Avoiding tail risk: key lesson from global financial crisis

Some types of structured products based on derivatives — such as credit default swaps, collateralised debt obligations and mortgage-backed securities — had racked up a poor reputation and were blamed for causing the global financial crisis in 2008.

“However, the main criticism shall be deregulation. Banks were allowed to use deposits to invest in derivatives. The practice was later driven by greed, with the assumption that housing prices would grow indefinitely. The musical chairs stopped when the US property bubble burst, resulting in a mortgage crisis in the country, then a spillover to become a global financial crisis,” explains Tong.

He adds that investors who were heavily invested in tail-risk-embedded structured products suffered major blows to their portfolios at that point.

“Morgan Stanley has issued a warning that the bull market might be coming to an end, so we suggest investors to avoid structured investments that are exposed to tail risk or short volatilities. Products that are less correlated with mainstream assets are recommended,” he says. Morgan Stanley cited that the market has priced in the fiscal stimulus, including the tax cut, and valuation was nearing its peak.

Alternative investments range from very conservative products where the principal sum is protected upon maturity, to short-tenured and very aggressive products, through which investors could lose more than they had initially invested.

But these opportunities are not for everyone, says Tong. “It requires patience before one can reap the benefits, with some investors even holding on to an undervalued stock for many years but barely seeing any movement.

“Besides, when the overall market sentiments are negative towards a particular undervalued asset, it is not easy to take on such positions, which are against the majority, as investors tend to herd when it comes to decision-making.

“Therefore, we suggest investors to explore avenues offered by financial advisors and fund managers to capture undervalued opportunities instead of randomly betting on it,” he says.

He adds that alternative investments, such as structured products are customisable, so the tenure can range from days to years while the returns can vary.

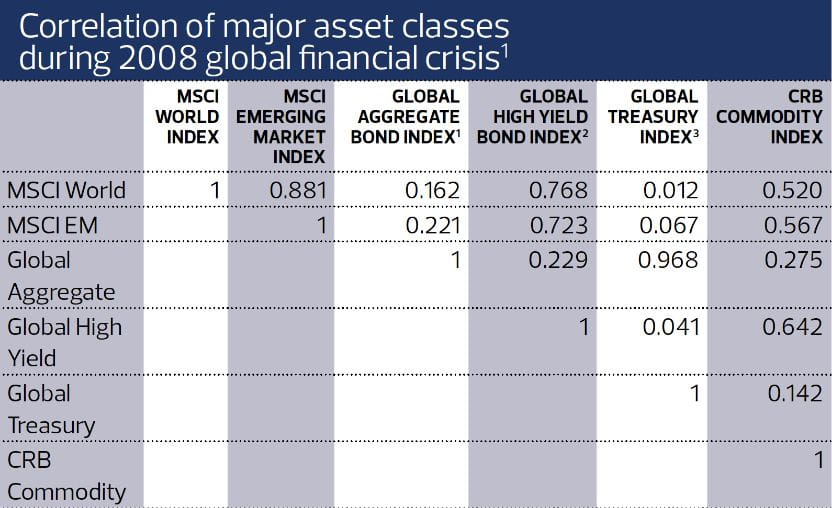

1. Correlation is calculated based on weekly return percentage, for the period between Jul 2007 – Apr 2009.

2. Bloomberg Barclays Global Aggregate Bond Index

3. Bloomberg Barclays Global High Yield Bond Index

4. Bloomberg Barclays Global Treasury Index

Illustration of alternative

Products like private equity provide access to investors to pool their money and invest in companies before their initial public offering. In general, however, private equity offerings are illiquid and carry higher risks, but also greater rewards.

Long-short funds allow investors to buy into equities that are expected to increase in value and short sell equities that are expected to lose their value.

“These strategies tend to have a low correlation with equities and bond markets, with the aim to deliver absolute returns during all market cycles,” says Tong.

“Structured products, are investments that will typically have ‘interest payment’ and ‘redemption upon maturity’. However, the amount of the payoff depends on the movement of stock prices, indices, exchange rates or future interest rates, using customisable structures. These products can provide great flexibility in terms of the payoff, tenure, and even the underlying principles but they can be complex with less liquidity,” he adds.

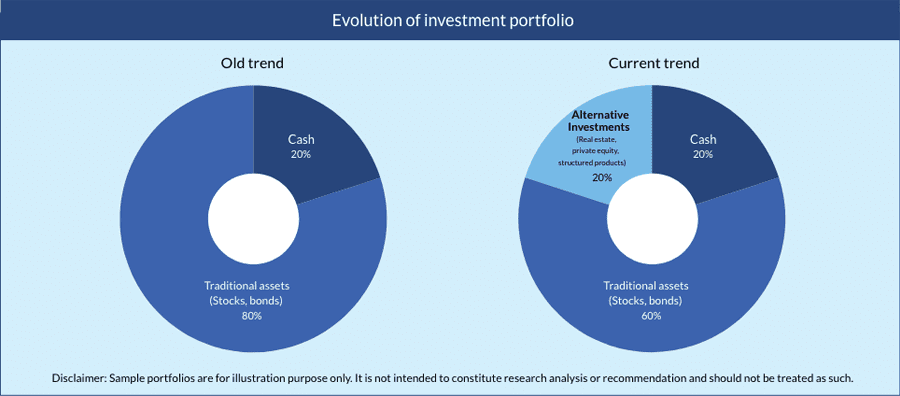

Evolution of investment portfolio

Tong points out, however, that alternative investments are becoming mainstream with more individual and institutional investors opting for diversification while most of the conventional assets closely correlated during crisis (refer to chart).

For an optimal portfolio, Tong says that one can opt to allocate up to 20% in alternative asset classes but there are no “holy grail solutions” when it comes to asset allocation. This depends on the investors’ appetite for risks and market conditions.

“Alternative investments should not form the core of one’s portfolio, but can complement the performance, especially in a volatile market,” he says.

He says that roughly 23% of alternative investments make up the composition of the global sovereign wealth funds.

“For example, on the tactical front, dual currency investments would enable one to capture some potential upside (with also downside risks) in the major currencies or even commodities like gold. “We find the euro, yen and pound sterling will have upside potential, underpinned by strong economic growth and labour markets,” he says.

On top of that, income boosters (available in the form of structured products and unit trusts) would be a good fit for investors who are trying to participate in potential market upside while aiming to protect their capital, upon maturity.

As investors have different risk appetites, RHB Wealth Management has solutions tailored for the conservative, balanced and aggressive investors.

1. For conservative investors

2. For balanced investors

3. For aggressive investors

Tong adds that the demand for alternative investments will continue to rise as this year is expected to be a turning point in the global markets with the return of manic volatility across equities, bonds and currency exchanges.

“Yet, we find opportunities in commodities, which are poised to rally further, with (crude) oil leading the pack. On the other hand, alternative investments might provide potential returns in equities, bonds or even the forex markets with relatively lower volatilities, provided that they are held until maturity,” he says.