What to do with your investments during a recession?

The boom is over. Your portfolio value is half of what it was last year. Is it time to cut your losses or buy in? Is this a good time to enter the market? If you find yourself asking these questions, you’re not alone.

The pandemic has forced a global lockdown, ending the longest bull market rally in history. Businesses have shuttered resulting in job losses. Income per capita is expected to drop significantly in 170 countries. Unemployment estimates are rising, the ringgit has declined in value, oil prices have plummeted and investor confidence is low.

The end of the Covid-19 lockdown is near, but the worst is far from over. According to the IMF (International Monetary Fund), the world economy will face the biggest recession since The Great Depression. The Great Lockdown of 2020 is expected to shrink global GDP (gross domestic product) by 3%, compared to the 0.1% decline seen during the global financial crisis of 2008-2009. Both advanced and emerging economies are facing recession as a result of suppressed demand and disruptions in the supply chain.

One positive area is private consumption, bolstered by the Bantuan Prihatin Rakyat handouts, growing 6.7% from the previous year. However, it could be a temporary boost as unemployment rates increase and purchasing power drops as we move further along the CMCO.

Goldman Sachs has forecasted a sharp contraction in advanced economies, with the US registering a 24% decline in GDP. The country is seeing its highest unemployment rate ever, with 22.03 million or 6.7% of the population jobless.

Source: FT, Trading Economics

Recovery is not too far away

Despite the initial worrying figures, there is a sliver of hope. Assuming the global cases continue to reduce in the second half of the year and containment efforts are gradually wound down, the IMF expects the global economy to grow by 5.8% in 2021, aided along by policy support.

China’s commodities industry, the earliest to be hit by the pandemic, is showing signs of recovery, indicating that the rest of the economy will soon follow suit. According to Bloomberg Economics, more than 90% of China’s workforce was back in business at the end of March, and the pickup was reflected in the steel, construction and crude processing industries. Oil refineries and coal-powered plants are nearing pre-Covid production levels, while metals stockpiles have shrunk from record highs.

To help keep the Malaysian economy afloat and aflush with liquidity, Bank Negara has announced a further cut on its overnight policy rate (OPR) to 2%, a level last seen during the 2008-09 global financial crisis. Keeping interest rates low has helped the economy recover before, and it is expected to gradually uplift the economy.

Economic activities are expected to improve in the second half of the year, bolstered by fiscal measures and infrastructure projects. Financially stable companies will be able to leverage on cheaper loans to expand, taking on some of the unemployed. The positive changes will be slow and gradual, with results that will only be reflected in 2022 figures.

Recovery will largely depend on how the pandemic evolves. If a vaccine is found within the next year, we can expect a short spike in growth.

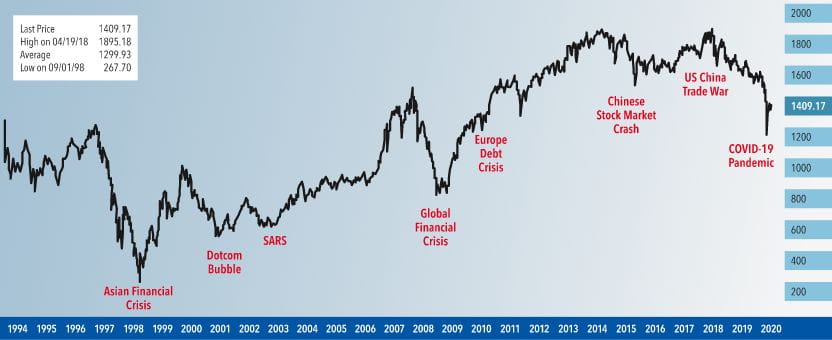

That said, let’s take a broader view. Looking at the KLCI’s journey from 1994 to 2020, we can see healthy rebounds following every major economic crisis. While past performance is not indicative of future results, the pattern still gives us hope.

KCLI Index from 1994 to 2020

Source: Bloomberg and RHB Research & Advisory

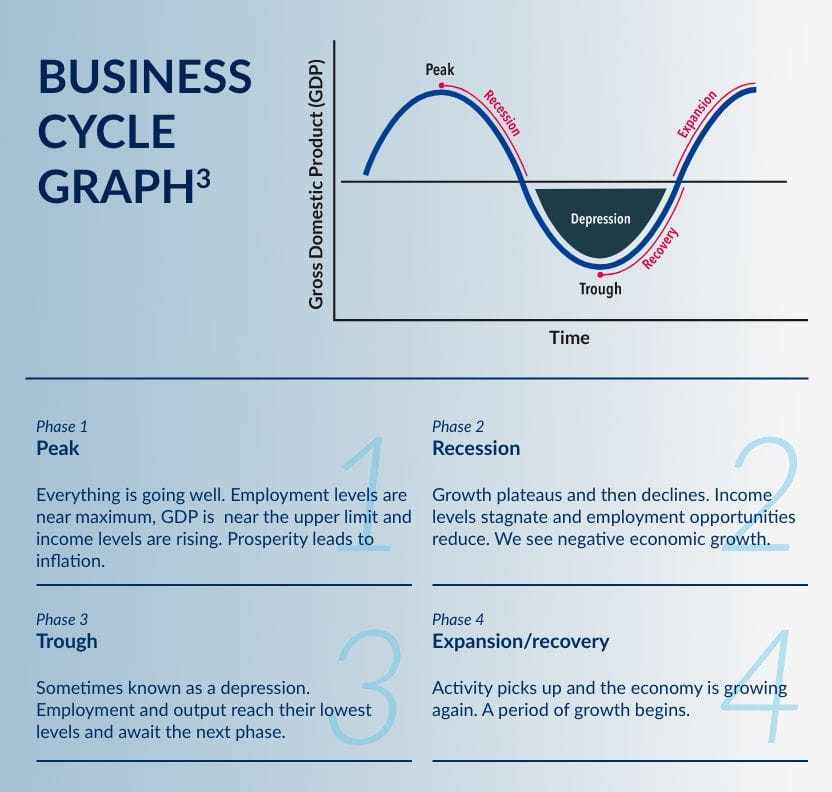

The economy moves in cycles consisting of four phases: the peak, recession, trough and recovery/expansion.

Source: www.investopedia.com

What should you do with your investments?

Stay liquid

While you might be tempted by the current conditions to invest as much as you can, it is important to retain cash. Besides maintaining an emergency cash fund of six months’ pay, retain 20-30% cash that can be deployed when the opportunity arises. This will keep you agile and flexible.

Invest in a broad range of asset classes

Imagine running your portfolio like you would a football team – there should be the attacking, midfield and defensive players in a formation that you can change as your risk tolerance evolves over time.

Diversify horizontally and vertically. Selecting the right mix and including passive investments such as unit trust funds or mutual funds will reduce risk, while maintaining steady returns.

Your portfolio can also include one fund that moves in contrast to the market, so you will still get some returns regardless of the market direction.

You can have more than one portfolio as well, each with their own risk approach and investment horizon.

Don’t rely on the algorithm

Digital investment platforms have become increasingly popular over the last decade. These use an algorithm to make trades, which makes them more effective for developed markets where information is consistent and perfect. In emerging markets, active managers outperform digital platforms over the longer term. An active manager or adviser can also provide insight and remind you of your goals.

Is now a good time to invest?

The current market is very volatile, and Trump’s accusation that China leaked the virus from a lab in Wuhan isn’t helping matters. While it might seem like bad news to most investors, there will always be that opportunist who sees the upside. Could that be you?

There isn’t a one-size fits all approach to investing. Your risk profile depends on what your goals are, your age group, how much you have already saved and how much you have to invest. Determining your risk profile will help you map out the right strategy and the right mix of investments.

The rule of thumb is “higher risk, higher returns”, but that doesn’t mean you should take on more risk than necessary. Diversification plays an important role in reducing risk because it takes the focus away from any one asset class.

Equities, for example, is riskier than fixed income, but your portfolio should include the right balance of both. Investing in different regions and sectors also mitigates risk.

After determining your risk appetite and your investment horizon, test the waters by investing your money in several tranches, say, 40% of your total, then 30% and so on. Like building a football team around core players, pick three to five core funds as the foundation of your portfolio. Starting off with core funds gives you agility by allowing you to build up your base and slowly add on other funds as “satellites” from time to time as the market direction, and your risk appetite, change over time.

Regardless of your risk profile, however, it is important to pace your investments into uniform tranches as a dollar cost averaging approach.

As an investor with RHB, your risk profile will be classified under one of six categories: Secure, Conservative, Income, Balance, Aggressive and Speculative.

Because investing always comes with some level of risk, there aren’t many options for Secure and Conservative investors who prefer risk-free investments and have limited tolerance for negative price movements.

The table below explains the other categories.