Covid-19 has hit the global economy on an unprecedented scale. Everyone from multi-billion dollar corporations to your neighbourhood nasi lemak aunty has seen their finances take a hit. Some of us have seen our incomes reduced or have even lost our jobs.

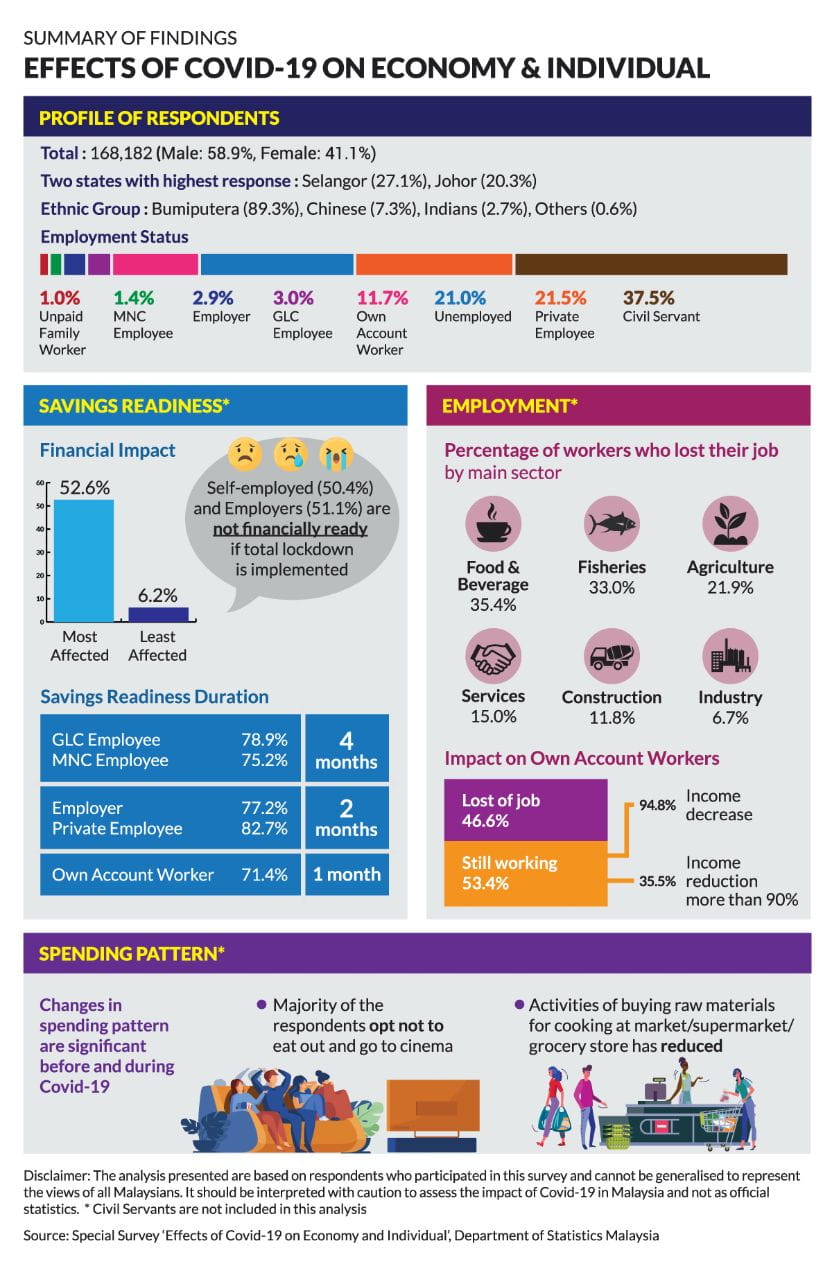

According to a survey conducted by the Department of Statistics Malaysia, most Malaysians do not have adequate savings (more than four months) for pandemic. No one expected this, so it’s not surprising that most of us are unprepared.

We’re creatures of habit and the MCO has forced us to change our lifestyles in the most drastic manner. We can no longer step out of our homes for a cup of coffee, and we’re learning how to be better cooks at home because that’s where we are, 24 hours a day. We’ve even learned how to carry out minor home repair and maintenance works on our own.

Our financial planning must take on a more sustainable approach. Exercising discipline has become second nature to us during this time, and we can actually take this a step further to help us plan our finances.

Get financially prepared for The New Normal.

You haven’t had time to prepare for an unexpected early retirement, or you’re already retired but you’re squeezing your finances. Here’s what you can do to make the most of the situation.

Put off or cancel any plans that might incur costs, such as travelling abroad or buying new items.

If you need urgent cash and own a credit card, check how much leeway you have with your credit facilities. You can opt for CashXcess to convert your available credit limit to instant cash with little to no interest/actual management fee. Consider this option if the payments are manageable so you don’t overstretch your retirement fund.

i.e. your extra car. You really only need one car.

If you’re still giving an allowance to your working children, now is the time to stop and give them the chance to be independent.

If you choose to continue working, digitise your skills. Your experience is very valuable and you can offer consultation on a freelance or contract basis. Businesses are looking to save costs on manpower, and you want to fit in with their direction.

If you own a property, consider renting it out and moving to a smaller home that you can pay for with less than the rental income. Your kids have moved out of the home so you won’t need a lot of space.

If you need the cash and have owned your home for more than 10 years, talk to your bank about refinancing.

Make living arrangements that will help you save money. For example, move to a place within walking distance of facilities or opt for co-living with your family.

There are options such as personal financing and cash advances to help you get back on your feet. You can discuss refinancing your home or taking on an overdraft. However, only consider these options if they can provide you with the opportunity and time to improve your financial situation and will not inconvenience you in the future.

This is the time to minimise and prioritise. Adopt prudent spending habits, and you can also sell items you have not used in the last six months.