Staying Ahead in a Shifting Market

In our quarterly Fund Discovery series, we delve into current market conditions and provide insights and strategies to diversify your portfolio.

Listen and subscribe to the podcast, hosted by RHB Bank’s Head of Investors Advisory, Nova Lui, to stay updated on the latest market developments.

As we step into the third quarter of 2025, global markets continue to navigate a fluid and fast-changing landscape. Trade policy adjustments, interest rate cuts, and rapid innovation in technology and digital assets are shaping investor sentiment, creating unique challenges. But as we’re “glass-half-full” kind of people (our optimism is backed by data), we also see fresh and exciting opportunities.

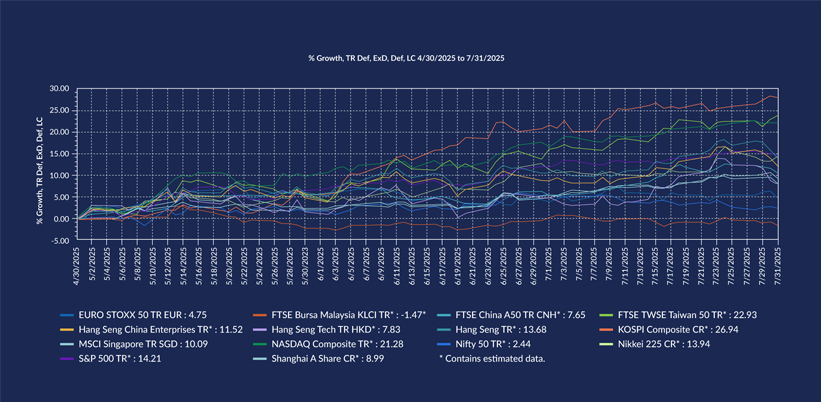

The past quarter has been nothing short of dynamic. In the U.S., the NASDAQ surged 21.3% and the S&P 500 gained 14.2%, driven by AI-fuelled tech giants despite tariff headwinds. In Asia, the FTSE Taiwan 50 jumped 22.9%, and South Korea’s KOSPI rocketed 26.9% on semiconductor strength and supportive policy reforms. Japan’s Nikkei 225 added 13.9%, aided by a weaker yen and robust export momentum. Closer to home, Hong Kong’s Hang Seng climbed 13.66% on optimism over China’s stimulus measures, while China’s A-shares rose 9%, though gains were tempered by ongoing trade frictions. Across markets, volatility remained elevated, shaped by U.S. tariffs, expectations of rate cuts, and varied global stimulus responses.

Domestically, the picture is more subdued. The FBM KLCI slipped 1.47%, weighed down by commodity weakness and political uncertainty. In July, Bank Negara Malaysia reduced the Overnight Policy Rate (OPR) by 25 basis points to 2.75%, signalling a shift toward stimulating economic growth and easing borrowing costs. The ringgit steadied, foreign flows returned selectively to export-led sectors, and government bonds continued to attract demand as investors sought stability amid external risks.

Source: Lipper Investment Management as of July 2025.

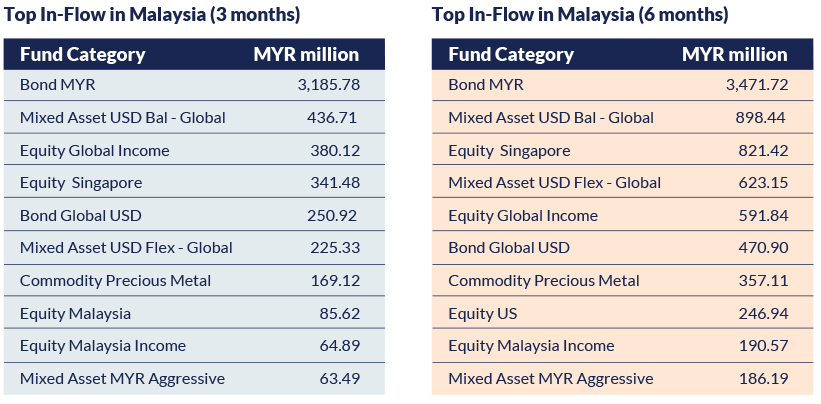

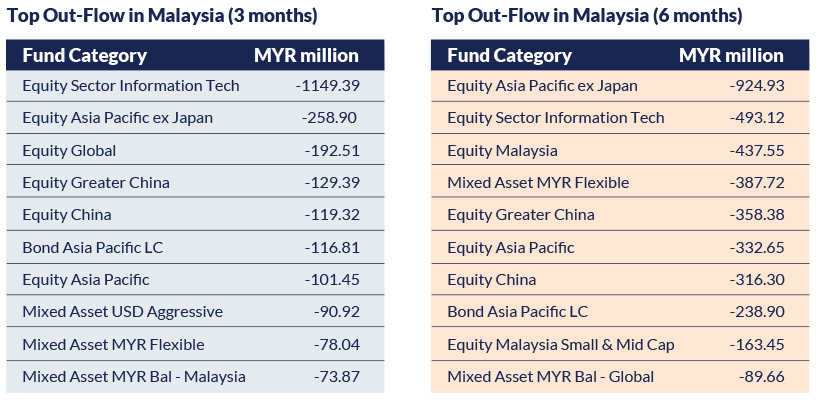

Q2 fund flows snapshot

We track fund flows not just as numbers, but as key reflections of market psychology and turning points. These figures will help you chart your next steps in diversifying your portfolio. Recent fund flow data indicates a strong tilt toward income-focused strategies, as investors gravitate toward liquidity and steady returns. Meanwhile, some equity and absolute-return funds are experiencing redemption, signalling profit-taking or strategic reshuffles.

Industry Top In-flow in Malaysia

Industry Top Out-flow in Malaysia

Source: Lipper Investment Management as of July 2025.

In the past quarter, fund flows revealed a clear tilt toward income-oriented and defensive strategies. Bond MYR funds attracted RM3.1 billion in just three months and RM3.5 billion over six months, supported by ringgit stability, attractive yields, and strong foreign demand. Within the global income space, Mixed Asset USD Flexible – Global and Equity Global Income funds gained traction, as investors sought yield with global diversification.

Conversely, certain equity segments saw notable outflows. The Technology sector faced RM1.1 billion in redemptions, while Asia ex-Japan equities also experienced selling pressure, reflecting a rotation toward defensives amid softer earnings and tariff uncertainties. Meanwhile, Commodity Precious Metals funds drew RM357 million in inflows over six months, underscoring the role of gold and commodities as hedges against inflation and global volatility.

Four key investment themes for Q3

Theme 1: Tariff Dip, Quality Grip

The easing of U.S. tariff pressures triggered a major recovery, with Technology, China, and India leading the rebound. Yet, this is not a time for indiscriminate risk-taking: quality remains the anchor.

Key takeaway: Capture the recovery while maintaining a quality filter to navigate policy uncertainty.

Theme 2: Rate cuts – WHEN, not IF

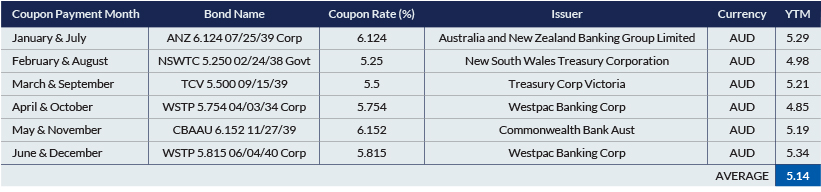

Rate cuts are gathering pace worldwide, with Malaysia already lowering the OPR. Bond opportunities are opening up, particularly Australian bank and state government bonds offering average yields above 5%. These instruments provide attractive income potential with strong credit backing, while also positioning for capital appreciation if yields fall.

Portfolio of AUD Bank and State Government Bonds

Source: Bloomberg as of July 2025.

Key takeaway: Allocating to quality fixed-income instruments offers steady coupons and potential capital appreciation as yields fall.

Theme 3: Quantum Blend – AI meets digital assets

AI and blockchain-based assets are converging, creating powerful new opportunities. AI enhances analytics and productivity; blockchain enables tokenisation and decentralised finance. This dual growth story is attracting institutional capital and moving into mainstream portfolios, though investors must manage volatility and evolving regulations.

Key takeaway: Exposure to this theme allows investors to participate in high-growth innovation while relying on AI-powered systems to manage complexity.

Theme 4: Build for the Storm

Volatility can be a source of opportunity. Strategies that blend high-dividend equities, absolute return approaches, and diversified income can protect against downturns while still capturing market rallies.

Key takeaway: Portfolios designed with high-dividend equities and absolute return strategies can thrive through storms, providing both stability and growth potential.

Our fund picks for Q3

Based on these four key investment themes in Q3 2025, we’ve handpicked a few funds for you to consider adding to your portfolio.

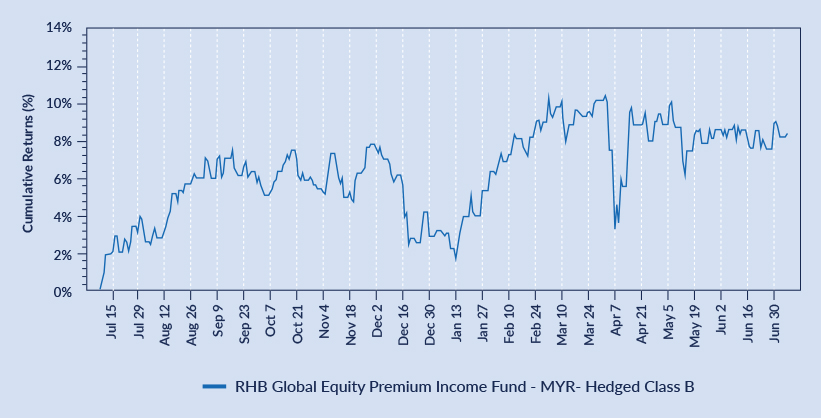

1. RHB Global Equity Premium Income Fund (RHBGEPI)

If you’re looking for steady income with growth potential, RHBGEPI is designed for you. The fund aims to deliver 7–9% income per year, generated through dividends and option premiums. Instead of seeing volatility as a risk, the fund uses it to its advantage—capturing extra returns when markets fluctuate.

Your money is spread across leading global blue-chip companies, managed actively to balance risks and opportunities. The fund invests in a JPMorgan UCITS ETF, backed by one of the world’s largest asset managers with over USD4 trillion in assets under management. For Malaysian investors, there’s also a MYR-hedged class, helping reduce the impact of currency swings.

Cumulative Returns of RHBGEPI

Source: Novagni (7 July 2025).

Who it’s for: Investors seeking regular income without giving up long-term equity growth potential — particularly those who want stability in volatile markets while maintaining exposure to global opportunities.

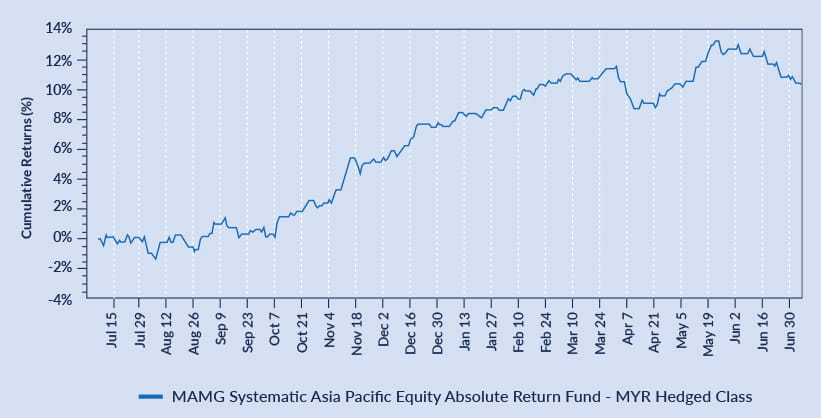

2. MAMG Systematic Asia Pacific Equity Absolute Return Fund – MYR-Hedged Class (MAMG SAPEAR)

What it is:

The MAMG Fund is built for stability, aiming to generate returns whether markets go up or down. It follows a market-neutral strategy, meaning it balances long and short positions in Asia-Pacific equities to reduce reliance on market direction.

Key features include:

- AI-driven insights – uses predictive models to dynamically adjust exposure across up to 4,500 stocks, covering both large and small-cap opportunities.

- Expert management – the fund is managed by BlackRock, one of the world’s largest and most experienced asset managers.

- Lower correlation to markets – the strategy is designed to deliver consistent alpha while controlling risk, offering diversification beyond traditional equity exposure.

Cumulative Returns of MAMG SAPEAR

Source: Novagni (7 July 2025).

Who it’s for:

Investors seeking stability in volatile markets, particularly those who value risk control, diversification, and returns not tied directly to market swings.

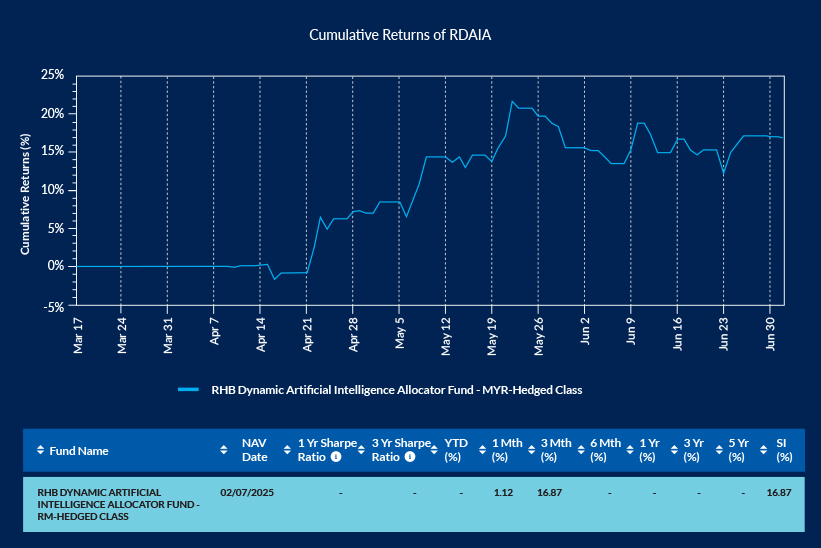

3. RHB Dynamic Artificial Intelligence Allocator Fund (RDAIA)

RDAIA is a multi-asset fund that blends traditional markets with innovation. Using an AI-driven model, the fund allocates across equities, bonds, and digital assets, making decisions free from emotional bias and guided by data-driven signals. It gains exposure to digital assets through institutional-grade ETFs, offering investors a secure gateway into this emerging asset class.

Back-tested results show the fund’s resilience in delivering stronger returns with lower drawdowns compared to its underlying benchmarks. Designed for progressive investors, RDAIA represents our “Quantum Blend” theme, where artificial intelligence meets digital assets to shape the next generation of portfolio design.

Cumulative Returns of RDAIA

Source: Novagni (7 July 2025).

Who it’s for:

Forward-looking investors who want diversification and are open to embracing digital assets and AI-powered strategies as part of their portfolio.

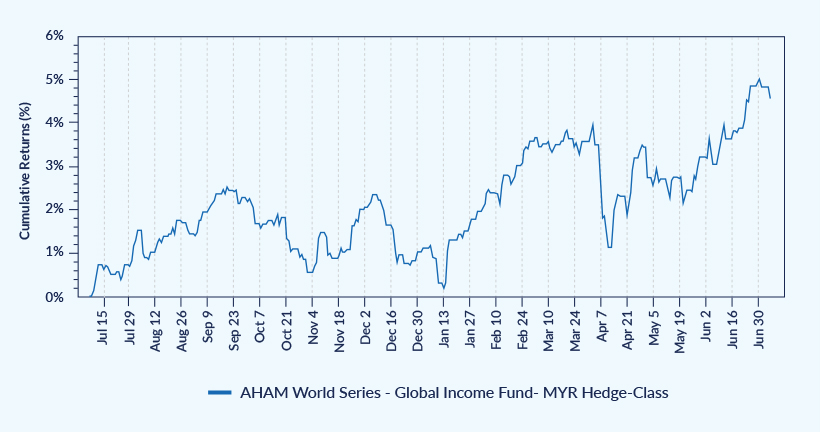

4. AHAM World Series – Global Income Strategy (AHAMGI)

The AHAMGI is a globally diversified bond solution, currently offering an attractive annualised yield of 6.3%. It follows a barbell strategy, balancing investment-grade bonds for stability with high-yield bonds for stronger returns. The fund is positioned to benefit from central banks’ expected rate cuts, which typically boost bond values.

Managed by top-tier global bond managers, this fund offers wide exposure across fixed income markets. It’s an excellent choice for investors seeking stability and consistent income, especially in a lower-rate environment where yield opportunities matter most.

Cumulative Returns of AHAMGI

Source: Novagni (7 July 2025).

Who it’s for:

Income-focused investors who value stability and want to capture opportunities from global interest rate cuts.

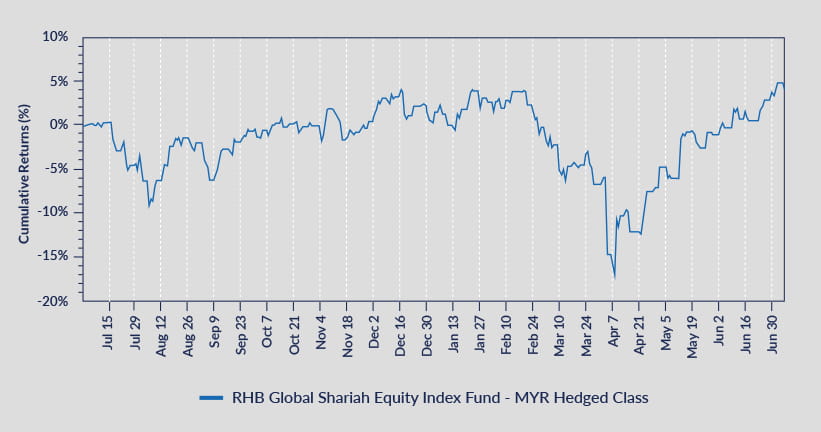

5. RHB Global Shariah Equity Index Fund (RHBGSEI)

RHBGSEI is a Shariah-compliant global growth fund that tracks the Dow Jones Islamic Market Titans 100 Index, offering exposure to some of the world’s largest Shariah-approved companies. It has a strong focus on U.S. technology leaders, including the “Magnificent Seven” (Apple, Microsoft, Alphabet, Amazon, Meta, Tesla, and Nvidia), which are driving much of today’s market growth.

Since its inception, the fund’s target vehicle has grown to more than USD 6 billion in assets, reflecting strong investor confidence. Managed by HSBC Global Asset Management, a trusted global name in Islamic finance, the fund combines transparency with growth potential. This makes it a compelling option for investors who want a Shariah-approved portfolio with high-growth exposure to global tech and blue-chip leaders.

Cumulative Returns of RHBGSEI

Source: Novagni (7 July 2025).

Who it’s for:

Investors seeking Shariah-compliant, growth-oriented investments with a strong tilt toward global technology leaders, particularly those comfortable with higher growth and market volatility.

Conclusion

In an environment shaped by shifting interest rates, technological disruption, and evolving investor expectations, having the right investment strategy has never been more important. The funds highlighted under our four key investment themes are designed to help investors diversify, capture growth opportunities, and manage risks in a rapidly changing world.

Whether your priority is steady income, exposure to innovation, or Shariah-compliant growth, RHB offers solutions tailored to different needs and goals. Take the next step in shaping your investment journey. Speak with your RHB Relationship Manager today to discover how these strategies can work for you.

Disclaimer:

Terms & Conditions apply.

This article has been prepared by RHB and is solely for your information only. This article is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party, without obtaining prior permission of RHB Bank Sdn Bhd (“RHB”). In preparing this presentation, RHB has relied upon and assumed the accuracy and completeness of all information available from public sources or which was otherwise reviewed by RHB. Accordingly, whilst we have taken all reasonable care to ensure that the information contained in this presentation is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness and make no representation or warranty (whether expressed or implied) and accept no responsibility or liability for its accuracy or completeness. You should not act on the information contained in this article without first independently verifying its contents.

Any opinion, management forecast or estimate contained in this article is based on information available as the date of this article and are subject to change without notice. It does not constitute an offer or solicitation to deal in units of any RHB fund and does not have regard to the specific investment objectives, financial situation or the particular needs of any specific person who may receive this. Investors may wish to seek advice from a financial adviser/unit trust consultant before purchasing units of any funds. In the event that the investor chooses not to seek advice from a financial adviser/unit trust consultant, he should consider whether the fund in question is suitable for him. Past performance of the fund or the manager, and any economic and market trends or forecast, are not necessarily indicative of the future or likely performance of the fund or the manager. Investors are advised to read and understand content of the relevant documents including but not limited to prospectus or information memorandum that has been registered with Securities Commission and Product Highlight Sheet before investing. Investors should also consider all fees and charges involved before investing. Prices of units and income distribution, if any, may go down as well as up; where past performance is no guarantee of future performance. Units will be issued upon receipt of the registration form referred to and accompanying the Prospectus. The printed copy of prospectus and Product Highlight Sheet is available at RHB branches/Premier Centre and investors have the right to request for a Product Highlight Sheet.

A Product Highlights Sheet (“PHS”) highlighting the key features and risks of the RHB Global Equity Premium Income Fund dated 22 April 2024, MAMG Systematic Asia Pacific Equity Absolute Return Fund dated 8 January 2024, RHB Dynamic Artificial Intelligence Allocator Fund dated 17 March 2025, AHAM World Series – Global Income Fund dated 15 December 2023, and RHB Global Shariah Equity Index Fund dated 16 February 2024 (“Fund”) are available and investors have the right to request for a PHS.

The Manager wishes to highlight the specific risks of the RHB Global Equity Premium Income Fund are Fund Management Risk, Liquidity Risk, Currency Risk, Country Risk, Interest Rate Risk, Suspension of Redemption Risk, and Distribution out of Capital Risk. The specific risks of MAMG Systematic Asia Pacific Equity Absolute Return Fund are Concentration Risk, Default Risk, Counterparty Risk, Country Risk, Currency Risk, Derivatives Risk, and Investment Manager Risk. The specific risks of the RHB Dynamic Artificial Intelligence Allocator Fund, which are Liquidity Risk, Currency Risk, Country Risk, Interest Rate Risk, Credit and Default Risk, Financial Derivatives Risk, Equity Risk, Equity-Related Securities Risk, Collective Investment Schemes Risk, Concentration Risk, Distribution Out of Capital Risk, and Risk of Over-Reliance on the Artificial Intelligence Risk Model. The specific risks of AHAM World Series – Global Income Fund, which are Concentration Risk, Liquidity Risk, Counterparty Risk, Country Risk, Currency Risk, Target Fund Manager Risk, and Distribution Out of Capital Risk. The specific risks of RHB Global Shariah Equity Index Fund are Management Risk, Liquidity Risk, Country Risk, Currency Risk, and other general risks are elaborated in the Information Memorandum.

Retail Bond is not a principal guaranteed product. The holder of the investment is assuming the credit risk of the issuer of the investment. In the event of winding up, liquidation or rating downgrade of the issuer of the investment or if you sell the investment prior to maturity, you will suffer a potential capital loss. Investor should obtain, read and understand the Product Highlight Sheet of the Retail Bond carefully before you make a decision to acquire the product. All information provided in this document is general and does not take into account of your individual objectives, financial situation or specific needs. The printed copy of Product Disclosure Sheet is available at RHB branches/Premier Centre and investors have the right to request for a Product Disclosure Sheet.

This article has not been reviewed by the Securities Commission Malaysia (SC).

RHB Bank Berhad 196501000373 (6171-M) | RHB Islamic Bank Berhad 200501003283 (680329-V)