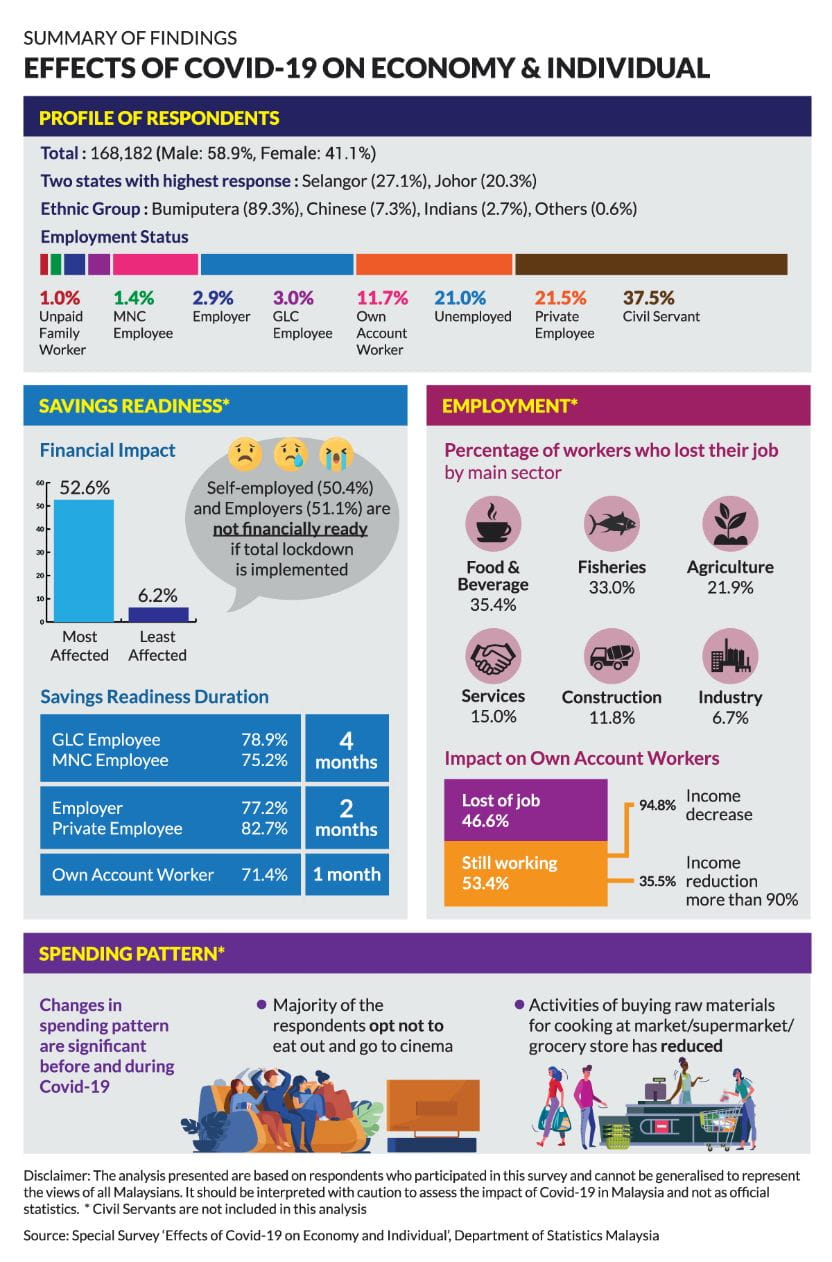

Covid-19 has hit the global economy on an unprecedented scale. Everyone from multi-billion dollar corporations to your neighbourhood nasi lemak aunty has seen their finances take a hit. Some of us have seen our incomes reduced or have even lost our jobs.

According to a survey conducted by the Department of Statistics Malaysia, most Malaysians do not have adequate savings (more than four months) for pandemic. No one expected this, so it’s not surprising that most of us are unprepared.

We’re creatures of habit and the MCO has forced us to change our lifestyles in the most drastic manner. We can no longer step out of our homes for a cup of coffee, and we’re learning how to be better cooks at home because that’s where we are, 24 hours a day. We’ve even learned how to carry out minor home repair and maintenance works on our own.

Our financial planning must take on a more sustainable approach. Exercising discipline has become second nature to us during this time, and we can actually take this a step further to help us plan our finances.

Get financially prepared for The New Normal.

You still have your job, for now, but you might lose it after the MCO. In this instance, you may not be covered by some of the current initiatives. The government is currently considering its options to extend coverage, but there is no harm in planning ahead. You can still come out on top.

1 /

Re-evaluate your expenses

If you do need to make a purchase, compare prices and take note of special discounts or bundles. Your credit or debit card may also have benefits and privileges such as discounts with certain retailers or a Cash Back feature. With a bit of planning you can save on dining, groceries, online shopping and more by making purchases using your credit card’s offers and rewards. Keeping track of monthly expenses will also be easier since you can view all your transactions online.

2 /

Save on your monthly expenses

If you have a card with a Cash Back feature, you’ll be able to save on your monthly expenses. If you have a card with a Rewards feature, redeem the points for savings vouchers and discounts.

3 /

Prioritise your expenses

If you are planning for a cash reserve. Assume you have to live off 30% less than what you would normally spend, and plan your budget around that amount. In three months, you will have saved 90% of your monthly income. You’ll be surprised at how much you can save. Here’s an example of a basic monthly budget and savings sheet:

Expenditures (excluding loans) for household with 2 dependents below 18, 2 cars under hire purchase. Net combined income – loans/debt/insurance/takaful premiums: RM3,000

4 /

Pick up a new work-related skill

If you’ve got time, pick up a new work-related skill to beef up your resume in case you need to go job-hunting later.

5 /

Join a network of folks in your field

Join a network of folks in your field to exchange tips and ideas. Job opportunities might pop up here later.

6 /

Offer your services for a small fee online

If you have a skill that can be adapted online, you can offer your services for a small fee. Advertise your services through your social media accounts for free.

7 /

Consider an insurance/takaful plan

If you’ve relied on company insurance/takaful before. Your bank can help you choose which plan suits your needs. Some Insurance/takaful plans can help you save for retirement or a rainy day.

8 /

Continue your saving habits

Continue your MCO money-saving habits as much as you can.

List down how you can help future employers save time and money through digitisation and bring it up during your job interviews. Your chances of getting the job will increase. Like you, businesses are also trying to get back on track.

Study consumer behaviour during and after the Covid-19 crisis to identify opportunities in your industry. Work out a business plan to help your future employer improve their business model and further digitise their operations. Prior to your interview, ask your future employer what steps they have taken to digitise their operations. Wow them with a proposal that includes both the company’s steps and your strategies, taking note of the company vision and mission. Highlight the efficiencies that can be achieved.

_

Talk to us about your needs for the best solution, today.