Less than a year ago, the global investment environment was awash with positive sentiment. Technology stocks were the darlings of the fund management industry, and seemingly everyone wanted a piece of premium tech equity. Malaysia’s own stock market was rosy; for a while in the 2017 investment climate, it almost seemed impossible to lose money.

Fast forward to today, and the conversation has turned distinctly from one of unbridled optimism in company earnings, to whispers of the next market slump. Malaysia’s stunning General Election results this year further threw a wrench in an already softening financial market.

Malaysia has seen a less than impressive earnings performances in quarter 1 of 2018. But why is this relevant? Markets may rise and fall, but the need to fund major financial milestones is constant. The market may well be softening, but you can ill afford the same fate for your finances.

Building the nest egg

So, you’ve resolved to take the bull (market) by the horns and get your long-term finances in order. Well done, but the challenge is only just beginning. Goal-based investing, that is, prioritising a series of key life goals and objectives, and then putting away funds with a view to accomplishing these goals, can be a complex affair. Not everybody has the funds to accomplish all of their goals, so prioritising is key

In this regard, RHB Wealth Research team opine allocating different weightages according to the urgency of these goals. Once you know how much you’re willing to commit to which goals, start working on these goals as early as possible, and let the compounding interest do all the hard work. As a general rule, a goal with a longer-term horizon can have a more aggressive investment allocations, while shorter-term goals should ideally be played more safely.

Short-term investing typically lasts no more than three years or so, which means you’d need a larger-than-normal initial investment amount. Alternatively, one might have to commit to fairly frequent top-ups in order to achieve the goal, if there is any shortfall. However, being short-term does not mean being reckless; over a shorter-term investment horizon, your allocations should mainly go into defensive assets such as investment grade bonds with shorter maturity dates, as well as resilient blue-chip equities with strong dividend track records.

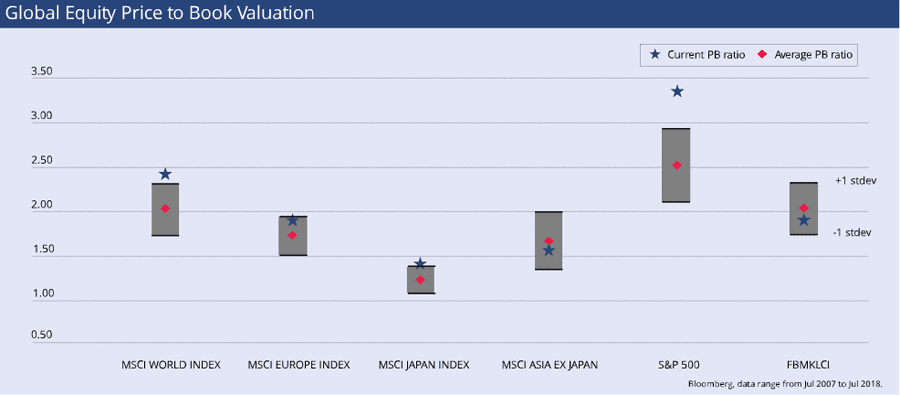

Advise from the experts is always welcome, but even so, investors should never take their eyes off the prevailing investment climate. Managing volatility can mean all the difference in terms of having enough for your children to take their pick of the top universities. It may be understandably tempting to make a play for a bit of alpha and go bargain-hunting in the current softening environment. However, undervalued equities should not be the sole reason for diving head-first back into the current equity market.

So, what is a person to do in this softening environment? In the view of RHB Wealth Research team investors to stay invested, but to also periodically rebalance their portfolios in order to keep up with market forces and the overall outlook. After all, money hidden under the bed is money that isn’t working for you. Softening markets can offer alluring opportunities to bargain-hunt, sure, but it is also a good time for goal-based investors to strategise and go defensive with their portfolios.

According to RHB Wealth Research team, funds have flowed out from equities and the high yield space, into investment grade bonds. Investors would be well advised to revise their asset allocations to favour inflation-friendly commodities like precious metals, downside protected structured products, as well as investment grade bonds. These assets will be more appropriate in late economic cycles or even periods of recession.

Beyond just the investing fundamentals however, when one is investing with a view to funding major life goals – a comfortable retirement, wealth transfer, and education funds for the children and grandchildren – there are a few truths that must be recognised.

My retirement fund can wait

In a sentence: No, it can’t. Most people are in their late 40s or early 50s by the time they start thinking of saving to pay off major expenses like mortgages and college tuition. By this time, it’s already too late to ride on the compounding benefits of investing, and subsequently staying invested, in order to save enough for those other major life goals.

My expenses won’t drastically increase over time

You’re setting yourself up for major disappointment here. Sure, mortgages and young children are expensive affairs, and sending out that final mortgage payment (particularly if you’ve managed to clear it ahead of retirement) may feel like the proverbial ball and chain being removed from your ankle. But in just a few short years, you can expect to be on the hook for an entirely new set of expenses.

University fees increase every year and continues to outstrip the inflation rate. As such, it is not just enough that your investments stay comfortably ahead of the inflation rate, because tertiary education costs have major cash flow implications. Investors need to constantly review their investment portfolio to guard against any potential shortfall in their targets. In short, investors will need to have enough to cover tuition fees (adjusted for inflation), campus living expenses, potential currency differences (depending on the location of study), as well as other unforeseen education and foreign living expenses.

Setting up an education fund is a form of goal-based investing, with a lump sum payment required at the end of the investment time horizon. This is in contrast to a retirement fund, where you’d be looking for regular cash flow in perpetuity.

RHB Wealth Research team opine having an education fund denominated in foreign currencies. This means investing primarily into asset classes that are also denominated in those currencies where your goals require. To this end, RHB has a well-managed range of products in foreign currencies such as the Australian Dollar, Pound Sterling, and the Singapore Dollar.

Before setting up an education fund however, investors need to consider the risks and trade-offs associated with committing to these goals, returns targets, time horizon, tax considerations, and the effects of these goals on their cash flow, among others.

All told, these particular expenses will be right up there with funding a couple of Ivy League degrees. Only this time, chances are, you won’t actually be earning a salary anymore. All this is to say nothing of the detrimental effect that inflation will have over one’s spending power over time.

If this isn’t worrisome enough, the fact is not everyone is able and willing to drastically scale back on their lifestyle as they get older. So, in a nutshell, your expenses probably will increase as time goes on.

But I have insurance coverage for myself

Be that as it may, there may be a number of key quality of life ancillaries that are not be covered. Further on up the road is the inevitability of increased aged care expenses such as dental procedures, hearing aids, vision care, and other healthcare ancillaries. This will inevitably force you to go out of pocket – in short, dipping into that nest egg that isn’t necessarily keeping ahead of inflation any longer.

Do not forget: your retirement fund is meant to keep you living at a certain lifestyle for many years to come. Ultimately, one will probably need extra funds on hand to keep up with unforeseen quality of life and healthcare-related expenses. So, while it’s good that you have in- surance coverage in place, it’s never a bad idea to overengineer your financial safety net.