Cracking the Gold Code: Price Drivers and Your Path to Ownership

Gold prices are hovering near record highs — but the story isn’t over. Here’s why the world’s oldest asset still has a place in a modern portfolio.

Prices have recently surged past the USD4,000 mark1. These levels would have seemed far-fetched just a few years ago. The metal’s remarkable rally, fuelled by persistent inflation, geopolitical unease, and a weaker US dollar, has left many investors wondering where is the gold price heading in long term.

This situation isn’t new, but this time around, the backdrop is. Unlike previous surges driven mainly by short-term fear, today’s demand for gold feels structural. It feels more real. Central banks are stockpiling it, retail investors are rediscovering it, and even digital-first investors are buying slivers of it through apps. This partially explains the recently interest on gold investing.

A deep-rooted rally

In the past year, gold has climbed nearly 57%, brushing against record highs multiple times. Here are the factors behind that drive:

- Central bank accumulation

China’s central bank recently extended its gold-buying streak to the 11th consecutive month2, while India, Singapore, and Turkey remain active buyers. This isn’t a speculative trade; it’s a geopolitical signal. As countries diversify away from the US dollar, gold serves as a neutral reserve asset — one that doesn’t depend on anyone’s balance sheet. - Expectations of rate cuts

Investor has priced in that US Federal Reserve will continue cutting rates into 20263. Lower yields reduce the “opportunity cost” of holding non-interest-bearing assets like gold. When cash earns less, gold suddenly feels more valuable. - Persistent inflation and a weaker dollar

Inflation has moderated from its post-pandemic peaks, but it’s still sticky. Currencies, from the ringgit to the yen, have weakened against the greenback. For many, gold remains the oldest and most elegant hedge against purchasing-power erosion.

Simply put, the drivers are both monetary and psychological. When people lose faith in paper assets or politics, they want something tangible and timeless where gold has been perceived as safe haven asset.

Gold: The missing piece in your investment puzzle?

You’re wondering if you missed the train. Prices are near historic highs, so shouldn’t you wait for a dip? Maybe. But then again, timing the market is difficult, gold could serve as part of the diversification options in your portfolio depending on your risk profile.

Few things that is different this time:

- Broader ownership base

Central-bank purchases have tightened supply, while retail participation has been expanded through exchange-traded funds (ETFs) and digital-gold platforms. Unlike the 2011 rally, demand today is more global and less speculative. - Slow-burning inflation

Inflation is proving stubborn, not explosive. That makes gold’s steady, defensive quality appealing to investors who value stability over quick gains. - A long runway of structural shifts

Energy transitions, geopolitical realignments, and digital-asset volatility are all fuelling uncertainty. In that climate, owning a slice of something real and scarce remains compelling.

Rethinking gold’s role

Instead of asking “Is it too late?” A better question might be “What role does gold plays in diversifying my porfolio?”

Gold isn’t a get-rich-quick asset; it’s a stay-rich-slowly one. Its performance isn’t tied to corporate earnings or dividends, and its correlation with stocks and bonds is low. This makes it a natural diversifier, especially when markets wobble.

Financial advisers often recommend allocating up to 5% of a diversified portfolio to gold or other precious metals. The logic isn’t to chase returns but to reduce volatility. In years when equities tumble or currencies weaken, gold tends to hold its ground.

For seasoned investors, that up to 5% slice can also function as a hedge against systemic risks such as policy shocks, currency debasement, or geopolitical events that upend valuations. For new investors, gold offers a useful entry point into tangible assets, teaching patience and long-term perspective.

Cliff Young approach to investing: Why gold’s “shuffle” works |

In 1983, 61-year-old Australian farmer Cliff Young won an 875km ultra marathon by shuffling at a slow and steady pace. While other racers alternated between sprinting and sleeping, Young shuffled relentlessly, eventually outpacing the pack. He won the race, beating the second-placed runner by an astounding 10 hours. |

Before you buy… read this

Of course, we should look before we leap. There are reasons to be cautious.

- A stronger-than-expected global recovery could push real yields higher, making bonds relatively more attractive.

- A rebound in the US dollar might dampen demand for gold-denominated assets.

- A sharp correction after such a long rally isn’t impossible as short-term traders take profits, creating temporary dips.

Still, these risks don’t erase gold’s strategic appeal. They merely underline that gold should be a measured allocation, not an all-in bet.

How to own gold in 2025

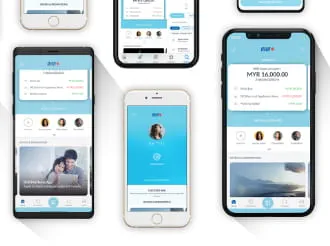

Investing in gold is more convenient — and varied — than ever. Lining up outside the jeweller’s is now just one of many options, some only requiring a few clicks on an app.

- Physical gold

Bars, coins, or jewellery appeal to traditionalists. They offer satisfaction but require secure storage and incur premiums. - Exchange-traded funds (ETFs)

ETFs like the iShares Gold ETF (CH), held via the RHB Gold Fund, track spot prices closely and provide liquidity without the hassle of storage. - Gold-linked funds

The RHB Gold & General Fund invests in global mining and metals companies, offering equity-linked upside that may outperform in prolonged bull markets. - Structured or dual-currency products

For investors seeking enhanced yield, Dual Currency Investments (DCI Gold) link returns to both gold and foreign-exchange movements — suitable for those with higher risk tolerance. - Paper gold

RHB allows paper gold/silver investment in a Multi Currency Account, with flexible initial purchases, no physical storage, and no minimum/maximum limits. Check out our RHB CASA Gold Campaign here.

For experienced investors, combining several of these can turn gold exposure into a multi-layered strategy that includes physical holdings for legacy, ETFs for liquidity, and structured notes for tactical plays. For newer investors, starting small through a regulated fund or digital-gold app offers both safety and flexibility. Your Relationship Manager will be able to help you establish an approach that works for your goals and risk appetite.

Purpose, not price

At its core, gold remains a paradox: it doesn’t yield interest, it doesn’t generate profits, yet it endures. That’s because gold isn’t a bet on growth; it’s insurance against uncertainty. Whether you’re a seasoned investor fine-tuning your portfolio, or a newcomer seeking an anchor in turbulent times, gold’s relevance lies not in its latest price tag but in its timeless function.

Whether gold suits you depends on your objectives, risk tolerance, and time horizon. Discuss an appropriate approach and sizing with your RHB Relationship Manager.

1 BBC News, Gold surges past $4,000 an ounce as uncertainty fuels rally, 8 October 2025.

2 Reuters, China's central bank extends gold buying for 11th month, 7 October 2025.

3 Reuters, JP Morgan raises gold outlook on investor interest, central bank buying, 23 October 2025.

Disclaimer:

*Member of PIDM. RHB Multi Currency Account is protected by PIDM Up to RM250,000 for each depositor. Multi Currency Account Gold Investment and Multi Currency Account Silver Investment are not protected by PIDM.

This article has been prepared by RHB Bank Bhd (“RHB”) and is solely for your information. This article is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, or passed to any third party, without obtaining prior permission of RHB. In preparing this presentation, RHB has relied upon and assumed the accuracy and completeness of all information available from public sources or which was otherwise reviewed by RHB. Accordingly, whilst we have taken all reasonable care to ensure that the information contained in this presentation is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness and make no representation or warranty (whether expressed or implied) and accept no responsibility or liability for its accuracy or completeness. You should not act on the information contained in this article without first independently verifying its contents.

Any opinion, management forecast or estimate contained in this article is based on information available as of the date of this article and is subject to change without notice. It does not constitute an offer or solicitation to deal in units of any fund and does not have regard to the specific investment objectives, financial situation or the particular needs of any specific person who may receive this. Investors may wish to seek advice from a financial adviser/unit trust consultant before purchasing units of any funds. In the event that the investor chooses not to seek advice from a financial adviser/unit trust consultant, he should consider whether the fund in question is suitable for them.

A Product Highlights Sheet (“PHS”) highlighting the key features and risks of the RHB Gold Fund dated 26 February 2024, RHB Gold and General Fund dated 29 August 2025, and RHB Dynamic Artificial Intelligence Allocator Fund dated 17 March 2025 (“Fund”) are available and investors have the right to request for a PHS. The Information Memorandum has been lodged with the Securities Commission Malaysia ("SC") who takes no responsibility for its contents. The SC’s approval or authorization, or the lodgement of the Information Memorandum should not be taken to indicate that the SC has recommended or endorsed the fund. Amongst others, investors should compare and consider the fees, charges and costs involved. Investors should also note that the price of units and distributions payable, if any, may go down as well as up. Where a distribution is declared, investors are advised that following the issue of additional units/distribution, the NAV per unit will be reduced from cum-distribution NAV to ex-distribution NAV. Any issue of units to which the Information Memorandum relates will only be made on receipt of a form of application referred to in the Information Memorandum. The printed copy of PHS and the Information Memorandum are available at RHB branches/Premier Centres. Investors are advised that investments are subject to investment risk and that there can be no guarantee that any investment objectives will be achieved. Investors should conduct their own assessment before investing and seek professional advice, where necessary and should not make an investment decision solely based on this article. Subscription of units of the Fund is only open to sophisticated investors.

The Manager wishes to highlight the specific risks of the RHB Gold Fund are Management Risk, Secondary Trading Risk, Currency Risk, and Country Risk. The specific risks of RHB Gold and General Fund are Concentration Risk, Political, regulatory and legal Risk, Counterparty Risk, Market Risk, Foreign exchange and Currency Risk, Derivatives Risk, Liquidity Risk, Small and Medium Capitalisation Companies Risk, Commodities Risk, Broker Risk, Equities Securities Risk, Risk of Using Rating Agencies and Other Third Parties, and Investment Management Risk. The specific risks of the RHB Dynamic Artificial Intelligence Allocator Fund, which are Liquidity Risk, Currency Risk, Country Risk, Interest Rate Risk, Credit and Default Risk, Financial Derivatives Risk, Equity Risk, Equity-Related Securities Risk, Collective Investment Schemes Risk, Concentration Risk, Distribution Out of Capital Risk, Risk of Over-Reliance on the Artificial Intelligence Risk Model, and other general risks are elaborated in the Information Memorandum.

Dual Currency Gold Investment ("DCI Gold") is a gold and foreign currency linked structured product investment. This structured product has an embedded derivative (the Reference Derivative) that is linked to the performance of gold measured against a selected foreign currency offered by the Bank. DCI Gold is not a principal protected investment.

This article has not been reviewed by the Securities Commission Malaysia (SC).

RHB Bank Berhad 196501000373 (6171-M)