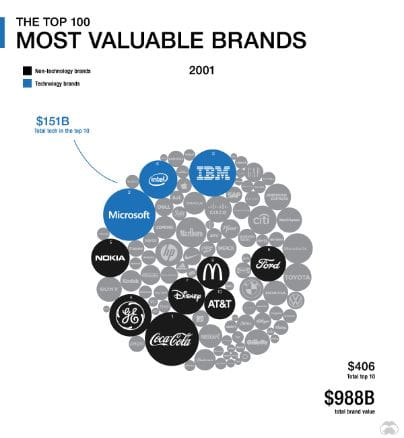

Digital has been the buzzword for the past two decades. Our world has been irrevocably changed by the introduction of new technologies which has led to the disruption of our existing way of life. This digital revolution has led to the creation of a new economy - the digital economy which is estimated to be worth USD3 trillion today.1 Tech giants like Amazon, Google and Facebook emerged out of seemingly nowhere to dominate this new world.

Most Valuable brands in 2001 vs 2019

Source : Visual Capitalist, Animation: How Tech is Eating the Brand World, 7 November 2019

Digitalisation has also become the catalyst that boosted the global gig economy, changing the nature of work. Grab, Airbnb, Foodpanda and other similar platforms now provide individuals with opportunities to work and live on their own terms. These platforms and business models rely on secure and reliable epayment systems, making financial service providers a vital part of this newly-created economy.

The opportunities unlocked by digital transformation has been one of the driving forces of the growth of the Asian economy. This is especially so in China where the Chinese government’s support of e-commerce has helped propel China’s e-commerce industry from 1% of the value of global transactions to more than 40%2. The Alibaba Group is now the world’s largest retailer and e-commerce company. China’s Singles’ Day has eclipsed both Black Friday and Cyber Monday combined as the world’s largest retail event when the Alibaba Group raked in record sales of USD38 billion in 24 hours on 11.11.20193.

In Malaysia, the digital transformation has been an engine of growth. Malaysia’s digital economy had grown at a rate of 9% p.a. between 2010 to 2016, faster than Malaysia’s overall GDP growth4 and is expected to contribute to 20% of the economy by 2020, up from 17.8% in 2015. E-commerce is growing particularly fast, and expected to exceed RM110 billion by 20205. As such the government is continuing to push digital transformation initiatives.

Recently, the government ran the eTunai initiative, where eligible Malaysians were entitled to redeem RM30 from an e-wallet app of their choice. This is to encourage the use of e-wallets amongst Malaysians. The government also began introducing cashless payment systems at government clinics. Both these initiatives are meant to help the government achieve its goal of transforming Malaysia into a cashless society. RHB Islamic Berhad is proud to have partnered with the Ministry of Health and Axiata Digital Encode Sdn Bhd to develop the e-wallet facility for government clinics.

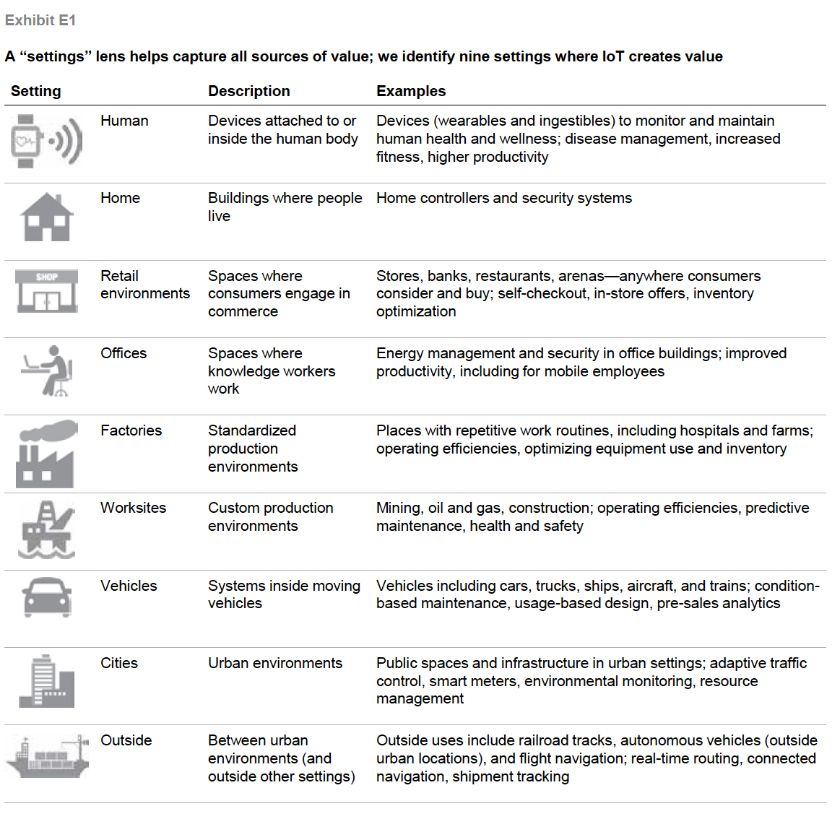

A Peek into the Future : 5G and the Internet of Things

“This wave of technology has more chance of reimagining whole swathes of the world than anything we’ve seen before.”—Tim O’Reilly, quoted in Chris Witeck, “The Internet of Things (IoT): The best is yet to come,”

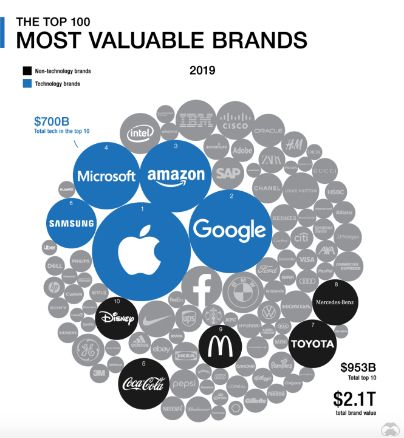

5G and the Internet of Things (IoT) are two big technology shifts that are expected to herald a new era in digital transformation and propel the world into the Fourth Industrial Revolution. Projections for the impact of IoT on the Internet and the economy are impressive. It is believed that there may be as many as 100 billion connected IoT devices and that the IoT will have a global economic impact of more than USD11 trillion by 2025.

First, what is the IoT? If you’ve ever used an app on your phone while being away on holidays to check your home CCTV feed, you’ve experienced the IoT. The IoT refers to a network of devices connected to each other via the internet. Each device is implanted with a computer chip that will enable it to connect to the internet, collect data, maybe even analyse it, and share it with other devices on the same network. All without any human intervention. Any object that can be fitted with a computer chip can become a part of the IoT. A coffee maker, a car, a thermometer or even an aeroplane. Different parts of an object can also be fitted with many small devices, such as computer chips in the different components of a jet engine.

IoT can radically change the way we live and work. Smart homes can make our lives easier and be potentially game-changing for older people and people with disabilities wanting to live independent lives. Our watches will double up as health monitors and trackers. Smart cities will help governments manage public assets, resources and services, while in business and manufacturing, all the data being collected via the IoT will help businesses improve customer service, identify new business opportunities, become more agile and improve efficiency.

The IoT is expected to really take-off with the rollout of 5G. 5G technology provides download speeds of up to 2.7 times faster than that of 4G. 5G will be able to send data to and from as many as a million devices per square kilometre, compared to 100,000 devices per square kilometre using today’s 4G networks6. It will have the capacity to process all the data and information being gathered by the billions of devices that make up the IoT. Experts believe that 5G isn’t just a network, it will become the underlying fabric of an ecosystem of fully connected intelligent sensors and devices.

Of course with the tremendous advantages of IoT and 5G, there are also some serious concerns. In a world that is still grappling with cybersecurity and data privacy, the rollout of 5G and the rise of IoT only adds fuel to the fire. The introduction of billions of new devices to the internet provides more points of entry for cyber attacks. It’s very possible the internet, and the world, can be brought to its knees because someone managed to hack into a toaster. Another area of great concern is privacy. A lot of data will be collected on the IoT. Data collection in smart cities, healthcare and smart homes raises the concern for the potential of increased surveillance and tracking

IoT is the future. But whether it can reach its full potential will depend on whether users can trust the security of IoT devices or not, and if we can trust that our privacy rights will be protected. We will have to find a way to maximise the benefits of IoT while minimising its risks to reap the benefits of IoT for humankind.

Applications for IoT

Source : McKinsey Global Institute, The Internet of Things : Mapping the Value Beyond the Hype, June 2015

Source : ZDNet, Is 5G the Missing Link for Autonomous Vehicles, Smart Cities, and a Brave New World?, 26 February 2018

Most Valuable brands in 2001 vs 2019

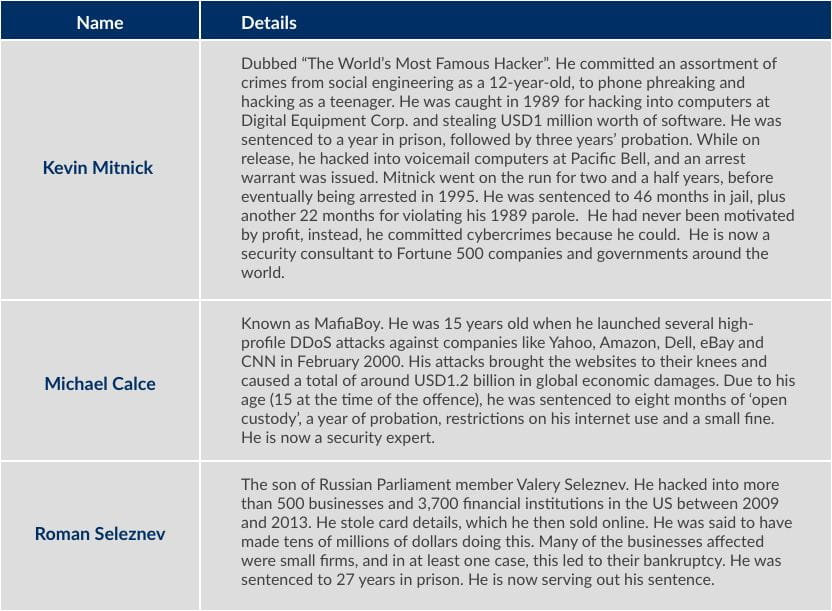

Cybercrimes have their roots in telecommunications and began with phone phreaking, which peaked in the 1970s. It has also evolved with technology, becoming more and more sophisticated.

Source : TMB, 5 Notorious Cyber Criminals Who got Caught by the Law, 9 April 2018

The Future of Cybersecurity

Cybercrime is a very lucrative business, as such, we can expect cybercriminals to continue to target organisations, especially financial institutions, using ever more sophisticated methods. We can also expect cybersecurity to be further complicated by the Internet of Things. Policymakers and organisations will need to search for the right measures to contain these threats. For financial institutions, the answer seems to lie in AI and analytic technologies, which can help organisations identify critical threats accurately, and respond more quickly to attacks.11 Regulators are also turning to technology in an effort to stay ahead of the curve. They are adopting a wide range of data gathering and analytical tools so that they can predict and anticipate potential problems instead of reactively regulating after major attacks occur12.

Here at RHB Bank, we take the security of your private data very seriously and have data protection measures in place to safeguard the personal information of our customers. RHB deploys multiple levels of firewalls in between our internal systems and the internet. The confidentiality of your information and transaction is ensured by a 128-bit Secure Socket Layer (SSL) encryption system. We only allow logins using valid user names and passwords and our system will automatically log you out of your Internet Banking session when inactivity is detected. We are continually looking into new technologies to further protect our customers’ data.

One of the new technologies we are adopting is the Motion Code technology for credit cards. This technology is used for the RHB Rewards Motion CodeTM Credit Card/-I, a credit card that is fitted with a mini e-ink screen that displays the Dynamic CVV security code. This code will automatically refresh every 4 hours, powered by a tiny battery within the card. It replaces the traditional static 3-digit CVV at the back of your card. With Dynamic CVV, you can shop and make payments online in peace, knowing that in the event your card is stolen, the card information becomes obsolete within 4 hours. This is one of the new offerings and solutions that RHB Bank is bringing to customers as part of its vision to be a digital-centric financial institution by 2022.

So, is Digital Transformation a Blessing or a Curse?

On the balance of things, digital transformation is a blessing. It creates value for the economy, and the digital economy offers opportunities for everyone, from the single individual to the mammoth corporation. The Internet of Things is expected to improve our quality of life on many different levels, despite the challenges it poses to cybersecurity and our privacy. We need to embrace digital transformation, while taking steps to mitigate some of the expected problems that come with it.

Sources : 1MDeC, About MDeC -What is the Digital Economy, 2019 2Skillsoft Blog, The Global Impact of Digital Transformation in Asia, 18 December 2018 3Techradar, Singles’ Day Officially Bigger than Black Friday and Cyber Monday Combined, 3 December 2019 4Ministry of Finance, Speech by YB Lim Guan Eng - Unlocking the Potential of the Digital Economy, 12 April 2019 5The Edge Malaysia, My Say : Technology and Digital Economy to Drive FDI Growth in Malaysia, 26 January 2020 6McKinsey Global Institute, By 2025, Internet of Things Applications Could have USD11 Trillion Impact, 22 July 2015 7Forbes, The 5G and IoT Revolution is Coming : Here’s What to Expect, 18 November 2019 8RHB Bank Berhad, Annual Report 2017, 27 March 2018 9The Edge Markets, Malaysian Online Consumer Value Security Above All -Experian, 23 April 2019 10Cybersecurity Ventures and Herjavec Group, Official 2019 Annual Cybercrime Report, 13 December 2018 11Stormshield, Financial Institutions and Cyber Attacks: A Cat and Mouse Game?, 9 October 2018 12PWC, Financial Services Technology 2020 and Beyond: Embracing Disruption, 2016