• Asian economies reeling from the novel Coronavirus. As the death toll and number of infections rise, fears are mounting on the extent of the economic damage to China and other Asian economies. The big unknown is the outbreak’s extent and duration. Accordingly, the Ministry of Finance has floated the prospect of an economic stimulus package to address the anticipated negative economic repercussions. We expect it to have a nominal allocation of c.MYR10bn to mitigate the impact on the tourism, hospitality, aviation, gaming and consumer sectors.

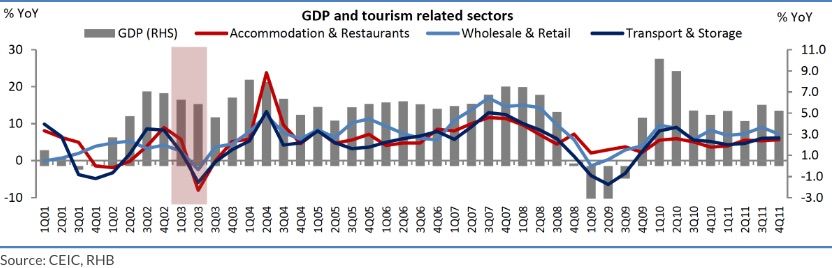

• Need antivirus measures. China’s 2020 economic growth rate could be impaired by 1 ppt, arising from the draconian containment measures in Hubei province and extended Lunar New Year shut down in other parts of the country. China is Malaysia’s largest trading partner and a significant source of foreign tourists (9M19: 12% of tourist arrivals). We pointed out in our recent economic report (Pandemic: Lessons From SARS) that Malaysia could see GDP growth shaved by 0.2 ppt if the viral outbreak becomes an extended crisis. Malaysia is highly reliant on the tourism industry, which accounts for 15.2% of GDP (2018). A decline in tourism, both domestic and international, would be most felt in the accommodation, restaurants, retail, and transport sectors. This is also where we think the focus of the Government stimulus should be aimed.

• Speed is of the essence. Judging from the SARS experience, we think it is in the Government’s interest to come up with a package of measures swiftly, not only to be proactive, but also given the speed at which consumer panic spreads, surpassing that of the virus itself. Nevertheless, the stimulus also needs to be comprehensive and effective in addressing the right targets. Already there is anecdotal evidence of a slowdown in various segments of the economy. These include lower airline passenger traffic, fewer tourists, reduced foot traffic at shopping malls and hotel booking cancellations.

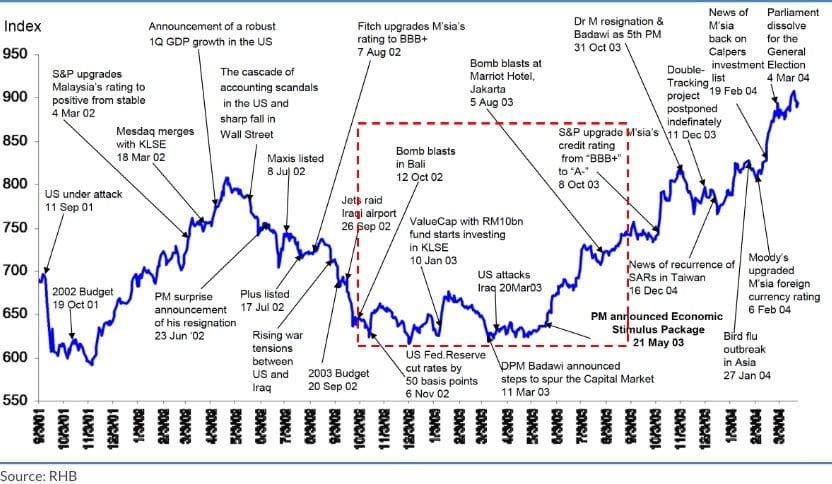

• Fiscal comparisons. In May 2003 the Government put in place a MYR7.3bn package of pro-growth measures as the SARS virus peaked in 2Q03. We think the quantum of the current stimulus ought to be bigger than in 2003 to the tune of MYR10bn after adjusting for inflation and growth of the tourism sector. We expect key initiatives to include reducing EPF contribution, targeting tax incentives, and accelerating the implementation of key infrastructure projects to achieve the maximum multiplier effect.

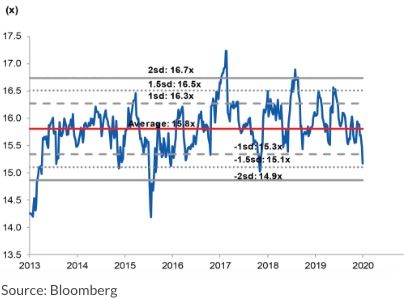

• Market friendly. The ensuing market volatility ties in with our existing strategy to trade the market and accumulate on dips on the back of our base case assumption that the outbreak will be contained and dissipated over the coming months. Note that during the SARS episode between Oct 2002 and May 2003, the FBM KLCI was range bound, with a V-shaped recovery occurring after the announcement of the 2003 economic stimulus package. Investors should look into accumulating bashed down blue chips and stocks in the gaming, construction and consumer sectors.

What the Government would end up doing is anyone’s best guess. But if history is any predictor, we could likely see a repeat of some of the measures introduced during the SARS period especially on efforts to cushion the adverse impact to the affected sectors and bring confidence back.

In addition, new measures, especially using the support of electronic and internet platforms as well as taking advantage of the Fourth Industrial Revolution could likely be introduced.

Fiscal neutral measures

i. Accelerate implementation of infrastructure projects with a short gestation period ie rural infrastructure in Sabah & Sarawak, refurbishment of old schools, and upgrading of clinics and hospitals;

ii. Temporary reduction in employee EPF contribution (in 2003, it was lowered to 9% from 11% for a year);

iii. Reduction in utility bills for hotel and restaurant operators (in 2003, 5% discount was given for hotel operators for six months)

iv. Special Relief Guarantee Facility (SRGF) a financing and credit guarantee of RM1bn under Bank Negara Malaysia (BNM), especially for working capital, provided to travel agents, hotel operators, restaurants and shopping centres;

v. Restructuring of loan packages for those who are affected by the virus as well as for retrenched workers in tourism-related sectors;

vi. Reduce levy on Human Resource Development Fund for both tourism and hotel operators;

vii. Price controls for selected drugs;

viii. Working with e-wallet companies, online shopping platforms and logistical services to promote greater online purchases.

Fiscal negative measures

i. Temporary reduction in personal and income tax rates (in 2003, Pioneer Status’ companies received 70% income tax exemption for five years);

ii. Reduction in road tax for taxis, with possible extension to e-hailing drivers (in 2003, road tax for taxis was reduced by 50%);

iii. Additional allowances for doctors and medical staff to be paid until the outlook is eradicated (in 2003 doctors were paid MYR400/month, medical staff paid MYR200/month);

iv. Partial reimbursement of business-related losses for tourism industries (ie accommodation, transport and retail);

v. Service tax exemption for hotel and restaurants;

vi. Incentives and packages for businesses to promote working from home.

Sector: Auto

Impact: Neutral

Comment: While the stimulus unlikely would have a direct impact to the sector, recovery in consumer sentiment would give a boost to discretionary spending.

Sector: Aviation

Impact: Positive

Comment: Reduction in utility bill for hotel/restaurant operators and lower levy on Human Resource Development Fund should translate into lower all-in price for hotel/restaurant. This should encourage more people to travel, hence higher demand for air travel.

Sector: Banks

Impact: Positive

Comment: Acceleration and revival of infrastructure projects would spur economic activities and improved business sentiment. This would in turn lead to a recovery in investor confidence and a pick-up in demand for credit. Measures to relieve consumers via lower income tax or EPF contributions should result in higher consumption spending. Although this would not boost lending to the household sector, namely residential mortgages or auto financing, a recovery in consumption spending would help the wholesale and retail segments. More importantly, we believe the measures would mitigate pressures on asset quality, and any significant increase in credit costs.

Sector: Basic Materials

Impact: Positive

Comment: A ramp-up in the implementation of approved infrastructure projects and/or revival of shelved projects should boost demand for building materials over the near- to medium-term.

Sector: Construction

Impact: Positive

Comment: We think the roll out of stimulus package will be able to bring forward positive news flow to the sector. Accordingly, this will shed brighter light to the sector’s recovery, which previously saw broad-based slowdown in 2019. The package also gives an added kicker, whereby the process of government approval to kick-off restored infrastructure projects, is expedited.

Sector: Consumer

Impact: Positive

Comment: Most of the measures based on past experiences have been effective in increasing disposable income hence consumer spending. The retail-based business would be prime beneficiaries from the higher discretionary spending and higher tourist arrivals.

Sector: Gaming

Impact: Positive

Comment: Both Genting Malaysia and Genting would benefit from the stimulus packages as it would lead to higher disposable income, which may see an increase in visitor arrivals. Other potential temporary measures such as service tax exemption and reduction in utilities bill for hotel and restaurants would also prevent margins from eroding, especially after the expected reduction in visitor arrivals to Resort World Genting from the novel coronavirus.

Sector: Healthcare

Impact: Neutral

Comment: The additional allowances for doctors/medical staff should affect government hospitals only. Public-listed healthcare companies should have neutral impact.

Sector: Logistics

Impact: Positive

Comment:A ramp-up in the implementation of approved infrastructure projects and/or revival of shelved projects should boost demand for building materials over the near- to medium-term.

Sector: Media

Impact: Neutral

Comment: The stimulus package would be a positive respite for the domestic economy and would further support waning consumer and business sentiments, with positive implications on advertising expenditure (adex) and the Visit Malaysia Year 2020. That said, greater structural issues afflicting the broader media sector remain a concern and could dilute the impact of the stimulus, in our view.

Sector: Non-Bank Financials

Impact: Positive

Comment: Potential stimulus package would help to safeguard and improve asset quality. Measures such as temporary reduction in EPF contribution and income taxes should lift individuals’ disposable income and improve cash flow, which would then better borrowers’ debt servicing capabilities.

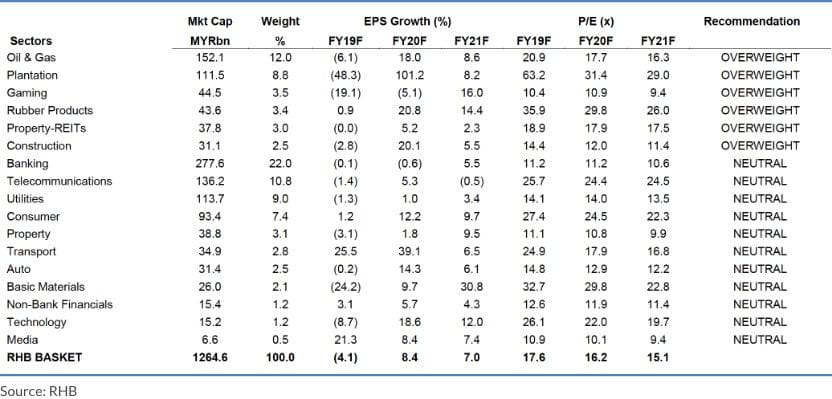

Sector: Oil & Gas

Impact: Neutral

Comment: We believe it should be a non-event towards the oil & gas sector as there are no major stimulus measures specifically related to the sector.

Sector: Plantations

Impact: Neutral

Comment: We believe it should be a non-event towards the plantation sector as there are no major stimulus measures specifically related to the sector.

Sector: Property

Impact: Neutral

Comment: The Government’s stimulus package alone is not enough to revive demand for property. Although we welcome the Government’s pump-priming effort by reviving shelved infrastructure projects and reducing income tax rates, the overall impact on the property sector should be quite muted, as the novel coronavirus fear should continue to dampen buying sentiment in the property market. Only stronger economic and income growth will drive demand for property.

Sector: REITs

Impact: Positive

Comment: Mildly positive across the board for REITs. We believe the industrial segment would benefit from the incentives put in place to encourage online retail spending as more space would be required for storage by retailers. For retail REITs, the drop in footfall possibly impacting sales numbers would be partly mitigated by the SRGF so we view this positively for the segment especially as shopping malls may start seeing negative implications of widespread fear-mongering. Hospitality REITs, believed to take the biggest hit amidst the novel coronavirus scare, would be the biggest beneficiaries in seeing its bottomline being held up, given the measures that are in place for hotel operators (utility bill reduction, service tax exemption, partial reimbursement, etc).

Sector: Rubber products

Impact: Neutral

Comment: No specific measures from the Government to affect this sector. However, we expect the demand for rubber gloves to surge in the near term due to rising healthcare awareness.

Sector: Technology

Impact: Neutral

Comment: Could be a boost to payment acquiring companies as online and e-wallet are expected to gain traction. Neutral to exporters as the stimulus package to boost local consumption and economy are not expected to have material impact on them.

Sector: Telecommunications

Impact: Neutral

Comment: The intended measures would have little direct impact on the sector given the safe haven characteristics and perceived defensiveness of the telcos’ earnings. The inclination for yield plays should benefit DiGi.Com given its superior prospective dividend yields.

Sector: Utilities

Impact: Neutral

Comment:The stimulus package could provide minimal support towards industrial and commercial electricity consumption in view of boosting economic activities. A reduction in the utilities bills of hotel and restaurant operators should have limited earnings impact to the sector as Tenaga’s earnings are largely regulated under RAB while IPPs’ earnings are also well kept by PPAs.

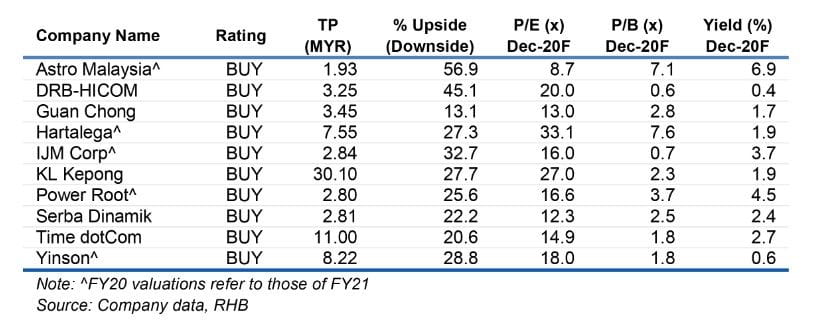

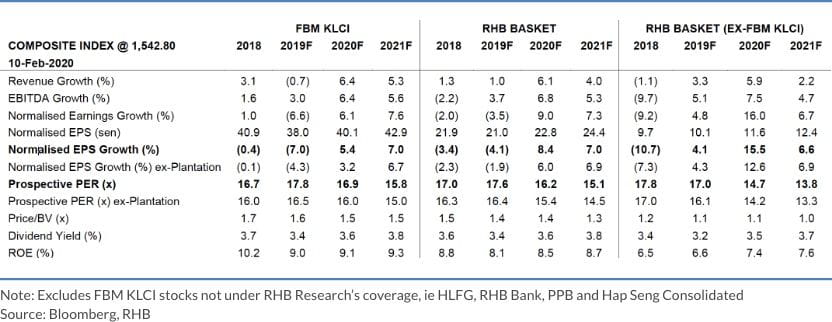

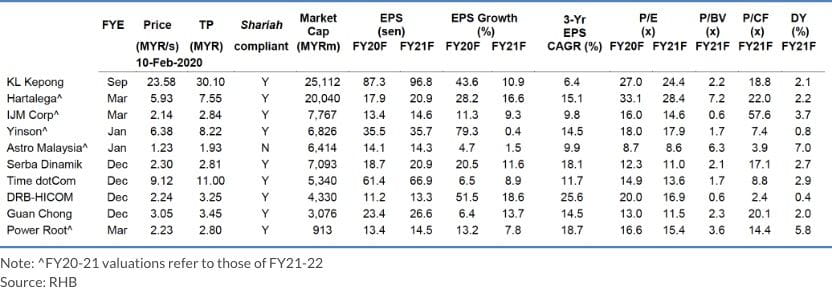

Figure 4: Earnings outlook and valuations

Buy: Share price may exceed 10% over the next 12 months

Trading Buy: Share price may exceed 15% over the next 3 months, however longer-term outlook remains uncertain

Neutral: Share price may fall within the range of +/- 10% over the next 12 months

Take Profit: Target price has been attained. Look to accumulate at lower levels

Sell: Share price may fall by more than 10% over the next 12 months

Not Rated: Stock is not within regular research coverage

Investment Research Disclaimers

RHB has issued this report for information purposes only. This report is intended for circulation amongst RHB and its affiliates’ clients generally or such persons as may be deemed eligible by RHB to receive this report and does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. This report is not intended, and should not under any circumstances be construed as, an offer or a solicitation of an offer to buy or sell the securities referred to herein or any related financial instruments.

This report may further consist of, whether in whole or in part, summaries, research, compilations, extracts or analysis that has been prepared by RHB’s strategic, joint venture and/or business partners. No representation or warranty (express or implied) is given as to the accuracy or completeness of such information and accordingly investors should make their own informed decisions before relying on the same.

This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to the applicable laws or regulations. By accepting this report, the recipient hereof (i) represents and warrants that it is lawfully able to receive this document under the laws and regulations of the jurisdiction in which it is located or other applicable laws and (ii) acknowledges and agrees to be bound by the limitations contained herein. Any failure to comply with these limitations may constitute a violation of applicable laws.

All the information contained herein is based upon publicly available information and has been obtained from sources that RHB believes to be reliable and correct at the time of issue of this report. However, such sources have not been independently verified by RHB and/or its affiliates and this report does not purport to contain all information that a prospective investor may require. The opinions expressed herein are RHB’s present opinions only and are subject to change without prior notice. RHB is not under any obligation to update or keep current the information and opinions expressed herein or to provide the recipient with access to any additional information. Consequently, RHB does not guarantee, represent or warrant, expressly or impliedly, as to the adequacy, accuracy, reliability, fairness or completeness of the information and opinion contained in this report. Neither RHB (including its officers, directors, associates, connected parties, and/or employees) nor does any of its agents accept any liability for any direct, indirect or consequential losses, loss of profits and/or damages that may arise from the use or reliance of this research report and/or further communications given in relation to this report. Any such responsibility or liability is hereby expressly disclaimed.

Whilst every effort is made to ensure that statement of facts made in this report are accurate, all estimates, projections, forecasts, expressions of opinion and other subjective judgments contained in this report are based on assumptions considered to be reasonable and must not be construed as a representation that the matters referred to therein will occur. Different assumptions by RHB or any other source may yield substantially different results and recommendations contained on one type of research product may differ from recommendations contained in other types of research. The performance of currencies may affect the value of, or income from, the securities or any other financial instruments referenced in this report. Holders of depositary receipts backed by the securities discussed in this report assume currency risk. Past performance is not a guide to future performance. Income from investments may fluctuate. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors.

This report does not purport to be comprehensive or to contain all the information that a prospective investor may need in order to make an investment decision. The recipient of this report is making its own independent assessment and decisions regarding any securities or financial instruments referenced herein. Any investment discussed or recommended in this report may be unsuitable for an investor depending on the investor’s specific investment objectives and financial position. The material in this report is general information intended for recipients who understand the risks of investing in financial instruments. This report does not take into account whether an investment or course of action and any associated risks are suitable for the recipient. Any recommendations contained in this report must therefore not be relied upon as investment advice based on the recipient’s personal circumstances. Investors should make their own independent evaluation of the information contained herein, consider their own investment objective, financial situation and particular needs and seek their own financial, business, legal, tax and other advice regarding the appropriateness of investing in any securities or the investment strategies discussed or recommended in this report.

This report may contain forward-looking statements which are often but not always identified by the use of words such as “believe”, “estimate”, “intend” and “expect” and statements that an event or result “may”, “will” or “might” occur or be achieved and other similar expressions. Such forward-looking statements are based on assumptions made and information currently available to RHB and are subject to known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievement to be materially different from any future results, performance or achievement, expressed or implied by such forward-looking statements. Caution should be taken with respect to such statements and recipients of this report should not place undue reliance on any such forward-looking statements. RHB expressly disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or circumstances after the date of this publication or to reflect the occurrence of unanticipated events.

The use of any website to access this report electronically is done at the recipient’s own risk, and it is the recipient’s sole responsibility to take precautions to ensure that it is free from viruses or other items of a destructive nature. This report may also provide the addresses of, or contain hyperlinks to, websites. RHB takes no responsibility for the content contained therein. Such addresses or hyperlinks (including addresses or hyperlinks to RHB own website material) are provided solely for the recipient’s convenience. The information and the content of the linked site do not in any way form part of this report. Accessing such website or following such link through the report or RHB website shall be at the recipient’s own risk.

This report may contain information obtained from third parties. Third party content providers do not guarantee the accuracy, completeness, timeliness or availability of any information and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such content. Third party content providers give no express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use. Third party content providers shall not be liable for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including lost income or profits and opportunity costs) in connection with any use of their content.

The research analysts responsible for the production of this report hereby certifies that the views expressed herein accurately and exclusively reflect his or her personal views and opinions about any and all of the issuers or securities analysed in this report and were prepared independently and autonomously. The research analysts that authored this report are precluded by RHB in all circumstances from trading in the securities or other financial instruments referenced in the report, or from having an interest in the company(ies) that they cover.

The contents of this report is strictly confidential and may not be copied, reproduced, published, distributed, transmitted or passed, in whole or in part, to any other person without the prior express written consent of RHB and/or its affiliates. This report has been delivered to RHB and its affiliates’ clients for information purposes only and upon the express understanding that such parties will use it only for the purposes set forth above. By electing to view or accepting a copy of this report, the recipients have agreed that they will not print, copy, videotape, record, hyperlink, download, or otherwise attempt to reproduce or re-transmit (in any form including hard copy or electronic distribution format) the contents of this report. RHB and/or its affiliates accepts no liability whatsoever for the actions of third parties in this respect.

The contents of this report are subject to copyright. Please refer to Restrictions on Distribution below for information regarding the distributors of this report. Recipients must not reproduce or disseminate any content or findings of this report without the express permission of RHB and the distributors.

The securities mentioned in this publication may not be eligible for sale in some states or countries or certain categories of investors. The recipient of this report should have regard to the laws of the recipient’s place of domicile when contemplating transactions in the securities or other financial instruments referred to herein. The securities discussed in this report may not have been registered in such jurisdiction. Without prejudice to the foregoing, the recipient is to note that additional disclaimers, warnings or qualifications may apply based on geographical location of the person or entity receiving this report.

The term “RHB” shall denote, where appropriate, the relevant entity distributing or disseminating the report in the particular jurisdiction referenced below, or, in every other case, RHB Investment Bank Berhad and its affiliates, subsidiaries and related companies.

Malaysia

This report is issued and distributed in Malaysia by RHB Investment Bank Berhad (“RHBIB”). The views and opinions in this report are our own as of the date hereof and is subject to change. If the Financial Services and Markets Act of the United Kingdom or the rules of the Financial Conduct Authority apply to a recipient, our obligations owed to such recipient therein are unaffected. RHBIB has no obligation to update its opinion or the information in this report.

Thailand

This report is issued and distributed in the Kingdom of Thailand by RHB Securities (Thailand) PCL, a licensed securities company that is authorised by the Ministry of Finance, regulated by the Securities and Exchange Commission of Thailand and is a member of the Stock Exchange of Thailand. The Thai Institute of Directors Association has disclosed the Corporate Governance Report of Thai Listed Companies made pursuant to the policy of the Securities and Exchange Commission of Thailand. RHB Securities (Thailand) PCL does not endorse, confirm nor certify the result of the Corporate Governance Report of Thai Listed Companies

Indonesia

This report is issued and distributed in Indonesia by PT RHB Sekuritas Indonesia. This research does not constitute an offering document and it should not be construed as an offer of securities in Indonesia. Any securities offered or sold, directly or indirectly, in Indonesia or to any Indonesian citizen or corporation (wherever located) or to any Indonesian resident in a manner which constitutes a public offering under Indonesian laws and regulations must comply with the prevailing Indonesian laws and regulations.

Singapore

This report is issued and distributed in Singapore by RHB Securities Singapore Pte Ltd which is a holder of a capital markets services licence and an exempt financial adviser regulated by the Monetary Authority of Singapore. RHB Securities Singapore Pte Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, RHB Securities Singapore Pte Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact RHB Securities Singapore Pte Ltd in respect of any matter arising from or in connection with the report.

Hong Kong

This report is distributed in Hong Kong by RHB Securities Hong Kong Limited (興業僑豐證券有限公司) (CE No.: ADU220) (“RHBSHK”) which is licensed in Hong Kong by the Securities and Futures Commission for Type 1 (dealing in securities). Any investors wishing to purchase or otherwise deal in the securities covered in this report should contact RHBSHK. RHBSHK is a wholly owned subsidiary of RHB Hong Kong Limited; for the purposes of disclosure under the Hong Kong jurisdiction herein, please note that RHB Hong Kong Limited with its affiliates (including but not limited to RHBSHK) will collectively be referred to as “RHBHK.” RHBHK conducts a full-service, integrated investment banking, asset management, and brokerage business. RHBHK does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this research report. Investors should consider this report as only a single factor in making their investment decision. Importantly, please see the company-specific regulatory disclosures below for compliance with specific rules and regulations under the Hong Kong jurisdiction. Other than company-specific disclosures relating to RHBHK, this research report is based on current public information that we consider reliable, but we do not represent it is accurate or complete, and it should not be relied on as such.

United States

This report was prepared by RHB and is being distributed solely and directly to “major” U.S. institutional investors as defined under, and pursuant to, the requirements of Rule 15a-6 under the U.S. Securities and Exchange Act of 1934, as amended (the “Exchange Act”). Accordingly, access to this report via Bursa Marketplace or any other Electronic Services Provider is not intended for any party other than “major” US institutional investors, nor shall be deemed as solicitation by RHB in any manner. RHB is not registered as a broker-dealer in the United States and does not offer brokerage services to U.S. persons. Any order for the purchase or sale of the securities discussed herein that are listed on Bursa Malaysia Securities Berhad must be placed with and through Auerbach Grayson (“AG”). Any order for the purchase or sale of all other securities discussed herein must be placed with and through such other registered U.S. broker-dealer as appointed by RHB from time to time as required by the Exchange Act Rule 15a-6. This report is confidential and not intended for distribution to, or use by, persons other than the recipient and its employees, agents and advisors, as applicable. Additionally, where research is distributed via Electronic Service Provider, the analysts whose names appear in this report are not registered or qualified as research analysts in the United States and are not associated persons of Auerbach Grayson AG or such other registered U.S. broker-dealer as appointed by RHB from time to time and therefore may not be subject to any applicable restrictions under Financial Industry Regulatory Authority (“FINRA”) rules on communications with a subject company, public appearances and personal trading. Investing in any non-U.S. securities or related financial instruments discussed in this research report may present certain risks. The securities of non-U.S. issuers may not be registered with, or be subject to the regulations of, the U.S. Securities and Exchange Commission. Information on non-U.S. securities or related financial instruments may be limited. Foreign companies may not be subject to audit and reporting standards and regulatory requirements comparable to those in the United States. The financial instruments discussed in this report may not be suitable for all investors. Transactions in foreign markets may be subject to regulations that differ from or offer less protection than those in the United States.

RHB Investment Bank Berhad, its subsidiaries (including its regional offices) and associated companies, (“RHBIB Group”) form a diversified financial group, undertaking various investment banking activities which include, amongst others, underwriting, securities trading, market making and corporate finance advisory.

As a result of the same, in the ordinary course of its business, any member of the RHBIB Group, may, from time to time, have business relationships with or hold positions in the securities (including capital market products) or perform and/or solicit investment, advisory or other services from any of the subject company(ies) covered in this research report.

While the RHBIB Group will ensure that there are sufficient information barriers and internal controls in place where necessary, to prevent/manage any conflicts of interest to ensure the independence of this report, investors should also be aware that such conflict of interest may exist in view of the investment banking activities undertaken by the RHBIB Group as mentioned above and should exercise their own judgement before making any investment decisions.

Malaysia

Save as disclosed in the following link (RHB Research conflict disclosures – Jan 2020) and to the best of our knowledge, RHBIB hereby declares that:

1. RHBIB does not have a financial interest in the securities or other capital market products of the subject company(ies) covered in this report.

2. RHBIB is not a market maker in the securities or capital market products of the subject company(ies) covered in this report.

3. None of RHBIB’s staff or associated person serve as a director or board member* of the subject company(ies) covered in this report

*For the avoidance of doubt, the confirmation is only limited to the staff of research department

4. RHBIB did not receive compensation for investment banking or corporate finance services from the subject company in the past 12 months.

5. RHBIB did not receive compensation or benefit (including gift and special cost arrangement e.g. company/issuer-sponsored and paid trip) in relation to the production of this report.

Thailand

RHB Securities (Thailand) PCL and/or its directors, officers, associates, connected parties and/or employees, may have, or have had, interests and/or commitments in the securities in subject company(ies) mentioned in this report or any securities related thereto. Further, RHB Securities (Thailand) PCL may have, or have had, business relationships with the subject company(ies) mentioned in this report. As a result, investors should exercise their own judgment carefully before making any investment decisions.

Indonesia

PT RHB Sekuritas Indonesia is not affiliated with the subject company(ies) covered in this report both directly or indirectly as per the definitions of affiliation above. Pursuant to the Capital Market Law (Law Number 8 Year 1995) and the supporting regulations thereof, what constitutes as affiliated parties are as follows:

1. Familial relationship due to marriage or blood up to the second degree, both horizontally or vertically;

2. Affiliation between parties to the employees, Directors or Commissioners of the parties concerned;

3. Affiliation between 2 companies whereby one or more member of the Board of Directors or the Commissioners are the same;

4. Affiliation between the Company and the parties, both directly or indirectly, controlling or being controlled by the Company;

5. Affiliation between 2 companies which are controlled, directly or indirectly, by the same party; or

6. Affiliation between the Company and the main Shareholders.

PT RHB Sekuritas Indonesia is not an insider as defined in the Capital Market Law and the information contained in this report is not considered as insider information prohibited by law. Insider means:

a. a commissioner, director or employee of an Issuer or Public Company;

b. a substantial shareholder of an Issuer or Public Company;

c. an individual, who because of his position or profession, or because of a business relationship with an Issuer or Public Company, has access to inside information; and

d. an individual who within the last six months was a Person defined in letters a, b or c, above.

Singapore

Save as disclosed in the following link (RHB Research conflict disclosures – Feb 2020) and to the best of our knowledge, RHB Securities Singapore Pte Ltd hereby declares that:

1. RHB Securities Singapore Pte Ltd, its subsidiaries and/or associated companies do not make a market in any issuer covered in this report.

2. RHB Securities Singapore Pte Ltd, its subsidiaries and/or its associated companies and its analysts do not have a financial interest (including a shareholding of 1% or more) in the issuer covered in this report.

3. RHB Securities, its staff or connected persons do not serve on the board or trustee positions of the issuer covered in this report.

4. RHB Securities Singapore Pte Ltd, its subsidiaries and/or its associated companies do not have and have not within the last 12 months had any corporate finance advisory relationship with the issuer covered in this report or any other relationship that may create a potential conflict of interest.

5. RHB Securities Singapore Pte Ltd, or person associated or connected to it do not have any interest in the acquisition or disposal of, the securities, specified securities based derivatives contracts or units in a collective investment scheme covered in this report.

6. RHB Securities Singapore Pte Ltd and its analysts do not receive any compensation or benefit in connection with the production of this research report or recommendation.

Analyst Certification

The analyst(s) who prepared this report, and their associates hereby, certify that:

(1) they do not have any financial interest in the securities or other capital market products of the subject companies mentioned in this report, except for: