How To Build Wealth When the Ringgit is Weak

Weak Ringgit got you feeling stuck? It’s time to reframe how you see opportunities. It’s not just about saving – it’s about smart positioning.

The Ringgit doesn’t stretch as far as it used to. You feel the pinch when paying for online purchases from abroad, traveling, buying imported groceries, and imagining your retirement years. Even your Netflix subscription feels more expensive. Our currency has been under pressure throughout 2025, making it more expensive to live, travel, and invest abroad. You’re not imagining things.

But here’s the good news: a weak currency will not necessarily stunt the growth of your carefully curated portfolio. With the right strategy, you can protect - and might even GROW - your wealth.

The Ringgit’s Rocky Ride

In January 2025, the Ringgit slumped to one of its lowest points in recent memory, touching RM4.51 to the Dollar. Since then, it has clawed back some ground, but barely enough to make any noticeable difference to everyday folks.

It hurts because:

- Imported goods cost more: From groceries to gadgets, you’re paying more for anything brought in from abroad.

- Overseas education is pricier: Tuition fees and living expenses have climbed for Malaysians with kids studying in the US, UK, or Australia.

- Retirement overseas becomes harder: Your savings don’t stretch as far if you’re retiring in a country with a stronger currency.

- Holiday plans cost more: Every Ringgit buys you fewer Euros, Dollars, or Pounds. Anyone want a RM50 convenience store sandwich?

What Do You Do?

You can’t move entire economies, but what you can do is shift your mindset from just saving to strategic positioning. Instead of solely relying on your Employee Provident Fund (EPF) or fixed deposits, consider beefing up your portfolio with assets that protect you from currency swings and inflation.

Here are 5 wealth power moves you can implement immediately:

- Open an RHB Multi Currency Account (MCA)

This will be your financial shield, the wind beneath your portfolio’s wings. RHB Multi Currency Account allows you to hold foreign currencies like USD, SGD, or AUD. You can buy low, hold, and convert when the Ringgit drops again—avoiding unnecessary losses when the rates are unfavourable. You are hedging.

Let’s paint a picture. If you had bought USD at RM 4.20 and held it till it hit RM 4.50, that’s a 7% gain just from currency movement. - Invest in foreign-denominated unit trusts or exchange traded funds (ETFs)

This is the shortcut to diversifying into global markets, like US tech, European infrastructure, or Asian growth sectors. These funds are typically denominated in stronger currencies, offering both asset and currency exposure. - Buy gold (or paper gold)

Gold is a classic safe-haven asset. When currencies weaken or inflation rises, gold tends to retain value. You don’t have to line up outside the jewellers and live in fear of getting robbed. Today, you can buy fractional paper gold via apps or online platforms—no vault required! - Consider foreign currency bonds

Invest in solid international companies that offer coupon payments in USD, SGD and AUD. When these payments are received, they convert into more Ringgit—especially if the Ringgit remains weak. - Explore offshore property or REITs

Own a slice of real estate abroad—or invest through real estate investment trusts (REITs). You earn rental income and potential capital appreciation in stronger currencies.

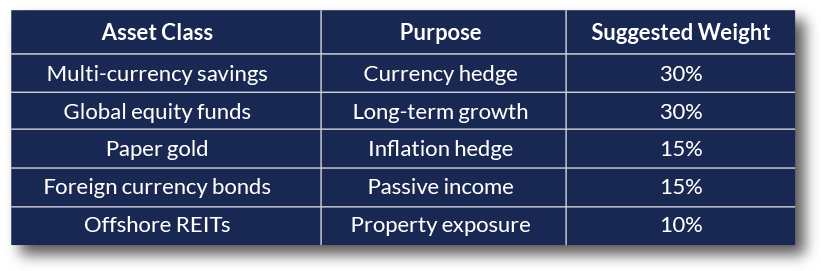

Here’s what a currency-shielded portfolio might look like (actual results may vary, depending on your risk profile and goals):

What you should NOT do

While global investing offers protection, it’s not without risks, like any other investment. Avoid these common mistakes:

Chasing hype assets: Don’t dive into crypto or forex trading without research or proper risk controls. Volatility is high, and losses can stack up fast. Keep it simple.

Over-leveraging: Taking out big loans to buy foreign assets may backfire, especially if you don’t understand the tax, legal, or repatriation rules of that country.

Take charge today

A weak Ringgit doesn’t mean you have to lose out. With the right tools and advice, you can build a more resilient and globally diversified portfolio—one that not only protects your wealth but positions you to grow it.

Talk to your Relationship Manager today about how to future-proof your finances, no matter what direction the currency takes.

Disclaimer:

RHB Multi Currency Account is protected by Perbadanan Insurans Deposit Malaysia (PIDM) up to RM250,000 for each depositor. RHB Multi Currency Account Gold Investment and Multi Currency Account Silver Investment are not protected by PIDM. Member of PIDM.