Malaysia’s Surprise Rate Cut: What It Means for You

Interest rate cuts (and increases) can affect your financial plans. Knowing how the rate cut works means you can make the right move at the right time.

Bank Negara Malaysia (BNM) has taken a step that caught many by surprise: a 25-basis point cut to the Overnight Policy Rate (OPR) to 2.75% from 3%. This is the first cut in almost five years, with the last being in July 2020 as part of pandemic recovery measures.

But what does this really mean for your wallet, your savings, and the economy? Let’s break it down so you can strategise accordingly.

What is the OPR and how does it affect you?

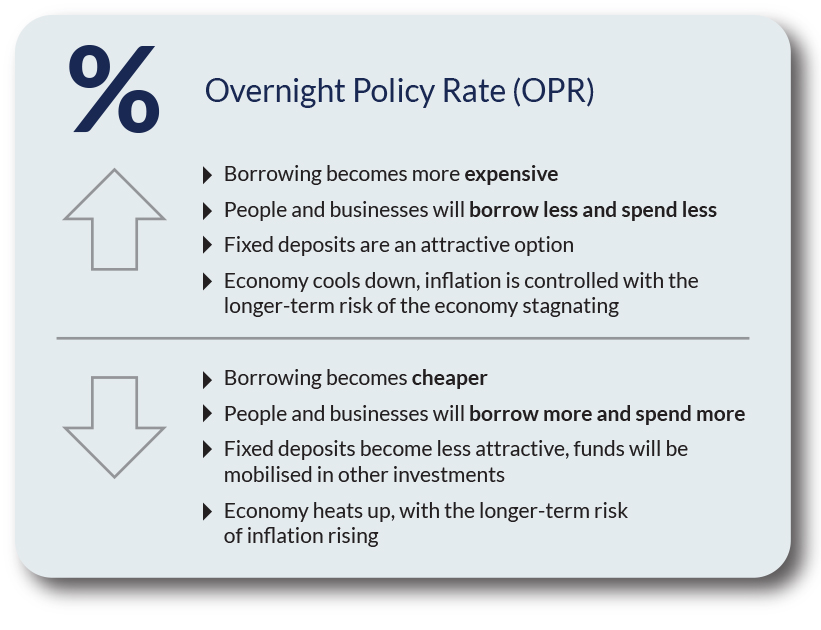

Banks need to manage their cash flow, sometimes ending the day with an excess or shortfall. To address these fluctuations, they lend to each other overnight to ensure sufficient liquidity. The OPR is the “base price” of money, set by the central bank. It influences almost any other interest rate in the economy, from your housing loan to your savings account.

It’s all a delicate balancing act. When BNM raises the OPR, borrowing becomes more expensive. People and businesses will borrow less and spend less, which cools down the economy and helps control inflation. When the OPR is lowered, the opposite happens. Borrowing becomes cheaper, encouraging households to buy homes or cars, and businesses to invest and expand. At the same time, savings in fixed deposits become less attractive, nudging people to mobilise their funds for other investments.

So why the cut now?

Malaysia’s economy is showing signs of slowing. GDP growth in the first quarter slipped to 4.4%, and inflation fell to 1.2% in June — far below the levels that usually worry policymakers. Add in global uncertainties like unstable exports, geopolitical tensions, and the threat of U.S. tariffs, and the outlook starts to look shaky. By cutting the OPR to 2.75%, BNM is essentially giving the economy a “booster shot”, or a little jolt.

Here's how it impacts each segment:

- Consumers and SMEs: Easier access to cheaper loans means less strain on monthly finances and more confidence to spend.

- The economy as a whole: The extra spending power helps keep demand steady, preventing growth from stalling.

- Investors: Lower rates can make equities and other investments more attractive compared to fixed deposits.

In short, the cut is a pre-emptive move to keep the country on a steady growth track before global headwinds become more turbulent.

Borrowing is now cheaper…

For households and small businesses, the OPR cut is a welcome relief. Lower borrowing costs mean that payments for mortgages, car loans, and refinancing packages will soon be reduced, helping to ease the burden.

RHB Bank has already taken swift action, reducing its Standardised Base Rate (SBR) and Base Rate (BR) by 25 basis points to 2.75% and 3.50%, respectively. At the same time, its Base Lending Rate (BLR) and Base Financing Rate (BFR) have been trimmed from 6.70% to 6.45%.

As RHB’s Group Managing Director and CEO, Datuk Mohd Rashid Mohamad, explains, “By easing borrowing costs, we are helping households and SMEs better manage their financial commitments while encouraging consumption and investment amid prevailing global uncertainties.” This move ensures that consumers and businesses alike can breathe a little easier when it comes to managing their finances.

…but savings may feel the pinch

On the flip side, the rate cut also means lower returns on savings. Fixed deposit rates and other savings account yields are expected to decline, which may leave savers feeling the pinch. As returns on traditional savings shrink, many Malaysians could be tempted to look for better opportunities in bonds, unit trusts, or even equities, which often perform well after a rate cut.

However, as always, it’s important to approach any investment with caution. Investment decisions should be based on careful research and, ideally, guidance from licensed financial advisers. If you’re uncertain about where to move your money, your Relationship Manager can help you review and rebalance your portfolio to match your goals and risk appetite.

Property buyers, it’s your signal

For those planning to take the big step in buying a home, the rate cut could not have come at a better time. The stars have aligned! With cheaper financing now available, monthly instalments are likely to become more manageable, particularly for first-time home buyers.

On a wider scale, the reduction in borrowing costs has a welcome effect of breathing new life into Malaysia’s property market, which has long faced challenges around affordability. While the cut doesn’t solve every barrier to home ownership, it does make the path a little easier.

Lower OPR, weaker Ringgit…a window for bond investors?

While the OPR cut is good news for Malaysian borrowers, it could put some short-term pressure on the Ringgit, as lower interest rates make Malaysia a little less attractive to foreign investors. This may cause the currency to weaken, especially against the U.S. dollar.

But a softer Ringgit could make Malaysian exports more competitive globally, giving local exporters a potential boost. On the same note (no pun intended), Ringgit-denominated assets may appear cheaper and more appealing to foreign buyers looking for value.

Another silver lining is that lower local interest rates reduce the cost of currency hedging, which might encourage more foreign participation in Malaysian bonds and equities. And if the U.S. Federal Reserve starts cutting its own rates later this year, as many analysts expect, pressure on the Ringgit could ease, with the potential for capital to flow back into Malaysia.

The lower OPR has created a favourable backdrop for fixed income investors. Lower interest rates typically push up the prices of existing bonds, especially medium to long-term government and high-grade corporate bonds. Their higher coupon rates become more attractive compared to newer issues with lower yields.

This is the time to lock in current attractive yields before any further cuts potentially reduce returns. By locking in now, you can ensure a predictable income and protect against reinvestment risk (the challenge of reinvesting later at lower rates). For example, buying a five-year corporate bond at 5% today can secure that income stream should the OPR drop further.

Here’s why a future drop is still possible. If the Federal Reserve lowers rates, Malaysia may follow suit to maintain competitiveness and currency stability. This could drive yields even lower, further lifting the value of existing bonds (like your corporate bond) and creating a potential for capital gain.

That said, bond investors should remain mindful of the duration risk (how sensitive a bond is to rate changes) and credit quality.

Cautious optimism

This OPR cut is more than just a minor adjustment — it’s a clear signal that Malaysia is staying cautious yet flexible in an unpredictable global climate. For consumers, it presents an opportunity to review existing loans, as refinancing could translate into real monthly savings. For savers, it may be time to reconsider traditional fixed deposits and explore other investment avenues that offer higher potential returns, while still keeping risk in check. And for investors, the shifting landscape calls for careful portfolio positioning, balancing growth opportunities with prudence.

Put simply, borrowing just got easier, savings may feel tighter, and the Ringgit might wobble. But with the right strategies, you can turn these changes into opportunities. Get in touch with your Relationship Manager today to put your plan into action.

Disclaimer:

This article has been prepared by RHB and is solely for your information only. This article is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party, without obtaining prior permission of RHB Bank/RHB Islamic Bank Berhad (“RHB”). In preparing this presentation, RHB has relied upon and assumed the accuracy and completeness of all information available from public sources or which was otherwise reviewed by RHB. Accordingly, whilst we have taken all reasonable care to ensure that the information contained in this presentation is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness and make no representation or warranty (whether expressed or implied) and accept no responsibility or liability for its accuracy or completeness. You should not act on the information contained in this article without first independently verifying its contents.