Rise of the Machines (and how you can benefit)

The AI boom is evolving, and the next wave has legs (literally). As countries race to lead in intelligent robotics, the focus is shifting from code on screens to machines that think, move, and transform industries.

We’re not talking about clunky, tin-can robots in old sci-fi movies. We’re talking about humanoids that sprint (like the Terminator), robotic guide dogs, and factory assistants that will never need a coffee break. Welcome to the era where AI and robotics converge, powered by global innovation. It’s not the future — it’s happening right now.

Robots, not borders

While the headlines often frame AI and tech competition as a geopolitical tug-of-war, the truth is far more collaborative and exciting. Around the world, robotics expos have become global gatherings where engineers, coders, and investors mingle, discuss, and flex the latest developments in bionic muscles and AI-enhanced locomotion. These events are like the auto shows of the tech world (except the cars can now talk back).

The new superstars of the Robot Era

Across continents, a new generation of companies is redefining what robots can do. These are a few companies taking the lead in developing your robot colleague:

Tesla (United States 🇺🇸)

Tesla isn’t just reimagining how we drive. The company is rethinking who does the work. Beyond electric vehicles, Tesla’s Optimus is designed to take on dull, dangerous, and repetitive tasks. Starting on factory floors and eventually moving into everyday environments, Optimus could, if scaled affordably, reshape how businesses approach safety, handle human rights issues, and cope with labour shortages.

ABB (Switzerland 🇨🇭)

ABB is one of the major global players behind the robots most people never see — the ones quietly assembling products, moving materials, and keeping factory lines running. What sets ABB apart is its focus on robots designed to work alongside humans, allowing companies to automate gradually without having to overhaul entire production facilities.

Hyundai Motor Group (Korea 🇰🇷)

Hyundai’s push into robotics is most visible through its ownership of Boston Dynamics, the company behind robots like Spot. Designed to move through industrial sites, Spot is already being used for inspection and monitoring, particularly in places that are difficult or unsafe for people to access. The benefit is straightforward: earlier problem detection and safer workplaces.

FANUC (Japan 🇯🇵)

FANUC is a long-established leader in industrial robotics, with its machines used in factories around the world. In practical terms, FANUC’s robots help manufacturers perform repetitive tasks consistently, improving product quality and supporting large-scale production.

Shanghai Electric (China 🇨🇳)

Workspaces were designed for humans, so Shanghai Electric has introduced Suyuan, a human-shaped robot aimed at industrial work. The appeal is simple: Suyuan can immediately be deployed without having to redesign entire factory layouts. And he never takes breaks.

XPeng (China 🇨🇳)

At this point we already know that EVs are the “gateway” to robotics. EV maker XPeng is making a long-term push into humanoid robots with IRON. Carmakers already build complex machines at scale, so transferring that capability into robots could really speed up their entry into real workplaces.

Yaskawa (Japan 🇯🇵)

Yaskawa’s robots are a familiar sight in automotive factories, where they take on repetitive and physically demanding jobs such as welding and painting. The impact is subtle but important: safer workplaces and more reliable product quantity and quality across industries.

UBTECH (China 🇨🇳)

UBTECH has been trialling its Walker humanoid robots in factory settings, including electric vehicle plants. The potential impact is practical rather than futuristic: dependable robots could handle routine physical work, reducing strain on workers and filling labour gaps.

It’s a global game

The robotics industry is evolving fast, and everyone is in on it, from emerging markets to economic powerhouses like the US and China. Humanoid robots are no longer prototypes; they’re migrating from labs into warehouses, factories, and distribution centres. From high-mobility “robot dogs” to general-purpose humanoids (some designed for service, others for heavy-duty industrial work), the variety of robotics hardware is growing, offering multiple paths for automation beyond traditional fixed-arm robots.

Why smart factories + humanoids = game-changer

Humanoids excel in high-mix, low-volume work such as aerospace subassemblies, automotive rework, and awkward material handling. These are tasks that legacy automation struggles to handle well. Their uncanny human-like reach and flexibility make them ideal when factories are laid out for humans, not robots. There is little to do in terms of retrofitting and adjusting to accommodate them. That means even legacy factories in developing economies can be upgraded without ripping out entire production lines.

With global labour shortages, rising wage costs, and human rights issues, especially in manufacturing hubs, smart factories powered by humanoids offer a real solution. Robots take on repetitive, dangerous, or ergonomically challenging tasks, while humans shift into higher-value roles: supervision, quality assurance, process optimisation, and engineering. This doesn’t just preserve jobs – it upgrades them. Maintenance techs evolve into “technician-analysts,” line operators become automation supervisors, and engineers collaborate with AI-enabled teams.

Humanoids are a practical solution to the problem of ageing populations and shrinking labour pools. Look at Japan, with over 29% of its population aged above 65; Italy with its similar demographics; and South Korea, which is projected to hit 40% by 2050. While we’re healthier and living longer than our ancestors, this exposes critical gaps in manufacturing and care sectors. Our robot friends can support sustained productivity as birth rates decline and more people entire retirement. Who knows, we might even be able to retire earlier!

Humanoids don’t tire, don’t need overtime pay, never complain, and can work 24/7 under smart-factory schedules. Combined with AI-based inspection and precision actuation, they reduce human error, boost uptime, and enhance workplace safety, especially in heavy or hazardous industries.

Robots at play, progress at work

Beyond commercial deployments, robotics innovation is also being accelerated through non-commercial but influential events. China’s humanoid robot competitions (yes, these are an actual thing) feature activities like football, track events, and even mundane tasks like sorting and cleaning, all of which serve as stress tests in real world conditions. Throwing these robots in the deep end to see how they hold up helps push robotics technology forward faster than lab testing alone ever could.

Why this matters to markets

Robots are stepping up to the front line. Their role is expanding and they are no longer just a background players. Humanoid and service robots are entering logistics, healthcare, elderly care, retail, mobility, and manufacturing. This shift is powered by embodied AI that doesn’t just think but moves.

The global race is no longer about raw computing power; it's about physical intelligence. According to industry projections, AI-driven humanoids could offset labour shortages, run autonomous smart factories, and transform how companies scale production. Some forecasts even suggest that humanoids could make up a significant share of manufacturing labour within the next decade1. Elon Musk has even said that, in the near future, work will be optional (and money irrelevant) for us warm-bodied humans.

Let’s look at what the markets have to offer us. While pure-play listed robotics companies are the most obvious choice, there are just a handful of them. We should look deeper into the ecosystem, at the chip and processor makers playing a pivotal role.

It’s like the classic gold rush scenario: when everyone else is rushing to the mines, you want to be one selling the shovels and equipment. Behind every humanoid robot is a heavy dose of computing power, much of it supplied by firms like NVIDIA, AMD, and TSMC. Their chips handle everything from vision and decision-making to real-time movement, making large-scale robotics deployment possible.

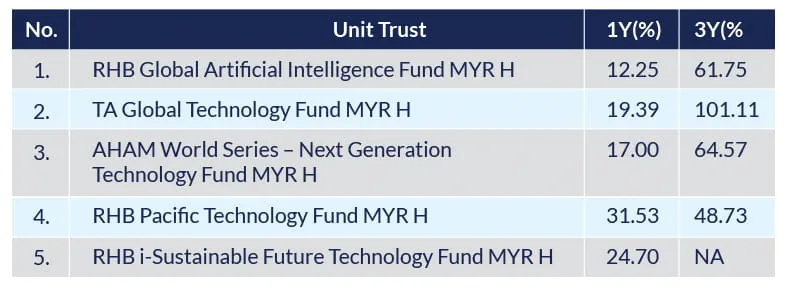

The following funds offer direct or indirect exposure to companies advancing AI and robotics technologies:

SPOTLIGHT: Funds riding the AI + Robotics Wave

Source: Lipper Investment Management as of 2 December 2025.

Quick take:

RHB Global Artificial Intelligence Fund – exposure to the companies driving AI breakthroughs, including those investing in robotics hardware and software.

TA Global Technology Fund – diversified access to big-name tech champions globally, capturing AI and automation trends.

AHAM World Series – Next Generation Technology Fund – plays into fast-growing future-tech themes, including humanoid robotics and automation.

RHB Pacific Technology Fund – taps into Asia-Pacific tech markets, where China’s robotics boom is accelerating.

RHB i-Sustainable Future Technology Fund – a Shariah-compliant fund with an innovation-driven portfolio, aligned for long-term structural shifts.

The Robot Era is already here – and so are the opportunities

AI and robotics are no longer futuristic buzzwords. They’re shaping real markets, real factories, and real economic transitions. The question isn’t “Will robots change the world?” but “Which part of the world will change fastest — and who’s got stock in that?”. Investors who understand this shift early may find themselves well-positioned for a decade defined not just by artificial intelligence, but by physical intelligence.

Just a decade ago, we were wondering if smartphones would catch on. Today, we’re wondering if robots will fold our laundry. And honestly…we can’t wait for that to happen. Get in touch with your Relationship Manager today to claim your stake in the Robot Era!

Disclaimer:

This article has been prepared by RHB and is solely for your information only. This article is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party, without obtaining prior permission of RHB Bank Sdn Bhd (“RHB”). In preparing this presentation, RHB has relied upon and assumed the accuracy and completeness of all information available from public sources or which was otherwise reviewed by RHB. Accordingly, whilst we have taken all reasonable care to ensure that the information contained in this presentation is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness and make no representation or warranty (whether expressed or implied) and accept no responsibility or liability for its accuracy or completeness. You should not act on the information contained in this article without first independently verifying its contents.

Any opinion, management forecast or estimate contained in this article is based on information available as the date of this article and are subject to change without notice. It does not constitute an offer or solicitation to deal in units of any RHB fund and does not have regard to the specific investment objectives, financial situation or the particular needs of any specific person who may receive this. Investors may wish to seek advice from a financial adviser/unit trust consultant before purchasing units of any funds. In the event that the investor chooses not to seek advice from a financial adviser/unit trust consultant, he should consider whether the fund in question is suitable for him. Past performance of the fund or the manager, and any economic and market trends or forecast, are not necessarily indicative of the future or likely performance of the fund or the manager. Investors are advised to read and understand content of the relevant documents including but not limited to prospectus or information memorandum that has been registered with Securities Commission and Product Highlight Sheet before investing. Investors should also consider all fees and charges involved before investing. Prices of units and income distribution, if any, may go down as well as up; where past performance is no guarantee of future performance. Units will be issued upon receipt of the registration form referred to and accompanying the Prospectus. The printed copy of prospectus and Product Highlight Sheet is available at RHB branches/Premier Centre and investors have the right to request for a Product Highlight Sheet.

A Product Highlights Sheet (“PHS”) highlighting the key features and risks of the RHB Global Artificial Intelligence Fund dated 2 December 2024, TA Global Technology Fund dated 22 August 2025, AHAM World Series – Next Generation Technology Fund dated 15 December 2023, RHB Pacific Technology Fund dated 16 February 2024, and RHB i-Sustainable Future Technology Fund dated 30 June 2025 (“Fund”) are available and investors have the right to request for a PHS.

The Manager wishes to highlight the specific risks of the RHB Global Artificial Intelligence Fund are Fund Management Risk, Liquidity Risk, Country Risk, Financial Derivatives Risk, Currency Risk, Credit and Default Risk, Interest Rate Risk, and Suspension of Redemption Risk. The specific risks of TA Global Technology Fund are Market Risk, Loan/Financing Risk, Non-compliance Risk, Manager Risk, Inflation Risk, Operational Risk, Fund Management of the Target Fund Risk, Sector Investment Risk, Currency Risk, Counterparty Risk, Temporary Suspension of the Target Fund Risk, and Distribution Out of Capital Risk. The specific risks of the AHAM World Series – Next Generation Technology Fund, which are Market Risk, Fund Management Risk, Performance Risk, Inflation Risk, Loan /Financing risk, Operational Risk, Suspension of Repurchase Request Risk, Related Party Transaction Risk, Concentration Risk, Liquidity Risk, Country Risk, Currency Risk, Counterparty Risk, and Investment Adviser Risk. The specific risks of RHB Pacific Technology Fund, which are Management Risk, Liquidity Risk, Currency Risk, Country Risk, and Interest Rate Risk. The specific risks of RHB i-Sustainable Future Technology Fund are Fund Management Risk, Redemption Risk, Loan/Financing Risk, Risk of Non-Compliance, Returns are not guaranteed, Risk of Termination of the Fund, Inflation Risk, Market Risk, Liquidity Risk, Islamic Financial Derivates Risk, Shariah-Compliant Equity-Related Securities Risk, Profit Rate Risk, Default and Credit Risk, Technology-Related Companies Risk, Sustainability Risk, Smaller Companies Risk, Currency Risk, Country Risk, Concentration Risk, Reclassification of Shariah Status Risk, and other general risks are elaborated in the Information Memorandum.

This article has not been reviewed by the Securities Commission Malaysia (SC).

RHB Bank Berhad 196501000373 (6171-M) | RHB Islamic Bank Berhad 200501003283 (680329-V)