Riding on the reawakening of the sleeping giant – China

In our quarterly Fund Discovery Series, we discuss current market conditions and offer suggestions and strategies to diversify your portfolio.

Listen and subscribe to the podcast version by RHB Bank’s Head of Investors Advisory, Nova Lui here to stay updated on the latest market developments.

The first quarter of 2023 was a bit like watching two equally matched tennis players in an extended rally. There was plenty of nail-biting action as the markets bounced from one side of the court to the other, as investors watched nervously from the sidelines.

Inflation continued to rise on one side, while the Federal Reserve and other central banks hiked up their interest rates on the other. One unfortunate casualty was Silicon Valley Bank (SVB), which had overstretched itself in the years leading up to the crisis through securities with long maturity dates without giving out enough loans to back them. As interest rates rose, bond prices sunk, and depositors began withdrawing en masse, pulling the rug from under the bank’s feet.

In Q1 2023, global equities gained overall as recession worries in developed markets cooled1. SVB’s collapse, while historically significant, had a fleeting impact akin to a viral TikTok video, as investors quickly moved on to the next thing, pushing US stocks higher. The Fed raised interest rates during both its Federal Open Market Committee (FOMC) meetings in 2023, tamping down inflation threats. Similarly, across the Atlantic, the European Central Bank raised interest rates by 50 basis points in both February and March. Another FOMC meeting is to be held in the first week of May.

Asia (excluding-Japan) equity market experienced stronger gains in Taiwan, Singapore, and South Korea while China saw a major boost as Covid restrictions were loosened.

In commodities, energy and livestock were the worst-performing sectors, while precious metals and industrial metals achieved price gains.

The good news is that monetary tightening may pause soon while there is potential for a rate cut by end of 2023 or early 2024. However, the markets still need a boost in economic indicators to ensure sustained growth. As such, the second quarter will likely be more challenging. Despite market volatility, investors may not want to lose sight of a potential recovery in China’s equity market. Like a phoenix rising from the ashes, China’s reawakening offers plenty of opportunities.

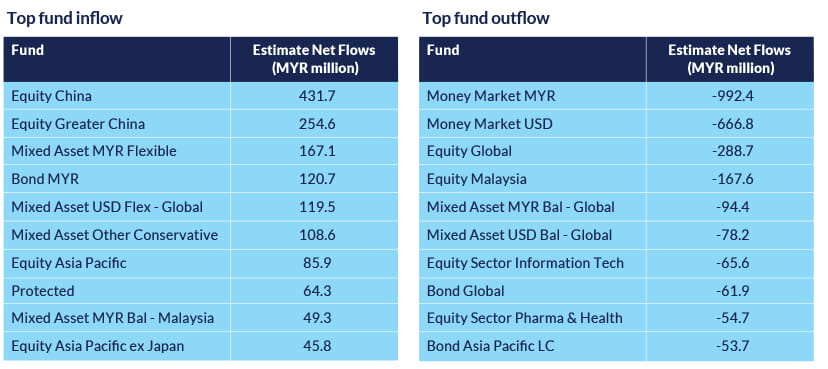

Let’s have a look at how the money moved in Q1 before we delve into our fund selections.

Source: Lipper Investment Management as of 31 March 2023

Not surprisingly, the reopening of China saw investors pour money into Chinese equity, with a combined inflow of close to RM700 million. In the fixed income space, we saw more fund flows from the money market to institutional class bond funds (MYR) as investors moved to capture the potential upside in the Malaysian fixed income market. Investors also shifted from Malaysian equity to mixed assets. This is an area we will continue to monitor following the recent RM170 billion investment from China. Emerging market equities attracted investors from developed market equities, eager to reap the benefits from activity in China.

The following are some ideas for Q2 2023. These are potential diversification ideas for equities, mixed, and fixed income funds that you can further discuss with your Relationship Manager, who can help you determine which of these would best suit your goals and risk profile. As with any investment, these funds carry some degree of risk, so we advise you to conduct your own research and discuss your options with a professional.

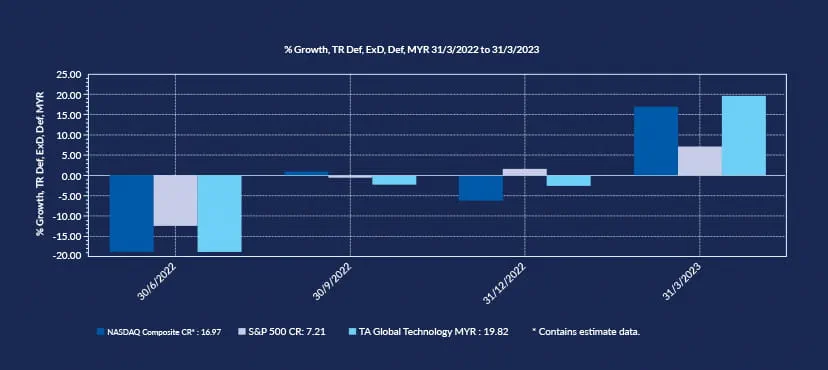

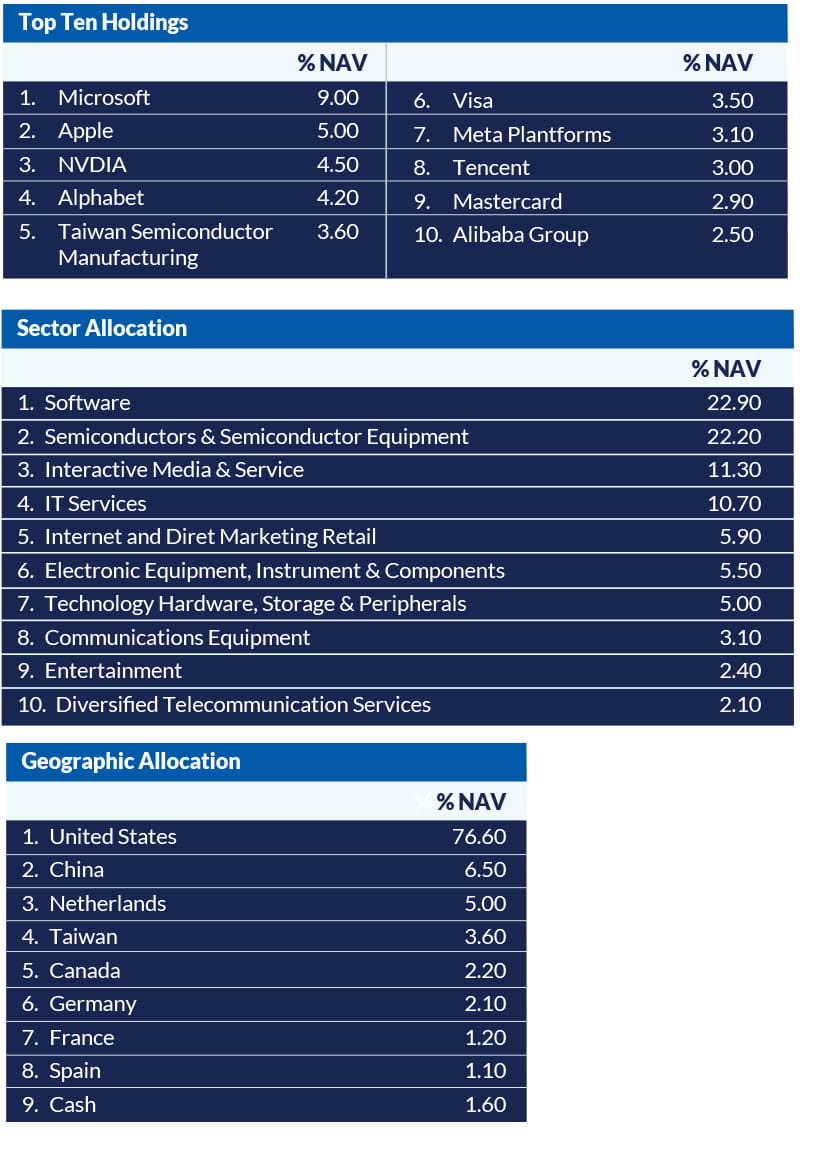

The TA Global Technology Fund

This fund aims for long-term capital appreciation through a globally diversified portfolio of mega cap technology stocks, with a focus on the US equity market.

Why we like this fund

The fund’s record shows it has the tendency to outperform the broad market index, including the S&P 500 and NASDAQ indices. Despite the choppy market conditions in the first quarter, it has appreciated nearly 20%. In addition, the downside bias in the previous three quarters could indicate a potential opportunity for this fund to catch up.

Source: Lipper Investment Management as at 31 March 2023

And, despite being a global fund, the fund manager invests in any underlying asset that offers a potential upside. In this case, it’s Chinese tech stocks like Alibaba and Tencent. This move has proven effective, as Alibaba recently saw its share price jump after announcing it would spin off its business into six groups, each with its own ability to raise funding and go public. Tencent’s share price soared on the back of high Q4 profits.

Source: Janus Henderson Investors, data as at 28 February 2023

China is still hot!

The International Monetary Fund (IMF) has forecast major activity in Asia’s emerging and developed markets.

Source: IMF, World Economic Outlook Update, January 2023

Note: Order of bars of each group indicates (left to right): 2022, 2023 projections, and 2024 projections.

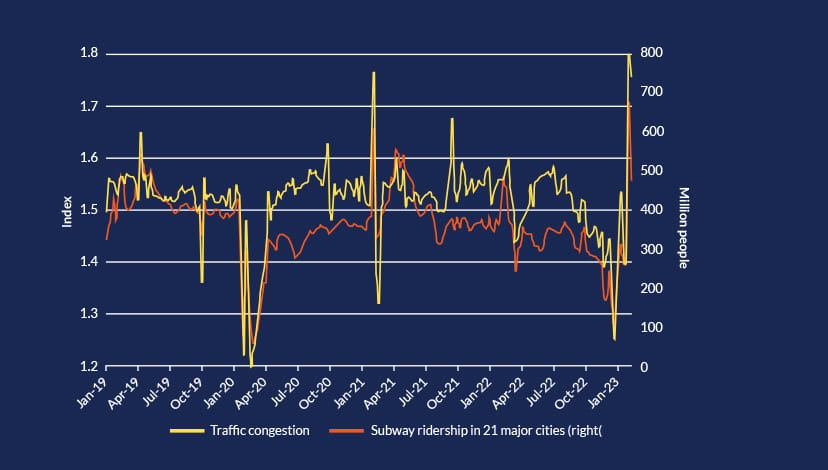

China as a regional economic powerhouse is expected to drive much of that growth, and investment firms maintain their bullish views on Chinese equities. RHB Asset Management's view are similar, as China’s reopening story has just begun and based on the already high traveling activity2 within the country, we’re excited to see these figures reflected on corporate earnings.

Source: Lipper Investment Management as of 31 March 2023

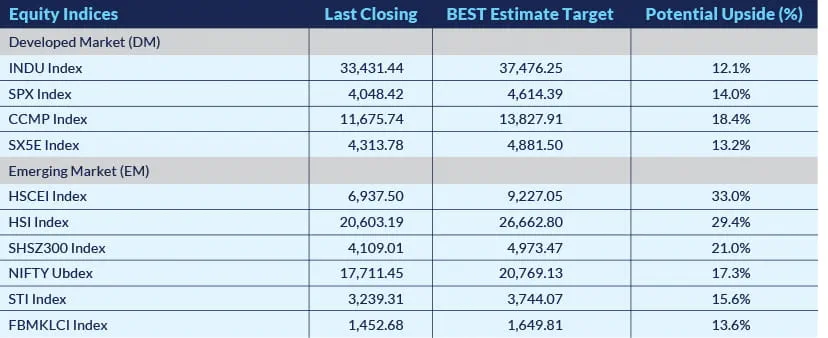

Based on Bloomberg’s BEST estimates, we could see an upside potential of 20-30% in Chinese equities.

Source: Bloomberg as of 6 March 2023

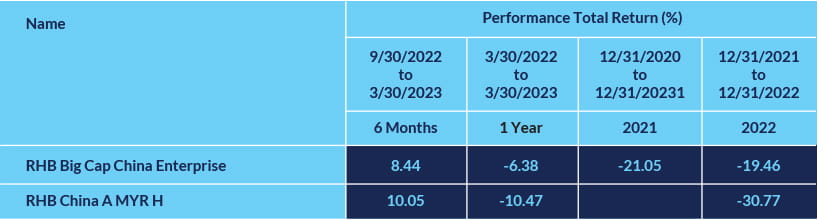

Another viable point of entry into China is through the RHB Big Cap China Enterprise or RHB China A funds, both of which have plenty of room to grow, as seen below.

Source: Lipper Investment Management as of 31 March 2023

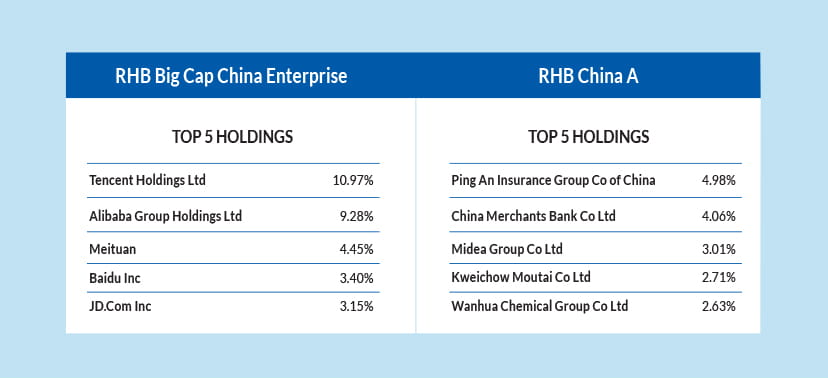

Referring to its top 5 holdings from the fund fact sheets, both RHB China A Share and RHB Big Cap China Enterprise have distinctive holdings which offers good diversification for clients to have both exposures in these markets.

RHB Big Cap China Enterprise holdings as of March 2023 and RHB China A holdings as of February 2023

Source: RHB Big Cap China Enterprise (March 2023) and RHB China A (February 2023)

RHB Strategic Income Fund – Series 12

If you already like China now but are still thinking twice, there is a relatively conservative option for an equity fund that is the RHB Strategic Income Fund – Series 12. This is a capital repayment fund that provides investors with the opportunity to invest into China’s green equities. It has a limited offer period until 11 May 2023, though, so act now!

Why we like this fund

China leads the world in renewable energy production figures and has notably pledged to reach carbon neutrality by 2060. From raw materials to equipment manufacturing, China controls the world’s green tech supply chains3. For example, China owns around 80% of global photovoltaic panel supply chains. Three-quarters of all lithium-ion batteries are produced in China, and many of the remaining batteries produced elsewhere also require Chinese components. There is no way to break away from China when it comes to renewable energy.

Principal Asia Pacific Dynamic Income Fund

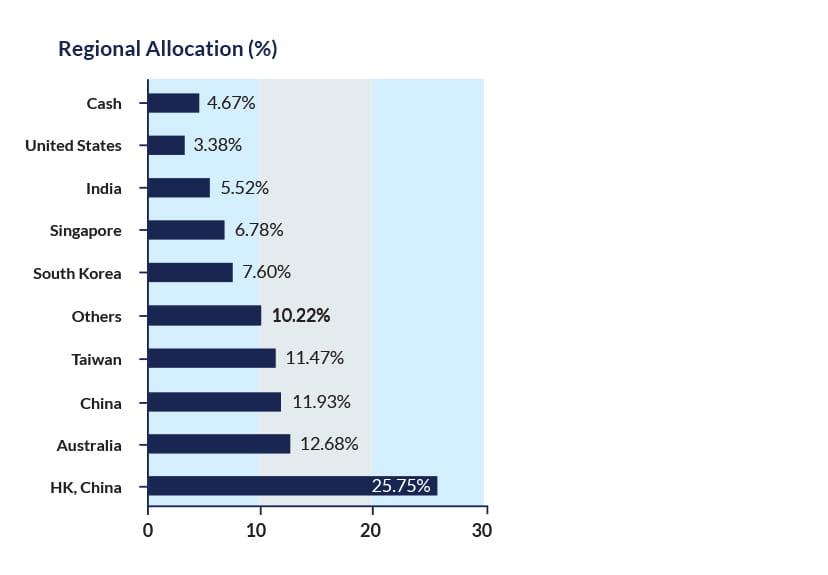

The fund aims to provide regular income by investing primarily in the Asia Pacific ex Japan region while achieving capital appreciation over the medium to long term. This fund is a great way to diversify your approach to emerging markets through exposure to both China and India.

Why we like this fund

Besides its multi-angle approach to emerging markets in Asia, its allocation is diversified enough to give investors access to regional growth in other countries as well, such as the US.

Manulife India Equity Fund

This fund makes our list again, click here to see why we still think it’s worth your time.

How we feel about fixed income

We still feel that fixed income warrants a mention over sitting on cash. The diagram below shows the inverse relationship between interest rates and bond pricing. As interest rates cool down, bond prices will inevitably go up.

While we’re seeing higher fixed deposit rates for now, Bank Negara Malaysia has paused its hikes, and we may see cuts by the end of 2023 or early 2024. It’s time to move to fixed income.

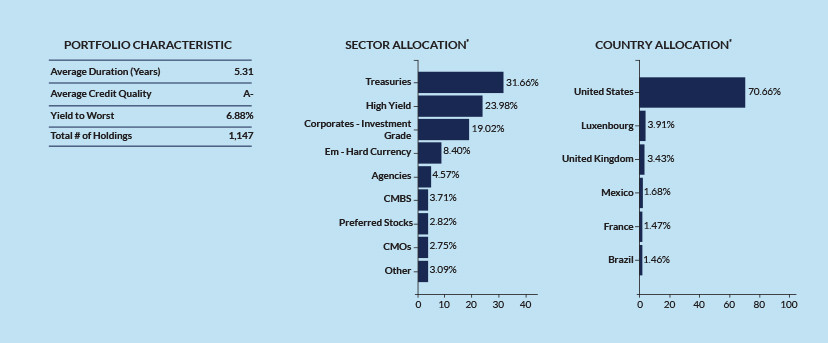

RHB American Income Fund

The fund aims to provide a high level of current income by investing in the target fund, AB FCP I - American Income Portfolio.

Why we like this fund

Its yield to worst (measure of the lowest possible yield) is 6.88%, which is quite solid by any means. Its holdings are spread across more than 1,000 fixed income instruments. The fund’s highest exposure is in US Treasury Bonds, which are rated AAA by Fitch.

Source: AllianceBernstein (Luxembourg) S.à.r.l., 31 January 2023. Exposire in AB FCP I - American Income Portfolio - 84.89%

Based on a 5-year US Treasury yield, there is plenty of upside from recovery in the US fixed income market.

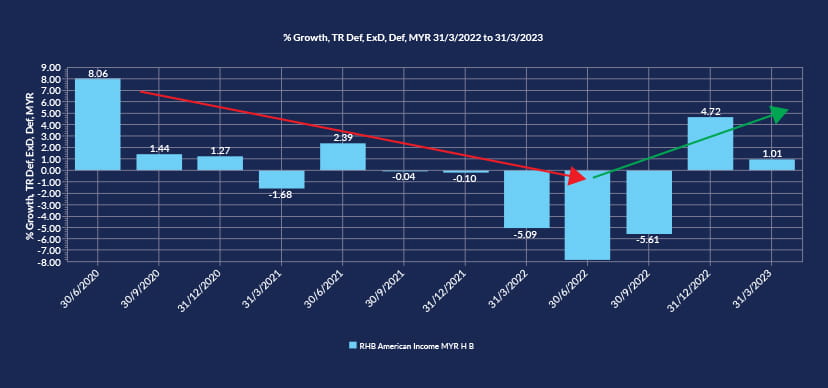

Source: Lipper Investment Management as of 31 March 2023

The recent quarterly performance of the bond market has shown a recovery in prices, and with more rate cuts expected, the RHB American Income Fund could benefit from this trend.

Source: Lipper Investment Management as of 31 March 2023

Get in touch with your Relationship Manager today to see how you can include these picks as part of your diversified portfolio.

1 Schroders, Quarterly markets review - Q1 2023, 5 April 2023.

2 The Guardian, China to reopen to foreign tourists…, Reuters, 14 March 2023.

3 Foreign Brief, Green tech geopolitics: China and the global energy transition, D. Song-Pehamberger, 28 January 2023.

Disclaimer:

This article is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party, without obtaining prior permission of RHB Bank Sdn Bhd (“RHB”) .

This article has been prepared by RHB and is solely for your information only. It may not be copied, published, circulated, reproduced or distributed in whole or part to any person without the prior written consent of RHB. In preparing this presentation, RHB has relied upon and assumed the accuracy and completeness of all information available from public sources or which was otherwise reviewed by RHB. Accordingly, whilst we have taken all reasonable care to ensure that the information contained in this presentation is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness and make no representation or warranty (whether expressed or implied) and accept no responsibility or liability for its accuracy or completeness. You should not act on the information contained in this article without first independently verifying its contents.

Any opinion, management forecast or estimate contained in this article is based on information available as the date of this podcast and are subject to change without notice. It does not constitute an offer or solicitation to deal in units of any RHB fund and does not have regard to the specific investment objectives, financial situation or the particular needs of any specific person who may receive this. Investors may wish to seek advice from a financial adviser/unit trust consultant before purchasing units of any funds. In the event that the investor chooses not to seek advice from a financial adviser/unit trust consultant, he should consider whether the fund in question is suitable for him. Past performance of the fund or the manager, and any economic and market trends or forecast, are not necessarily indicative of the future or likely performance of the fund or the manager. The value of units in the fund, and the income accruing to the units, if any, from the fund, may fall as well as rise.

A Product Highlights Sheet (“PHS”) highlighting the key features and risks of the TA Global Technology fund dated 28 March 2023, RHB Big Cap China Enterprise Fund dated 28 February 2022, RHB China A Fund dated 19 April 2021, RHB Strategic Income Fund – Series 12 dated 28 March 2023, RHB Asia Pacific Dynamic Income Fund dated 29 November 2022, RHB Manulife India Equity Fund dated 25 January 2022 and RHB American Income Fund dated 21 January 2020. (“Fund”) is available and investors have the right to request for a PHS.

Investors are advised to obtain, read and understand the PHS and the contents of the Information Memorandum and its supplementary (ies) (if) (“the Information Memorandum”) before investing. The Information Memorandum has been registered with the Securities Commission Malaysia (“SC”) who takes no responsibility for its contents. The SC’s approval and authorization of the registration of the Information Memorandum should not be taken to indicate that the SC has recommended or endorsed the Fund. Amongst others, investors should consider the fees and charges involved. Investors should also note that the price of units and distributions payable, if any, may go down as well as up. Where a distribution is declared, investors are advised that following the issue of additional units/distribution, the NAV per unit will be reduced from cum distribution NAV to ex-distribution NAV. Any issue of units to which the Information Memorandum relates will only be made on receipt of a form of application referred to in the Information Memorandum. The printed copy of prospectus and Product Highlight Sheet is available at RHB branches/Premier Centre and investors have the right to request for a Product Highlight Sheet. Investors are advised that investments are subject to investment risk and that there can be no guarantee that any investment objectives will be achieved. Investors should conduct their own assessment before investing and seek professional advice, where necessary and should not make an investment decision based solely on this update.

The Manager wishes to highlight the specific risks of the TA Global Technology Fund are Fund Management of the Target Fund Risk, Sector Investment Risk, Currency Risk, Counterparty Risk, Temporary Suspension of the Target Fund Risk and Distribution Out of Capital Risk. The specific risks of the RHB Big Cap China Enterprise Fund are Currency Risk, Country Risk, Market Risk and Particular Security Risk. The specific risks of the RHB China A Fund are Management Risk, Liquidity Risk, Currency Risk, Country Risk, Interest Rate Risk, General Risks, Investment Objective Risk, Regulatory Risk, Business, Legal and Tax Risks, Risk Factors Relating to Industry Sectors/Geographic Areas, Risk of Suspension of Share Dealings, Interest Rate Risk, Credit Risk, Liquidity Risk, Inflation/Deflation Risk, Derivatives Risk, Warrants Risk, Credit Default Swap Risk, Futures, Options and Forward Transactions Risk, Credit Linked Note Risk, Equity Linked Note Risk, Insurance Linked Securities Risk, General Risk associated with OTC Transactions, Counterparty Risk, Specific Risk relating to Collateral Management, OTC Derivative Clearing Risk, Custody Risk, Smaller Companies Risk, Portfolio Concentration Risk, Technology Related Companies Risk, Lower Rated, Higher Yielding Debt Securities Risk, Property and Real Estate Companies Securities Risk, Mortgage Related and Other Asset Backed Securities Risks, Initial Public Offerings Risk, Risk Associated with Debt Securities Issued Pursuant to Rule 144A under the Securities Act of 1933, Emerging and Less Developed Markets Securities Risk, Specific Risks Linked to Securities Lending and Repurchase Transactions, Potential Conflicts of Interest Risk, Investment Funds Risk, Exchange Rates Risk, Fixed Income Securities Risk, Equity Securities Risk, Private Equity Risk, Commodities Risk, Convertible Securities Risk, Contingent Convertible Securities Risk, Sovereign Risk, Hedging Risk, Synthetic Short Selling Risk, Risks Relating to Investments in the China Market, China – Risks regarding RQFII Status and RQFII Quota, China – Repatriation and Liquidity Risks, China Interbank Bond Market Risks, China Bond Connect Risk, Shanghai-Hong Kong Stock Connect and Shenzhen – Hong Kong Stock Connect Risks, The Benchmark Regulation Risk, and IBOR Reform Risk. The specific risks of the Principal Asia Pacific Dynamic Income Fund are Returns not guaranteed Risk, Market Risk, Inflation Risk, Manager Risk, Financing Risk, Stock Specific Risk, Country Risk, Liquidity Risk, Currency Risk, Credit and Default Risk, Interest Rate Risk, Risk associated with investing in CIS and Risk of investing in emerging markets. The specific risks of the RHB Manulife India Equity Fund are Manager’s Risk, Market Risk, Liquidity Risk, Country Risk, Currency Risk, Small-Cap Risk, Natural Resources Sector Risk, Taxation Risks, Financial Derivative Instruments other than for Investment Purpose Risk, Foreign Exchange Risks, Liquidity and Volatility Risks, Emerging Markets Risks, Political and Regulatory Risks, Custodial, Clearance and Settlement Risk, Credit Downgrade Risk, Macroeconomic Risk Factors, Global Commodity Prices Risk, Oil Price Risks, Government Policy Risks, Risk of Price Controls, Risk of Stock Market Controls, Geopolitical Risks, Labour Market Risks, Environmental Regulation Risks and Swing Pricing Risk. The specific risks of the RHB American Income Fund are Management Risk, Country Risk, Liquidity Risk, Currency Risk, Country Risk – Emerging Markets, Focused Portfolio Risk, Turnover Risk, Derivatives Risk, OTC Derivative Counterparty Risk, Structured Instruments Risk, Fixed-Income Securities Risk – General, Fixed-Income Securities Risk – Lower-Rated and Unrated Instruments, Credit Risk – Sovereign Debt Obligations, Credit Risk – Corporate Debt Obligations and other general risks are elaborated in the Information Memorandum.

This article has not been reviewed by the Securities Commission Malaysia (SC).