BY RHB WEALTH RESEARCH

An upbeat post-Budget forum. The Budget 2020 Forum held yesterday was officiated by Minister of Finance YB Lim Guan Eng, followed by three moderated panel sessions. Forum participants were generally upbeat on the proposals tabled in Parliament last Friday that were relatively market-friendly, containing pro-growth initiatives and other measures to address structural shortcomings in the economy. While forum panellists highlighted execution risks, we reiterate that the Budget proposals are no panacea to cure the ills constraining the market and the broader economy.

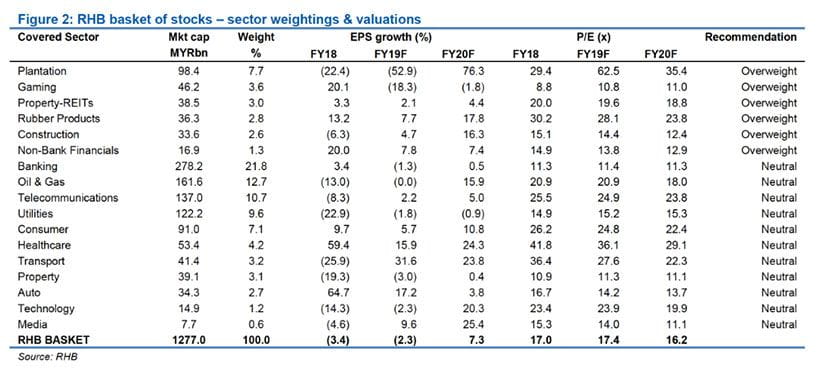

As much as could be expected. We are of the view that the Budget 2020 proposals were as much as could have been expected, given the limitations. It was a people-centric budget, with multiple proposals supportive of the B40 segment, in addition to initiatives to pump-prime the economy via the construction sector. We are also encouraged by wide-ranging proposals to kick-start labour reform and move industries further up the value chain. In our view, the construction and consumer sectors are the biggest winners, while measures are also mildly positive for plantations, property and telcos. We make no change to stock recommendations and sector weightings.

An expansionary budget in 2020. Despite a slight deviation from the medium-term fiscal consolidation path, it is deemed as necessary by the Ministry of Finance, given the challenging global economic environment that poses downside risks to the domestic economy. This, in our view, is unlikely to prompt international agencies from cutting Malaysia’s sovereign credit rating, as the Government’s fiscal consolidation track remains intact and is now more transparent in its debt and liability commitments. We laud the MOF’s emphasis on spending to derive value for money, with the right outcomes. This could help to instil confidence among investors, despite an increase in the fiscal deficit to 3.2% of GDP from the medium-term target of 3%. It is also a well-thought-through pro-growth budget, given the allocations to promote investment, create jobs, and improve the efficiency of the economy through digitalisation.

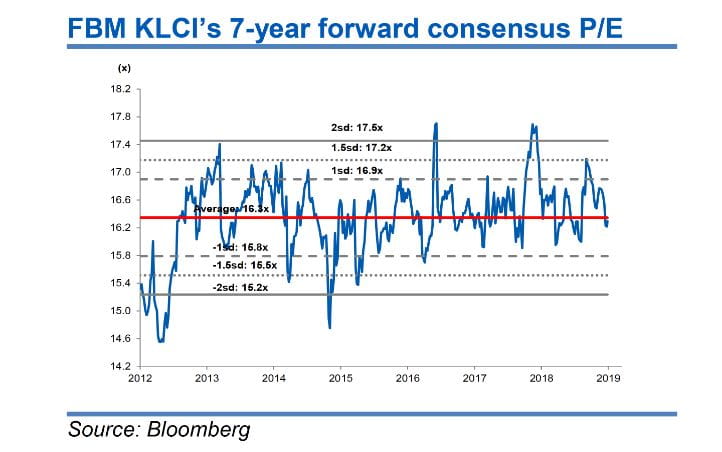

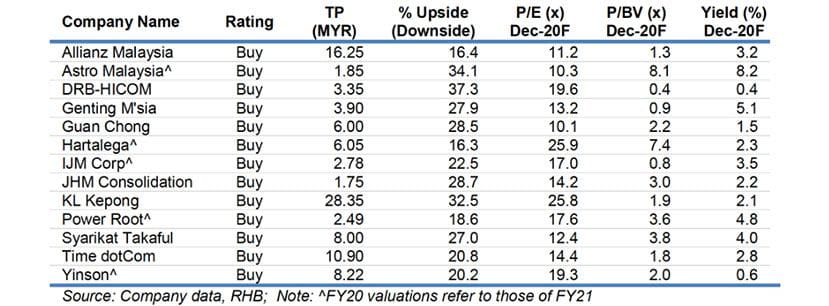

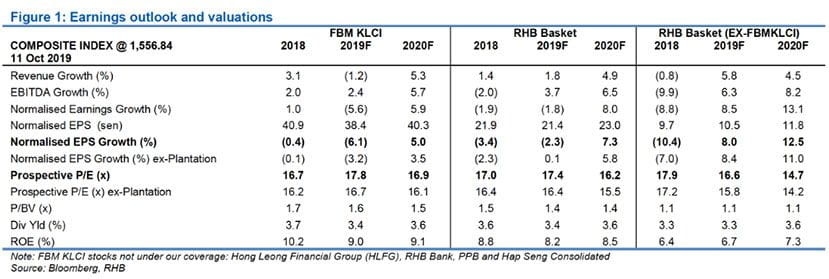

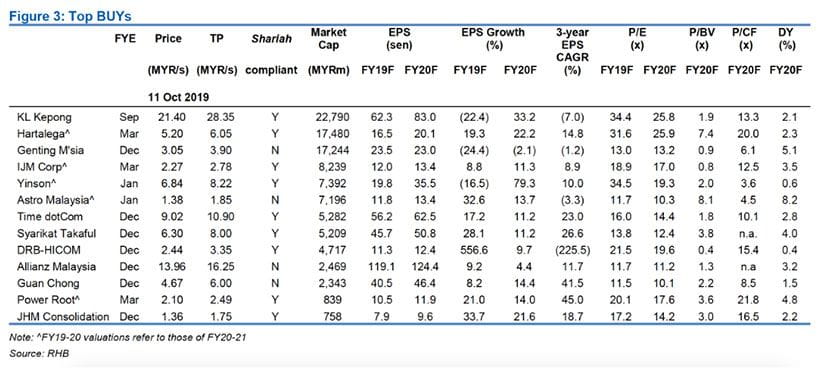

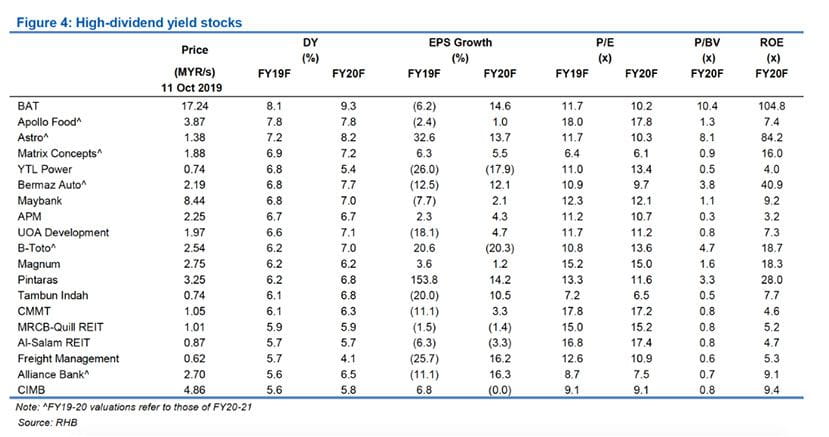

A trader’s market in a low-yield, low-growth world. The local market has lagged on growth concerns and unattractive valuations, exacerbated by various external and domestic worries. A likely US-China trade truce looks far from being comprehensive, and leaves in place existing punitive tariffs that will weigh on global growth in 2020. Bottom-up stock-picking will be key, focusing on quality laggards, resilient yield plays and defensive stocks as tactical options. Small- and mid-caps offer more robust growth at sensible valuations. We are OVERWEIGHT on construction, gaming, rubber gloves, NBFIs and REITs. We make no change to our end-2019 FBM KLCI target of 1,620 pts.

Finance Minister Lim Guan Eng kick-started his Budget 2020 overview speech by highlighting the prevailing trade war between the US and China, which has had a significant impact on trading countries such as Malaysia.

YB Lim pointed that the reorientation of the global supply chain has boosted interest in Malaysia, where investment and trade diversion were concerned.

“Malaysia is reindustrialising by digitalising our economy, by integrating with the global supply chain better, and by incentivising honest work,”

he said, pointing out that Budget 2020 was designed to cope with the entrenched uncertainties in the global environment.

- One way to achieve this is to attract high-quality investments from multi-national corporates. With incentives valued at MYR5bn over five years, this could create 150,000 high-quality jobs and help enrich the Malaysian supply chain.

- Concurrently, the Government is also aiming to upgrade high-potential local companies to become global champions in exports through incentives valued at MYR5bn over five years, which could create 100,000 jobs locally.

- Another key area: Embracing the digital economy to improve competitiveness. Private sector adoption of the digital revolution could create significant breakthroughs, but would require significant investments in infrastructure. YB Lim said the Government is building the digital backbone by implementing the National Fiberisation & Connectivity Plan (NFCP) over the next five years.

The second thrust of Budget 2020 emphasises on the equitable sharing of wealth among Malaysians. This includes encouraging the hiring of workers to encompass women, the youth, and unemployed graduates, as well as reducing the dependency on low-skilled foreign workers through the Malaysians@Work initiative.

During the Q&A session, the moderator put forth the first tough question: The ability of the Government to execute its policies and budget tabled, given some of the unresolved matters proposed during Budget 2019. This question delighted the crowd.

YB Lim acknowledged some of execution time lags for a number of Budget 2019 proposals, but highlighted the intent of the Government to “walk the talk” – this could be seen in some of its accomplishment, including the public declaration of assets by Members of Parliament, he said.

On the capacity of the country to move into Industrial Revolution 4.0 or IR4.0, he said the Government was trying to push for special bodies to take charge. For example, the Malaysians@Work initiative is being led by the Employees Provident Fund.

A question from the floor was made with regards to the optimistic projections for Malaysia’s 2020 GDP forecast, amidst the external global uncertainties currently. YB Lim acknowledged the global uncertainty – where global trade was expected to slow if the US-China trade war continued on – but noted that the Government is taking proactive measures, as seen by the slightly expansionary Budget 2020.

When asked on the Samurai bond and its hedging practice, YB Lim pointed out that the 0.5% rate offered by Japan is one of the lowest offered, in part due to the latter’s confidence in Malaysia, as well as the good relationship between the two countries.

He also expected more loans to be undertaken by the Government, in view of the infrastructure projects that will take place in 2020. Among some of those mentioned include the Light Rail Transit, Mass Rapid Transit, and East Coast Rail Link projects.

As for the minimum wage increase for major cities, YB Lim pointed out the increase limited for such areas is to give the economy breathing space, especially for employers, given the current economic situation. When asked on the definition of “major cities”, he said an announcement would be made in due course by the Human Resource Ministry.

On the question of inheritance tax, and whether the Government will impose more taxes on the super-rich, YB Lim said no plans for either are on the table, much to the relief of the crowd.

The crowd clapped as he ended the session by stating that Budget 2020 was meaningful, as it put Malaysian businesses and the ordinary man on the street back to work.

Johan Mahmood Merican: A key challenge for Budget 2020 is expanding expenses YoY, with revenue growth lower than the GDP growth rate.

The objective of the digital service tax stated in Budget 2020 is to level theplaying field between foreign digital and local brick-and-mortar services providers

– the latter is currently paying service tax to the Government, but the former is not.

Johan also said that one of the initiatives being undertaken by the Government to recoup lost revenue is the increased focus by the Royal Malaysian Customs Department on contraband cigarettes.

Dr Richard Record: Malaysia is currently ranked 15th in the World Bank’s Doing Business 2019 report. Note that the ranking here refers to business regulations, as well as the ease of doing business within a specific country.

Dr Record felt encouraged that Budget 2020 is focused on the labour market, especially the target to increase the labour force participation rate (LFPR) for women.

He also commented on the Government’s proposal to increase the tax on top income earners, by setting the tax rate of 30% for taxable incomes in excess of MYR2m. Dr Record stated that this 30% bracket is still behind Malaysia’s other peers, eg Thailand, Vietnam, and the Philippines.

Andrew Wood: Standard & Poor’s (S&P) currently has a rating of A- for Malaysia, which is considered a strong one. The outlook for the rating is stable, which means that S&P did not expect a change in ratings for the next 24 months.

Wood said that, while 2019’s revenue had become more petroleum-dependent, Budget 2020’s quality of revenue has improved – because the country’s income sources are now more diversified.

The important criteria that S&P is focusing on are improvements of the debt to GDP, which was expected to decline from 2020 to 2022.

Dr Veerinderjeet Singh said Budget 2020 is well-crafted and inclusive. He believed that the Sales and Service Tax’s scope should be widened.

Dr Veerinderjeet said enforcement should be tighter – to ensure higher government revenue collection.

Allen Ng (Chief Economist, Securities Commission Malaysia)

The share of high-tech manufacturing as a percentage of GDP has plateaued since 2010 while the degree of reliance on foreign workers has remained flat since 2015.

Malaysia’s working-age population – measured by the percentage of population between ages 25 to 54 to the total population – is projected to peak at above 45% by 2030. Therefore, we are left with one decade to grow the economy before it becomes more challenging.

Malaysia is moderately more complex than expected for its income level, and is positioned to take advantage of many opportunities to diversify production. That said, our country has yet to fully deliver its full growth potential (5.5% growth expectation) based on our current economic structure.

Tan Sri Datuk Soh Thian Lai (President, Federation of Malaysian Manufacturers)

According to the 11th Malaysia Plan, the services sector is expected to contribute 56.5% to GDP in 2020, while the manufacturing segment is to contribute 22.1% in 2020.

The manufacturing sector is still relevant as a significant source of employment and investment. It continues to be the main catalyst for growth, and linkages for services and other economic sectors.

Currently, domestic direct investment (DDI) appears to be dwindling and must be addressed. DDI has dropped to MYR121.1bn in 2018 from MYR171.3bn in 2014. Total DDI in 1H19 is at MYR42.5bn, of which 18.8% is attributable to the manufacturing sector.

Overall, Malaysia is still competitive but should capitalise on opportunities from the escalating US-China trade war to bring in more investments.

M R Chandran (Senior Advisor, 27 Advisory)

MYR810m to upgrade infrastructure and programmes for the welfare of Felda communities will help to increase the earnings of settlers, who have suffered due to poor FFB yields and depressed CPO prices.

Implementation of B20 for the transport sector in 4Q20 is expected to lift local palm oil consumption by 500,000 tonnes per year. However, execution is the key as the previous track record has not been great.

Transformation of the agriculture sector is vital to improve upstream productivity, by inducing technology adoption and focus on downstream expansion for better yields. There is huge growth potential in personal care products (PCP) and pharmaceutical segments.

As for the minimum wage increase to MYR1,200 from MYR1,100 in major cities, it should be immaterial to the upstream plantation sector, as workers are located in rural areas.

Reduction in CPO export duty is a good move, but duties should be removed altogether in the light of the rising cost for the industry.

There is no more suitable land resource available in Malaysia and the Government should limit the total planted area of palm oil at 6m ha, instead of 6.5m ha to stop deforestation.

Dato’ Ir Soam Heng Choon (President, Real Estate and Housing Developers’ Association)

Mainly existing initiatives on property sector have been extended including rent-to-own schemes, youth ownership housing schemes, etc.

Meanwhile, there are some concerns on the lowering of the foreign buying threshold to MYR600,000, as developers could potentially increase house prices to allow foreigners to purchase those units. However, there is a minimal possibility for such an occurrence, as approvals are needed from the authority for developers to increase prices. The implementation of such measures is also subjected to state governments. All in all, a long-term framework needs to be established to ensure consistent in policy implementation.

Overall, with the increased spending in infrastructure, buying sentiment may improve.

Noor Azmi Mat Said (CEO, SME Corp)

There are currently 907,065 SMEs registered in Malaysia, of which 76.5% are micro-enterprises (sales turnover of below MYR300,000 or employees number less than five). 89.2% of SMEs are in the services sector, while 11% is in agriculture.

SME GDP grew 6.2% in 2018 and continued to outperform the overall economy since 2004.

The 19 strategies and 62 initiatives that have been laid out in the National Entrepreneurship Policy 2030 are expected to empower the B40 group and inculcate entrepreneurship culture, while providing more job opportunities.

The contribution to GDP is expected to increase to 41% in 2020, from 38.3% in 2018, while SME exports to overall exports are targeted to improve to 23% in 2020 from the current 17.3%.

Average rating of 7 out of 10. All panelists gave an average rating of 7 out of 10 on the initiatives for the digital economy in Budget 2020. This Budget lays a foundation and contains good ingredients to spur growth. However, execution would be the most important aspect.

Dato Seri Wong Siew Hai

Budget 2020 puts E&E in an important position, as initiatives are pro-growth. The digital economy covers both services and manufacturing, as it will make this industry more competitive and agile.

Market access remains the biggest challenge to SMEs, not the access to financing. Investors are unaware of some SMEs due to the lack of visibility. He proposed to establish a virtual platform for SMEs to gain better market access.

Responses from SMEs on adopting Industry 4.0 are still low, as they are worried about embarking on this path. That said, efforts are being made such as having workshops to create awareness about Industry 4.0, and results have been encouraging.

There has to be a published plan/road map/country direction, in a manner like what and how the National Fiberisation and Connectivity Plan (NFCP) was put into action. The Government needs to let digital initiatives be made known to the public, and the private sector must be willing to embrace it.

The Government should not complicate the process of incentive applications. Also, greater transparency is required and processes should be efficient. All incentives are given for everyone to improve cost and competitiveness.

Tengku Dato’ Sri Azmil Zahruddin Raja Abdul Aziz

Public private partnership (PPP) is the key to succeed for building an ecosystem in a digital economy, through providing incentives and grants. The initiatives are in the form of matching grants – and are dependent on companies’ willingness to embrace them.

Budget 2020 may be meant for year 2020, but implementation will usually take more than a year. Normally, it is difficult for a government to maintain the course after 2-3 years into it.

Large companies often struggle with the digital transformation despite having better access to their markets. For this, GLCs need to step up, and there are a lot of opportunities for large companies to accelerate growth.

Malaysia is still behind globally, such as in the big data space. There is a limited number of companies that are really adopting big data analytics, such as Grab.

Larger GLCs lack ambition and are too content with where they are. They should look to improve. For example, Bursa Malaysia always has the same largest 30 stocks across the years, whereas in the U.S, this has changed over the years. This shows Malaysia lacks ambition to grow and change. As such, GLCs will need to step up and not tolerate management teams that are unambitious.

Sean Goh

SMEs form the backbone of the digital economy. They are likely to adopt frontend changes with a multiplier effect, especially if they are shown how digital initiatives are able to help generate extra revenue. For digitalisation to be realised, SME should focus on end-to-end digitalisation, which is more powerful and inclusive.

Stop using buzzwords (such as “digitalisation”) as it misled people into the “technology”– it has to be always a problem-driven solution rather than a focus on what technology is being used.

Bawani Selvaratnam

Other than infrastructure, mindset is key. There has to be a shift in mindset. For example, the telecommunications industry should not focus on just connectivity, but rather come up with value-added services to remain relevant.

Everyone also needs to transform and adapt to this dynamic environment. Hence, regulators also play an important role in innovating and accelerating the deployment of infrastructure, unlike the days of 3G deployment.

The road map for the digital infrastructure plan under the MYR21.6bn NFCP is expected to be implemented within the next five years.

Chin Wei Min

Market-based funding has provided more options for SMEs. MYR550m has been generated through crowd-funding over the past 2.5 years. SMEs usually require MYR30,000-500,000 in funding.

In general, SMEs have trouble accessing financing. Hence, the need for market-based financing and P2P lending will broaden the value chain, while creating a platform for younger people to invest, because no one size fits all.

Human capital needs to keep up with the digital transformation. Innovation comes from the people, not the technology.

Buy: Share price may exceed 10% over the next 12 months

Trading Buy: Share price may exceed 15% over the next 3 months, however longer-term outlook remains uncertain

Neutral: Share price may fall within the range of +/- 10% over the next 12 months

Take Profit: Target price has been attained. Look to accumulate at lower levels

Sell: Share price may fall by more than 10% over the next 12 months

Not Rated: Stock is not within regular research coverage

Investment Research Disclaimers

RHB has issued this report for information purposes only. This report is intended for circulation amongst RHB and its affiliates’ clients generally or such persons as may be deemed eligible by RHB to receive this report and does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. This report is not intended, and should not under any circumstances be construed as, an offer or a solicitation of an offer to buy or sell the securities referred to herein or any related financial instruments.

This report may further consist of, whether in whole or in part, summaries, research, compilations, extracts or analysis that has been prepared by RHB’s strategic, joint venture and/or business partners. No representation or warranty (express or implied) is given as to the accuracy or completeness of such information and accordingly investors should make their own informed decisions before relying on the same.

This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to the applicable laws or regulations. By accepting this report, the recipient hereof (i) represents and warrants that it is lawfully able to receive this document under the laws and regulations of the jurisdiction in which it is located or other applicable laws and (ii) acknowledges and agrees to be bound by the limitations contained herein. Any failure to comply with these limitations may constitute a violation of applicable laws.

All the information contained herein is based upon publicly available information and has been obtained from sources that RHB believes to be reliable and correct at the time of issue of this report. However, such sources have not been independently verified by RHB and/or its affiliates and this report does not purport to contain all information that a prospective investor may require. The opinions expressed herein are RHB’s present opinions only and are subject to change without prior notice. RHB is not under any obligation to update or keep current the information and opinions expressed herein or to provide the recipient with access to any additional information. Consequently, RHB does not guarantee, represent or warrant, expressly or impliedly, as to the adequacy, accuracy, reliability, fairness or completeness of the information and opinion contained in this report. Neither RHB (including its officers, directors, associates, connected parties, and/or employees) nor does any of its agents accept any liability for any direct, indirect or consequential losses, loss of profits and/or damages that may arise from the use or reliance of this research report and/or further communications given in relation to this report. Any such responsibility or liability is hereby expressly disclaimed.

Whilst every effort is made to ensure that statement of facts made in this report are accurate, all estimates, projections, forecasts, expressions of opinion and other subjective judgments contained in this report are based on assumptions considered to be reasonable and must not be construed as a representation that the matters referred to therein will occur. Different assumptions by RHB or any other source may yield substantially different results and recommendations contained on one type of research product may differ from recommendations contained in other types of research. The performance of currencies may affect the value of, or income from, the securities or any other financial instruments referenced in this report. Holders of depositary receipts backed by the securities discussed in this report assume currency risk. Past performance is not a guide to future performance. Income from investments may fluctuate. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors.

This report does not purport to be comprehensive or to contain all the information that a prospective investor may need in order to make an investment decision. The recipient of this report is making its own independent assessment and decisions regarding any securities or financial instruments referenced herein. Any investment discussed or recommended in this report may be unsuitable for an investor depending on the investor’s specific investment objectives and financial position. The material in this report is general information intended for recipients who understand the risks of investing in financial instruments. This report does not take into account whether an investment or course of action and any associated risks are suitable for the recipient. Any recommendations contained in this report must therefore not be relied upon as investment advice based on the recipient’s personal circumstances. Investors should make their own independent evaluation of the information contained herein, consider their own investment objective, financial situation and particular needs and seek their own financial, business, legal, tax and other advice regarding the appropriateness of investing in any securities or the investment strategies discussed or recommended in this report.

This report may contain forward-looking statements which are often but not always identified by the use of words such as “believe”, “estimate”, “intend” and “expect” and statements that an event or result “may”, “will” or “might” occur or be achieved and other similar expressions. Such forward-looking statements are based on assumptions made and information currently available to RHB and are subject to known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievement to be materially different from any future results, performance or achievement, expressed or implied by such forward-looking statements. Caution should be taken with respect to such statements and recipients of this report should not place undue reliance on any such forward-looking statements. RHB expressly disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or circumstances after the date of this publication or to reflect the occurrence of unanticipated events.

The use of any website to access this report electronically is done at the recipient’s own risk, and it is the recipient’s sole responsibility to take precautions to ensure that it is free from viruses or other items of a destructive nature. This report may also provide the addresses of, or contain hyperlinks to, websites. RHB takes no responsibility for the content contained therein. Such addresses or hyperlinks (including addresses or hyperlinks to RHB own website material) are provided solely for the recipient’s convenience. The information and the content of the linked site do not in any way form part of this report. Accessing such website or following such link through the report or RHB website shall be at the recipient’s own risk.

This report may contain information obtained from third parties. Third party content providers do not guarantee the accuracy, completeness, timeliness or availability of any information and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such content. Third party content providers give no express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use. Third party content providers shall not be liable for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including lost income or profits and opportunity costs) in connection with any use of their content.

The research analysts responsible for the production of this report hereby certifies that the views expressed herein accurately and exclusively reflect his or her personal views and opinions about any and all of the issuers or securities analysed in this report and were prepared independently and autonomously. The research analysts that authored this report are precluded by RHB in all circumstances from trading in the securities or other financial instruments referenced in the report, or from having an interest in the company(ies) that they cover.

The contents of this report is strictly confidential and may not be copied, reproduced, published, distributed, transmitted or passed, in whole or in part, to any other person without the prior express written consent of RHB and/or its affiliates. This report has been delivered to RHB and its affiliates’ clients for information purposes only and upon the express understanding that such parties will use it only for the purposes set forth above. By electing to view or accepting a copy of this report, the recipients have agreed that they will not print, copy, videotape, record, hyperlink, download, or otherwise attempt to reproduce or re-transmit (in any form including hard copy or electronic distribution format) the contents of this report. RHB and/or its affiliates accepts no liability whatsoever for the actions of third parties in this respect.

The contents of this report are subject to copyright. Please refer to Restrictions on Distribution below for information regarding the distributors of this report. Recipients must not reproduce or disseminate any content or findings of this report without the express permission of RHB and the distributors.

The securities mentioned in this publication may not be eligible for sale in some states or countries or certain categories of investors. The recipient of this report should have regard to the laws of the recipient’s place of domicile when contemplating transactions in the securities or other financial instruments referred to herein. The securities discussed in this report may not have been registered in such jurisdiction. Without prejudice to the foregoing, the recipient is to note that additional disclaimers, warnings or qualifications may apply based on geographical location of the person or entity receiving this report.

The term “RHB” shall denote, where appropriate, the relevant entity distributing or disseminating the report in the particular jurisdiction referenced below, or, in every other case, RHB Investment Bank Berhad and its affiliates, subsidiaries and related companies.

RESTRICTIONS ON DISTRIBUTION

Malaysia

This report is issued and distributed in Malaysia by RHB Investment Bank Berhad (“RHBIB”). The views and opinions in this report are our own as of the date hereof and is subject to change. If the Financial Services and Markets Act of the United Kingdom or the rules of the Financial Conduct Authority apply to a recipient, our obligations owed to such recipient therein are unaffected. RHBIB has no obligation to update its opinion or the information in this report.

Thailand

This report is issued and distributed in the Kingdom of Thailand by RHB Securities (Thailand) PCL, a licensed securities company that is authorised by the Ministry of Finance, regulated by the Securities and Exchange Commission of Thailand and is a member of the Stock Exchange of Thailand. The Thai Institute of Directors Association has disclosed the Corporate Governance Report of Thai Listed Companies made pursuant to the policy of the Securities and Exchange Commission of Thailand. RHB Securities (Thailand) PCL does not endorse, confirm nor certify the result of the Corporate Governance Report of Thai Listed Companies.

Indonesia

This report is issued and distributed in Indonesia by PT RHB Sekuritas Indonesia. This research does not constitute an offering document and it should not be construed as an offer of securities in Indonesia. Any securities offered or sold, directly or indirectly, in Indonesia or to any Indonesian citizen or corporation (wherever located) or to any Indonesian resident in a manner which constitutes a public offering under Indonesian laws and regulations must comply with the prevailing Indonesian laws and regulations.

Singapore

This report is issued and distributed in Singapore by RHB Securities Singapore Pte Ltd which is a holder of a capital markets services licence and an exempt financial adviser regulated by the Monetary Authority of Singapore. RHB Securities Singapore Pte Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, RHB Securities Singapore Pte Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact RHB Securities Singapore Pte Ltd in respect of any matter arising from or in connection with the report.

Hong Kong

This report is issued and distributed in Hong Kong by RHB Securities Hong Kong Limited (興業僑豐證券有限公司) (CE No.: ADU220) (“RHBSHK”) which is licensed in Hong Kong by the Securities and Futures Commission for Type 1 (dealing in securities) and Type 4 (advising on securities) regulated activities. Any investors wishing to purchase or otherwise deal in the securities covered in this report should contact RHBSHK. RHBSHK is a wholly owned subsidiary of RHB Hong Kong Limited; for the purposes of disclosure under the Hong Kong jurisdiction herein, please note that RHB Hong Kong Limited with its affiliates (including but not limited to RHBSHK) will collectively be referred to as “RHBHK.” RHBHK conducts a fullservice, integrated investment banking, asset management, and brokerage business. RHBHK does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this research report. Investors should consider this report as only a single factor in making their investment decision. Importantly, please see the company-specific regulatory disclosures below for compliance with specific rules and regulations under the Hong Kong jurisdiction. Other than company-specific disclosures relating to RHBHK, this research report is based on current public information that we consider reliable, but we do not represent it is accurate or complete, and it should not be relied on as such.

United States

This report was prepared by RHB and is being distributed solely and directly to “major” U.S. institutional investors as defined under, and pursuant to, the requirements of Rule 15a-6 under the U.S. Securities and Exchange Act of 1934, as amended (the “Exchange Act”). Accordingly, access to this report via Bursa Marketplace or any other Electronic Services Provider is not intended for any party other than “major” US institutional investors, nor shall be deemed as solicitation by RHB in any manner. RHB is not registered as a broker-dealer in the United States and does not offer brokerage services to U.S. persons. Any order for the purchase or sale of the securities discussed herein that are listed on Bursa Malaysia Securities Berhad must be placed with and through Auerbach Grayson (“AG”). Any order for the purchase or sale of all other securities discussed herein must be placed with and through such other registered U.S. broker-dealer as appointed by RHB from time to time as required by the Exchange Act Rule 15a-6. This report is confidential and not intended for distribution to, or use by, persons other than the recipient and its employees, agents and advisors, as applicable. Additionally, where research is distributed via Electronic Service Provider, the analysts whose names appear in this report are not registered or qualified as research analysts in the United States and are not associated persons of Auerbach Grayson AG or such other registered U.S. broker-dealer as appointed by RHB from time to time and therefore may not be subject to any applicable restrictions under Financial Industry Regulatory Authority (“FINRA”) rules on communications with a subject company, public appearances and personal trading. Investing in any non-U.S. securities or related financial instruments discussed in this research report may present certain risks. The securities of non-U.S. issuers may not be registered with, or be subject to the regulations of, the U.S. Securities and Exchange Commission. Information on non-U.S. securities or related financial instruments may be limited. Foreign companies may not be subject to audit and reporting standards and regulatory requirements comparable to those in the United States. The financial instruments discussed in this report may not be suitable for all investors. Transactions in foreign markets may be subject to regulations that differ from or offer less protection than those in the United States.

DISCLOSURE OF CONFLICTS OF INTEREST

RHB Investment Bank Berhad, its subsidiaries (including its regional offices) and associated companies, (“RHBIB Group”) form a diversified financial group, undertaking various investment banking activities which include, amongst others, underwriting, securities trading, market making and corporate finance advisory.

As a result of the same, in the ordinary course of its business, any member of the RHBIB Group, may, from time to time, have business relationships with or hold positions in the securities (including capital market products) or perform and/or solicit investment, advisory or other services from any of the subject company(ies) covered in this research report.

While the RHBIB Group will ensure that there are sufficient information barriers and internal controls in place where necessary, to prevent/manage any conflicts of interest to ensure the independence of this report, investors should also be aware that such conflict of interest may exist in view of the investment banking activities undertaken by the RHBIB Group as mentioned above and should exercise their own judgement before making any investment decisions.

Malaysia

Save as disclosed in the following link (RHB Research conflict disclosures – Oct 2019) and to the best of our knowledge, RHBIB hereby declares that:

1. RHBIB does not have a financial interest in the securities or other capital market products of the subject company(ies) covered in this report.

2. RHBIB is not a market maker in the securities or capital market products of the subject company(ies) covered in this report.

3. None of RHBIB’s staff or associated person serve as a director or board member* of the subject company(ies) covered in this report

*For the avoidance of doubt, the confirmation is only limited to the staff of research department

4. Save as disclosed below, RHBIB did not receive compensation for investment banking or corporate finance services from the subject company in the past 12 months.

5. RHBIB did not receive compensation or benefit (including gift and special cost arrangement e.g. company/issuer-sponsored and paid trip) in relation to the production of this report.

Thailand

RHB Securities (Thailand) PCL and/or its directors, officers, associates, connected parties and/or employees, may have, or have had, interests and/or commitments in the securities in subject company(ies) mentioned in this report or any securities related thereto. Further, RHB Securities (Thailand) PCL may have, or have had, business relationships with the subject company(ies) mentioned in this report. As a result, investors should exercise their own judgment carefully before making any investment decisions.

Indonesia

PT RHB Sekuritas Indonesia is not affiliated with the subject company(ies) covered in this report both directly or indirectly as per the definitions of affiliation above. Pursuant to the Capital Market Law (Law Number 8 Year 1995) and the supporting regulations thereof, what constitutes as affiliated parties are as follows:

1. Familial relationship due to marriage or blood up to the second degree, both horizontally or vertically;

2. Affiliation between parties to the employees, Directors or Commissioners of the parties concerned;

3. Affiliation between 2 companies whereby one or more member of the Board of Directors or the Commissioners are the same;

4. Affiliation between the Company and the parties, both directly or indirectly, controlling or being controlled by the Company;

5. Affiliation between 2 companies which are controlled, directly or indirectly, by the same party; or

6. Affiliation between the Company and the main Shareholders.

PT RHB Sekuritas Indonesia is not an insider as defined in the Capital Market Law and the information contained in this report is not considered as insider information prohibited by law. Insider means:

a. a commissioner, director or employee of an Issuer or Public Company;

b. a substantial shareholder of an Issuer or Public Company;

c. an individual, who because of his position or profession, or because of a business relationship with an Issuer or Public Company, has access to inside information; and

d. an individual who within the last six months was a Person defined in letters a, b or c, above.

Singapore

Save as disclosed in the following link (RHB Research conflict disclosures – Oct 2019) and to the best of our knowledge, RHB Securities Singapore Pte Ltd hereby declares that:

1. RHB Securities Singapore Pte Ltd, its subsidiaries and/or associated companies do not make a market in any issuer covered in this report.

2. RHB Securities Singapore Pte Ltd, its subsidiaries and/or its associated companies and its analysts do not have a financial interest (including a shareholding of 1% or more) in the issuer covered in this report.

3. RHB Securities, its staff or connected persons do not serve on the board or trustee positions of the issuer covered in this report.

4. RHB Securities Singapore Pte Ltd, its subsidiaries and/or its associated companies do not have and have not within the last 12 months had any corporate finance advisory relationship with the issuer covered in this report or any other relationship that may create a potential conflict of interest.

5. RHB Securities Singapore Pte Ltd, or person associated or connected to it do not have any interest in the acquisition or disposal of, the securities, specified securities based derivatives contracts or units in a collective investment scheme covered in this report.

6. RHB Securities Singapore Pte Ltd and its analysts do not receive any compensation or benefit in connection with the production of this research report or recommendation.

Hong Kong

The following disclosures relate to relationships between RHBHK and companies covered by Research Department of RHBSHK and referred to in this research report:

RHBSHK hereby certifies that no part of RHBSHK analyst compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this research report.

RHBHK had an investment banking services client relationships during the past 12 months with: -.

RHBHK has received compensation for investment banking services, during the past 12 months from: -.

RHBHK managed/co-managed public offerings, in the past 12 months for: -.

On a principal basis. RHBHK has a position of over 1% market capitalization of: -.

Additionally, please note the following:

Ownership and material conflicts of interest: RHBSHK policy prohibits its analysts and associates reporting to analysts from owning securities of any company covered by the analyst.

Analyst as officer or director: RHBSHK policy prohibits its analysts, and associates reporting to analysts from serving as an officer, director, advisory board member or employee of any company covered by the analyst.

RHBHK salespeople, traders, and other non-research professionals may provide oral or written market commentary or trading strategies to RHB clients that reflect opinions that are contrary to the opinions expressed in this research report.