The markets were braced for bad news ahead of the tabling of Budget 2019 in Parliament, after being warned of the need to “sacrifice”. The reality, as it turned out, was not as taxing – this was after an unexpected MYR30bn special dividend from Petronas, which forestalled the need for deeper spending cuts and/or more punitive tax-raising initiatives. The strong emphasis on fiscal discipline and initiatives to assist the less privileged was anticipated. The legal tobacco industry was the only outright winner, benefitting from the proposed improvement in enforcement against cigarette smuggling. The gaming sector was the sacrificial lamb, hit by higher casino duties and reduction in NFO draw days. Overall, we are encouraged by initiatives on institutional reforms and measures to promote a more entrepreneurial economy. While the budget proposals are supportive of growth and could help to lift near-term market sentiment, government finances remain constrained.

Fiscal consolidation on track helped special dividend from Petronas.

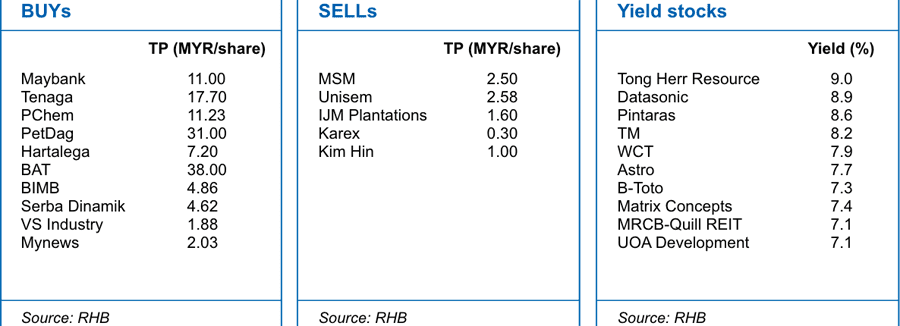

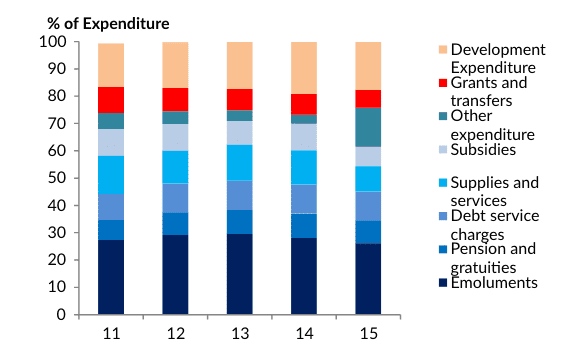

Malaysia’s fiscal deficit is projected to narrow to 3.4% of GDP in 2019 from a revised estimate of 3.7% for 2018. This is amid more prudent spending and an expected special dividend from Petronas to help pay off the one-off tax refund. Total revenue excluding Petronas’ special dividend is expected to decline 2% to MYR231.8bn for 2019, while total expenditure – excluding the tax refunds – is envisaged to fall 4.4% to MYR277.6bn. This involves savings from non-essential expenditure, postponing programmes with less urgency under the zero-based budgeting approach, and scaling down existing projects and subsidies & social assistance rationalisation initiatives to a more targeted lower income group. Although the 2018-2019 budget deficits were adjusted higher – derailing the original course of fiscal consolidation – we are confident that international rating agencies will look past this as a one-off event.

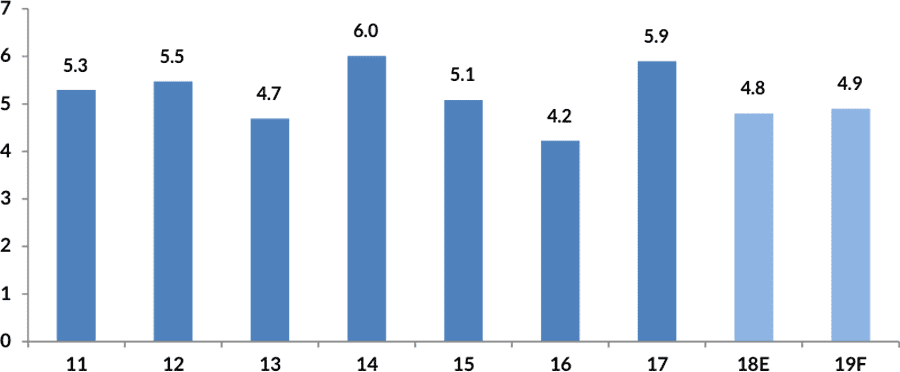

GDP forecasts lowered. As a whole, government expenditure is less expansionary, and we believe economic growth will likely be weaker in 2019 than in 2018. Accordingly, we revise our GDP growth forecasts downwards to 4.8% and 4.6% in 2018 and 2019.

Positive for tobacco sector, mixed elsewhere.We expect the improvement in enforcement initiative to benefit the legal tobacco industry, and leader British American Tobacco in particular. The various proposals have mixed implications for most other sectors, including consumer, telecommunications, media, and property. The revision of the minimum wage to MYR1,100 will be negative for the labour-dependent construction and plantation sectors.

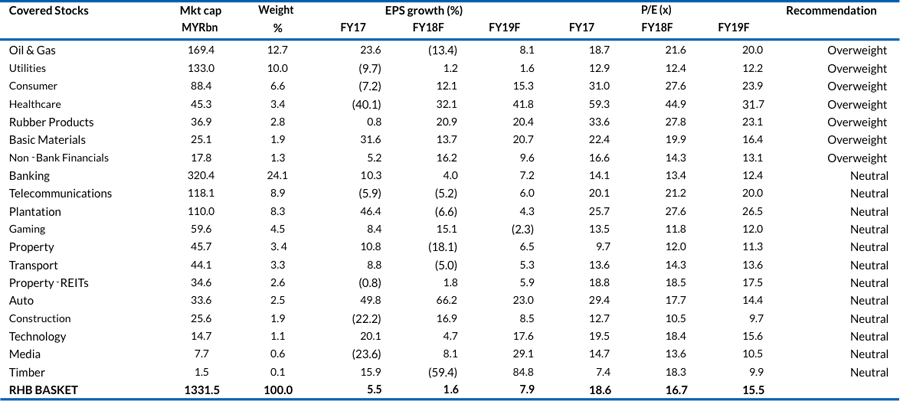

Changes to recommendations. We downgrade our call on the gaming sector to NEUTRAL from Overweight after cuts to earnings estimates at Genting Malaysia, Genting, Magnum and Berjaya Sports Toto.

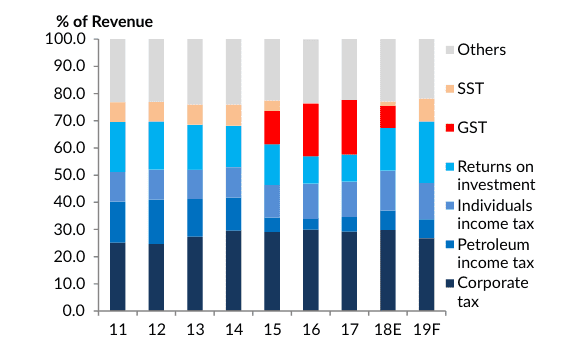

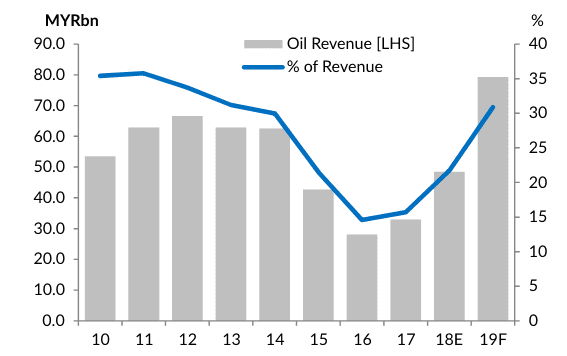

External environment still challenging for equities. Slowing global growth, a tightening monetary environment, and an increasingly unpredictable and drawn out US-China trade war are the key external worries. The increasing reliance on oil-related revenue is a significant weakness, posing a risk to the country’s public finances should oil prices fall significantly.

Investment strategy. The absence of more punitive proposals could offer an opportunity for a mild relief rally. Nonetheless, government finances remain constrained – leaving it with little wriggle room should the external environment deteriorate. When the dust settles, we still see limited fundamental upside for the market, capped by unattractive valuations. Domestic equities are likely to remain range-bound, with occasional bouts of volatility that lends itself to a trading strategy. We also highlight domestic political, policy, and execution risks going forward. We advocate investors adopt a core defensive strategy for tactical reasons. Our end-2018 FBM KLCI target is unchanged at 1,720 pts. We remain OVERWEIGHT on consumer, utilities, oil & gas, rubber products, basic materials, and non-bank financial institutions (NBFIs).

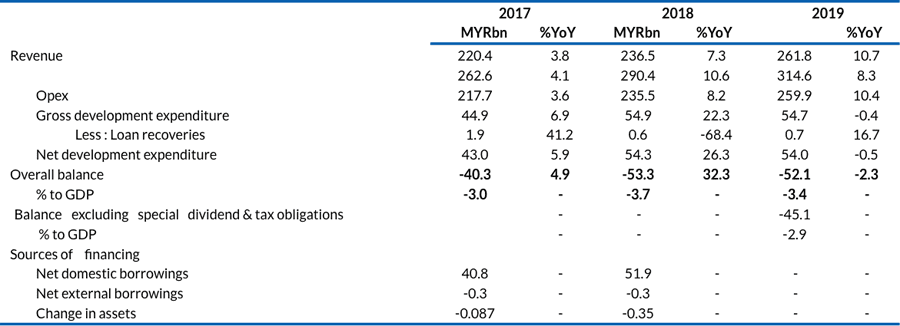

Finance Minister Lim Guan Eng tabled a budget of MYR314.6bn for 2019, representing an increase of 8.3% vs the revised Budget 2018’s MYR290.4bn. While operating expenditure is expected to increase 10.4% to MYR259.9bn, this is anchored by revenue growth of 10.7% to MYR261.8bn. The latter includes a one-off special dividend of MYR30bn from Petronas, which will go towards repaying the GST and income tax refunds of MYR37bn. This, together with more prudent spending, will allow the budget deficit to narrow to 3.4% of GDP in 2019, lower than 2018’s revised estimate deficit of 3.7%. The budget deficit for this year has been revised higher to take into account previously unbudgeted items, as well as paying back of some GST refunds of MYR8.6bn, or 0.6% of GDP.

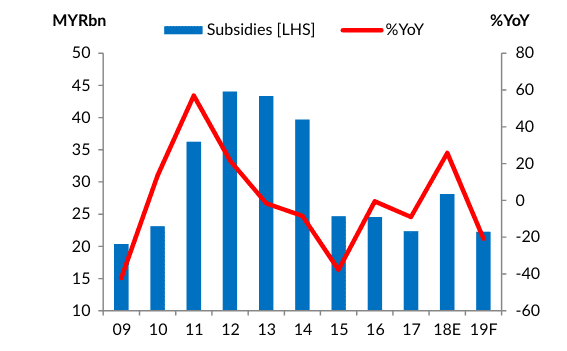

It should, however, be noted that total revenue – excluding Petronas’ special dividend – is expected to decline 2% to MYR231.8bn for 2019, while total expenditure (excluding the tax refunds) is envisaged to fall 4.4% to MYR277.6bn. This involves savings from non-essential expenditure, postponing programmes with less urgency under the zero-based budgeting approach, and scaling down existing projects and subsidies & social assistance rationalisation to a more targeted lower income group. In particular, government procurement and subsidies & social support will be cut by 20.4% and 20.8% in 2019.

All in, excluding the Petronas special dividend and tax refunds, the budget deficit should come in at 2.9% of GDP – a significant reduction from the 3.7% of GDP in 2018. Overall, this will be considered a continuation of fiscal consolidation, although the one-off payment will likely provide a needed boost for the economy – the Government has forecasted for the economy to sustain at 4.9% in 2019 from the 4.8% estimated for this year.

Given that the tax refunds are to be funded mostly by Petronas’ retained earnings, we believe it will not be difficult to achieve the 2019 deficit target. This also shows the Government’s strong commitment towards fiscal consolidation.

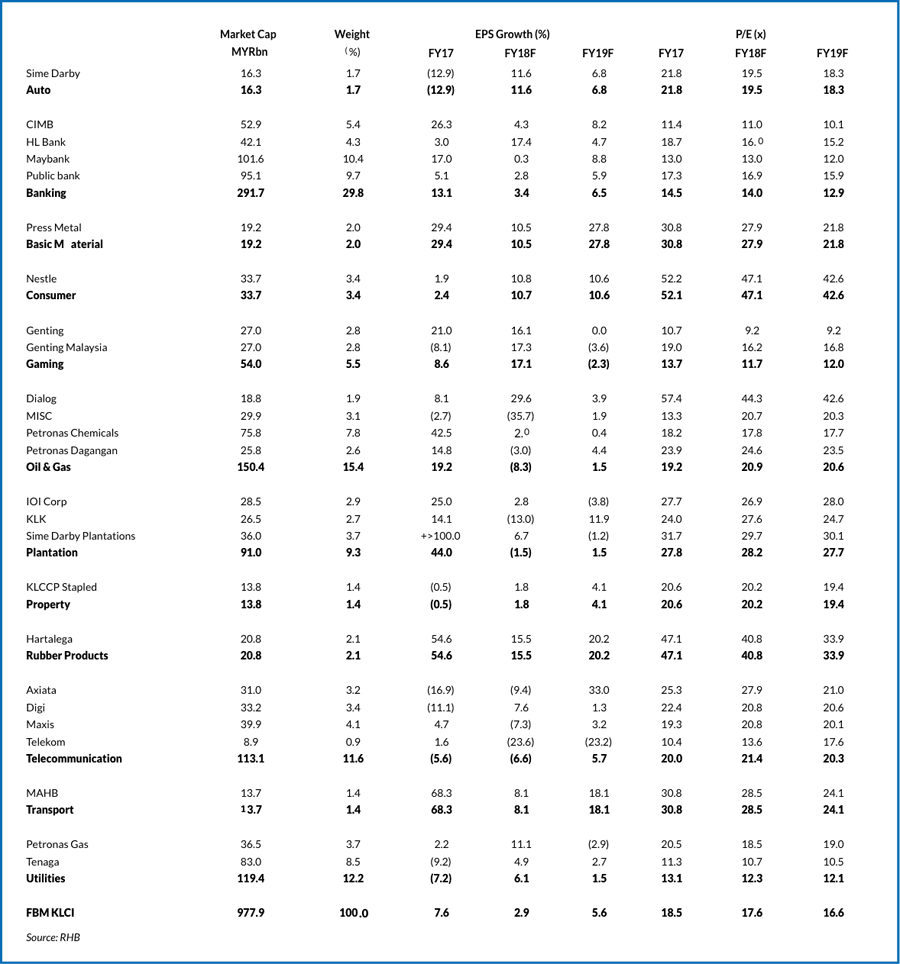

Figure 1: The Government’s financial position

We have just revised our GDP growth forecasts downwards to 4.8% and 4.6% in 2018 and 2019 from 5% previously for both years. This is because we are wary of the challenging global environment amidst rising trade protectionism and rising interest rates, which will place a drag on growth going forward.

Although the repayment of GST and income taxes – totalling MYR37bn (2.4% of GDP) – by the Government should, no doubt, channel funds to the private sector and boost disposable incomes and improve cash flows of business and individuals, we believe other measures – such as the introduction of new taxes and subsidy & social support rationalisation, as well as the overall challenging global growth environment – may curb private spending growth.

Furthermore, civil servants’ emoluments are projected to register only a marginal increase in 2019. As a result, we expect private consumption and investment to slow to 6.5% and 4.5% in 2019 from 7.2% and 4.7% this year.

Source : MOF, RHB

The Government is reducing subsidies into a more focused mechanism and social support for a more targeted income group. It will float RON95 fuel prices but will subsidise 30 sen per litre of RON95 fuel for single-car owners with engine capacities below 1,500cc and motorcycles with engine capacities below 125cc. However, this is limited to 100 litres a month for a car and 40 litres per month for a motorcycle. The Government has allocated MYR2bn for this mechanism, which represents a 33% decrease from the previous year’s MYR3bn.

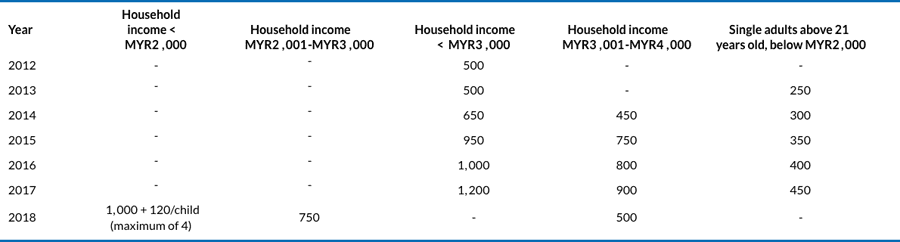

In addition, the Government reduced the Living Aid Assistance (BSH) cash transfers, previously known as 1Malaysia People’s Aid (BR1M), to MYR5bn in 2019 from MYR6.8bn this year, which would narrow the beneficiaries to 4.1m households from 7m. The bonus payments for civil servants have also been reduced to MYR500 for 2019 from MYR1,500 this year. These initiatives are likely to put a cap on private consumption. However, other measures to support private consumption such as:

i. Raising the minimum wage by another RM50 to MYR1,100;

ii. Subsidiestoequalisepricesofcriticalgoods–egwheatflour,rice,sugar,andcooking oil – between urban and rural areas;

iii. Providing incentives for employers to hire those past the retirement age of 60…

…should help to mitigate this slowdown.

Nonetheless, under the floating fuel price mechanism, the RON95 price is expected to increase to MYR2.63 per litre if current international prices (average for Oct 2018) prevail. This is a 19.5% increase from the current fixed RON95 price of MYR2.20 per litre and will add 1.5ppts to the Consumer Price Index for next year. We have taken this into account for our 2019 inflation forecast, in which we expect it to double to a pace of 2.5% from the 1.2% estimated this year (Ministry of Finance (MOF) 2018 estimates: 1.5-2.5%, 2019 forecast: 2.5-3.5%).

On the housing sector, the Government will address the property overhang issue by waiving the stamp duty charges for first-time purchases of homes valued between MYR300,001 and MYR1m. This ought to boost property purchases, but only for a limited time of six months. The impact to the economy may, however, be somewhat limited, as the Government has also increased the Real Property Gains Tax and stamp duty charges, negating the stamp duty waiver mentioned above.

To enable the small & medium enterprise (SME) industry, the Government announced a myriad of incentives and loan guarantees for SMEs and reduced the corporate income tax rates by 1% for firms with less than MYR2.5m in paid-up capital. This should help support private investments, as these SMEs constantly require funding.

However, the overall impact on 2019 private investments may not be so significant, as most of these measures (excluding the tax cut) were already in place in previous years.

All in, we understand that Budget 2019 has a lack of goodies for the economy, and that the fiscal consolidation drive remains on course. However, the one-off payment of MYR37bn in tax refunds – which is being funded through special dividends by Petronas – ought to help to hold up the consumer and business spending somewhat.

Meanwhile, tax reforms and improvements in transparency – to reflect a more accurate financial standing – should not be understated in this budget. Although the 2018-2019 budgets were readjusted higher – derailing the original course of fiscal consolidation – we are confident that the international rating agencies will look past this as a one-off event. The Government is also committed to reducing the budget deficit further to 3% in 2020 and 2.8% in 2021, which means the longer-term consolidation plan is in place, and should help assure investors and stakeholders.

Overall, Budget 2019 broadly supports our GDP forecast of 4.6% for 2019 from the +4.8% estimated for this year – although our 2019 estimate is lower than MOF’s forecast. Despite slower growth expected for 2019, due to the challenging external environment, we are encouraged by the fact that Malaysia’s economic fundamentals and public finances will be strengthened to face challenges going forward. Nevertheless, we would like to highlight the risk of the increasing reliance on oil-related revenue, which will account for 30.9% of revenue in 2019, up from 21.7% in 2018. This will pose a risk to the country’s public finances should oil prices fall significantly.

Focus 1 – Implementing Institutional Reforms

Strategy 1: Strengthening Fiscal Administration

i. The Government is implementing a “zero-based budgeting” exercise for Budget 2019;

ii. The Government will table a Fiscal Responsibility Act by 2021 to avoid reckless mammoth spending that entails mega debts;

iii. The administration intends to table a new Government Procurement Act next year to govern procurement processes to ensure transparency and competition while punishing abuse of power, negligence, and corruption;

iv. The Government’s current cash basis of accounting is to be converted into an accrual basis by 2021 – this is to ensure full disclosure of debts and liabilities, as well as the value of assets.

Strategy 2: Restructuring & Rationalising Government Debts

i. The Government is to set up a Debt Management Office. This office is to be responsible for the reviewing and managing of the Government and its agencies’ current and future debts and liabilities;

ii. The Government has taken the decision to cancel the MYR15bn Multi-Product and Trans-Sabah Pipeline projects. The construction of the MYR81bn East Coast Rail Link (ECRL) is also suspended – pending renegotiation of the project’s costs. The Government has cancelled the MYR60bn Mass Rapid Transit Line 3 (MRT3) project for now, pending the completion of Mass Rapid Transit Line 2 (MRT2). It has also postponed implementation of the Kuala Lumpur-Singapore High-Speed Rail, which would have cost at least MYR110bn;

iii. The Government has decided to proceed with several infrastructure projects, ie Light Rail Transit Line 3 (LRT3) and MRT2. The Klang Valley Double-Tracking Phase 2 project – which was awarded via direct negotiations – has been terminated and will be retendered via an open tender exercise;

iv. The Government will take all necessary actions to recover funds lost and stolen from a strategic development company owned by the Ministry of Finance.

Strategy 3: Raising Government Revenue

Leveraging Assets:

i. The Government is seeking to reduce its stake in non-strategic companies and utilise the proceeds to pare down debt;

ii. The real Public Private Partnership (PPP) model for public projects based on land swap transactions will be implemented using an open tender mechanism and not through direct negotiations;

iii. The Government will plan scheduled and staggered land sales via auctions to the highest bidder, based on conditions imposed on the land, to maximise revenue;

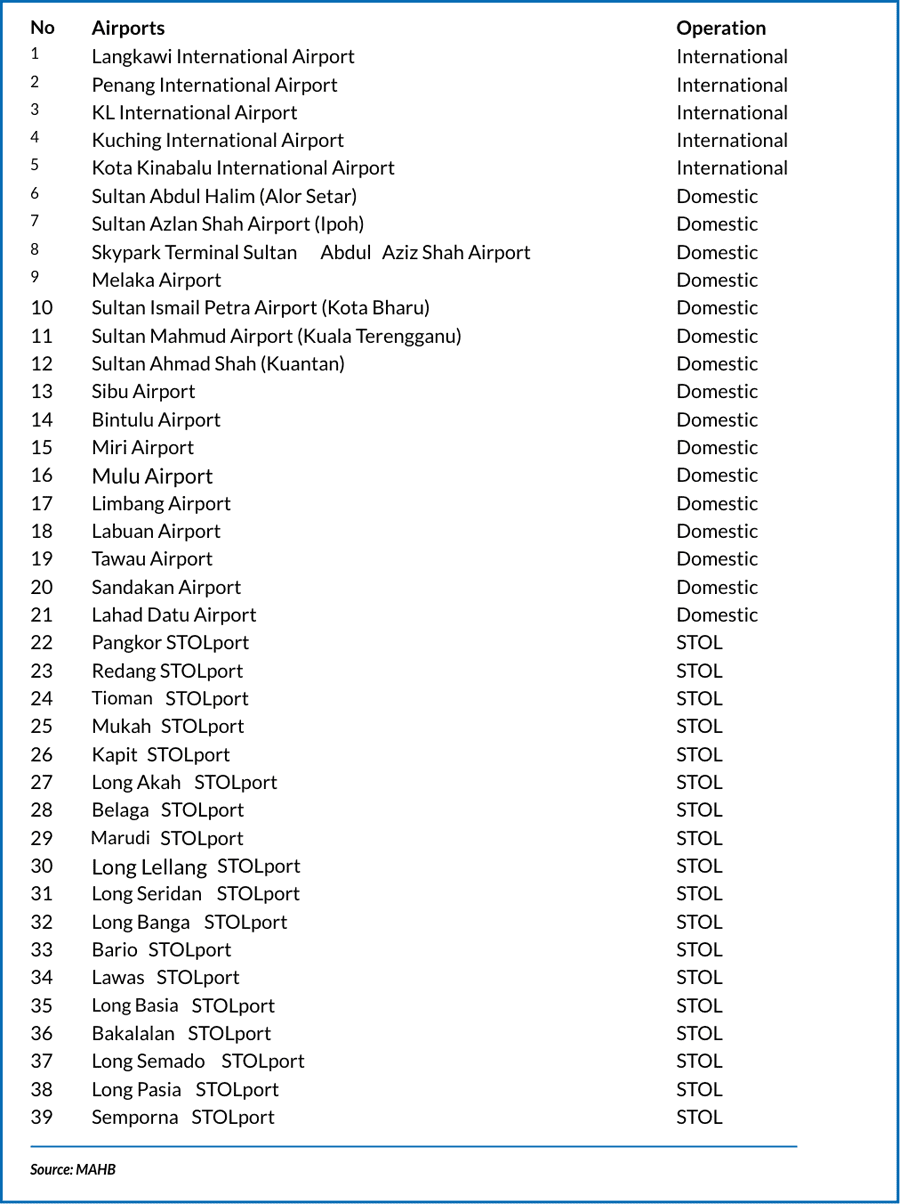

iv. To privatise infrastructure assets, the Government intends to set up the world’s first “Airport REIT”. Investors in this REIT will receive income arising from user fees collected from Malaysia Airports (MAHB), which has the concession to operate these airports

Reviewing Taxation:

i. Imported services will be subjected to a service tax starting 1 Jan 2019;

ii. For online services imported by consumers, service providers from overseas will need to be registered with the Royal Malaysian Customs, and be charged and remitted with the relevant service tax on transactions with effect from 1 Jan 2020;

iii. The Government will launch a Special Voluntary Disclosure Programme to offer an opportunity for taxpayers to voluntarily declare any unreported income for Malaysian tax purposes, including those in offshore accounts;

iv. The Inland Revenue Board (IRB) will investigate unexplained extraordinary wealth displayed by possession of luxury goods – the IRB will then use all necessary measures permitted by the law to recover such monies, whether in the form of additional taxes, penalties, or fines;

v. The Government will review existing relief and incentives to make them relevant and cut down on leakages. It will also place a time-limit on the carrying forward of losses and allowances for tax relief to a maximum of seven years;

vi. The Government will review the types of fiscal schemes to support investments, with the intention to expire incentives that are duplicitous or no longer relevant;

vii. The Royal Malaysian Customs will step up enforcement against cigarette smuggling;

viii. The Government is proposing to impose a departure levy for all outbound air travellers starting 1 Jun 2019;

ix. he Real Property Gains Tax rates will be revised for the disposal of properties or shares in property holding companies after the fifth year. The rate shall be increased to 10% from 5% for firms and foreigners. It will also be raised to 5% from 0% for Malaysian individuals: low cost, low-medium cost and affordable housing with prices below MYR200,000 will be exempted;

x. The stamp duty on the transfer of property valued at more than MYR1m will increase to 4% from 3%;

xi. Tax exemption granted for interest earned on whole sale money market funds will cease beginning 1 Jan 2019;

xii. The Government will remove restrictions on trade in MYR, transactions between Labuan and Malaysian residents, as well as maintaining the current tax rate of 3%. However, the tax ceiling of MYR20,000 – under the Labuan Business Activity Tax Act 1990 – will be removed;

xiii. On the taxes, fees and levies on the Gaming Industry:

xiv. The Government is expecting to receive a one-off special dividend of MYR30bn from Petronas, which will go towards repaying the GST and income tax refunds of MYR37bn.

Focus 2 – To Ensure Socio-Economic Wellbeing Of Malaysians

Strategy 4: Ensuring Welfare & Quality Of Life

i. The Government will enhance the Living Aid Assistance cash grants for the B40 households, according to the size of the family, starting Jan 2019;

ii.MYR45m was allocated under the e-Kasih programme, to incentive husbands to contribute for their wives’ retirement savings under Employees Provident Fund’s (EPF) i-SURI contribution scheme. For every minimum MYR5 monthly contribution by husbands, the Government will contribute MYR40 to the accounts of their wives;

iii. Car owners of 1,500cc and below and motorcycle owners of 125cc and below will enjoy a petrol (RON95) subsidy of at least MYR0.30 per litre for 100 litres and 40 litres per month – this is expected to commence in 2Q19;

iv. MYR150m allocated to equalise prices of critical goods – this is to minimise the price differences between urban and rural areas;

v. The Government is adopting the latest technology and techniques to be more efficient and effective in price monitoring, ie the use of Price Catcher mobile application. MYR20m will be allocated towards better enforcement;

vi. MYR20 per month in electricity subsidies to be more targeted – only the poor and hard core poor registered with e-Kasih will qualify. The subsidy will increase to MYR40per month, with the allocation of MYR80m;

vii. The Government will identify and collaborate with non-government organisations and social enterprises to support efforts in uplifting underprivileged and marginalised communities. MYR10m is allocated for this imitative;

viii. Income tax deductions will be provided for contributions from any parties to any social enterprise subject to a maximum of 10% of aggregate income of a company or 7% of aggregate income for a person other than a company.

Strategy 5: Improving Employment & Employability

i. MYR20m has been allocated to the Human Resource Development Fund to benefit 4,000 youth by launching “Apprenticeship” and “Graduate Enhancement Programme for Employability” programmes;

ii. The employer portion of EPF contributions is to be cut to 4% from the current 6% effective 1 Jan 2019 while the mandatory employee contribution for this group is to be zeroed. Also proposed is the provision of additional tax deductions to employers who employ this group up to a monthly salary of MYR4,000;

iii. Provision of an additional tax deduction for companies that employ ex-convicts up to a monthly salary of MYR4,000 each;

iv. One-off MYR500 assistance to qualified elderly pensioners receiving pensions of less than MYR1,000 per month;

v. MYR10m pa allocated to make health care services available for the parents of “contract of service” officers and “quarantine leave” when their children suffer from infectious diseases commencing 12 Nov 2018;

vi. Allow for up to seven days of unrecorded leave for Malaysians of all faiths throughout the duration of service for the purposes of performing religious pilgrimages and functions;

vii. Minimum wage is to be raised to MYR1, 100 per month for the whole of Malaysia starting 1 Jan 2019;

viii. Public-listed companies in Malaysia are to disclose key pay metrics each year in their annual reports, as well as a statement by the company on how to improve their employees’ pay;

ix. Expediting industrial dispute resolution between employers and employees by setting up an Industrial Appeals Court.

Strategy 6: Enhancing Health & Social Welfare Protection

i. Full implementation of the Employment Insurance System (EIS) starting 1 Jan 2019. The Social Security Organisation (SOCSO) will pay compensation to those who have lost their jobs. EIS will provide advice and help find new jobs at the SOCSO offices;

ii. B40 Health Protection Fund to provide free protection against Top 4 critical illness for up to MYR8,000 and 14 days of hospitalisation, as well as income cover at MYR50 per day starting 1 Jan 2019. Hospitalisation income of MYR700 pa is also available. Great Eastern Life Insurance to contribute the initial seed funding of MYR2bn to this fund, which will be managed by Bank Negara Malaysia;

iii. To waive stamp duties for all Perlindungan Tenang Insurance products for two years beginning 1 Jan 2019 – this is to make available affordable insurance products;

iv. Combined tax relief for EPF contributions and life insurance or takaful deductions will be separated into MYR4,000 for EPF contributions and MYR3,000 for takaful or life insurance premiums. For civil servants under the pension scheme, the tax deduction will be up to MYR7,000;

v. MYR29bn is to be allocated for the Ministry of Health – this includes an allocation of MYR10.8bn for medicine and upgrade of services;

vi. MYR100m is to be allocated to the Health Ministry to pilot a nationwide health screening programme: Health Protection Scheme (PEKA);

vii. MYR20m to be allocated to make way for free mammogram screening, human papillomavirus vaccination, and pap smear tests;

viii. MYR50m is to be allocated to treat rare diseases and provide more haemodialysis treatments and Enhanced Primary Healthcare;

ix. Public-Private Partnership programmes as an investment in healthcare facilities while the private sector will invest to deliver quality services;

x. Sugar-sweetened beverages to be added to the list of manufactured goods subject to excise duties – at MYR0.40 per litre – to be implemented on 1 Apr 2019 for non- alcoholic beverages containing added sugars of more than 5gm per 100ml drink and juices containing added sugars of more than 12gm per 100ml drink;

xi. Limiting the number of locations where smoking will be allowed from 1 Jan 2019;

xii. MYR5.9bn to be allocated to the Defence and Home Affairs Ministries to strengthen national security.

Strategy 7: Raising Real Disposable Income

Housing For All:

i. MYR1.5bn is to be allocated for programmes that ensure the availability of supply to support the construction and completion of affordable homes;

ii. MYR1bn is to be allocated to help those earning less than MYR2,300 per month to own a house for the first time, available from 1 Jan 2019 for two years, or until exhausted, at participating financial institutions through a concessionary financing rate of 3.5% pa;

iii. Exempt stamp duties up to MYR300,000 on sale & purchase and loan agreements for a period of two years until Dec 2020 for first-time home buyers purchasing property worth up to MYR500,000. MYR25m is to be allocated for households with income of less than MYR5,000 for mortgage guarantees;

iv. The Public Sector Housing Financing Board will extend the loan repayment period to 35 years (from 30) for first loans, and 30 years (from 25) for the second loan;

v. MYR400m is to be allocated for the maintenance of government housing quarters for the police, armed forces, and teachers;

vi. The Real Estate Housing Developers Association has stated a 10% reduction in the price of houses that are not subjected to price controls in new projects;

vii. For a limited time of six months – starting 1 Jan 2019 – all stamp duty charges for first- time purchases of homes – valued between MYR300,001 and MYR1m – have been waived. In return, developers will offer a minimum price discount of 10% for these residential properties;

viii. The Government has approved private sector-driven “Property Crowdfunding” platforms as an alternative source of financing for first-time home buyers – this is to be regulated by the Securities Commission.

Encouraging Public Transport Adoption:

i. MYR240m has been set aside to introduce a MYR100 transport pass on the Rapid KL rail and bus network on 1 Jan 2019. A MYR50 monthly pass will be made available just for Rapid KL bus services only. This campaign will be expanded to other bus companies at a subsequent stage;

ii. Syarikat Prasarana is to improve the bus network by optimising its current fleet. It will also work in partnership with other existing bus companies to manage routes and services, as well as cost controls;

iii. Reduction in LRT3 and MRT2 construction costs translate into lower public transportation fares;

iv. MYR20m has been allocated for the Kuala Lumpur City Council next year to provide additional free Go KL bus services from the existing four routes;

v. MYR500m is being allocated for the Public Transport Loan Fund – with a 2% interest subsidy – via Bank Pembangunan Malaysia. This isp Strategy made available to public transport operators;

vi. To freeze toll hikes will cost the Government MYR700m. It will also abolish tolls for motorcycles for the First and Second Penang Bridges, as well as the Second Link in Johor – this is to cost approximately MYR20m pa effective 1 Jan 2019;

vii. MYR10m has been allocated to upgrade the Autogate Malaysia Automated Clearance and M-Bike Systems to ease congestion and travel hardship for those traveling to and fro between Malaysia and Singapore.

Strategy 8: Education For a Better Future:

i. MYR2.9bn will be provided to help students from lower income groups;

ii. MYR652m has been allocated to upgrade schools:

iii. Donations to national and public institutions of higher learning registered with the Ministry of Education to upgrade infrastructure will be tax-exempted starting 1 Jan 2019;

iv. MYR100m towards the reconstruction of dilapidated schools, to be funded via competitively-tendered PPP projects;

v. MYR206m will be allocated towards the development and provision of training programmes in polytechnics and community colleges;

vi. MYR30m has been set aside for the Training and Vocational Education and Training (TVET) Prestige Fund. This is to encourage training institutions to bid for funds to run programmes with specific key performance indicators on job placements for graduates. An additional MYR20m has been earmarked for raising youth competency via a TVET- sponsored boot camp;

vii. MYR400m is to be allocated to our institutions of higher learning via a contestable fund. MYR30m will be disbursed in the form of matching grants via the Malaysia Partnerships & Alliances In Research programme;

viii. MYR3.8bn has been earmarked for scholarships and loans to all Malaysians. MYR2bn of this has been set aside for bumiputeras under Majlis Amanah Rakyat or MARA;

ix. MYR17.5m is being invested over the next five years in the Malaysia Professional Accountancy Centre, which is aimed at producing more qualified bumiputera accountants;

x. MYR210m has been set aside as part of the Bumiputera Empowerment Agenda to strengthen education and human capital development programmes that are managed by Yayasan Peneraju Pendidikan Bumiputera;

xi. Ensure the sustainability of the National Higher Education Load Fun (PTPTN):

xii. MYR70m has been allocated for the PATRIOT programme, which is being introduced to youths aged between 15 and 30 – it involves 70,000 participants;

xiii. MYR100m has been allocated to prepare athletes for the 2020 Tokyo Olympics;

xiv. MYR10m has been allocated for e-Sports to the Malaysia Digital Economy Corp as recognition of the industry’s popularity.

Upholding Islam:

MYR1.2bn has been allocated for both Islamic development and opeli This is in addition to MYR150m for programmes such as building mosques and training of professionals among religious learning modules using Braille.

Focus 3 – To Foster An Entrepreneurial Economy

Strategy 9: Unleashing The Power Of The New Economy

Embracing The Digital Economy:

i. Malaysia Technology Development Corp, Malaysia Debt Ventures, Malaysia Venture Capital Management, Kumpulan Modal Perdana, and Cradle Fund will be streamlined and made more efficient in delivering capital to companies in various stages of financing needs;

ii. MYR2bn is being allocated by government-linked investment funds to co-invest with the private equity and venture capital funds;

iii. MYR50m has been allocated set up a Co-Investment Fund to invest alongside private investors via new alternative financing platforms like Equity Crowdfunding and Peer-to- Peer Financing;

iv. The Capital Markets & Services (Prescription of Securities) Guidelines will be gazetted in early 2019 – this will set up a new regulatory framework to approve and monitor Digital Coin and Token Exchanges;

v. Extend the double tax deduction policyf or additional expenditure in curred when issuing sukuk under the principles of ijarah and wakalah, as well as for additional expenditures incurred by the companies issuing retail bonds or sukuk. Both these policies will be made available for three years commencing 2019 – the year of assessment;

vi. The setting up of a Special Committee on Islamic Finance led by the Ministry of Finance and comprising members from Bank Negara Malaysia and the Securities Commission;

vii. MYR1bn is being allocated for the National Fibre Connectivity Plan in 2019 to enhance digital economy growth;

viii. Broadband infrastructure is to be developed to attain speeds of 30Mbps in rural areas within five years;

ix. The Mandatory Standards for Access Pricing is being enforced to reduce fixed broadband prices by at least 25% in 2018.

Accelerating Adoption Of Industry 4.0:

i. MYR210m will be allocated in 2019 - 2021 to assist migration of 500 SMEs to Industry 4.0 through the Malaysia Productivity Corp;

ii. MYR2m will be provided for Knowledge Resource For Science & Technology Excellence to enhance public and private sector co-operation;

iii. 250 facilities, 1,200 scientific equipment, and 46 research data will be made available for private sector access;

iv. At least 100 government - sponsored researcher sare to be placed with the privates ector in researcher-mapping programmes;

v. MYR2bn is being allocated for up to 70% government guarantees via a Business Loan Guarantee Scheme to encourage SMEs to invest in automation;

vi. The MYR3bn Industry Digitalisation Transformation Fund will be used to finance 2% interest costs via Bank Pembangunan Malaysia to catalyse smart technology adoption;

vii. The Malaysian Investment Development Authority will continue to provide matching grants via its High Impact Fund, mainly for research & development, upgrading facilities, and purchasing new technology;

viii. An 80-acre plot of land in Subang is to be developed into a world class aerospace industry hub by Khazanah Nasional. High-skilled workers will be nurtured in collaboration with MARA;

ix. Double tax deduction for companies that sponsor scholarships for students in related fields such as engineering and technology, are part of the National Dual Training Scheme for Industry4.0, or provide structured training programmes.

Strategy 10: Seizing Opportunities In The Face Of Global Challenges

To increase investments of companies already participating in the Principal Hub, the Government is proposing to improve existing incentives by charging a concessionary 10% income tax rate on the overall statutory income related to Principal Hub activities for a period of five years.

Strengthening SMEs:

i. A MYR4.5bn SME Loan Fund will be made available via commercial financial institutions with a 60% guarantee from Skim Jaminan Pembiayaan Perniagaan, including MYR1bn for bumiputera SMEs;

ii. Corporate income tax rate for taxable income of up to MYR500,000 and SMEs with less than MYR2.5m in paid up capital will be reduced to 17% from 18%;

iii. MYR2bn worth of credit and takaful facilities made available by EXIM Bank to support SMEs in export financing;

iv. MYR100m is being allocated to upgrade the capabilities of SMEs in the halal industry via various programmes;

v. The MYR1bn SME Shariah-Compliant Financing Scheme has been made available via Islamic financial institutions, where the Government will provide a 2% profit rate subsidy;

vi. MYR200m has been made available by Permodalan Usahawan Malaysia for the wholesale & retail industry, as well as for the purchase of business premises to be rented to bumiputera SMEs;

vii. MYR100m is being allocated to TEKUN to finance small entrepreneurs;

viii. MYR20m is being allocated to initiate a “Buy Malaysian First” campaign to support local products and services;

ix. New tiered levy systems are to be implemented, where the levies charged will be higher for employers with an elevated percentage of foreign workers;

x. To assist agriculture and plantation sectors by reducing the extension levies for foreign workers that have served for 10 years or more: to MYR3,500 per worker pa from MYR10,000

Lubricating The Transport & Logistics Sector:

i. MYR2.46bn will be allocated for upgrading and restoration works for railway tracks;

ii. MYR25m will be provided to develop a truck depot at Kota Perdana Special Border Economic Zone in Bukit Kayu Hitam, Kedah;

iii. Converting 380 acres of land in Pulau Indah into a Free Trade Zone to catalyse increased shipping and logistics activities in Port Klang – it will also act as an extension of the Port Klang Free Zone.

Value-Adding Commodities:

i. To increase the demand for palm oil, the biodiesel B10 programme will be used for the transportation industry while the biodiesel B7 initiative will be used for the industrial sector;

ii. On top of that, MYR30m is to be distributed to smallholders to assist them in obtaining Malaysian Sustainable Palm Oil (MSPO) certification;

iii. To aid rubber industry smallholders, the Government is committed towards increasing the use of local rubber as a raw material for various industrial products, eg MYR100m will be allocated to encourage the use of local rubber as a composite material for the building of roads in Malaysia;

iv. The Government will continue to provide a Rubber Production Incentive of MYR50m to protect smallholders from the effects of a fall in rubber prices;

v. For the agricultural sector, there will be allocations of:

Boosting Tourism:

i. The Ministry of Tourism has set a target of attracting 30m foreign tourists contributing MYR100bn by 2020;

ii. MYR100m in matching grant allocations has been earmarked for the private sector for overseas marketing campaigns;

iii. Tax-free incentives to Penang’s Swettenham Pier, as well as Pulau Pangkor being declared as duty-free island;

iv. Pulau Langkawi’s duty-free status will be further expanded;

v. 50% proceeds of tourism tax will be granted to states to encourage tourism activities;

vi. Loan facilities amounting MYR500m will be provided – at 2% interest subsidy – via the SME Tourism Fund with SME Bank;

vii. The redevelopment and restoration of the Sultan Abdul Samad Building into an arts, cultural, & heritage hub;

viii. A MYR20m allocation to the Malaysia Healthcare Tourism Council to generate a 25% growth in medical tourism in a year.

Strategy 11: Redefining The Role Of Government In Business:

i. The Government business is not to be in the business;

ii. Its presence in non-strategic industries has crowded out the private sector investments, to the point where the latter were unable to grow and compete;

iii. A special task force will be set up to assess the role of statutory bodies and companies owned by Ministry of Finance Inc;

iv. The goal is to reduce the Government’s involvement in areas where the private sector is efficient;

v. Increasing the quality of service by privatising, eg TVET training institutes, Pusat Sains Negara, and the Planetarium.

Strategy 12: Ensuring Equitable and Sustainable Economic Growth

Ensuring Balanced Development:

Upgrading rural infrastructure facilities;

i. Allocating MYR926m for development and upgrading of roads and bridges;

ii. Allocating MYR694m and MYR738m for electricity and water supplies;

iii. An allocation of MYR100m for Indian youth community development;

iv. Allocating MYR 100m to streng then the development of Orang Asli communities through the construction and upgrading of basic infrastructure;

v. Allocating MYR20m for registered residents associations to carry out neighbourhood activities;

vi. MYR100m allocated to upgrade roads, MYR160m for water supply projects, and MYR35m for basic infrastructure to FELDA – a 51% increase from the previous year’s allocation;

vii. Allocations of MYR5bn for Sabah and MYR4.3bn for Sarawak’s development expenditure, eg basic infrastructure and economic corridors;

viii. Pan Borneo Highway to continue with revised costs.

Women In The Workforce:

i. In 2017, women participation’s rate in the labour force stood at 53.5%. 60% of unemployed women stated that housework was the main factor hindering them from joining labour force;

ii. Raising women’s empowerment level by 30% would improve Malaysia’s GDP by c.7- 12%;

iii. MYR10m is to be allocated to build up to 50 childcare facilities in government buildings,

iv. The Government remains committed towards a 30% target for women’s participation at leadership and decision-making levels in companies and organisations;

v. The Government is encouraging and incentivising the private sector to ensure 30% women participation in company’s boards of directors is to be realised by 2020.

Environment & Energy For The Future:

i. Forest and marine reserves are under the care of the various state governments;

ii. MYR60m will be allocated to the state governments in order to protect and expand existing natural reserves;

iii. Action to be taken to list the Forest Research Institute Malaysia Forest Park and Royal Belum Perak as UNESCO World Heritage Sites;

iv. MYR5m micro-grants to preserve the environment in Orang Asli and Orang Asal communities;

v. 70% pioneer status incentive or 60% investment allowances to be introduced to companies that implement environmentally-friendly plastics based on bio-resin and biopolymers;

vi. The MYR2bn Green Technology Financing Scheme is to be initiated at selected commercial banks, where 2% of interest costs are to be subsidised for the first five years – this is to encourage investments in green technology;

vii. A MYR1bn Sustainable Development Financing Fund will be provided by Bank Pembangunan Malaysia via am interest rate subsidy of 2% to support the Agenda 2030 for Sustainable Development, as well as the 17 Sustainable Development Goals under the United Nations Development Programme;

viii. To encourage the use of green energy, the Government will expand the list of green assets that qualify for the Green Technology Investment Allowance to 40 assets (from nine) in the MyHijau directory.

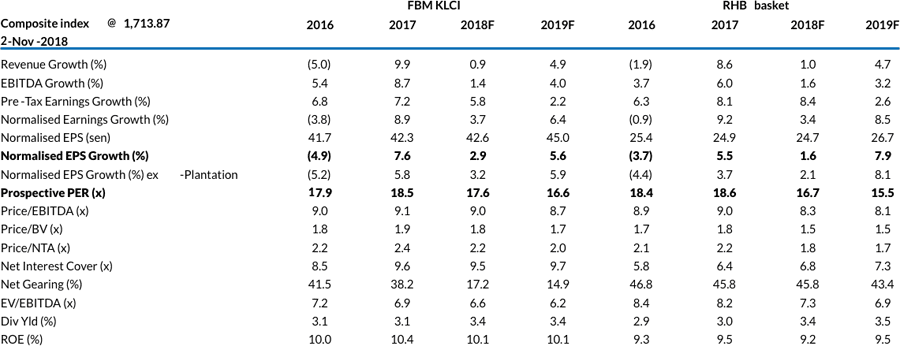

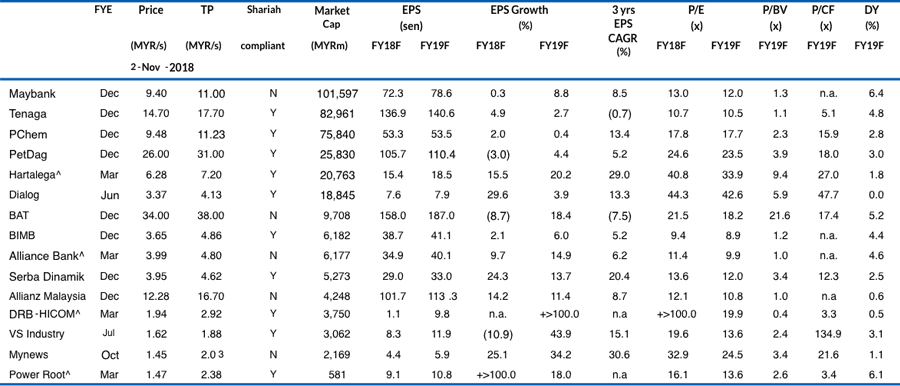

Figure 9: Earnings outlook and valuations

Overall, Budget 2019 has fallen largely within our expectation and the measures introduced do not alter our view and anticipation of resilient consumer spending. The downscaled cash handout assistance and the absence of wage hike or bonus for civil servants are not surprising, given the Government’s commitment to manage the budget deficit. However, we think the targeted fuel subsidy could raise inflationary pressure for those who are left unsubsidised.

On a brighter note, the minimum wage is now set at MYR1,100 instead of MYR1,050 as previously proposed and the Government has also continued to prioritise protecting the welfare of the B40 group via several measures. This should lend support to consumer spending and we think the inflationary pressure within the B40 group is very likely to be contained.

We view the consumer sin sector as the biggest winner, as both tobacco and brewery markets are spared from an excise duty hike as was earlier feared. BAT (ROTH MK, BUY, TP: MYR48) received a much-needed and significant boost as the Government has pledged to intensify enforcement efforts in clamping down illicit trade to recover at least MYR1bn in tax losses. This is in line with our assumption that justifies our BUY call on the stock and hence we made no changes to our earnings forecasts. To illustrate, MYR1bn of excise duty translates into the sale of 2.5bn sticks of cigarettes based on the current excise duty of MYR0.40 per stick. This would potentially reduce the illicit market share to c.45% from c.60%, based on total annual consumption of 16-18bn sticks. BAT as the leader in the legal tobacco market (market share of >50%) would be in a good position if the clampdown is effectively executed.

Meanwhile, the Government has decided to add sugar-sweetened beverages to the list of manufactured goods subject to excise duty. The duty proposed will be at MYR0.40 per litre, to be implemented on 1 Apr 2019 on non-alcoholic beverages containing added sugars of more than 5gm per 100ml; and on fruit or vegetable juices having added sugars of more than 12gm per 100ml. The stocks under our coverage that would potentially be impacted include Nestle, (NESZ MK, NEUTRAL, TP: MYR128), Power Root (PWRT MK, BUY, TP: MYR2.38), Cocoaland (COLA MK, BUY, TP: MYR2.97) and MSM (MSM MK, SELL, TP: MYR2.50).

The proposed rates translate into excise duties of MYR0.10-0.12 per 250ml serving for ready-to-drink RTD beverages under Nestle and Power Root. We believe that the additional tax would be passed on to consumers via price increases, but as it is a common situation faced by everyone in the industry, we do not expect the sales volume to drop significantly as a result. This is especially so for Nestle, given its strong market position and brand equity. RTD canned beverages accounted for 15% of Power Root’s FY18 revenue but the contribution for Nestle is unknown, as the company does not provide disclosure on the breakdown.

Meanwhile, for Cocoaland, most of the beverage products are on a contract manufacturing basis (with sales on a declining trend) – which also means reduced dependency. The key driver would still be the sales of gummy products, and as such we do not think the company would be significantly affected.

As for MSM, we think the excise duties would affect the industrial segment of the market and not impact the domestic and export segments, as the sugar purchases are carried out in bulk for industrial counterparts. The industrial segment contributed 41% to sales volume and 40% to revenue 1H18.

The Government has continued to view the tourism industry as the key sector driving GDP growth. Measures including tax-free incentives, loan facilities, and government grants are proposed in order to achieve the Ministry of Tourism’s target of 30m foreign tourist arrivals contributing MYR100bn by 2020. We believe the initiatives and strong tourist arrivals should benefit retail players, in particular AEON (AEON MK, BUY, TP: MYR2.76) and Berjaya Food (BFD MK, BUY, TP: MYR1.75), and to a lesser extent convenience store players including Mynews (MNHB MK, BUY, TP: MYR2.03).

Interestingly, the Government is looking to adopt the latest technology and techniques to be more efficient and effective in price monitoring. A mobile app called “Price Catcher” will be developed to collect information on the prices of goods & services and help the authorities monitor against unlawful pricing practices. This would further be complemented by the existing anti-profiteering act. We believe the measure could drive stronger consumerism, which would in turn benefit Padini (PAD MK, BUY, TP: MYR6.88), which offers value-for- money products. On the flipside, this could pose further challenges for AEON in the competitive market environment.

Although we do not expect the consumer sector to be overly exciting moving forward, we believe it would continue to offer earnings visibility on the back of the defensive nature and solid financial strength of consumer companies (healthy cash flows, sturdy balance sheets). As such, the sector should continue to provide a shelter or safe haven for investors amidst both external and internal risks. Despite seemingly elevated valuations, sector premiums could be maintained if the uncertainties and volatilities across the domestic and external macro-environment persist.

Our Top Pick is Power Root for its earnings recovery on the back of lower raw material costs, favourable FX and moderating advertising & promotion expenses. We also like retail-based players including AEON and Padini as proxies to capitalise on resilient consumer spending on the back of their wide store networks and established brand names. We believe BAT could see the light at the end of tunnel in view of more committed efforts in illicit trade clampdown. Meanwhile, we like Mynews for its long-term growth sustainability, driven by store expansion, while the start of its food plant operations by early-2019 could encourage higher patronage.

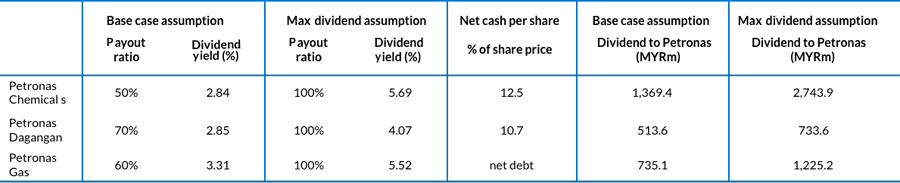

In Budget 2019, the Government’s non-tax revenue would see a substantial MYR54bn contribution from Petronas. To recap, Petronas will pay a regular MYR24bn dividend to the Government, together with an additional MYR30bn special dividend. Petronas, in our opinion, has more than enough cash reserves to meet the obligation. This is due to improved cash flow – driven by higher oil prices – as well as its solid balance sheet (MYR107.6bn net cash at end-2Q18).

We believe that this special dividend by Petronas is likely to be a one-off event, mainly to fund the outstanding tax refund amounting to MYR35.4bn. This comprises MYR16bn worth of income tax and MYR19.4bn in GST refunds. Beyond 2019, we expect Petronas to revert to its normalised level of dividend, ranging MYR20-30bn pa, depending on oil prices.

The announcement is negative for local upstream services players – especially Greenfield related players – whose revenue is largely dependent on Petronas’ capex allocation (capex was MYR44.5bn in 2017). Petronas’ new financial obligations to the Government imply that the budget allocation is unlikely to change significantly in 2019. Consequently, we believe OSV and jack-up rig players will not see significant re-rating at least through 1H19.

We believe that the dividend ramp-up would benefit Petronas-related listed companies’ shareholders, as the dividend payout will likely shift higher to channel cash back up to the parent company (Petronas Group). Petronas Chemical stands out among three listed Petronas subsidiaries in terms of room for upside in yield expansion (from 2.84% to 5.69% in FY18F if dividend payout ratio is raised to 100% from the existing 50%), due to its low current dividend payout and high net cash holdings.

We keep our OVERWEIGHT stance on the oil & gas sector, with a positive bias toward downstream and maintenance-related players. Upstream – related to exploration activities in particular – activities will likely remain muted in the near term, as Petronas capex is not expected to increase YoY in 2019. Top sector picks are Petronas Chemicals (PCHEM MK, BUY, TP: MYR11.23), Petronas Dagangan (PETD MK, BUY, TP: MYR31) and Serba Dinamik (SDH MK, BUY, TP: MYR4.62).

Lim Sin Kiat, CFA +603 9280 8879

It comes as no major surprise that Budget 2019 contained many proposals aimed at improving the wellbeing of those in the lower income (B40) segment, including being able to own a home.

Of the property-related proposals (see section on Property: Neither Good Nor Bad), the establishment of a MYR1bn fund by Bank Negara Malaysia (BNM) to improve accessibility to financing for purchase of affordable homes will see direct involvement by several banks.

The fund provides assistance to those earning less than MYR2,300 per month to purchase affordable homes priced up to MYR150,000. It will be made available from 1 Jan 019 at AmBank, CIMB Bank, Maybank, RHB Bank and Bank Simpanan Nasional (BSN) at a concessionary financing rate of 3.5% pa.

From our checks with banks, it is unclear if the MYR1bn would be used as funding for the actual loan amount or would be used to cover the 112-165bps differential between the concessionary rate of 3.5% and market rates charged by banks. Board rates range between 4.62% and 5.15% for a housing loan of MYR150,000 taken over 35 p years.

At market rates, the above housing loan would work out to monthly repayments of MYR721 to MYR771. At the concessionary interest rate of 3.5%, a MYR150,000 mortgage (assuming 100% loan-to-value) with a 35-year tenure would work out to monthly repayments of MYR620. This is 14-19% lower than repayments at normal market rates and accounts for 27% of monthly income of MYR2,300.

With the Budget proposals expected to have a neutral impact on the property market, we do not expect any material change in banks’ lending to the sector. As at end-September, residential mortgages accounted for 33% of system loans while non-residential properties made up another 13%.

On the flipside, the downward revision in GDP forecast by RHB economists to 4.8% for 2018 and 4.6% for 2019 (from 5% for both years) suggests downside risk to our earnings projections for banks. While we remain comfortable with our sector earnings growth of 5.4% for 2018F, our forecast increase of 9.8% for 2019 may be impacted by softer-than-expected operating income growth.

Fiona Leong +603 9280 8886

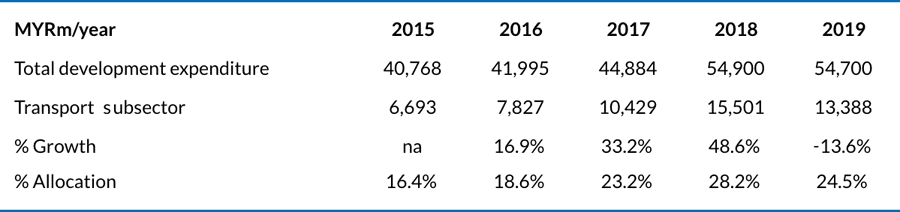

Despite a marginal decrease of 0.4% YoY in the development budget (DE) to MYR54.7bn for 2019 from MYR54.9bn for 2018, the allocation for the transport subsector fell by a larger margin of 13.6% YoY from MYR15.5bn for 2018 – to MYR13.4bn for 2019. This indicates that the Government is unlikely to commence any new mega infrastructure projects, and instead continue to place an emphasis on existing projects that are people-centric and deliver high multiplier effects.

The large rise in the DE from 2017 to 2018 by MYR10bn is to account for the full year impact from the commencement and higher progress rates for large scale projects such as the Mass Rapid Transit 2 (MRT2), Pan Borneo Highway and Light Rail Transit 3 (LRT3). Our economists also believe that the increase in the DE could be contributed by a change in financing structure, ie placed directly under the Government, instead of being issued as government guaranteed borrowings.

Meanwhile, the Government is forecasting a slowdown in the rate of growth for the construction sector – from an average of 7.1% in 2016-2017 to 4.5% in 2018, followed by 4.7% in 2019. This indicates that activity in the sector is likely to be less buoyant in 2019, hence our NEUTRAL stance.

Source: RHB, Bloomberg

Related proposals/ measures:

i. High-impact mega projects will continue at reduced cost. These include the LRT3 at MYR16.6bn, MRT2 at MYR30.5bn and the Pan Borneo Highway;

ii. The Klang Valley Double Track (KVDT) Phase 2 at MYR5.2bn will be re-tendered though an open tender exercise from a direct negotiation award previously;

iii. The MYR110bn KL-Singapore high speed rail (HSR) project will be delayed to 2020;

iv. The MRT3 MYR60bn project has been cancelled pending the completion of MRT2;

v. The MYR81bn East Coast Rail Link (ECRL) project is suspended, with ongoing negotiations to rationalise its cost;

vi. MYR19bn worth of projects that were awarded through direct negotiations and limited tenders will be renegotiated. These projects can continue with at least a 10% reduction in construction cost to save the Government at least MYR1.9bn;

vii. The Government will adopt a more robust Public Private Partnership (PPP) model based on land swap transactions using the open tender mechanism;

viii. 24 PPP projects worth MYR5.2bn – including schools, army camps, police, firestations and affordable housing – will adopt this new model in order to save MYR800m;

ix. MYR1.5bn (from MYR2.2bn in 2018) will beal located for the construction of affordable housing through Program Perumahan Rakyat (PPR), Perumahan Penjawat Awam Malaysia (PPAM), PR1MA and Syarikat Perumahan Nasional;

x. The Government will allocate MYR400m for upgrading, repair and maintenance of government housing quarters for police, armed forces and teachers;

xi. MYR240m allocated for MYR100 (for rail and bus) and MYR50 (bus only) unlimited monthly passes to encourage public transportation daily ridership;

xii. MYR700m will be allocated in 2019 for a freeze of intra-city toll rate hikes. We believe this will have minimal to no impact on toll road concessionaires, as the Government will continue to compensate concessionaires for toll rate hike deferments;

xiii. The Government will prioritise solutions to all eviate congestion for both the Causeway and the Second Link to Singapore – we believe the JB-Singapore Rapid Transit System could be a potential solution;

xiv. MYR652m (from MYR615m) will be allocated for the upgrading of schools. An additional MYR100m will be for the reconstruction of dilapidated schools funded through land swap with the Ministry of Education;

xv. MYR2.5bn will be allocated for the upgrading and restoration of existing railway tracks;

xvi. MYR926m allocation for the construction and upgrading of rural roads and bridges. MYR85m for the upgrading and maintenance of community areas;

xvii. Expansion of road networks in Sabah and Sarawak will be prioritised–MYR5bn(from MYR4bn) will be allocated to Sabah in 2019; MYR4.3bn (similar with 2018) will be allocated to Sarawak. Further allocations will be made for the enhancement of water, electricity, healthcare and education infrastructure;

xviii. The previous Government announced but did not allocate MYR1.3bn to compensate the concessionaire (MRCB) for the abolishment of the Eastern Dispersal Link (EDL) highway. The same applies for Prasarana’s expenditure for LRT3. These shortfall in allocations have now been included to the revised 2018 Budget.

xix. The minimum wage being increased by 10% to MYR1,100 (from MYR1,000) is expected to have muted impact on the construction sector, as we understand that the majority of construction workers earn wages above the minimum due to overtime payments.

Tay Yow Ken, CFA +603 9280 8682

tay.yow.ken@rhbgroup.com

Gaming: An Easy Target

NEUTRAL

Prior to the Budget, the Government highlighted the importance of reducing government debts and to source for alternative revenue streams to replace the income forgone from abolishing the GST. On top of that, the Government has also expressed its intention to curb gambling addition amongst the rakyat via the reduction of special draw days.

The following measures affecting gaming companies are proposed:

i. Flat rate casino licence to increase to MYR150m(from MYR120m)pa;

ii. Casino duties to be increased to 35% from 25%pa;

iii. Machine dealer’s licence to increase to MYR50,000 pa from MYR10,000;

iv. Gaming machine duties to be increased to 30%(from 20%)on gross collection.

Genting Malaysia (GENM MK, NEUTRAL, TP: MYR4.26) would take the biggest hit, with the 10ppt hike in casino duties. Casino duties in Malaysia have not seen a hike in the last 20 years. Relative to casino peers, Malaysia’s casino duties are high vs the Philippines and Singapore (5% for VIP and 15% for mass market), but lower than Macau’s 39%, imposed on both mass and VIP market customers. Following the Budget proposals, we cut FY19F- 20F EPS by c.19% and downgrade our call to NEUTRAL (from Buy).

For its parent company Genting (GENT MK, BUY, TP: MYR11.50), we reduce FY19F-20F EPS marginally by c.6%, as it only has a 30% exposure to Malaysian casino operations. We continue to like its exposure to Genting Singapore’s reinvestment plans into Resorts World Sentosa, as well as its potential to win the ongoing bid for the Japan casino licence. Beyond that, we also like its exposure to industries beyond gaming.

As part of the Budget, the Ministry of Tourism aims to achieve 30m foreign tourists arrivals by 2020. This will be positive for Genting Malaysia, as its flagship hilltop is a magnet for those visiting Kuala Lumpur. Its facilities opened under the Genting Integrated Tourism Plan (GITP) would continue to draw tourists to the hilltop.

On the number forecast operator (NFO) front, the reduction in special draw days by 50% was within expectations, following an announcement made by Finance Minister Lim Guan Eng in August. Based on our records, Berjaya Sports Toto (BST MK, NEUTRAL, TP: MYR2.31) (Btoto) was allocated an average of 21-23 special draw days pa whereas Magnum (MAG MK, NEUTRAL, TP: MYR1.87) was allocated an average of 21-27 special draw days pa. With a 50% reduction in respective average draw days, we cut Btoto’s FY19F- 20F EPS by c.6% and Magnum’s FY19F-20F EPS by 9%. There are no changes to NFO gaming taxes.

We downgrade the sector to NEUTRAL (from Overweight), given the negative sentiment on Genting Malaysia for the short to medium term. We have not factored in machine dealer’s licenses and gaming machine duties into our valuation, as we have assumed this is not applicable to Genting Malaysia.

Alexander Chia +603 9280 8889

alexander.chia@rhbgroup.com

Media: Levelling The Playing Field

NEUTRAL

Service tax levied from Jan 2020 for imported online services

As expected, the Government made it mandatory for online services – which includes (but not limited to) downloaded software, music, video or digital advertising – to pay a service tax from 1 Jan 2020.

This should level the playing field for media companies, more specifically the broadcasters: Astro Malaysia (ASTRO MK, BUY, TP: MYR2.30) and Media Prima (MPR MK, NEUTRAL, TP: MYR0.43), whose businesses have been significantly impacted by competition and cannibalisation from over-the-top (OTT) services such as Netflix, Amazon and Viu, as well as the change in media consumption behaviour.

Jeffrey Tan +603 9280 8863

jeffrey.tan@rhbgroup.com

NBFI: Spurring Insurance Penetration

NEUTRAL

The Government announced that it will pilot a national B40 Health Protection Fund to provide free protection against the top 4 critical illnesses for up to MYR8,000, and up to 14 days of hospitalisation income cover at MYR50 per day or MYR700 per year. This Health Protection Fund is effective starting 1 Jan 2019 and will be managed by BNM. BNM also indicated its gratitude to Great Eastern Life Insurance (GE Life) for contributing the initial seed funding of MYR2bn to the Health Fund. The Government also hopes to grow the fund size with more partnership and contributions with other insurance companies.

While not explicitly mentioned, we think this affirms recent news reports that alternative resolution to the listing of foreign insurers has been considered. We believe that Prudential Financial, the other likely foreign insurer subject to the 70% shareholding cap, may also consider taking the same measure. We note that there was no mention in the Budget as to the status of the disposal of stake by foreign insurers to the stipulated 70% threshold.

In order to raise the insurance and takaful penetration rate for the B40 households, BNM had launched Perlindungan Tenang in 2017. This was aimed to provide the B40 segment with affordable, accessible and simple insurance at extremely low costs. To further spur the take-up rate, the Government announced in the Budget that it will waive the stamp duty for all Tenang Insurance products for two years beginning 1 Jan 2019.

To encourage a higher insurance take-up rate, the combined tax relief for EPF contribution and life insurance or takaful deduction will be separated into MYR4,000 for EPF contribution and MYR3,000 for takaful or life insurance premiums. For civil servants under the pension scheme, the tax deduction will be up to MYR7,000. We are positive on the latest developments as they should help speed up the insurance penetration rate – hovering at c.54% over the last decade – which is much below BNM’s targeted 75% penetration rate by 2020. More importantly, this should help spur growth in the penetration rate for the B40 segment, which is estimated at only c.4%.

We are NEUTRAL to mildly positive on the NBFI sector. Of the insurance stocks under our coverage, Allianz (ALLZ MK, BUY, TP: MYR16.70) remains our Top Pick for its still-resilient general insurance segment and as a proxy to the underpenetrated life insurance segment.

Stephanie Cheah +603 9280 8859

stephanie.cheah@rhbgroup.com

Plantation: Higher Minimum Wages & B10 Biodiesel Implementation

NEUTRAL

The initiatives in Budget 2019 that affect the plantation industry include:

i. The increase in minimum wages to MYR1,100 per month instead of MYR1,050 per month, as previously announced in Sep 2018;

ii. To reduce dependency on low-skilled foreign labour by implementing a new tiered levy system, where levies charged will be higher for employers with an increased percentage of foreign workers. However, the Government will assist the agriculture and plantation industries by reducing the extension levy for foreign workers that have served for 10 years or more: to MYR3,500 per worker pa from MYR10,000;

iii. The implementation of a B10 biodiesel programme for the transportation industry and B7 for the industrial sector in 2019;

iv. An allocation of MYR30m to assist smallholders to obtain the Malaysian Sustainable Palm Oil (MSPO) certification;

v. A provision of a Rubber Production Incentive – with an allocation of MYR50m – to protect the effects of the fall in rubber prices for smallholders. The latter will receive supplement income from the fund when rubber prices fall below MYRM2.20 per kg.

We expect the minimum wage increase to affect most of the planters within our coverage by 2-4%. The exception is Felda Global Ventures (FGV MK, NEUTRAL, TP: MYR1.45), who we estimate will be affected by a larger 12-15%. We explain more about this in our sector note released today.

As for the new tiering system for the foreign worker levy, we believe it is hard to quantify the impact for now, as we do not have details on how much the new levies will be.

However, the reduction of the extension levy for foreign workers that have served for 10 years or more is positive, as it shows the Government understands the plight of the industry, as well as the constant cost of retraining new workers.

The B10 biodiesel mandate is also positive news, and we expect this to increase demand for CPO by 0.25m tonnes to 1m tonnes per year. We explain more about this in our sector note issued today.

The allocation to assist smallholders to obtain the MSPO certification is also positive, and we estimate it could help at least 500,000ha of land get certified, assuming costs of MYR100 per ha.

Lastly, the MYR50m rubber production incentive should also be positive for smallholders overall. However, we believe this fund would not be available for larger players with rubber landbank, eg Kuala Lumpur Kepong (KLK MK, NEUTRAL, TP: MYR22.80).

Overall, we believe Budget 2019 has a net neutral impact for the sector, with some positives, as well as some negatives. We make no changes to our NEUTRAL sector call.

Hoe Lee Leng, +603 9280 8860

hoe.lee.leng@rhbgroup.com

Property: Neither Good Nor Bad

NEUTRAL

Key measures for the property sector under Budget 2019:

i. The real property gains tax (RPGT) will be revised up to 10% from 5% for companies and foreigners, and 5% from 0% for Malaysian individuals upon the disposal of properties or shares in property holding companies after the fifth year. However, low cost, low-medium cost and affordable housing with prices below MYR200,000 will be exempted;

ii. The stamp duty on the transfer of property valued above MYR1m will increase to 4% from 3%;

iii. For the first time ever, home buyers purchasing residential properties priced less than MYR500,000 will have the stamp duty exempted for the first MYR300,000 on sale & purchase and loan agreements for a period of two years until Dec 2020;

iv. All stamp duty charges will be waived for first-time purchases of homes valued between MYR300,000 and MYR1m in 1H19. This will be part of the National Home Ownership Campaign, and developers will also offer a minimum price discount of 10% for these residential properties;

v. Approval of “Property Crowd funding” plat forms that will serveas alternative sources of financing for first-time home buyers. These exchange platforms will be regulated by the Securities Commission under a peer-to-peer financing framework.

We are upbeat on the incentives offered (via stamp duty waiver) for developers to clear their unsold inventory, as well as stamp duty exemptions for residential properties priced below MYR500,000. Together with the property crowdfunding initiative, these efforts should help boost home ownership among the low income group. Having said that, potential home buyers will likely hold back their property purchases until next year to benefit from the stamp duty waiver – consequently, 4Q18 sales may be negatively affected. Developers that could benefit from Budget 2019 are mainly those that have high exposure to property products priced below MYR500,000, such as Mah Sing (MSGB MK, BUY, TP: MYR1.30), Matrix Concepts (MCH MK, BUY, TP: MYR2.40), Tambun Indah Land (TILB MK, BUY, TP: MYR1.13), and – to a certain extent – UOA Development (UOAD MK, NEUTRAL, TP: MYR2.60) and Hua Yang (HYB MK, NEUTRAL, TP: MYR0.43).

Meanwhile, the higher RPGT is slightly negative to the market, as this will likely deter foreigners from buying properties in Malaysia. Developers with higher exposure to foreign buyers – eg Eastern & Oriental (EAST MK, NEUTRAL, TP: MYR1.38) and UEM Sunrise (UEMS MK, NEUTRAL, TP: MYR0.93) – may be adversely affected amidst the prevailing slowdown in the market.

Loong Kok Wen, CFA +603 9280 8861

loong.kok.wen@rhbgroup.com

REITs: Airport REIT Initiative

NEUTRAL

The Government intends to set up the world’s first Airport REIT, which will receive income arising from user fees collected from Malaysia Airports Holdings (MAHB MK, BUY, TP: MYR8.90), which has the concession to operate these airports. The Government expects to raise MYR4bn from selling a 30% stake of the REIT to private investing institutions. The REIT exercise will only be carried out after the new Regulated Asset Base and user fees structure has been negotiated and finalised. Going forward, the Airport REIT will have the opportunity to raise funds publicly either by issuing new REIT units or via borrowings to fund capex.

We are still waiting for further clarification on the Airport REIT initiative. We are uncertain with a few aspects, as according to the listed REIT guidelines, at least 75% of a REIT’s total asset value must be invested in real estate that generates recurrent rental income at all times. We understand that MAHB has consistently paid MYR400m of user fees to the Government. However, we believe this may not be enough for a REIT (based on MYR4bn indicative value for a 30% stake, and assuming 5-6% dividend yield and 90% dividend payout). As such, we do not rule out the possibility of a combination of base rent and user fees.

In addition, under the guidelines, the REIT’s investment in property development activities and real estate under construction must not exceed 15% of the REIT’s total asset value. This restriction could potentially be a hurdle for the Airport REIT to fund development capex to the airports in the future.

Overall we are positive on this privatisation move, as we think it is likely to spur more activity in the REIT market. Currently, the number of REITs that have a market cap above MYR5bn is still very limited. The Government also indicated that the initiative could potentially be replicated in other sectors eg hospitals or rail infrastructure.

Potential assets to be injected into the Airport REIT:

Telecommunications : Advancing Broadband

NEUTRAL

MYR1bn allocation for the National Fiberisation and Connectivity Plan (NFCP)

We believe the allocation would come from the Universal Service Provision (USP) fund and should be welcomed by the industry.

The Minister of Communications and Multimedia, Gobind Singh Deo had during the Malaysia – A New Dawn conference on 9 Oct revealed some targets under the NFCP. Most specifically, the target for 98% broadband population coverage by 2023 with a minimum speed of 30Mbps (copper services to be phased out by then), supported by the 700MHz band.

TM (T MK, NEUTRAL, TP: MYR3.60) could potentially benefit if the Government commits to defray some of the cost associated with the upgrade of Streamyx service in non-unifi areas, which affects some 0.5m subscribers. We see infrastructure service providers such as OCK Group (OCK MK, BUY, TP: MYR0.89) also benefitting from fibre deployment works under the NFCP, given its good track record of USP-type jobs in the past. The target for at least 25% reduction in the prices of fibre broadband plans by end-2018 has been achieved with new broadband plans launched by Maxis (MAXIS MK, NEUTRAL, TP: MYR5.70), Timedotcom (TDC MK, BUY, TP: MYR9.30) and Celcom recently, that saw retail prices cut by up to 56%. This follows the implementation of the mandatory standard on access pricing (MSAP), with new access agreements inked by TM with all three access seekers.

Jeffrey Tan, +603 9280 8863

jeffrey.tan@rhbgroup.com

Transport & Logistics: Surprises In The Aviation Space

NEUTRAL

MYR1bn allocation for the National Fiberisation and Connectivity Plan (NFCP)

Establishment of Airport REIT. The Government is proposing the setting up of the world’s first Airport REIT. We understand the establishment of this REIT is effectively adding an extra layer between Malaysian Airports (MAHB) (MAHB MK, BUY, TP: MYR8.90) and the Government. Based on preliminary estimates, the latter expects to raise c.MYR4bn via the sale of a 30% stake in the REIT. At this juncture, we are uncertain if the estimated proceeds are based on the issuance of shares or debt – or both – as well as the assets that will be included in the REIT. However, we note that the construction and maintenance costs of KLIA2 and a partial of Penang International Airport’s expansion costs still remain on MAHB’s books.

As deliberations are still ongoing, details remain sketchy at the moment. Key details as to who will bear the development capex remain uncertain. From our understanding, listed REIT companies can only fund up to 15% of construction development capex. REITs must also pay out 90% of dividends in order to receive tax benefits. In return, REIT investors will receive user fee income from MAHB, which is now being paid to the Government (approximately MYR400m pa). While the group’s development capex is still being deliberated under the Regulatory Asset Base (RAB) framework, we note that its maintenance capex already stands at c.MYR350m pa. Therefore, the user fee may be p subjected to a revision under this arrangement.

We are largely neutral with a negative bias on this latest development to MAHB. Much will depend on the final agreement between the group and the Government. The former will continue to operate the assets under concession, as per the Operating Agreement. We also note that the Airport REIT exercise is expected to be carried out only after the new RAB and user fee structures have been negotiated and finalised.

Departure levy for outbound travellers. In order to spur domestic tourism, the Government has also proposed the imposition of a departure levy for all outbound travellers beginning 1 Jun 2019. The proposed rate is 2-tiered: MYR20 for outbound travellers to ASEAN states and MYR40 to all other international countries. We note that this is a separate levy collected by the Government, and is independent of the current passenger service charge.

We are largely neutral on this development for MAHB, but negative for AirAsia X (AAX MK, UNDER REVIEW), given the sensitivity of its passengers to increases in fare prices. In the case of the latter, with a potential spill-over effect to lower air travel demand against increasing opex from higher crude oil prices and pressure on spreads, we expect the group to remain in the red for subsequent quarters. Note that, while we currently have a BUY call and MYR0.53 TP on AAX, our forecasts and recommendation are under review post transfer of analyst coverage.

Other key announcements in Budget 2019 include:

i. Anallocated MYR2.46bn to fund the upgrading and restoration works for railway tracks;

ii. Another MYR25m to fund the initial phase of a truck depot’s development. This is in order to catalyse development and growth of the Kota Perdana Special Border Economic Zone in Bukit Kayu Hitam, Kedah. This economic zone will act as a strategic trading and logistic hub between Malaysia and Thailand and establish the nation as a regional e-commerce hub;

iii. 380-acres of land in Pulau Indah, Selangor, to be converted into a Free Trade Zone (FTZ). This new FTZ will serve as a natural extension to the Port Klang Free Zone. We expect to see a growing container throughput volume, fuelled by increasing activities arising from industrial demand. We believe the impact will be positive to Westports (WPRTS MK, NEUTRAL, TP: MYR3.60) over the longer run.

We are neutral on the latest news flow involving the infrastructure developments in the transport & logistics sector. This is given the subdued earnings outlook for the larger-cap stocks under our coverage coupled with unattractive valuations.

Stephanie Cheah +603 9280 8859

stephanie.cheah@rhbgroup.com

RHB Guide to Investment Ratings

Buy: Share price may exceed 10% over the next 12 months

Trading Buy: Share price may exceed 15% over the next 3 months, however longer-term outlook remains uncertain Neutral: Share price may fall within the range of +/- 10% over the next 12 months

Take Profit: Target price has been attained. Look to accumulate at lower levels

Sell: Share price may fall by more than 10% over the next 12 months

Not Rated: Stock is not within regular research coverage

Investment Research Disclaimers

RHB has issued this report for information purposes only. This report is intended for circulation amongst RHB and its affiliates’ clients generally or such persons as may be deemed eligible by RHB to receive this report and does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. This report is not intended, and should not under any circumstances be construed as, an offer or a solicitation of an offer to buy or sell the securities referred to herein or any related financial instruments.

This report may further consist of, whether in whole or in part, summaries, research, compilations, extracts or analysis that has been prepared by RHB’s strategic, joint venture and/or business partners. No representation or warranty (express or implied) is given as to the accuracy or completeness of such information and accordingly investors should make their own informed decisions before relying on the same.

This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to the applicable laws or regulations. By accepting this report, the recipient hereof (i) represents and warrants that it is lawfully able to receive this document under the laws and regulations of the jurisdiction in which it is located or other applicable laws and (ii) acknowledges and agrees to be bound by the limitations contained herein. Any failure to comply with these limitations may constitute a violation of applicable laws.

All the information contained herein is based upon publicly available information and has been obtained from sources that RHB believes to be reliable and correct at the time of issue of this report. However, such sources have not been independently verified by RHB and/or its affiliates and this report does not purport to contain all information that a prospective investor may require. The opinions expressed herein are RHB’s present opinions only and are subject to change without prior notice. RHB is not under any obligation to update or keep current the information and opinions expressed herein or to provide the recipient with access to any additional information. Consequently, RHB does not guarantee, represent or warrant, expressly or impliedly, as to the adequacy, accuracy, reliability, fairness or completeness of the information and opinion contained in this report. Neither RHB (including its officers, directors, associates, connected parties, and/or employees) nor does any of its agents accept any liability for any direct, indirect or consequential losses, loss of profits and/or damages that may arise from the use or reliance of this research report and/or further communications given in relation to this report. Any such responsibility or liability is hereby expressly disclaimed.