Grow with the Nation: Positioning Your Portfolio for the 13th Malaysia Plan

For investors, the 13th Malaysia Plan (13MP) is a roadmap to identify where opportunities are likely to grow. By understanding these themes and positioning portfolios early, you can capture potential returns while contributing to Malaysia’s long-term progress.

Every five years, Malaysia sets out a new economic vision that shapes how capital flows across industries. The 13th Malaysia Plan (13MP), with the theme Melakar Semula Pembangunan (Redesigning Development), will be the government’s investment roadmap for 2026 to 2030.

For investors, this is important because government spending and incentives often signal where the next growth stories will emerge. Where the government leads, private capital often follows, creating opportunities to grow wealth in line with the nation’s direction. Global markets have shown this pattern before: U.S. infrastructure bills boosted construction and clean energy stocks, while China’s five-year plans have consistently guided capital towards sectors like technology and advanced manufacturing. Malaysia’s 13MP could have a similar catalytic effect for local and regional markets.

Spotting the themes in the plan plays a crucial role in positioning your portfolio – but you should do this before the plan is officially ratified.

We’ve done the legwork and highlighted several likely key themes to watch:

Key Themes and Opportunities

- Energy Transition & Environmental, Social, and Governance (ESG)

Malaysia’s pledge to reach net zero by 2050 is more than rhetoric. Expect greater emphasis on renewables, green bonds, and sustainability-linked policies.

Why it matters: Rising carbon taxes and ESG reporting requirements will separate tomorrow’s winners from laggards.

Investor Note: Early movers into green assets tend to benefit from regulatory tailwinds and growing institutional capital flows. This is a long-term structural trend, not a passing cycle. - Equities: Solar companies, green-tech firms, ESG-compliant corporates.

- Fixed Income: Green Sukuk and sustainability-linked bonds.

- Private Investments: EV charging networks, waste-to-energy projects, energy-efficiency consulting.

- Business Opportunities: Companies embedding ESG practices may access incentives and attract global capital.

- Digital Transformation & AI

The government’s digital-first vision includes AI integration, data centres, and cybersecurity as critical pillars.

Why it matters: Digital adoption is compounding—boosting productivity, creating new industries, and reshaping business models.

Investor Note: Positioning now helps capture structural growth before valuations rise as adoption accelerates. - Equities: Telcos as data enablers, cybersecurity firms, digital solution providers.

- Private Equity / VC: Stakes in Malaysian AI start-ups and fintech ventures.

- Business Opportunities: SMEs can tap grants to digitalise and scale.

- Food Security & Agri-Tech

Global disruptions have highlighted Malaysia’s reliance on food imports. 13MP is likely to prioritise self-sufficiency and modern farming methods.

Why it matters: Food resilience is both a social and economic necessity—policies here are likely to enjoy bipartisan support.

Investor Note: Food security plays are defensive in nature, providing stable returns even in uncertain global markets.

- Equities: Plantation firms diversifying into food crops, agri-tech companies.

- Private Investments: Vertical farms, aquaculture, modern food processing.

- Business Opportunities: Agribusinesses aligned with national food security may enjoy subsidies and land-use incentives.

- Advanced Manufacturing

Malaysia is building capacity in high-value industries such as semiconductors, electronics, and medical devices.

Why it matters: With supply chains shifting due to geopolitics, Malaysia is well-placed to attract investment as companies diversify production bases.

Investor Note: Manufacturing is cyclical but offers outsized gains for investors with long-term horizons and higher risk tolerance. - Equities: E&E supply chain companies, precision engineering firms.

- Real Estate: Industrial property and logistics hubs in Penang, Kulim, Johor.

- Private Equity: Funds backing SMEs in advanced manufacturing.

- Healthcare & Wellness

With an ageing population and the lessons of the pandemic, healthcare remains central to national planning.

Why it matters: By 2040, one in five Malaysians will be over 60, creating steady demand for healthcare solutions.*

Investor Note: Healthcare is a demographic-driven theme—less cyclical, more resilient, and an ideal defensive anchor for portfolios.- Equities: Private hospitals, pharmaceutical firms, glove manufacturers (post-restructuring).

- Fixed Income: Healthcare Sukuk or bonds for expansion.

- Personal Finance: Health insurance and critical illness coverage as wealth-protection tools.

- Business Opportunities: Elder care services, medical tourism, and wellness products.

Tailoring Your Strategy

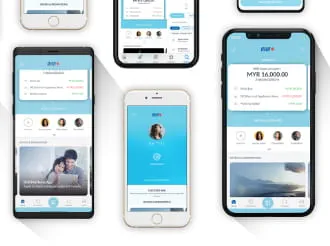

Every investor stands to benefit from the themes outlined in the 13MP, but the approach will vary depending on financial goals, experience, risk appetite, and the size of your portfolio. Through the RHB Share Trading App, you can easily access a variety of trading tools, track market movements, and position your portfolio for growth.

For individual investors or aspiring wealth builders, the most accessible way to participate in these national priorities is through the public markets. Unit trusts, exchange-traded funds (ETFs), and carefully selected blue-chip stocks on Bursa Malaysia provide diversified exposure to renewable energy, healthcare, and digital transformation sectors, for example. These instruments allow investors to capture upside potential without taking on the risks of direct project ownership. For example, an ETF focused on ESG leaders could offer a low-barrier entry point into the green economy while spreading risk across multiple companies. The AHAM Select Dividend Fund targets high-dividend companies, making it suitable for those seeking income streams. An alternative for those who are keener on high-growth companies is the RHB Thematic Growth Fund.

For more experienced investors, the strategy often extends beyond listed equities into private markets. This group can consider allocations to private equity, venture capital, or even direct stakes in businesses that align with the 13MP’s direction. For instance, investing in a fund that backs semiconductor supply chain companies, or an early-stage AI start-up, not only provides exposure to high-growth sectors but also enhances portfolio diversification.

This category of investors is also well-placed to take advantage of co-investment opportunities with institutional players, which can offer privileged access to deals that are not available to the broader market.

For business owners, the 13MP presents both an investment and an operational strategy. Aligning a business with national priorities—whether by adopting ESG practices, digitalising operations, or exploring agri-tech opportunities—can unlock tangible benefits such as tax incentives, preferential financing, and eligibility for government grants.

Importantly, the plan also earmarks significant spending on construction, infrastructure, and mega projects such as the East Coast Rail Link (ECRL), Penang LRT, Johor–Singapore Special Economic Zone (JS-SEZ), flood mitigation works nationwide, and new ports and industrial parks. These create opportunities not only for large contractors but also for SMEs within the supply chain—whether as subcontractors, suppliers, or service providers.

Beyond the financial upside, businesses that align with the plan may also gain reputational advantages, becoming more attractive to both domestic and international partners. For example, a manufacturing SME that upgrades its processes to meet green supply chain standards may not only cut costs but also secure long-term contracts with multinational corporations, while a construction-related SME could find new visibility and growth through participation in federally funded infrastructure works.

In essence, the 13MP provides a strategic compass for all investor segments. The key lies in identifying which opportunities best suit one’s profile and integrating them into a broader, diversified wealth plan.

Balancing opportunity and risk

While thematic investing can be powerful, it should always be part of a well-diversified portfolio. Execution risks, policy delays, and global headwinds—such as inflation or geopolitical tensions—can affect the speed and scale of returns. Concentrating too heavily on one theme may also expose investors to unnecessary volatility. By spreading investments across different asset classes and sectors, investors can capture upside from 13MP-linked opportunities while cushioning their portfolios against unexpected shocks. Ultimately, the best results come from balancing conviction in growth themes with the discipline of diversification.

Conclusion

The 13th Malaysia Plan isn’t just about government policy—it’s a chance for you to grow alongside the nation. By spotting these themes early and positioning your portfolio now, you can build wealth in step with Malaysia’s progress and ensure your financial journey keeps pace with where the country is headed. Talk to your Relationship Manager to find a strategy that suits your aspirations and risk profile.

*Source: Population Projections (Revised), Malaysia, published by the Department of Statistics Malaysia (DOSM) on 22 September 2023.

Disclaimer:

This article has been prepared by RHB Bank Bhd (“RHB”) and is solely for your information. This article is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, or passed to any third party, without obtaining prior permission of RHB. In preparing this presentation, RHB has relied upon and assumed the accuracy and completeness of all information available from public sources or which was otherwise reviewed by RHB. Accordingly, whilst we have taken all reasonable care to ensure that the information contained in this presentation is not untrue or misleading at the time of publication, we cannot guarantee its accuracy or completeness and make no representation or warranty (whether expressed or implied) and accept no responsibility or liability for its accuracy or completeness. You should not act on the information contained in this article without first independently verifying its contents.

Any opinion, management forecast or estimate contained in this article is based on information available as of the date of this article and is subject to change without notice. It does not constitute an offer or solicitation to deal in units of any fund and does not have regard to the specific investment objectives, financial situation or the particular needs of any specific person who may receive this. Investors may wish to seek advice from a financial adviser/unit trust consultant before purchasing units of any funds. In the event that the investor chooses not to seek advice from a financial adviser/unit trust consultant, they should consider whether the fund in question is suitable for them.

Product Highlight Sheets (“PHS”) highlighting the key features and risks of the RHB Thematic Growth Fund dated 3 March 2025, and AHAM Select Dividend Fund dated 3 April 2025 are available and investors have the right to request for a PHS. Investors are advised to obtain, read and understand the contents of the PHS, Information Memorandum, and any supplementary documents (if any) ("collectively known as the Information Memorandum") before investing. The Information Memorandum has been lodged with the Securities Commission Malaysia ("SC") who takes no responsibility for its contents. The SC’s approval or authorization, or the lodgement of the Information Memorandum should not be taken to indicate that the SC has recommended or endorsed the fund. Amongst others, investors should compare and consider the fees, charges and costs involved. Investors should also note that the price of units and distributions payable, if any, may go down as well as up. Where a distribution is declared, investors are advised that following the issue of additional units/distribution, the NAV per unit will be reduced from cum-distribution NAV to ex-distribution NAV. Any issue of units to which the Information Memorandum relates will only be made on receipt of a form of application referred to in the Information Memorandum. The printed copy of PHS and the Information Memorandum are available at RHB branches/Premier Centres. Investors are advised that investments are subject to investment risk and that there can be no guarantee that any investment objectives will be achieved. Investors should conduct their own assessment before investing and seek professional advice, where necessary and should not make an investment decision solely based on this article. Subscription of units of the Fund is only open to sophisticated investors.

The Manager wishes to highlight the specific risks of the RHB Thematic Growth Fund, which are Market Risk, Particular Securities Risk, Interest Rate Risk, and Credit and Default Risk. The specific risks of the AHAM Select Dividend Fund are Stock Specific Risk, Country Risk, Interest Rate Risk, Credit and Default Risk, Warrants Investment Risk, Currency Risk, Political Risk, Regulatory Risk, Distribution Out of Capital Risk, as well as other general risks are elaborated in the Information Memorandum.

This article has not been reviewed by the Securities Commission Malaysia (SC).

RHB Bank Berhad 196501000373 (6171-M)