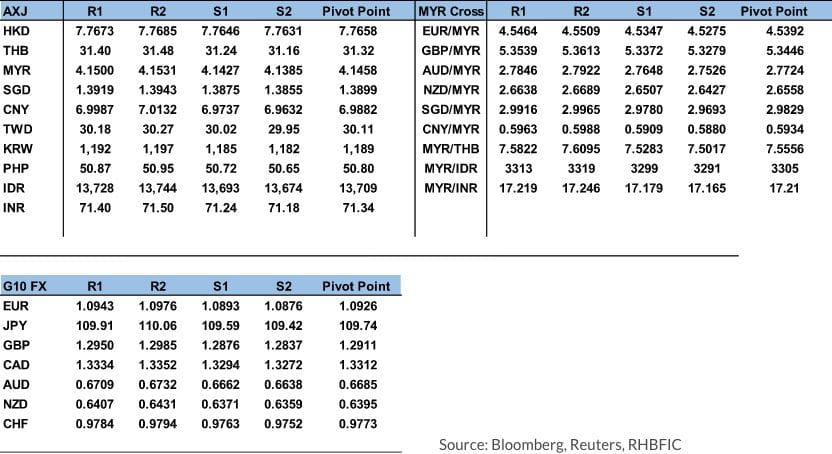

Technicals – Support, Resistance and Pivot Points

RHB GTGM Disclaimer

This report is prepared for information purposes only by RHB Group Treasury & Global Markets (“RHB GTGM”), a strategic business group of RHB Bank Berhad (“RHB Bank”).

All research is based on material compiled from data considered to be reliable at the time of writing, but RHB GTGM does not make any representation or warranty, express or implied, as to its accuracy, completeness or correctness. Neither this report, nor any opinion expressed herein, should be construed as an offer to sell or a solicitation of an offer to acquire any securities or financial instruments mentioned herein. RHB GTGM accepts no liability whatsoever for any direct or consequential loss arising from the use of this report or its contents. This report may not be reproduced, distributed or published by any recipient for any purpose without prior consent of RHB GTGM and RHB GTGM accepts no liability whatsoever for the actions of third parties in this respect.

Readers are reminded that the financial circumstances surrounding any company or any market covered in the reports may change since the time of their publication. The contents of the reports themselves are subject to change without any notification. Readers should obtain separate legal or financial advice to independently evaluate the particular investments and strategies.

RHB Bank, its affiliates and related companies, their respective directors, associates, connected parties and/or employees may own or have positions in securities or financial instruments of the company(ies) covered in this research report or any securities or financial instruments related thereto, and may from time to time add to, or dispose off, or may be materially interested in any such securities or financial instruments. Further, RHB Bank, its affiliates and related companies do and seek to do business with the company(ies) covered in this research report and may from time to time act as market maker or have assumed an underwriting commitment in securities or financial instruments of such company(ies), may sell them or buy them from customers on a principal basis and may also perform or seek to perform significant banking, advisory or underwriting services for or relating to such company(ies), as well as solicit such banking, advisory or other services from any entity mentioned in this research report.

RHB Bank and its employees and/or agents do not accept any liability, be it directly, indirectly or consequential losses, loss of profits or damages that may arise from any reliance based on this report or further communication given in relation to this report, including where such losses, loss of profits or damages are alleged to have arisen due to the contents of such report or communication being perceived as defamatory in nature.