Regaining control of your cash flow

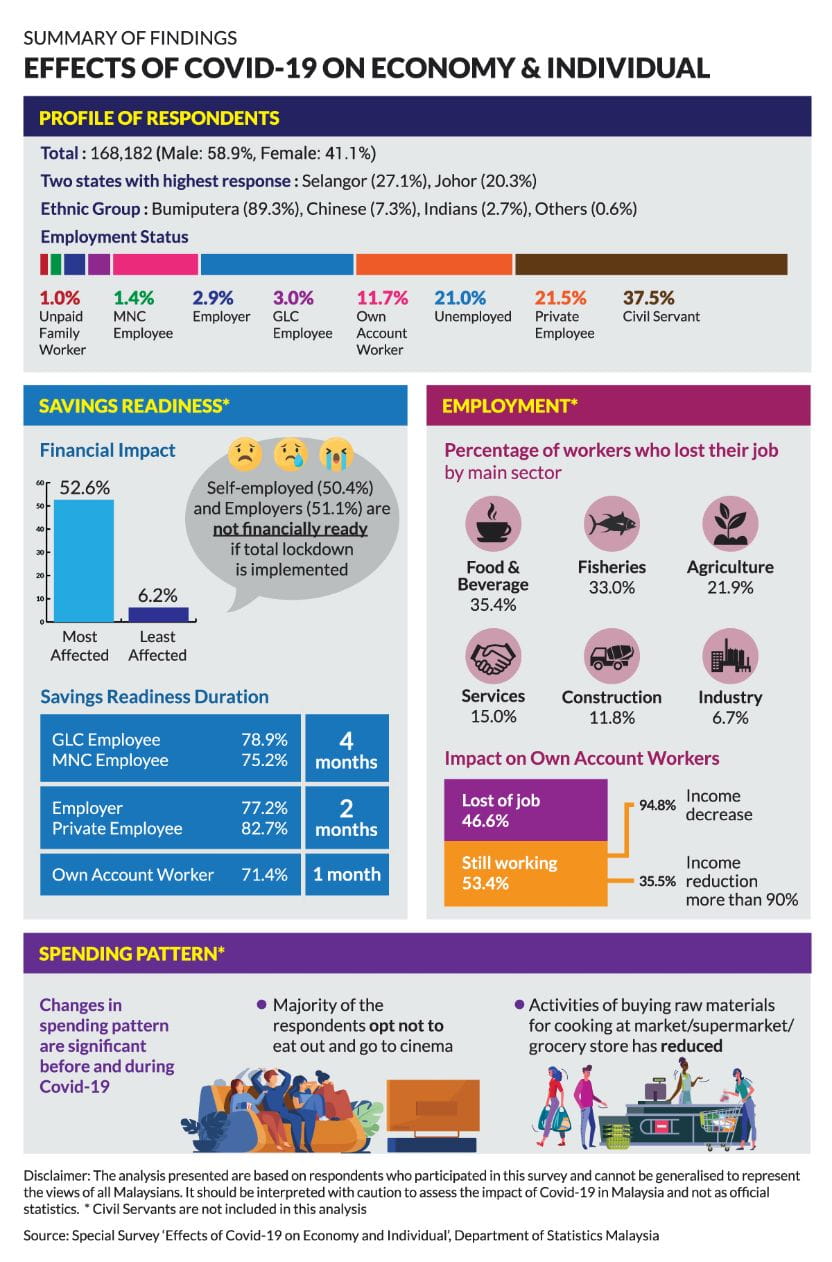

The ongoing health crisis has had a huge impact on unemployment levels. As at February 2021, the unemployment rate stood at 777,500 persons (4.8%), a year-on-year increase of 1.5% from 3.3% in February 2020. The second full lockdown will likely have an impact on unemployment rate, although the extent is yet unknown.

It’s unfortunate, but if you find yourself among those affected, read on for some tips on how to manage your finances and get you back on your feet.

1 /

Spread out your commitments over a few instalments

If you have a credit card(s) and need urgent cash, check how much leeway you have with your facilities. You can spread out your commitments over few instalments with little to no interest/actual management fee. An option is to apply for CashXcess to convert your available credit limit into instant cash. Consider the option and take it up if the payments are manageable and you want to free up your cash flow for now, and you have the means to repay it later. Do take note that the interest/actual management fee on overdue payments is very high, so you’ll need to be much more disciplined in making your payments.

2 /

Consider a Personal Financing facility

If you don’t have any available credit limit on your existing credit card, but still need urgent cash, you can consider a Personal Financing facility. Take note of the interest/profit rates offered and take up the financing plan that suits your needs and budget. You may consider requesting a top up if you have an existing personal financing facility.

3 /

Consolidate all your cards’ balances with Balance Transfer

Interest/actual management fee on credit cards can accumulate and it might look like you’ll never clear the debt. To better manage your payments, a Balance Transfer can consolidate all your cards’ balances onto just one card, with little to no interest/actual management fee. With a lower payment, all your focus will go to the payment of the principal amount instead of on interest/actual management fee. This will help you to pay off your debt faster.

Talk to us about your needs for the best solution, today.