Foreign Currencies to look out for in 2026: A Malaysian Investor’s Guide

Foreign currencies play an important role in portfolio diversification. We’ve prepared a guide on where to start, and which currencies can strengthen your financial strategy in 2026.

The ringgit has been gaining steadily against the dollar over the past year or so. We’ve even seen it just about brush the RM4 mark, at around RM4.04 to the dollar. This trend is expected to continue in 2026 – albeit in intervals. Does that mean foreign currencies are no longer relevant? Not at all.

Holding a portion of your wealth in other currencies isn’t about making fast profits. You want your portfolio to be diversified, flexible, and future-proof in an increasingly connected world. For this reason, you don’t want to ignore foreign currencies.

Foreign currencies are an invaluable tool for:

- Investors with overseas stocks, funds, or bonds/sukuk

- Malaysians planning overseas travel, education, or medical expenses

- Business owners earning or paying in foreign currencies

- Anyone looking to reduce reliance on a single currency

Anyone can invest in foreign currencies – with the right intention. One common pitfall is treating currencies like a trading game, always chasing quick wins. They work best when they support a broader financial plan, NOT when they are the main event.

Think of foreign currencies as financial shock absorbers, helping to smooth out volatility and open doors beyond domestic markets. They just need a little tweaking every now and then to adjust to the road.

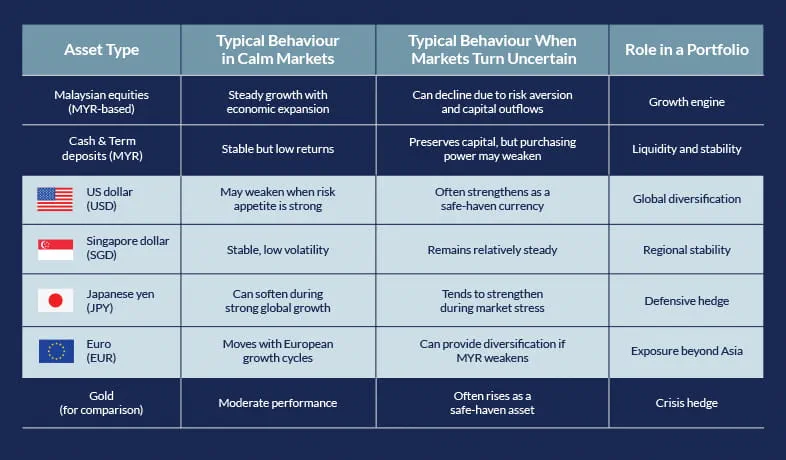

Here’s how one might position foreign currencies within a portfolio:

Investing in foreign currencies does not necessarily mean holding cash. It can be in the form of other assets that are denominated in that particular currency, such as equity or even property. We’ve listed a few of the best foreign currencies for Malaysians to invest in this year and highlighted their strengths.

US Dollar (USD): Still the world’s anchor currency…?

Despite the current market and tense atmosphere surrounding the US and its policies, the dollar remains the backbone of global trade, commodities, and investments. It is still the world’s primary reserve and settlement currency, especially during geopolitical stress. Many international funds, technology stocks, and commodities are priced in USD, making it the most widely held foreign currency worldwide.

2026 outlook

The USD may soften slightly if US interest rates ease while Malaysia maintains a stable monetary policy. Even so, it continues to serve as a reliable safe-haven currency, especially during global uncertainty.

How to use the USD

Holding some USD exposure can:

- Support international investing

- Provide liquidity during volatile markets

- Help manage overseas education or business costs

Singapore Dollar (SGD): Policy-anchored stability with mild appreciation bias

The Singapore dollar remains one of the most stable currencies in the region, supported by a disciplined policy framework and strong economic fundamentals. Unlike many central banks, the Monetary Authority of Singapore (MAS) manages the SGD through the exchange rate, which continues to anchor expectations and limit excessive volatility.

2026 outlook

The outlook for the SGD remains constructive. Current policy settings allow for modest appreciation over time, while effectively capping sustained weakness. As long as global conditions remain broadly supportive, the path of least resistance for the Singapore dollar is likely to be gradual strength rather than sharp moves.

Singapore’s economic fundamentals remain among the strongest in the region. Growth is expected to stay resilient into 2026, supported by firm external demand, the ongoing electronics upcycle, and steady momentum in trade-related and modern services sectors. Inflation is also expected to remain manageable, giving MAS room to maintain its current policy stance through at least the first half of 2026.

Large structural buffers, including a persistent current account surplus and prudent fiscal management, further reinforce confidence in the currency. While external risks remain, Singapore has historically proven more resilient than regional peers during periods of global uncertainty.

How to use the SGD

SGD exposure works well for investors who want to:

- Hold a low-volatility, high-quality regional currency

- Preserve capital while maintaining liquidity

- Diversify Asian currency exposure

- Support travel, education, or business needs in Singapore

The Singapore dollar is best viewed as a core stability holding within a diversified portfolio, offering consistency and resilience rather than aggressive upside.

Japanese Yen (JPY): Defensive, but recovery likely to be gradual

The Japanese yen remains a traditional safe-haven currency, but its recovery path is expected to be slow. While Japan is moving away from ultra-loose monetary policy, the pace of change remains cautious, limiting near-term upside for the yen.

2026 outlook

Japan’s policy environment continues to support a gradual normalisation. Fiscal stimulus and reflation-focused policies are helping to lift domestic yields to multi-year highs. However, the Bank of Japan has been clear that any tightening will be measured and incremental, rather than aggressive.

At the same time, relatively high interest rates in the US keep yield differentials wide, reducing the yen’s appeal as a return-seeking currency. As a result, the yen is likely to recover only modestly, with movements driven more by shifts in global risk sentiment than by domestic policy changes alone.

How to use the JPY

JPY exposure remains relevant for investors who want to:

- Add a defensive, safe-haven element to their portfolio

- Cushion against periods of global market stress

- Balance higher-yielding or growth-linked currencies

While the yen may not deliver strong appreciation in the near term, it continues to play an important risk-mitigating role within a diversified portfolio, particularly during periods of heightened volatility.

Euro (EUR): Access to Europe’s economic engine

The euro represents one of the world’s largest economic blocs. Many global brands, infrastructure assets, and multinational companies operate and report in euros.

2026 outlook

If growth in the Eurozone stabilises and interest rate gaps narrow, the euro could see modest appreciation against the ringgit.

How to use the EUR

EUR exposure is useful if you:

- Invest in European equities or funds

- Want diversification beyond Asia and the US

- Spend or earn in Europe

Chinese Renminbi (CNY): Stability amid structural headwinds

China’s economic outlook for 2026 remains subdued. Growth is expected to moderate as the property sector continues to face challenges and overall debt levels stay elevated. These structural pressures present downside risks, even as inflation remains relatively contained.

2026 outlook

Economic growth is projected to slow further in 2026, reflecting weaker property activity, softer export momentum, and modest productivity gains. While these factors weigh on the outlook, relatively low inflation gives policymakers room to deploy targeted monetary and fiscal support if conditions deteriorate.

Such measures may help stabilise near-term activity, but deeper structural imbalances are likely to persist, limiting the scope for a strong or sustained rebound. As a result, the renminbi is expected to remain broadly stable, with limited appreciation potential and policy support playing a key role in managing volatility.

How to use the CNY

CNY exposure may be appropriate for investors who want to:

- Maintain regional diversification within Asia

- Align currency holdings with China-linked trade or investments

- Take a long-term approach to Asia’s structural growth themes

Given the ongoing structural challenges, the renminbi is best viewed as a strategic, long-term allocation, rather than a tactical currency for short-term gains.

Australian Dollar (AUD): A selective growth play

The Australian dollar is closely tied to global growth, commodities, and interest rate differentials. As a resource-rich economy with strong links to Asia, Australia often benefits when global demand is resilient. Compared to its regional peer, the New Zealand dollar, the AUD currently offers a stronger macro and yield profile.

2026 outlook

The outlook for the AUD remains constructive but selective. Market expectations point to further policy tightening by the Reserve Bank of Australia through 2026, with interest rates potentially edging higher. Australia’s relatively resilient domestic demand, supportive commodity prices, and a central bank that remains cautious about easing too early all provide support for the currency.

Against the US dollar, the AUD has already shown relative strength and is expected to continue outperforming the New Zealand dollar. While inflation is projected to ease gradually, it is likely to remain firm enough to keep monetary policy restrictive, which supports the AUD’s carry appeal.

How to use the AUD

AUD exposure may be suitable for investors who want to:

- Gain exposure to global growth and commodities

- Diversify beyond Asian and US currencies

- Hold a higher-yielding currency within a diversified portfolio

- Support education, travel, or investment needs linked to Australia

As with other growth-linked currencies, the AUD can be more volatile during periods of global uncertainty. It works best as a complementary allocation, rather than a core holding, within a well-diversified portfolio.

Practical tips before you start

- Diversify, don’t speculate

Foreign currencies are about balance, not betting. - Match currency to purpose

Hold currencies you actually need — for travel, education, or investments. - Start small

A 5–10% allocation is enough for beginners. - Watch the big picture

Interest rates, central bank policies, and global trade trends matter more than daily price moves. - Use the right tools

Multi-currency accounts, foreign currency funds, and structured investments can make exposure easier to manage.

Speaking of the right tools, RHB offers several foreign currency solutions, such as:

- Foreign currency funds via RHB Bank / RHB Premier Bank through Personal Financial Consultant (PFC) and Relationship Manager (RM)

These are professionally managed funds that hold assets denominated in foreign currencies. Instead of buying the currency itself, you buy into a fund that gives you exposure to currency movements along with other assets such as global equities or bonds/sukuk. It’s a hands-off way to diversify internationally without worrying about exchange logistics.

- Dual Currency Investment (DCI) solutions

DCIs are structured products where you invest in one currency with the potential to earn higher returns — but with some currency risk attached. Your returns depend on exchange rate movements between two currencies over a set period. This isn’t for everyone, but for experienced investors, it can offer a way to get enhanced returns while still managing risk.

- RHB Multi-Currency Account/-i

A practical multi-currency account lets you hold 34 currencies in one place. It’s especially helpful if you travel often, have overseas expenses, or spend money internationally. Instead of converting currency every time you transact, you simply keep the right currency ready. This gives you flexibility and lets you time conversions when rates look favourable.

Foreign currency exposure in 2026 isn’t about predicting which currency will “win”. It’s about planning smartly. Each currency plays a different role. The right mix depends on your goals, risk profile, and time horizon. Talk to your Relationship Manager today to add foreign currencies to your portfolio.

Source: RHB Research Institute. For more information, please refer here.

RHB Multi Currency Account/-i is protected by PIDM up to RM250,000 for each depositor. Multi Currency Account Gold Investment and Multi Currency Account Silver Investment are not protected by PIDM.

Member of PIDM.

RHB Bank Berhad 196501000373 (6171-M) | RHB Islamic Bank Berhad 200501003283 (680329-V)