How a Modest Bet on Digital Assets Could Potentially Elevate Your Long-Term Strategy

Digital assets are among the fastest growing areas of investments. Here’s how making a small change in your portfolio could position it for big potential.

What if just a fraction of your portfolio—less than 5%—could open the door to a whole new world of investment opportunities? We’re not talking about betting on the next crypto moonshoot. Instead, it’s about understanding how digital assets are steadily becoming a legitimate and powerful part of a diversified investment strategy. With a solid understanding and the right approach, even a small exposure could potentially make a big difference.

What are digital assets?

Digital assets are more than just cryptocurrencies. They’re digital representations of value that are recorded and verified on a blockchain. What makes them special is their ability to be owned, traded, or transferred securely without a central authority—thanks to decentralised ledger technology.

They come in various forms1:

- Cryptocurrencies like Bitcoin and Ethereum, which act as decentralised currencies or stores of value.

- Non-Fungible Tokens (NFTs), which allow creators to mint and sell unique digital art, music, and collectables.

- Tokenised assets, which let investors own fractional shares of traditionally illiquid investments like real estate, private equity, gold, or fine art.

- Programmable money, which can be coded for specific uses (think healthcare, education, or travel).

- Central Bank Digital Currencies (CBDCs), which are government-backed digital currencies in development or early use stages globally.

What these all have in common is the ability to transform how value is created, accessed, and exchanged.

Malaysia’s quiet (but confident) entry into digital assets

You might not know it, but Malaysia is already a participant in the global digital asset revolution. Bank Negara Malaysia is involved in Project Dunbar, a collaboration with central banks from Australia and Singapore to explore the use of CBDCs for cross-border transactions. The goal? Cheaper, faster, and more secure payments between countries.

Closer to home, the Securities Commission Malaysia (SC) has implemented clear regulations around digital asset exchanges and platforms. Only those registered and approved by the SC are legally permitted to operate, offering investors a more secure environment to explore these new asset classes. An important sidenote is that this does not include unit trust funds with exposure to digital assets.

Together, these moves signal a national-level readiness to integrate digital assets into Malaysia’s financial future.

Start small, think long-term

You don’t need to go all in. In fact, most wealth advisors recommend allocating between 1% and 5% of your portfolio to digital assets, particularly if you are new to the space, or risk averse.

Why such a small slice? Because that’s all it takes to:

- Boost diversification: Digital assets often move independently of traditional markets, giving your portfolio more resilience.

- Capture upside potential): As adoption increases, some digital assets could outperform traditional ones.

- Gain exposure to innovation): Tokenisation and decentralised finance (DeFi) are laying the groundwork for the future of investing.

It has become part of culture

Digital assets aren’t just shaking up the finance world – they’re becoming embedded in culture. Gamers are trading blockchain-backed skins and weapons. Music fans are buying NFT albums to directly support their favourite indie artists. And art lovers are collecting digital works that live entirely on-chain. For these younger investors, digital assets represent expression, ownership, and access. It’s no longer about what you can buy, but what you can belong to.

Unlocking wealth through tokenisation

Perhaps the most exciting aspect of digital assets is tokenisation, which is the ability to break down expensive or illiquid assets into digital “tokens” that can be bought and sold. Let’s say you’ve always wanted to invest in luxury real estate or a blue-chip art collection. With tokenisation, you can own a fraction of that asset, gaining exposure without needing millions in the bank. Tokenisation is a way to democratise wealth, driven by technology.

Don’t dive in – test the waters first

Let’s be real. There is no such thing as a zero-risk investment, and we would never want to mislead you. Digital assets come with a fair share of risk. Price volatility is common. Regulations can shift quickly. Scams and phishing attacks are rampant. In fact, in this year alone more than USD2.17 billion has been stolen from scam-linked cryptocurrency services2 . That’s why digital assets are more suited to experienced investors who understand risk and are willing to do their homework.

If you’re new to the space but curious, one of the safest ways to start is by using trusted, regulated platforms—or better yet, a managed fund that includes digital asset exposure. One such option is the RHB Dynamic Artificial Intelligence Allocator Fund, Malaysia’s first AI-powered multi-asset fund. The fund includes investments in collective investment schemes (exchange-traded funds, or ETFs) with exposure to digital assets, while maintaining a balanced portfolio of more traditional assets like equities, money market instruments, and deposits.

The fund dynamically adjusts allocations using artificial intelligence, aiming to optimise returns while navigating market volatility. It’s a solid way to gain exposure without needing to actively trade or worry about setting up crypto wallets.

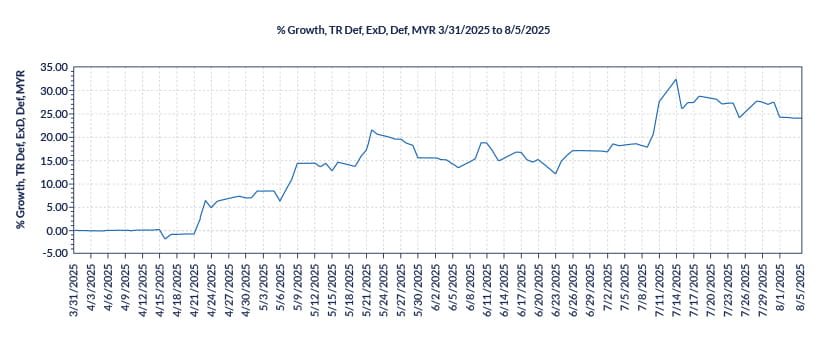

The chart below shows the fund’s growth since its launch early this year:

Source: Lipper Investment Management as of 5 August 2025.

In short, it’s a smart on-ramp into the world of digital assets for those who want in but want to do it right.

Small moves, big possibilities

Digital assets are no longer a fringe trend. They’re becoming an accepted part of the global financial landscape, supported by governments, embraced by creators, and increasingly accessible to everyday investors.

If you’re looking for new ways to diversify your portfolio, enhance long-term returns, and gain exposure to the future of value, it might be time to carve out a small space for digital assets.

Talk to your Relationship Manager to learn more!

1 Investopedia, What Are Digital Assets? Definition, Types, and Their Importance, August 2025.

2 Chainalysis, 2025 Crypto Crime Mid-Year Update, July 2025.

Disclaimer:

This article has been prepared by RHB Bank Bhd (“RHB”) and is solely for your information. This article is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, or passed to any third party, without obtaining prior permission of RHB. In preparing this presentation, RHB has relied upon and assumed the accuracy and completeness of all information available from public sources or which was otherwise reviewed by RHB. Accordingly, whilst we have taken all reasonable care to ensure that the information contained in this presentation is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness and make no representation or warranty (whether expressed or implied) and accept no responsibility or liability for its accuracy or completeness. You should not act on the information contained in this article without first independently verifying its contents.

Any opinion, management forecast or estimate contained in this article is based on information available as of the date of this article and is subject to change without notice. It does not constitute an offer or solicitation to deal in units of any fund and does not have regard to the specific investment objectives, financial situation or the particular needs of any specific person who may receive this. Investors may wish to seek advice from a financial adviser/unit trust consultant before purchasing units of any funds. In the event that the investor chooses not to seek advice from a financial adviser/unit trust consultant, he should consider whether the fund in question is suitable for them.

A Product Highlights Sheet (“PHS”) highlighting the key features and risks of the Fund is available and investors have the right to request for a PHS. Investors are advised to obtain, read and understand the contents of the PHS and Information Memorandum dated 17 March 2025 and its supplementary(ies) (if any) ("collectively known as the Information Memorandum") before investing. The Information Memorandum has been lodged with the Securities Commission Malaysia ("SC") who takes no responsibility for its contents. The SC’s approval or authorization, or the lodgement of the Information Memorandum should not be taken to indicate that the SC has recommended or endorsed the fund. Amongst others, investors should compare and consider the fees, charges and costs involved. Investors should also note that the price of units and distributions payable, if any, may go down as well as up. Where a distribution is declared, investors are advised that following the issue of additional units/distribution, the NAV per unit will be reduced from cum-distribution NAV to ex-distribution NAV. Any issue of units to which the Information Memorandum relates will only be made on receipt of a form of application referred to in the Information Memorandum. The printed copy of PHS and the Information Memorandum are available at RHB branches/Premier Centres. Investors are advised that investments are subject to investment risk and that there can be no guarantee that any investment objectives will be achieved. Investors should conduct their own assessment before investing and seek professional advice, where necessary and should not make an investment decision solely based on this article. Subscription of units of the Fund is only open to sophisticated investors.

The Manager wishes to highlight the specific risks of the RHB Dynamic Artificial Intelligence Allocator Fund, which are Liquidity Risk, Currency Risk, Country Risk, Interest Rate Risk, Credit and Default Risk, Financial Derivatives Risk, Equity Risk, Equity-Related Securities Risk, Collective Investment Schemes Risk, Concentration Risk, Distribution Out of Capital Risk, Risk of Over-Reliance on the Artificial Intelligence Risk Model, as well as other general risks are elaborated in the Information Memorandum.

This article has not been reviewed by the Securities Commission Malaysia (SC).

RHB Bank Berhad 196501000373 (6171-M)