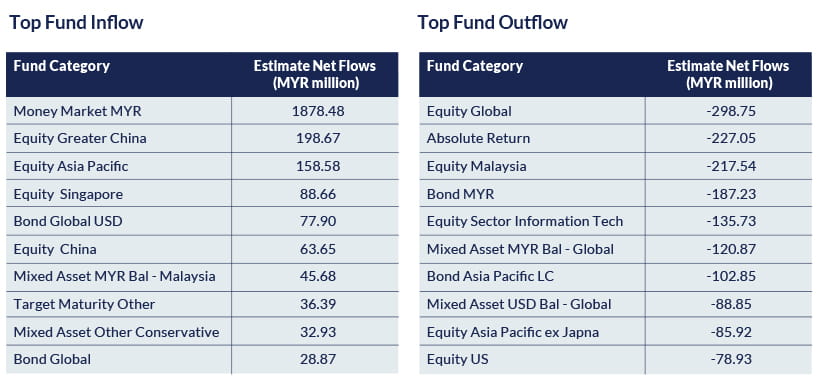

Source: Lipper Investment Management as of June 2023.

Chinese equities continued to attract the bulk of funds, with Singaporean dividend equities garnering significant attention. It’s interesting to note that a substantial portion of funds, around 70%, went into money market funds.

On the contrary, we saw a noticeable outflow from global and technology-related funds. This outflow is particularly evident in equity funds when compared to the inflow figures. We see this as a sign that investors were leveraging market conditions to strategically rebalance their portfolios, making the most of profit-taking opportunities.

We’ve picked some funds that you could include as part of your overall strategy in Q3. These are potential diversification ideas for equities, mixed, and fixed income funds that you can further discuss with your Relationship Manager, who can help you determine which of these would best suit your goals and risk profile. As with any investment, these funds carry risks, so we advise you to conduct your own research and discuss your options with a professional.

*Source: Gartner Research, January 2023.

Source: Janus Henderson Investors, as at 31 January 2023.

Note : The above are the team’s view and subject to change without notice. References made to individual theme do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable.

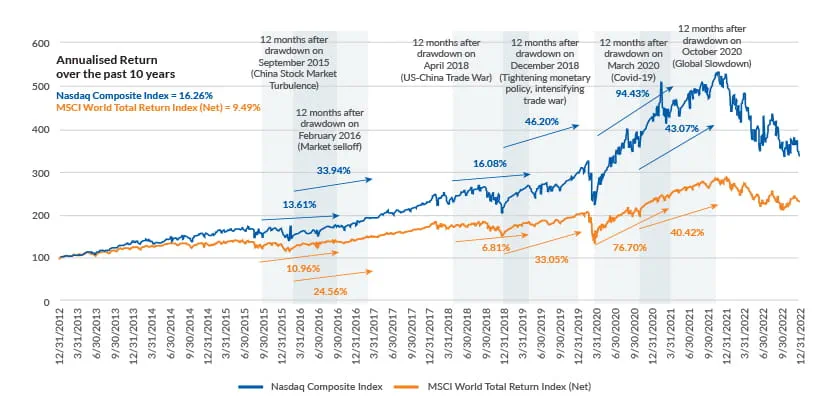

Technology sustains long-term growth. The pace of innovation is relentless, introducing fresh opportunities in new areas. From blockchain and IoT to established domains like cloud computing, e-commerce, and AI-driven platforms like ChatGPT, technology offers diverse avenues for investment and expansion.

Following the recent correction within the technology sector in August, the door is open for investors to enter and capitalise on the potential for long-term growth.

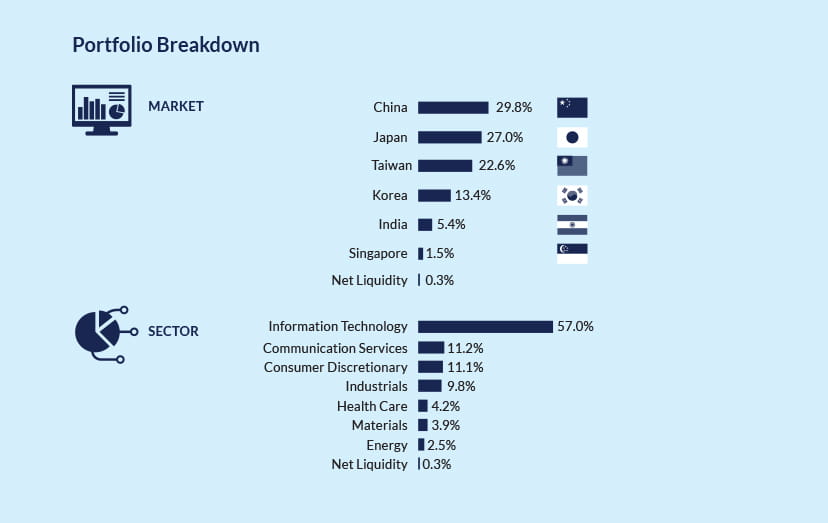

Source: Janus Henderson Investors, data as at 28 February 2023.

The fund’s advisor, Janus Henderson Investors, is a UK-based team of sector experts with more than 80 years of collective experience in navigating technology's hype cycle. Their investment philosophy emphasises valuation discipline as the cornerstone of bottom-up research.

Source: RHB Pacific Technology Fund Fact Sheet as of 31 May 2023.

The ripple effect of enthusiasm in AI in the US has had a palpable effect on Asia’s semiconductor chain. Key semiconductor players like TSMC, Samsung, Tokyo Electron, and SK Hynix performed formidably in the first half of 2023. As long as AI continues to grow, the chain will benefit. And although global sales of semiconductor manufacturing equipment are expected to decline this year after a bumper 2022, a rebound is anticipated next year.

With a robust diversification across Asia's technology sector and subsectors helping to spread the risk, the fund is well-positioned to seize opportunities in the electric vehicle and robotics spaces.

Source: AHAM fund fact sheet

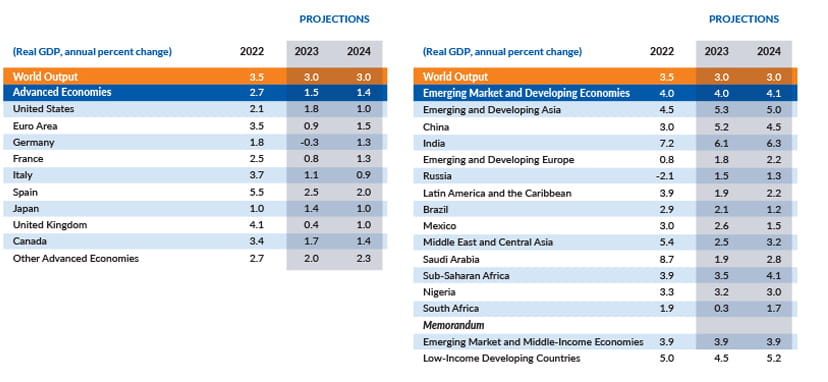

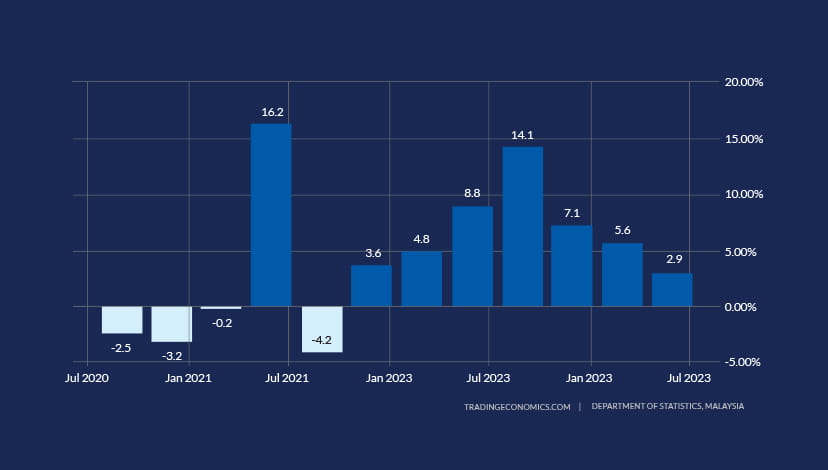

Surge in Investment: A remarkable upswing in Foreign Direct Investment (FDI), escalating by RM14.1 billion, culminated in an unprecedented Q1 2023 total of RM893.2 billion. With the aim of achieving a 20% FDI target and the ambitious Domestic Direct Investment (DDI) growth projections, these promising figures are backed up by MITI's commendable achievement of over RM230 billion in committed investments and more than RM10 billion in trades thus far.

Monetary Resilience: Malaysia's monetary policy remains steadfast and supportive, steering clear of the excessive tightening observed in some developed economies. This accommodating approach underscores Malaysia's dedication to nurturing a growth-driven and economically favourable environment.

Strategic Resource Allocation: The fund's prudent asset allocation across the Asia mirrors the prevailing optimism in the continent.

Anticipating Post-Election Clarity: Post state-level elections, the investment landscape in the Malaysian equity funds much clearer. With that behind us, investor confidence is returning, offering a more defined outlook for Malaysia.

We hope this list of picks helps you in your diversification strategy. Get in touch with your Relationship Manager today to discuss investment ideas!