Malaysia has always been known as a global hub for Islamic funds — the country has come a long way since the launch of the first shariah-compliant fund in 1993. In 2017, the country even launched a five-year Islamic Fund and Wealth Management Blueprint to further strengthen this position, aimed at developing Malaysia as an international provider of Islamic wealth management services.

The demand for shariah-compliant funds has increased over the years as investors start to acknowledge that it could potentially provide them with defensiveness, portfolio diversification benefits and greater transparency.

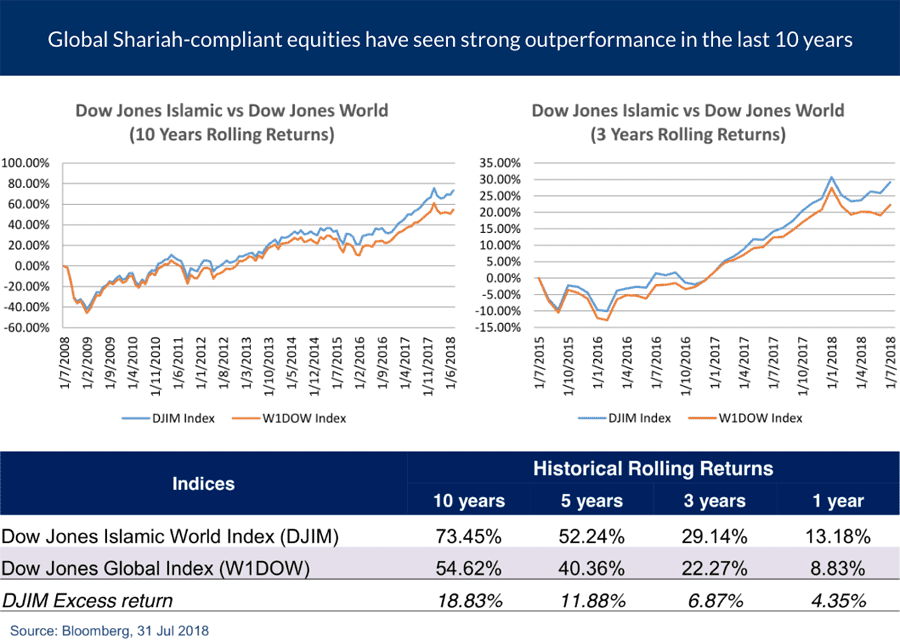

Global shariah equities have seen strong outperformance over the past decade, evident in the performance of the Dow Jones Islamic World Index (DJIM) and its conventional counterpart, the Dow Jones Global Index (W1DOW).

According to Bloomberg data, as at July 31 2018, the DJIM had delivered returns of 73.45%, 52.24%, 29.14% and 13.18% over 10-year, 5-year, 3-year and 1-year periods respectively. In comparison, W1DOW delivered returns of 54.62%, 40.36%, 22.27% and 8.83% over the same period. This means that the DJIM delivered excess returns of 18.83%, 11.88%, 6.87% and 4.35% over 10-year, 5-year, 3-year and 1-year periods respectively.

It is common to hear that Shariah-compliant funds underperforming conventional funds over a long period. This is because conventional funds benefit from growing dis-cretionary spending during a good economic environment from certain sectors, including “sin stock” sectors such as gaming, gambling and alcohol. Shariah-compliant funds, on the other hand, do not invest in these sectors.

However, there are many advantages to having Shariah-compliant products in one’s portfolio, according to RHB Asset Management Sdn Bhd. For one, Shariah-compliant products provide investors with a layer of defensiveness towards cyclical sectors such as financials and industrials.

The companies within these sectors typically have a large portion of cash in hand or are saddled with huge debts, indicating that they would be heavily impacted in an economic decline, says RHB. To top it off, there are various factors that could affect the performance of these companies.

For example, the anticipation of an interest rate cut recently has dampened the optimism of earnings for banking institutions. This led to the FBM KLCI — which had significan’t financials weights for its constituents — to drop 2.9% year to date (1Q2019). Meanwhile, the index’s Shariah-compliant equivalent, FBM Emas was up 2%, thus outperforming by more than 4%.

Appeal to investors

Generally, Shariah-compliant funds are more appealing to investors with a lower risk appetite and who expect less volatility and stable returns. This is because the Shariah screening process helps to filter out the more volatile stocks. Shariah-compliant stocks are generally selected through a stringent process that takes into account the financial standing of the companies.

Shariah-compliant stocks are also generally companies with low debt. One of the screening criteria is that the company’s debt must not be more than one-third of the company shareholders’ funds. This ensures that Shariah-compliant companies are less volatile.

Shariah-compliant investments bear similarities, thus accept a form of Socially Responsible Investing (SRI). Due to this, the products have recently enjoyed great attention following the increasing global demand for more SRI products. In a 2018 report released by the US SIF Foundation, more than one in every US$4 under professional management in the US (worth more than US$12 trillion) was invested according to SRI strategies.

SRI focuses on companies that place a significan’t emphasis on the environmental, social and governance aspects within their business operations. This forms part of risk management tools for sustainable long-term returns, promoting global collaboration towards sustainable markets that contributes to a more prosperous world for all.

According to RHB, Shariah-compliant investments and SRI seek to promote the social economic well-being of society, with shariah investing being more binding and resilient, given the additional layer of risk management achieved through negative screening. Negative screening for shariah investment is conducted to eliminate any involvement with sinful or non-permissible elements, which require analytical judgment and thorough research.

But the demand for Shariah-compliant products is not restricted to the equity space. Greater government support from Muslim-majority countries to issue debt via sukuk structures also provides continuous supply-demand dynamics to the overall growth of the sukuk market.

Sukuk represents ownership of an asset or its usufruct, explains RHB. The claim embodied in a sukuk is not simply a claim to cash flow, but an ownership claim, which differentiates sukuk from conventional bonds. The latter represent proceeds over interest-bearing securities, whereas sukuk are basically investment certificates consisting of ownership claims over a pool of assets.

Additionally, the assets are free of any obligations, implying that the underlying assets cannot represent receivables or debt. If the earnings of the issuer fall short of the expected returns, sukuk holders are not allowed to obtain loans to cover the shortfall.

Sukuk holders also hold undivided beneficial ownership in the sukuk assets. Ownership of the underlying assets of the contract is transferred to the sukuk holders, thus, the issuer cannot continue to own the assets once the sukuk is issued.

Funds to consider

RHB has a wide range of Shariah- compliant products that can help investors to diversify their portfolios and reap potential good returns. The fund house covers multiple markets under its Shariah products, including Malaysia, Asean, China (A-shares), Asia-Pacific and global mandates. This provides more options to investors to pick the right investment based on their preferences, while balancing the risk and reward for selected assets and market exposures.

Among the key products are RHB Dana Hazeem, a fund that invests in both Shariah-compliant equity and sukuk; RHB Dana Hikmah, a fund with a highly concentrated portfolio focusing on 25 high-conviction names within Malaysia’s equity market; RHB Dana Islam, which focuses on superior growth based on the general KLCI Emas Index; and RHB Dana IEOUT, a high growth fund that invests in Malaysian small caps.

The region-focused funds include RHB Islamic Regional Balanced, a fund with balanced asset allocation between equity and fixed income. As it is diversified into the regional Asia-Pasific market, the fund offers better returns compared with the local equity market. RHB also offers RHB Islamic Asean Megatrend, a fund with a thematic Asean growth portfolio, which can benefit from the ongoing infrastructure plans and growing domestic consumption across the region.

Last year, RHB’s equity Shariah fund’s performance was affected by the unexpected event specific to the Malaysian market. More than one-third of the companies listed on Bursa Malaysia are construction or construction-related companies. These companies were severely impacted by the cancellation or postponement of the mega infrastructure projects, further dampened by external events such as the trade war between the US and China as well as the anticipation of interest rate hikes in the US.

Nevertheless, the funds’ performance has rebounded in the first four months of 2019 as the government started to revive the said mega infrastructure projects. Additionally, 70% of the equity funds are in the first quartile and second quartile among peers ranking and beat the respective fund’s benchmark (performance as at March 31 by Lipper).

On the other hand, RHB’s sukuk funds have enjoyed a very good performance as investors turned more cautious on the outlook of the local and global economy.

Going forward, RHB is looking into diversifying its product offering by introducing ESG and SRI funds in the near future. Several studies and working papers have been done to enhance the understanding of the whole SRI concept and potential.