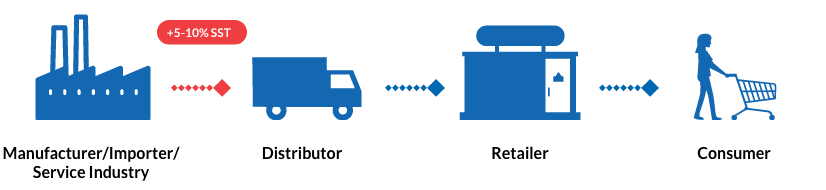

This year, the Ministry of Finance reintroduced the Sales and Service Tax (SST) in place of the Goods and Services Tax (GST). The enhanced version, dubbed SST 2.0, took effect on 1 September 2018. More than a month after its implementation and despite being a reintroduction of a previous tax system, many in the market are still unsure how to react.

'Do I freeze my investments?'

'How different is it from the old SST?'

'When will the dust settle?'

Uncertain times may call for uncommon approaches. Here are some pointers from our tax team. But first, let’s take a look at the areas of enhancements in the new tax model before we discuss the opportunities going in.

The new tax model is fundamentally the same Sales and Service Tax introduced fifty years ago, but with enhancements in a number of areas designed to boost production, consumer demand and the economy.

Sales Tax at 5% or 10%.

New SSTSales Tax between 5% to 10% remains reviewable

What’s differentRates currently reviewable based on feedback from businesses.

Service Tax at 6%.

RM50 for principal credit/charge card and RM25 for supplementary credit/charge card imposed on an annual basis.

New SSTSales Tax between 5% to 10% remains reviewable

What’s differentRates currently reviewable based on feedback from businesses.

Businesses

|

Previous SST

|

|

Restaurant business threshold varied depending on the location of the business:

|

|

Hotel business includes any taxable person operating one or more hotels having more than 25 rooms.

|

|

Refunds -Not specified.

|

|

Restaurant business threshold of RM1.5 million for all types of restaurant business.

|

|

Hotel business scope expanded to include lodging house, serviced apartment, homestay, bed and breakfasts, inn, resthouse and boarding house, of any number of rooms.

|

|

Refunds - Timely refunds.

|

|

Lowered threshold for restaurants and closing loopholes in the previous SST.

|

|

Closing loopholes previously apparent in the previous SST.

|

|

To alleviate cashflow. A reactionary measure to the GST model which failed to refund majority of businesses over its course. |

Manufacturers

Previous SST

Input costs - Not specified.

___________________________________________________________________________

Designated Area exemptions

Special Area exemptions

New SST

Input costs including raw materials, components and packaging are tax-free.

___________________________________________________________________________

Insurance & Medical

Previous SST

Insurance - B2B Insurance excluding certain insurance in relation to export of goods.

___________________________________________________________________________

Medical - Not specified.

New SST

Insurance - Scope of insurance expanded to cover all B2B products excluding certain insurance in relation to export of goods; and all B2C products excluding life insurance or family Takaful policies, and medical insurance or medical Takaful policies.

___________________________________________________________________________

Medical - Medical providers, medical products and consultation exempted.

What’s different

Medical and life insurances exempted. Export insurance exempted.

___________________________________________________________________________

Medical supplies and services exempted.

Entertainment

Previous SST

Night club, private club and golf club with threshold of RM300,000 for private club and golf club. Not specified for night club, health centre, massage parlour, beer house, dance hall etc.

New SST

Night club, private club and golf club with threshold of RM500,000 for these businesses.

Gaming now taxable, and includes casinos, gaming machines, sweepstakes, lottery, games of chance and betting.

Electricity, IT services, domestic flights including helicopter services, and car rentals now taxable.

What’s different

Luxury items and services now taxable.

Source: Deloitte, Sales Tax and Service Tax (“SST”) Framework - Deloitte Analysis and Views, 19 July 2018.

At the end of the 3-month ‘tax holiday’ and the beginning of a new tax model, consumer spending behaviour will normalise and move cautiously with the new prices of goods and wages. In spite of a new tax model made to boost spending, the enhanced SST model may not promise high spending power just yet, so retail and consumer stocks are not the best buys at the moment. Stocks that remain the least volatile are those least affected by the new SST—they are export-oriented or less dependable on the imports market.2

Despite the newly-announced Service Tax on domestic flight tickets, airports and fleets have reported positive passenger growth into as far as the third months of SST implementation.

This makes discretionary spending sectors such as aviation a good option. Also look at growing sectors due to SST exemptions on manufacturing input, such as suppliers of raw materials, cans and packaging. Logistic companies, spurred by the high volume of online shopping, could also prove to be rewarding picks.2

Watch market sentiments closely. They are unstable due to external factors and ‘price correction’ events may suddenly present buying opportunities. What’s more certain would be the one or two consumer spikes over the year-end seasonal spending spree.2

Unit trusts and financial planning products such as life insurance and medical insurance purchased by individuals are not subject to the SST.1 While luxury items and services are now subject to the SST1 and made less attractive, your disposable income could now go into investing in better health and coverage for your family members. Take it as a refocus from expensive indulgence to personal well-being—which leads to happiness just the same.

The new tax model’s enhancements are meant to incentivise manufacturers and drive growth.3

Study the areas related to your industry to take full advantage of exemptions as well as cost-saving facilities and processes. Meanwhile, a larger number of service providers and professional services previously registered under the GST no longer fall within the scope of taxable services and are automatically exempted from Service Tax.3, 4

You’d have the most to gain as a Small-to-Medium-sized Entrepreneur. Because the SST framework exempts distributors and retailers, it simplifies your administrative process and frees you from compliance requirements, thus greatly reducing your business costs.5

In line with the single-stage tax principle, all manufacturers big and small are entitled to tax-free input of raw materials, components, packaging and so on. Agricultural-based producers, for example, can look forward to exempted material costs such as fertiliser, even tractors and fishing boats.6

If you are a manufacturer of goods for export, you can benefit from the weak ringgit as well as SST exemptions to diversify your product range and expand. With the new tax model’s exemptions for B2B services such as export insurance and overseas R&D, the opportune time is now.

Third months into the implementation of the SST, an appeal from the local photography industry resulted in the reduction of tax on cameras and accessories by half.7 The Ministry of Finance has been open to review items and rates based on incoming industry feedback—and still is.8 So if you feel your industry or business deserves a better rate or basket of exemptions, take full advantage of the government’s decision to remain open to reviews and changes. Your feedback matters and can help shape your business, whether as an individual company or a representative of your industry.

Clarifications on vague areas such as disbursements are still pending from the Royal Malaysian Customs Department.9 Be wary of unreliable sources and rumours on social media. Instead, keep abreast with the latest announcements and read up on details made available by the Royal Malaysian Customs Department at its official website on the SST at mysst.customs.gov.my

The market is uncertain, but things should become much clearer towards the end of the transition tunnel. Not all areas of the SST were discussed here. You should take time to go further into detail in the areas of the SST specific to your industry, to be able to fully utilise the benefits of the new tax model. Also, stay tuned to the upcoming Budget 2019—our tax team will once again offer an overview and some insights.

Keep in mind, every part of your business or investment portfolio should be taken into account before making decisions. When you are ready, arrange a time with your certified Relationship Manager for further consultation on wealth management.

Sources : 1 Royal Malaysian Custom Department, MySST, 15 October 2018. 2 The Edge Markets, Valuation already ‘stretched’ for consumer stocks, 18 September 2018. 3 The Edge Markets, MoF: New SST will involve less manufacturers than GST, 7 August 2018. 4 The Star Online, No SST for essential items, 20 July 2018. 5 The Edge Markets, Tax: SMEs welcome the return of SST, 13 July 2018. 6 Malay Mail, Doctor’s fees, baby formula among SST-exempt items, says Guan Eng, 19 July 2018. 7 The Star Online, SST on cameras reduced to 5%, says Guan Eng, 16 September 2018. 8 The Sun Daily, Post-implementation changes to SST must be handled well: Experts, 3 September 2018. 9 The Edge Markets, More time needed to grasp SST 2.0, say businesses, 23 August 2018.