BY RHB WEALTH RESEARCH

We live in interesting times. The rise of China challenging the US as an existing world power has resulted in a trade conflict that has caused wide-spread uncertainty in global financial markets. Arguably, this trade conflict is also driven by the large wealth and political/ideological gaps between the haves and the have-nots and between different political ideologies, according to RHB Asset Management.

History tells us that major “tipping points” in financial markets are typically difficult to predict. However, when US President Donald Trump declared the first of his many rounds of tariffs on Chinese imports in January last year, the consensus mainstream opinion was already one of concern and condemnation — that the president had just opened Pandora’s box and set the world’s two largest economies on a collision course. Their fears were realised when China retaliated shortly after-wards, sounding the horn for a lengthy and damaging trade war.

It has been nearly two years. While there were occasional breakthroughs in negotiations and, at times, it seemed like both sides were close to finding a mutually agreeable solution, most of the trade war was marked by hostile tit-for-tats resulting in a gloomy global economic outlook.

In September last year, both countries formalised tariffs on a total of US$260 billion worth of imports and, in May, after an extended period of goodwill, Trump dissipated all positive momentum by unexpectedly hiking tariffs on US$200 billion worth of Chinese goods from 10% to 25%. He also fired off a series of tweets threatening to impose tariffs of 10% on US$300 billion worth of Chinese imports, effective Sept 1.

In retaliation, China announced on Aug 23 that it would be levying new tariffs ranging from 5% to 10% on US$75 billion worth of US imports. Beijing’s new import taxes will take effect on Sept 1 and Dec 15 — the same dates Trump’s tariffs on US$300 billion in Chinese goods are slated to kick in (first tranche valued at US$112 billion) — and will include goods such as soy-beans and oil.

China will also add a 25% tariff on cars and 5% tariff on auto parts. This move triggered a furious response from Trump, who immediately retaliated by hiking tariffs on Chinese imports — the 25% imposed on the existing US$250 billion of Chinese goods will be ratcheted up to 30% from Oct 1, and the new round of tariffs on US$300 billion in goods will be taxed 15%, up from the initial 10%. What should investors expect next? A range of factors — such as the upcoming 2020 US presidential election, slowing global economic performance and political instability around the world — could play a role in shaping how the trade war and, to a larger extent, the global economy plays out for the remainder of the year.

Back in March last year, Trump infamously justified his tariff decision by bragging that trade wars are “good and easy to win”. In essence, tariffs would drive up the costs of China-produced goods to make them less competitive against US-manufactured products, which, the president argued, would bring manufacturing jobs back home, force concessions from China and “Make America Great Again”.

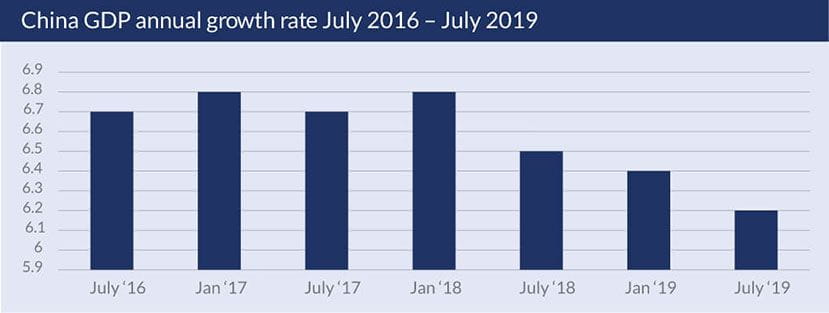

There is no denying that the figures for the first half of 2019 indicate that tariffs are causing great pain for the Chinese economy, as the country post-ed some of the lowest figures in over a decade. Gross domestic product growth dropped to a 30-year low of 6.2% while industrial output fell to a 17-year low of 4.8%. In addition, retail sales grew 7.6% year on year against an expected 8.6%, while the labour market worsened as the unemployment rate in urban areas increased to 5.3%.

The National Bureau of Statistics Purchasing Manager’s Index contract-ed for the fourth consecutive month in August to 49.5 while exports for August fell 1% year on year, with exports to the US falling 16%, marking the second largest decrease since June’s 1.3% drop.

This occurred even as the value of the renminbi declined and exporters “front-loading” US-bound shipments before the September tariffs took effect, suggesting that tariffs are probably causing a decline in external demand for Chinese exports.

However, despite the gloomy picture, the resilience of the Chinese economy and President Xi Jinping’s administration cannot be overstated. Much of it has to do with the country’s state-directed economic model that grants state-owned enterprises (SOE) and state-owned banks a significant amount of influence, as well as the government’s freedom to utilise a wide range of fiscal and monetary measures to stimulate the economy.

Furthermore, after August’s escalation in tensions, the Chinese government allowed the renminbi to fall past the key valuation level of RMB7/US dollar, even though daily fixing is on the strong end. This jolted global financial markets and drew accusations of currency manipulation by the US Treasury Department.

As we have witnessed over the course of the year, the Chinese government will not hesitate to reduce taxes and cut reserve requirement ratios (RRR) for banks to inject liquidity into the economy. For the first quarter alone, the Chinese financial system pumped a record RMB8.2 trillion worth of credit into the economy, and issued RMB1.2 trillion worth of local government bonds to spend on infrastructure projects, resulting in robust growth during the period as GDP expanded 6.4% and most major indicators trend-ed upwards.

While growth momentum halted after the stimulus eased in April, the-government has not ruled out implementing further measures if the economic conditions deteriorate, or if the trade war tensions continue to take a toll on the Chinese economy.

There is no arguing that the US economy is superior in scale and level of development. However, that does not guarantee that it will come out on top in the trade war. Contrary to Trump’s claim that the US’ strong economic position would result in an easy victory, Xi and his administration have repeatedly demonstrated the ability to strike where it hurts most.

First, while China lacks the capacity to implement sweeping, indiscriminate tariffs on all US imports—given the significantly lower amount of US imports into the country — a quick study of its tariffs list would reveal that it is intentionally targeting key pressure points of the US economy.

The latest round of Chinese tariffs saw US soybean imports taxed 33%,compared with 3% for Brazilian and Argentinian producers, while the upcoming Dec 15 tariffs will see China taxing US automobiles and car parts 42.6%, com-pared with 12.6% for German and Japanese manufacturers.

Secondly, China, with its massive consumer base, remains one of the larg-est and most attractive foreign markets for US businesses. Any change in relations between the two countries would have a huge impact on US companies.

Finally, with the 2020 presidential election looming, China is aware that Trump is desperate for a strong stock market performance to justify his economic policies to voters, especially after mounting criticism of his controversial immigration policy and setbacks in diplomatic negotiations with North Korea.

Unfortunately, 2019 is shaping up to be a very turbulent year as the US economy continues to flash warning signs of a recession. On Aug 5, the US stock markets suffered the worst day of the year after Trump reignited his trade war with China.

This, coupled with a weaker than expected US Federal Reserve interest rate cut, resulted in an inversion of the US Treasury yield curve for the first time since 2007 and sparked recession fears, given that an inverted yield curve is typically a harbinger of a recession within 18 months.

In a bid to thwart Trump’s reelection prospects, China is also purposely targeting “Rust Belt” states containing some of the president’s strongest supporters by pilling tariffs on agricultural and steel imports, resulting in high unemployment levels.

If the economy fails to improve in time and Trump’s support base continues to suffer from the effects of the trade war, there is a chance that some of these voters would change their minds, spelling trouble for the president’s al-ready shaky path to re-election.

The longer the US-China trade war drags on, the heavier the toll will be for both economies. While investors find solace that both sides are still open to negotiation, there is a chance that trade hostilities and tensions will continue to persist. As China transforms into an economic heavyweight, it will almost certainly clash with the US on a multi tude of issues outside of trade as the two countries battle for global supremacy.

In fact, we could argue that the trade war is a structural conflict between two fundamentally opposing countries and that the disputes on trade are merely a disguise for far more deeply rooted issues revolving around China’s rapid ascent as a global leader in technology and innova-tion, which would directly threaten the US’ pole position in the global hegemony.

In May, the US placed 143 entities, including Chinese tech giant and global 5G leader Huawei, on its trade blacklist, citing them as individuals and organi-sations that pose significan’t risks to US security and foreign policy.

As China has yet to issue a response, we do not know the metaphorical straw that will break the camel’s back. How-ever, we do know if a battle for tech-nological supremacy does take place, it would likely be much more intense, impactful and longer lasting than ex-isting trade conflicts.

The more pressing question is this — should we be expecting a recession in the near future? It could be argued that after close to a decade of a bull mar-ket, it is time for the market to correct. And numerous indicators such as the inversion of the Treasury yield curve, weaker housing activity, soft consumer spending, and deteriorating European economies and a lower-than-expected growth forecast for China suggest that investors should brace themselves for a bumpy ride ahead.

RHB Asset Management’s view is that, despite the current trade war conditions, the global economy will stay afloat due to the strong fundamentals of both countries, along with the fact that both leaders are aware of what is at stake domestically and would hope-fully not risk destabilising the entire global economy. However, the actual likelihood of a global recession remains a distinct possibility.

As history shows, geopolitical situations can change overnight and major financial tipping points often happen in the blink of an eye. There is always a possibility that a global recession could occur if relations between the two largest economies in the world continue to deteriorate, or if the trade war continues to drag on, or in the worst-case scenario, spirals into other areas of conflicts.

Investors should understand that the investment journey is never a smooth ride and it is in their best interests to diversify their investments via a portfolio with different asset classes. At RHB, we do have a few model portfolio to cater for different clients’ risk profiles. Through diversification of unit trust funds, clients will be able to reduce concentration risk via investments in different asset classes such as equity, fixed income and commodity. In these volatile times, RHB also offers close-ended funds such as the RHB Strategic Income Series 7. This fund has simple features with only 1½ years’ tenure and rides the underlying fund performances of a well-known global fixed income fund via Option. For more insights, consult our investment specialists by contacting a relationship manager.