in emerging market currencies.

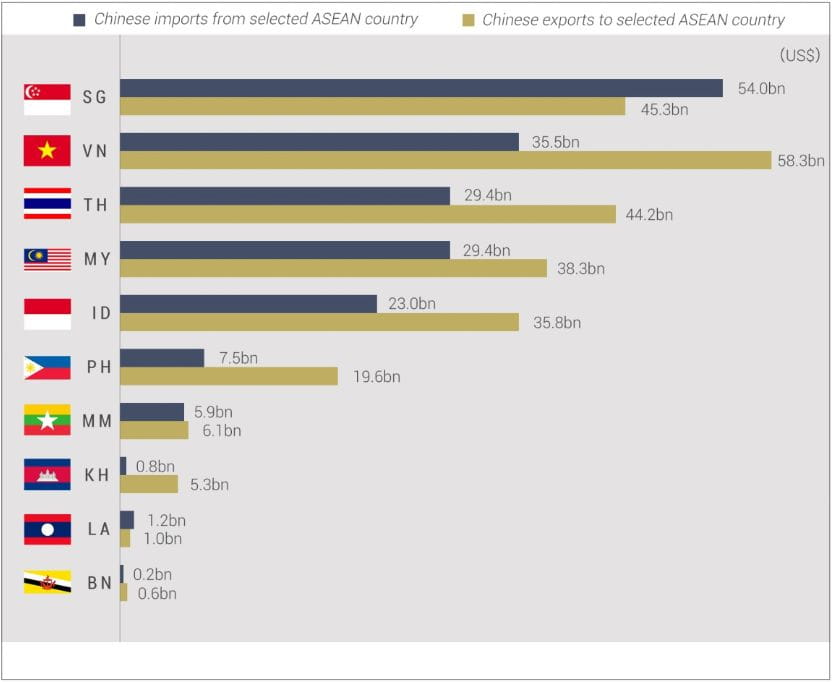

The prolonged US-China trade war has been one of the major factors for dampened market sentiment since it began in 2018. The signing of the Phase 1 trade deal between US and China in January 2020 signalled a temporary truce between the nations. This led to a strengthening of the Renminbi (RMB), as well as MYR and Singapore Dollar (SGD). These two countries are major exporters and trading partners with China.

China’s top trading partners from ASEAN (2017)

On the other hand, the bushfire crisis in Australia in January led the AUD, which is typically considered a proxy for economic growth in China, to its largest drop in 11 years.

Not surprisingly, the British Pound (GBP) rose just before it finally exited the European Union (Brexit) after a protracted negotiations and heated political referendum.

All of these show significant events involving major world economies holding some sway over currency and forex movements.

What does this mean to investors?

Investors will have to decide on their risk appetite and gauge which sectors and currencies will be the most impacted by interest rates and currency fluctuations. The COVID-19 outbreak has slowed down business activities and delayed investment plans, implying potentially further stimulus measures via monetary and fiscal policies.

Already, there is debate in among Malaysian policy makers and economists whether there should be further economic stimulus packages, on top of those announced last month.

Among the hardest hit are the travel and aviation sectors. Troubled national carrier Malaysia Airlines has cautioned that a protracted COVID-19 pandemic could lead it to bankruptcy amid plunging demand and travel bans.

The tourism sectors in the Association of Southeast Asian Nations (ASEAN) region have also suffered greatly due to travel restrictions imposed to contain the widespread of COVID-19 in countries outside China. For example, countries such as Vietnam and Thailand are very reliant on tourists from China and will feel significant economic pinch if the COVID-19 pandemic is protracted.

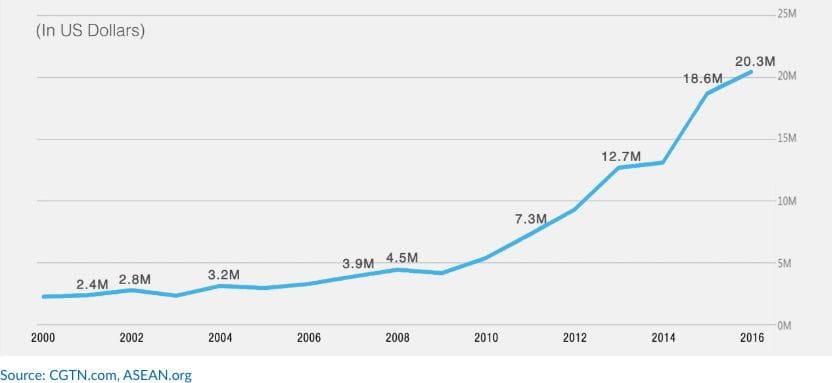

Total visits to ASEAN countries from China

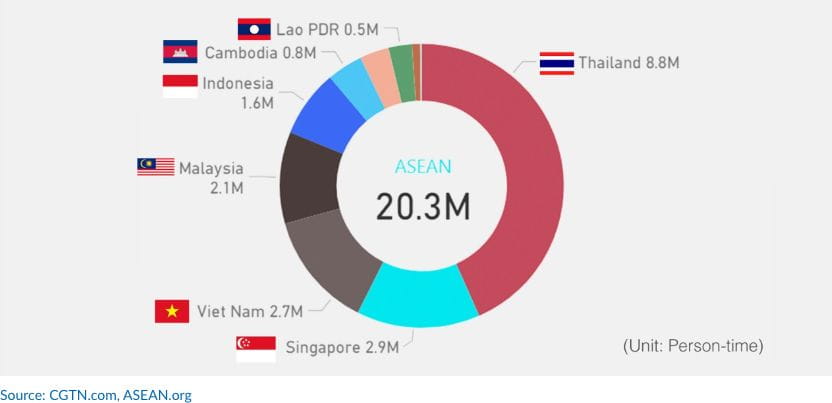

Tourism revenue accounts for 12% of Thailand’s gross domestic product (GDP) and 32% of Vietnam’s total tourist arrivals were from China in 2018. The sharp fall in Chinese visitors will also have indirect knock-on effects on the retail sector and domestic consumption.

Total visits from China to selected ASEAN countries (2016)

Clearly, dampened business sentiment will continue to weigh on investors in the short to medium term. This means that will investors have to be very selective and informed in their decision making.

How will Malaysia’s current political environment impact investments?

The uncertainty and pressure on MYR is currently very intense. We are just one month into a new federal government and there are possible policy changes down the road that could have an impact on the economy. Despite the COVID-19 outbreak, public sentiment has been restored after the brief political turmoil in February 2020 that led to the change of government and top leadership.

A major silver lining is that the COVID-19 outbreak in China has tapered off and the country is slowly returning to work and other major social/economic activities. If the pandemic is kept under control in the coming months, China could lead a global economic recovery this year.

We still believe that Malaysia’s economic fundamentals are intact. That said, there are pockets of opportunities to take advantage of such as DCIs.

DCI is a type of foreign exchange linked structured product investment. DCI is a structured product with an embedded derivative (the Reference Derivative) linked to the performance of a pair of currencies which allows an investor to enjoy potentially higher returns than traditional deposits.

For more information on DCI, contact RHB Premier today. Visit any of our premier centres or call us at 03-9206 1188.

Sources : 1 CNBC, Federal Reserve cuts rates to zero and launches massive $700 billion quantitative easing program 15 March, 2020. 2 Malaysian Reserve, Malaysia unveils RM250 billion stimulus package to counter coronavirus pandemic, 27 March, 2020. 3 The Star, Rising oil prices lift ringgit against USD, 16 May 2019. 4 CNBC, Oil jumps more than 10% one day after sharpest decline since 1991, amid hopes for continued OPEC talks, 9 March, 2020. 5 ABC, Coronavirus isn’t the only contributor to Australia’s weakening dollar, 28 February, 2020. 6 Business Insider, The pound rises as the UK bids goodbye to EU — but experts say to brace for an up to 7% drop if trade talks falter, 31 January 2020. 7 NST, Covid-19: Most of world’s airlines on verge of bankruptcy, 17 March 2020. 8 Bangkok Post, Record 38.27m tourists in 2018; 41m expected in 2019, 28 January, 2019. 9 Vietnam National Administration of Tourism, Vietnam tourism 2018 in numbers, 9 November 2019. 10 Sky News, Coronavirus: China tries to go back to work to heal illness-inflicted economy, 7 March, 2020.