Q4 2025: The World Turns Bullish

In our quarterly Fund Discovery series, we delve into current market conditions and provide insights and strategies to diversify your portfolio.

Listen and subscribe to the podcast hosted by RHB Bank’s Head of Investor Advisory, Nova Lui, to stay updated on the latest market developments.

After a whirlwind third quarter marked by shifting policies and market surprises, investors enter the final stretch of 2025 with cautious optimism. The US Federal Reserve made its long-awaited first rate cut in September, signalling a pivot that lifted market sentiment across the globe. Equity indices rebounded strongly, especially in Asia, where technology counters regained their shine. Speaking of shine, gold surged past the USD4,000 mark as investors hedged against a weakening dollar, a reminder that diversification still matters.

Despite the optimism, global politics continue to stir volatility. Renewed China-U.S. trade frictions resurfaced after Washington hinted at tariff increases following Beijing’s rare-earth export curbs. Meanwhile, a U.S. government shutdown disrupted economic data flows, forcing investors to rely on private indicators to gauge growth momentum.

Closer to home, Malaysia’s Budget 2026 continues to champion fiscal support for construction, utilities, and green infrastructure, providing a welcome boost for domestic sectors as the country balances growth with sustainability.

Themes to watch: 3 signals for smart investors

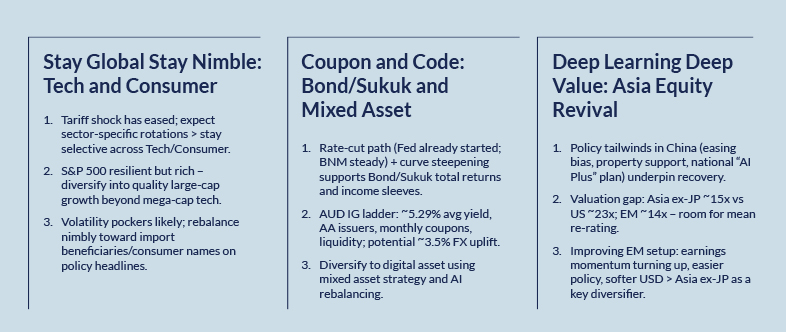

We’ve identified three core themes shaping investment strategy this quarter:

- Stay Global, Stay Nimble

- Coupon and Code

- Deep Learning, Deep Value

Diversification remains your best defence and offence. With market dispersion widening, investors are advised to look beyond borders. Global technology and consumer sectors continue to offer opportunities, but selectivity is key. A nimble allocation strategy lets you capture upside while cushioning against shocks.

As interest/profit rates ease, income-oriented strategies return to the spotlight. Bond/Sukuk and mixed-asset funds stand to benefit from capital gains, not just steady coupons. Meanwhile, the rise of AI-driven rebalancing and digital-asset integration provide opportunity for active investors.

Asia ex-Japan equities are back in focus. Supported by attractive valuations, policy stimulus, and improving corporate earnings, the region offers deep value and long-term growth potential. Investors seeking exposure to the “next wave” of growth stories may find Asia’s mix of innovation and reform particularly compelling.

Spotlight: Top 5 funds for Q4 2025

Here’s where we get to the burning question: what are our picks for Q4?

We’ve selected five funds that represent a blend of growth, income, and innovation.

- RHB Global Shariah Equity Index Fund

- RHB Asia Equity High Income Fund

- RHB Asia Pacific Equity Dividend Fund

- RHB Dynamic Artificial Intelligence Allocator Fund

- AHAM World Series – Global Income Fund

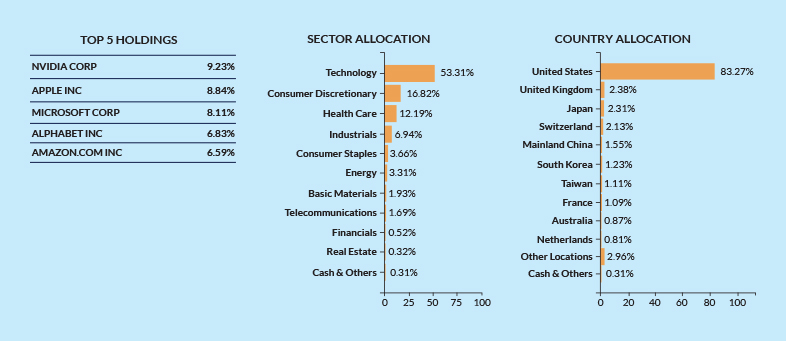

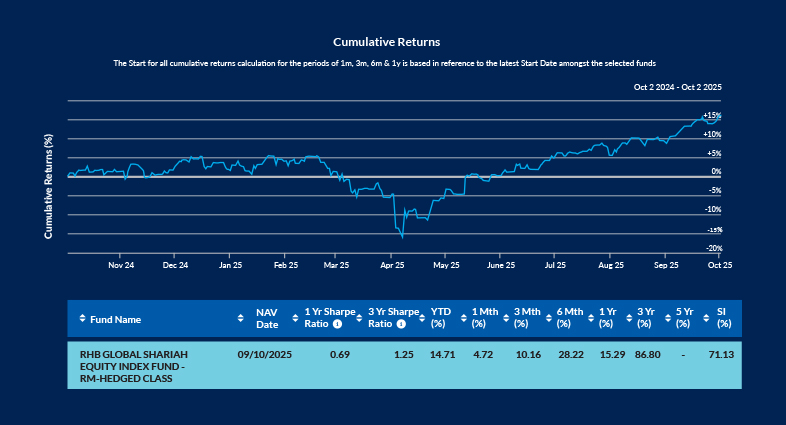

Shariah-compliant investing goes global with this global equity fund that mirrors the Dow Jones Islamic Market Titans 100 Index.

Heavyweight exposure to the Magnificent Seven tech names ensures participation in global innovation, while full replication and index diversification help balance the risk profile. With the target ETF surpassing USD 5 billion in fund size, this fund suits investors seeking global reach through an ethical lens.

Source: Fund fact sheet as of 31 August 2025

Source: Novagni as of 2 October 2025

Targeting a 7-9 % income through dividends and option premiums, this fund blends Asia’s equity growth with downside resilience. With a beta (volatility) below 1, it provides stable exposure to Asia Pacific markets that is still trading at cheaper valuations than developed peers. Ideal for investors who value consistent payouts without sacrificing capital appreciation potential.

Source: J.P. Morgan Asia Equity High Income Fund Fact sheet as of 30 September 2025

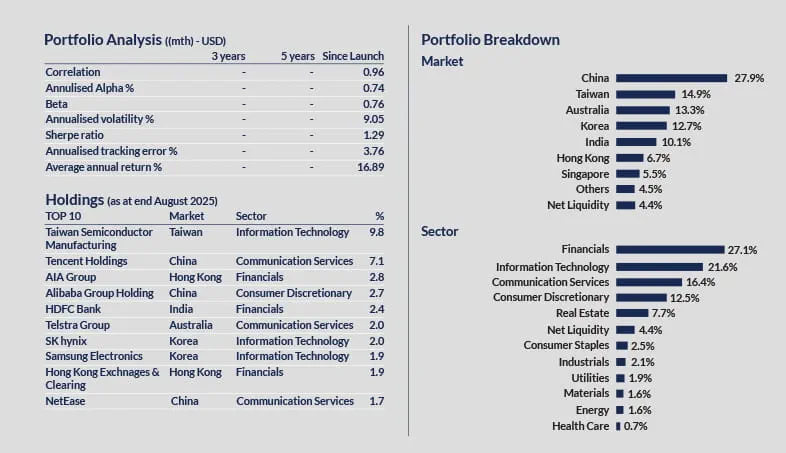

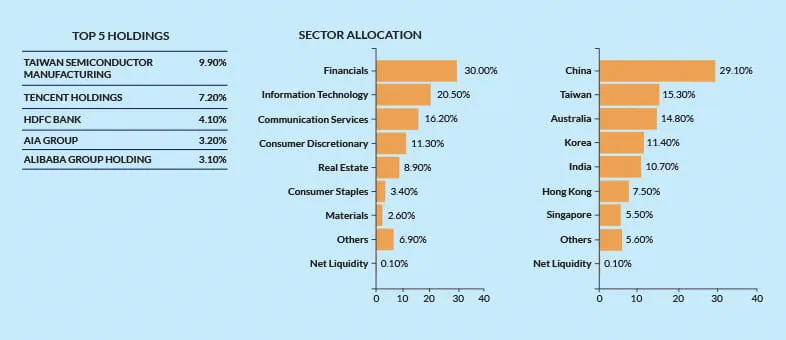

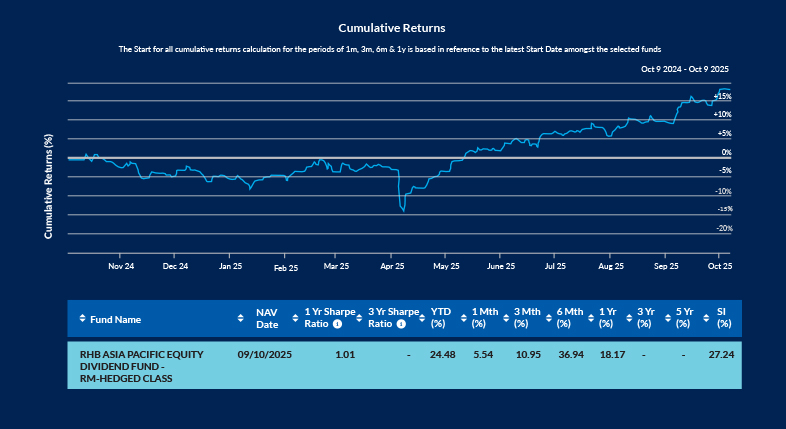

A dynamic mix of dividend yield and growth, this feeder fund invests into the J.P. Morgan Asia Equity Dividend Fund, offering more than 90% exposure to professionally managed Asian equities. Perfect for medium- to long-term investors seeking both regular income and participation in Asia’s structural growth story.

Source: Fund Fact Sheet as of 31 August 2025

Source: Novagni as of 9 October 2025

Malaysia’s first AI-driven multi-asset fund brings the future of investing into the present. It leverages proprietary models to rebalance monthly across equities, fixed income, digital assets (including cryptocurrency ETFs) and money markets. Designed to eliminate human bias, its data-driven decisions adapt tactically to market shifts, making it ideal for those who want technology to work for their portfolios.

Source: Novagni as of 9 October 2025

A feeder fund into the PIMCO GIS Income Fund, one of the world’s most respected fixed-income strategies. This fund emphasises global diversification, consistent yield, and capital preservation. A reassuring choice for investors who prefer steady income and lower volatility amid uncertain times.

Source: Fund Fact Sheet 31 August 2025

Source: Novagni as of 9 October 2025

Balance, blend, and be prepared

The closing months of 2025 mark a turning point for global markets, a moment where optimism must be paired with prudence. With interest/profit rates trending lower and technology reshaping industries, investors have room to reposition for growth while staying protected from volatility.

Our advice: balance growth, income, and innovation within your portfolio. Whether your goal is capital appreciation, consistent income, or exposure to new investment frontiers like AI and digital assets, there’s a fund — or a combination of funds — to fit your risk appetite and time horizon. Speak to your Relationship Manager to find the right combination!

Disclaimer:

This article is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party, without obtaining prior permission of RHB Bank Sdn Bhd (“RHB”).

This article has been prepared by RHB and is solely for your information only. It may not be copied, published, circulated, reproduced or distributed in whole or part to any person without the prior written consent of RHB. In preparing this presentation, RHB has relied upon and assumed the accuracy and completeness of all information available from public sources or which was otherwise reviewed by RHB. Accordingly, whilst we have taken all reasonable care to ensure that the information contained in this presentation is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness and make no representation or warranty (whether expressed or implied) and accept no responsibility or liability for its accuracy or completeness. You should not act on the information contained in this article without first independently verifying its contents.

Any opinion, management forecast or estimate contained in this article is based on information available as the date of this article and is subject to change without notice. It does not constitute an offer or solicitation to deal in units of any RHB fund and does not have regard to the specific investment objectives, financial situation or the particular needs of any specific person who may receive this. Investors may wish to seek advice from a financial adviser/unit trust consultant before purchasing units of any funds. In the event that the investor chooses not to seek advice from a financial adviser/unit trust consultant, he should consider whether the fund in question is suitable for him. Past performance of the fund or the manager, and any economic and market trends or forecast, are not necessarily indicative of the future or likely performance of the fund or the manager. The value of units in the fund, and the income accruing to the units, if any, from the fund, may fall as well as rise.

A Product Highlights Sheet (“PHS”) highlighting the key features and risks of the RHB Global Shariah Equity Index Fund dated 16 November 2020, RHB Asia Equity High Income Fund dated 3 July 2025, RHB Asia Pacific Equity Dividend Fund dated 22 January 2024, RHB Dynamic Artificial Intelligence Allocator Fund dated 17 March 2025, and AHAM World Series – Global Income Fund dated 15 December 2023. (“Fund”) is available and investors have the right to request for a PHS.

The Manager wishes to highlight the specific risks of RHB Global Shariah Equity Index Fund are Market Risk, Emerging Markets Risk, Foreign Exchange Risk, Shariah Restrictions Risk, Stock Risk, Liquidity Risk, Risks Associated with Government or Central Banks’ Intervention, Prohibited Securities Risk, Taxation Risk, Withdrawal of UK from the EU Risk, Risks relating to the Index, Counterparty Risk, Derivatives Risk, Index Tracking Risk and Operational Risk. The specific risks of RHB Asia Equity High Income Fund are Fund Management Risk, Liquidity Risk, Country Risk, Currency Risk, Interest Rate Risk, Credit and Default Risk, Financial Derivatives Risk, Suspension of Redemption Risk, and Distribution Out of Capital Risk. The specific risks of the RHB Asia Pacific Equity Dividend Fund are Management Risk, Liquidity Risk, Country Risk, Currency Risk, and Interest Rate Risk. The specific risks of RHB Dynamic Artificial Intelligence Allocator Fund are Liquidity Risk, Currency Risk, Country Risk, Interest Rate Risk, Credit and Default Risk, Financial Derivatives Risk, Equity Risk, Equity-Related Securities Risk, Collective Investment Schemes Risk, Concentration Risk, Distribution Out of Capital Risk, and Risk of Over-Reliance on the Artificial Intelligence Risk Model. The specific risks of AHAM World Series – Global Income Fund are Concentration Risk, Liquidity Risk, Counterparty Risk, Country Risk, Currency Risk, Target Fund Manager Risk, Distribution Out of Capital Risk, and other general risks are elaborated in the Information Memorandum.

This article has not been reviewed by the Securities Commission Malaysia (SC).

RHB Bank Berhad 196501000373 (6171-M) | RHB Islamic Bank Berhad 200501003283 (680329-V)