The trade war provoked by the United States President Donald Trump is one major geopolitical event that has injected uncertainty into the markets this year. The ensuing volatility is not expected to end anytime soon as the events continue to develop, with some expecting further escalation in the near future. Adding to the existing uncertainties is the rising interest rates environment that has led to massive fund out-flows from emerging markets. Under these circumstances, investors need to understand the risks and take proper steps to protect themselves from the headwinds.

For one, investors should understand that the current risks to the market may continue to unfold and worsen. Some observers see the trade war as a black swan event that could potentially transform into a full-scale trade conflict. The targets of the trade war are some of the biggest economies of the world, and the European Union, China and Canada have all vowed to retaliate with more tariffs. The consequences of the trade war are already slowly being observed in global economies. Some industries impacted by the tariffs have voiced out the possibility of laying off workers or increasing prices to cope with the higher cost of purchasing raw materials.

According to the International Monetary Fund, the global economy could lose US$430 billion or 0.5% of the global GDP growth by 2020 if the current trade war escalates. A full-scale trade war will also lead to a currency war, with emerging markets currencies and economic growth becoming the collateral damage.

Recognising the possible damage, China has already offered to increase its imports by US$70 billion from the US. But the proposal was rejected by Trump, and he is unlikely to have any better offers that could suit his appetite going forward, according to RHB Wealth Research team. In fact, the trade war rhetoric is expected to get worse in the third quarter possibly until the end of the year, as the midterm elections in the US is expected to occur in November. Trump may play up the issue to garner support from his base for more seats in the Senate.

Another risk factor is the rising interest rates that signal the end of the quantitative easing period. The US Federal Reserve has hinted that two more rate hikes could be expected in 2018, and the European Central Bank has announced it will end its quantitative easing programme by the end of this year. But with the flattening yield curve also observed, some are concerned if this means the next recession is about to rear its head. There are several ways to view this event.

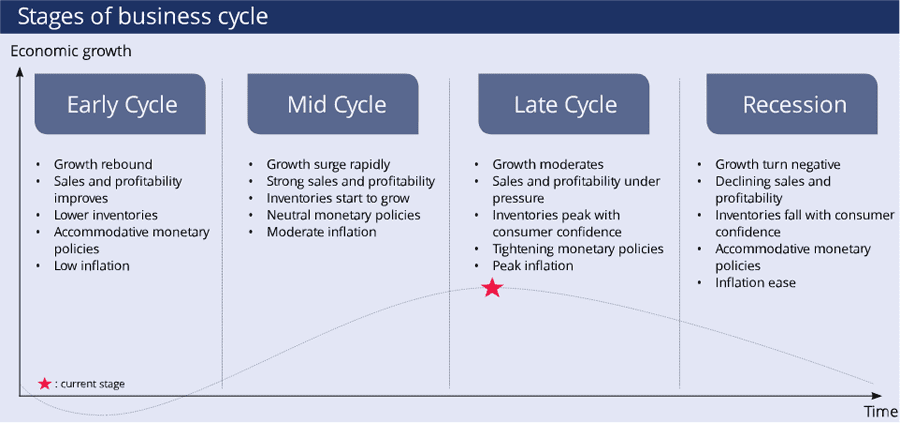

Business cycle

The Keynesian approach that looks at aggregate demand to understand business cycles would interpret that the economy is not at its late stages, according to RHB Wealth Research team. With improved fiscal spending and tax cuts, the strength of aggregate demand in the US has not shown any signs of weakness. In addition, recent retail sales growth in the US showed a year-on-year growth of 6.6% in June 2018. This is in line with a strong labour market and a historically low unemployment rate.

However, the monetarist approach believes that economic stages are driven mainly by the money supply, which is controlled by central banks. According to this view, the global economy is at the mid-to-late cycle as monetary policies are being tightened gradually. RHB Wealth Research team’s point of view is that the moderating growth and tightening monetary policies are all showing signs of being in the late economic stages, this combining with mixture of earnings reported in Quarter 2 (where some of the tech giants are reporting some disappointing figures) and higher inflation are showing signs of the late-business cycle. Therefore, the global market should be starting or about to embark its late business cycles now.

Market neutral funds

That said, the market is currently driven by fear instead of fundamentals, RHB Wealth Research team observes. When the sentiment sub-sides, the market will end higher in the second half of the year with stable growth and earnings back in the driver seat. But the current volatility should not be ignored, and investors can mitigate some of the risks by considering alternative investments that can provide potential returns regardless of market conditions. The investment instruments should have a low correlation to equities and bonds. They can also limit the potential drawdown and volatility of their portfolio by putting their money in different investment structures.

One way to do it is through market strategy oriented funds, RHB Wealth Research team suggests. Market neutral funds would be a good choice under the current situation, as this strategy has very low systematic risk. By definition, market neutral funds seek to generate consistent returns in all market environments, typically through the use of paired long and short positions. It also holds lower volatility and has a low correlation to equity and bonds.

Market neutral strategies do have some key risks, however. One is underperformance, in which its performance tends to lag behind when the equity market is rallying. There might also be leverage risk, where it might suffer more if the underlying strategy shorts a rally. There is also investment risk whereby the performance might be negative and incur a capital loss.

Be selective in volatile environment

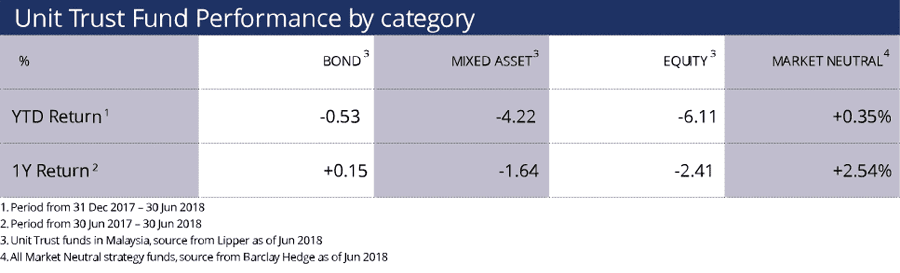

So far, volatility has been eroding returns in the market, as observed from the Malaysia All Unit Trust Fund performance, be it fixed income, equity, or a mixture of both, according to Lipper data as at June 2018. But market neutral funds in general had a more resilient perfor- mance over the past one year, according to performance data compiled by Barclay Hedge with a sample of approximately 90 funds.

In recent times, many may compare the performance of actively-managed funds to their passive peers, especially on whether the fees charged are justifiable compared to its performance. In such uncertain times, however, RHB Wealth Research team believes that actively- managed funds are a better choice.

This is because the top-quartile funds that consistently outperform its benchmark are more likely to continue outperforming going for- ward. The top fund managers are also able to tilt their positions to weather through all market conditions. For instance, they can reduce sensitivity of the funds amidst a rising interest rate environment or the escalating trade war. For funds that cover inefficient markets such as the emerging markets, fundamental analysis performed by fund managers also offers more opportunities to exploit the inefficiencies.

boosters (available in the form of structured products and unit trusts) would be a good fit for investors who are trying to participate in potential market upside while aiming to protect their capital, upon maturity.