The unfolding, global novel-coronavirus (Covid-19) pandemic is a crisis that very few in the world has ever seen before. At the time of writing, there are over 5.8 million confirmed cases spread over 200 countries and territories since the first case was recorded in Wuhan, China, back in December 2019, and the virus has resulted in over 360,000 deaths. For context, SARS and MERS only produced approximately 8,000 and 2,500 global cases, respectively. While the virus was mostly contained within China at the start of 2020, the number of cases across the globe have skyrocketed over the recent weeks, as the number of confirmed cases in the United States, Italy and Spain have all exceeded China, with the US alone racking up over 1.7 million confirmed patients. From an economic perspective, the pandemic has also caused rapid declines in global demand and sparked fears of an impending global recession, with key stock indices, such as the Dow Jones Industrial Average and S&P 500, recording some of its worst performances since the 2008 Global Financial Crisis (GFC).

Deepening Crisis or Improving Situation?

As the number of confirmed cases and deaths continue throughout March and most of April, it is clear that the pandemic has become a public health crisis without precedent in living memory, and brings with it the greatest socioeconomic crisis of the 21st Century. While China was ground zero for Covid-19, since March, the US has become the country with the most number of cases and deaths, with over 1.7 million infected patients – roughly 30% of the global total – and over 101,000 deaths.

US President Donald Trump announced on March 30 that he would extend federal coronavirus guidelines, such as social distancing and working from home protocols, until April 30, and urged Americans to brace for a significant lockdown. This comes after the White House coronavirus coordinator warning that the pandemic could kill as many as 200,000 people. Trump also claimed that the travel ban restricting the entry of non-U.S. citizens traveling from China, Iran, the U.K., Ireland, and 26 European countries in the Schengen Area would remain in place, and that the list on countries may be expanded further. Over in Europe, although both the number of confirmed cases and death toll continues to climb in the key economies of UK, France, Spain, Italy and Germany, however these trends appear to have peaked out. Both Italy, United Kingdom and Spain have recorded over 200,000 cases, with France following closely behind at nearly 186,238 cases. The death tolls have also climbed with Italy and the UK breaching 30,000 mark, while France edges close to the tally with over 27,000 deaths. However, one point of concern is the skyrocketing increase in confirmed cases in Russia, with the total number of confirmed cases breaching 387,000 at the time of writing.

As the covid-19 pandemic continues to spread and the nation-wide lockdowns imposed in key global manufacturing and financial hubs grinded the global economy to a screeching halt, it is abundantly clear that we are edging closer to turbulent times. Economist across the globe have already slashed growth expectations for 2020, with the International Monetary Fund “IMF” predicting a dismal -3.0% for 2020 – a level much worse than during the 2008 GFC – and 5.8% in 2021. However, there remains considerable uncertainty around this forecast. Firstly, it is the pandemic itself - the pandemic is assumed to fade in the second half of 2020, allowing for a gradual lifting of containment measures. Secondly, its macroeconomic fallout - the disruptions are assumed to be concentrated mostly in the second quarter of 2020 for almost all countries except China. And lastly, the associated stresses in financial and commodity markets are assumed to ease in the second half of 2020.

However, whether these assumptions will prove to be optimistic remains to be seen, especially in light of the uncoordinated containment efforts amongst the different countries that we are seeing now.

With many countries’ economies already slowing before the pandemic, Covid-19 poses a serious risk of sending them into recession, and has sent the US stock market into a bear market. The slide began on 20 February 2020 – just a little over a week where the three key US indexes recorded all-time highs – and from 24 to 28 February, as stock markets across the world suffered some of the largest declines since the 2008 Global Financial Crisis. In the US, the Dow Jones Industrial Average capped off its worst ever quarter since 1987, and the index fell by 23.2% over the first quarter of 2020, marking the worst quarter since fourth quarter of 1987 (-25.3%). The S&P 500 closed down 12.5% for March and down 20% for the quarter, the worst since fourth quarter 2008 (-22.6%). As a result of the pandemic, over 30 million have filed for jobless aid over the past 6 weeks since the pandemic forced millions of employers to halt operations and slash their workforce. To add to market woes, economists at the Federal Reserve St. Louis district estimate a total employment reduction of 47 million during the pandemic, which would translate to an unemployment rate of 32%. According to the Commerce Department on 28 April, US GDP fell at a 4.8% qoq annual rate for the first quarter of 2020, officially marking an end to the record expansion since the 2008 Global Financial Crisis.

In Europe’s major economies, non-essential services closed by government decree account for about one-third of output. This means that each month these sectors remain closed translates into a 3 percent drop in annual GDP, and that is before other disruptions and spillovers to the rest of the economy are taken into account. Due to the aforementioned factors, a deep European recession this year is a foregone conclusion, as preliminary estimates showed that Eurozone GDP contracted by -3.8% for Q1 2020.

However, while things are worsening in some countries, there are improvements in others, with key highlights being China, South Korea, Taiwan and Hong Kong, where the number of confirmed cases have dwindled over recent weeks due to prompt government action and fruitful lockdown initiatives. Over recent weeks, we are seeing signs of recovery across numerous countries in Western Europe and Asia, as the number of new cases are starting to plateau and governments have started removing mobility restrictions and are looking to restart their economies. Even in the US, the worst-hit country in the world, more than a dozen states have eased restrictions in an attempt to revitalize the slumping economy as the number of confirmed cases plateaued. With this positive momentum behind them, investors are regaining confidence that the devastating pandemic is likely to eventually subside, and, as a result of this renewed optimism, equity benchmarks recorded its first gains of 2020 during the month of April. The Dow Jones Industrial Average recorded an 11.1% gain, while the S&P 500 delivered a 12.7% return. This monthly rally would mark the best performances for both indexes since January 1987.

To best examine what the road to recovery looks like, On March 28, China lifted its two-month lockdown on the city of Wuhan – the ground zero for Covid-19 – and declared victory over the pandemic, with the Director of the National Health Commission claiming that the virus was fully contained after the city reported no new cases for seven days. At the start of 2020, things were looking especially bleak for China and the Chinese economy, as the rampant spread of the virus unfortunately coincided with Lunar New Year festivities and travels. Since 31 December 2019, the date that Chinese officials notified the World Health Organization, the number of confirmed cases soared for the first two months and the death toll quickly exceeded the tally from the SARs epidemic back in 2003. To combat the virus, Beijing embarked on one of the largest mass mobilization efforts in history utilizing both modern technology and strict quarantine measures. Authorities closed all schools, forced millions to remain indoors, and deploying vast number of medical resources to Wuhan and the surrounding Hubei province. While these strict restrictions grinded the Chinese economy to a virtual halt, it was a systematic, coordinated and comprehensive response that ultimately delivered positive results and played a key role in alleviating the spread of Covid-19. Contrasting to the rest of the world, the number of confirmed cases in China have plateaued since the end of February, indicating that the strict measures were delivering positive results. With the end of the countrywide lockdown, all aspects of life are returning to normal, where depending on the industry, 75% - 95% of the workforce started going back to work. Due to these positive developments, the Chinese economy has significantly outperformed its global peers, with the MSCI China Index being one of the best performers across the globe (-5.92% at the time of writing) and March’s PMI figures have re-entered into expansionary territory at 52.0, indicating that business has slowly, but surely, come back to life.

Relapse or Recovery?

As more and more countries enter the ‘spread deceleration’ phase of the virus progression curve, characterized by a declining number of new cases and growing number of recoveries resulting from effective social distancing measures, travel restrictions and broad early testing have mitigated the spread of the virus, optimism amongst investors have been rising.

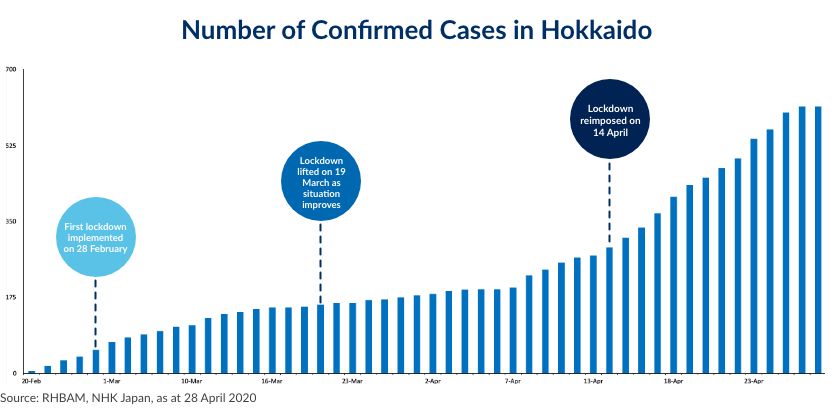

However, the spread of Covid-19 is unpredictable and unprecedented in its scale and pervasiveness. There are numerous accounts of recovered patients testing positive for the virus again, and as we can see from the island of Hokkaido in Japan, there is always a chance of a second surge in cases after an initial recovery.

Hokkaido, the first area of Japan to see a major coronavirus outbreak, entered into lockdown in response to a sharp increase in infections. Initially, the prefecture was lauded for its quick response and successful efforts in containing the spread of the virus, which culminated in the lifting of all lockdown measures on March 19 as the number of confirmed cases dwindled to low single-digits. However, once the lockdown was lifted, a second wave of infections slammed the island even harder and a mere 26 days later, the island was forced back into lockdown, with numerous government officials admitting that they made a mistake reopening the island prematurely.

Hokkaido serves as a grim reminder that, until a successful vaccine is developed for Covid-19, there is always the possibility of a resurgence in the number of infections, given how prevalent the virus is. In fact, it is safe to say that the threat of COVID-19 to lives and livelihoods will only subside when enough people are immune to the disease to blunt transmission, either through a successful vaccine or through prior exposure. While no fully tested vaccine has been released, there has been an unprecedented growth in research and development in the pharmaceutical space in relation to Covid-19. By late January, scientists in China have already deciphered and shared its genetic code, allowing researchers around the world to discover a potential cure.

By the end of April, there are already 100 vaccine candidates under development worldwide, and 8 of them have already entered early clinical trials on humans. In addition, a variety of drugs for treatment are also being evaluated. Although, full-scale production and distribution of a successful vaccine would not take place until 12-18 months after clinical trials, the production of potentially effective solution would be a giant step forward, both in the fight against Covid-19, as well as for markets to recover.

The Road Ahead: The New Normal amid an Uneven Recovery

While we believe that it is difficult for investor confidence to return to the record highs of 2019 until a successful vaccine is developed and distributed, we hold the view that the massive stimulus measures initiated across the globe should somewhat repair investor sentiments and support recovery efforts.

Furthermore, even as markets are plummeting into unchartered waters, investors need to understand that the global recession we are in now is essentially a massive health crisis. Contrary to the recession of 2008 – 2009, which was a result of the failures of global financial system through decades of poor decisions, the current crisis happened because of government mandated lockdowns and strict mobility restrictions which grinded global supply chains and consumer demand to a screeching halt. Simply put, as the Covid-19 curve continues to flatten across the globe and as new medical solutions appear, we believe that a recovery, albeit a slow and arduous one, would take place soon after.

Even as the world gears towards reopening for business, the base case for RHB Asset Management is that the world will see a sharp global recession in 2020, but the recovery will be differentiated and uneven across the different countries and sectors.

Mr. Tan Jee Toon, Chief Investment Officer of Asia Pacific Equities at RHB Asset Management remarked that, “Different countries and sectors, and even different industries even within the same country will likely undergo different recovery paths. To invest successfully in the post Covid-19 world, it is important for investors to make that distinction.”

But more importantly, after such a cataclysmic episode, the world would not be the same ever again. There will be a “New Normal.” And this time will be no different. Mr. Tan explained that, “RHB Asset Management is of the view that Covid-19 pandemic will pass, and will in fact create future winners in this New Normal who are able to take advantage of this unfortunate event.”

Mr. Tan highlights the following as some of the key seismic shifts in the investment landscape.

Many companies now have most employees working from home. Chances are many will probably continue doing so after the lockdown is over. Some companies will no longer require as much expensive office space. Technology needs of companies will also change dramatically after this episode.

Local resilience of prized sectors that are considered critical to national security including food, medical supplies, and drugs, will be emphasized.

With the experience of the global lockdown, the world will certainly be changing their supply chains and bring manufacturing closer to their home bases but with increasing levels of automation. That is going to happen everywhere in the world. This would not end globalization but will certainly change it. The ever worsening US-China trade spat will certainly accelerate this process. But changing the China-centric global supply chain is easier said than done.

The pandemic has painfully exposed the inadequacies of healthcare systems around the world. We believe this would drive significant changes, innovations and investments in the healthcare sector from increasing hospital beds, scaling up of medical equipment, development of new therapies and treatment, and adoption of tele-medicine etc.

The quarantine measures globally have created “forced” adoption of the on-line mode of living, like e-commerce, on-line delivery of groceries and food, video-streaming, on-line entertainment, and on-line education. Having tasted the convenience of the on-line world, consumers will be inclined to continue even after the pandemic ends.

While this Covid-19 pandemic is deeply unsettling and a first for many of us, it is not the first pandemic or global recession that mankind has ever seen. Throughout history, mankind has prevailed, and we will do so again. However, as the case study of Hokkaido demonstrates, the path to recovery may be bumpy, there is always the likelihood of a second, or even a third wave of infections that could set back the positive momentum.

But what we can be certain of is this – there is always a silver lining in every scenario, and there are always opportunities waiting to be discovered. Investors would do well to stay calm, be well informed and refrain from making rash decisions. It is also key that they align themselves with a wealth manager that they can trust in order to achieve their long term investment objectives.