Budget 2026: FIVE Steps to Turn Policy into Personal Gain

Budget 2026 isn’t just about handouts and tax cuts. It’s a roadmap. Here’s how you can read between the lines, act early, and make national policy work for your personal financial goals.

Every October, Malaysians tune in to the Budget hoping for good news — more cash aid, tax cuts, or relief for rising costs. But Budget 20261 isn’t just a list of handouts; it’s a roadmap that gives us a sneak peek into the next decade of national development. When you know how to read the signs, you’ll spot plenty of opportunities that could make a real difference to your financial future. Whether you’re a salaried professional, SME owner, or investor, understanding the “why” behind these measures can help you make smarter, future-proof financial moves.

Read the Budget like an insider

Each year, the Budget tells a story about Malaysia’s long-term priorities. Budget 2026 is another chapter in a journey that began with the 12th and now continues into the 13th Malaysia Plan — a roadmap towards a more inclusive, digital, and low-carbon economy.

While most folks focus on the rebates and handouts, the real insight lies in where the government is investing. When you see increased allocations for renewable energy, electric vehicles, or artificial intelligence, that’s your directional signal.

These aren’t random incentives. They point to where job creation, new businesses, and investment opportunities will grow in the next five to ten years. For example, if solar panel installation or agritech automation are being heavily supported, consider upskilling or investing in those fields.

Put on a different lens

Budgets are designed to address everyone, but not in the same way.

- B40 households often receive direct support through cash transfers such as STR and SARA, enhanced PERKESO coverage for gig workers, and initiatives to strengthen elderly care systems.

- M40 and T20 Malaysians, on the other hand, tend to benefit indirectly through tax reliefs, business incentives, investment stability, and opportunities in high-growth industries.

Understanding which measures apply to your bracket helps you strategise better. The budget isn’t just a national document; it’s a personal playbook.

Here’s how to get off the sidelines and maximise the Budget.

Step 1: Conduct a Personal Financial Audit

|

Category |

Action |

|

Debt |

List all your debts - especially those with high interest. Budgets often introduce or extend debt management schemes via Agensi Kaunseling & Pengurusan Kredit (AKPK) or similar agencies. You can also explore tools like the RHB Smart Instalment Plan, which helps to convert your big expenses into manageable instalments. |

|

Expenses |

Break down your spending — childcare, education, healthcare, green products, or lifestyle. This makes it easier to match your expenses with new tax reliefs or subsidies. |

|

Investments |

Align your portfolio with national themes. With Budget 2026’s focus on Environmental, Social and Governance (ESG), technology, food security, and renewable energy, review your holdings and consider adjusting exposure. Your RHB Share Trading App or Relationship Manager can guide you through suitable opportunities. |

Step 2: Don’t Miss the “Quiet” Incentives

While most people celebrate the big-ticket announcements, the smaller, quieter incentives are where real savings hide.

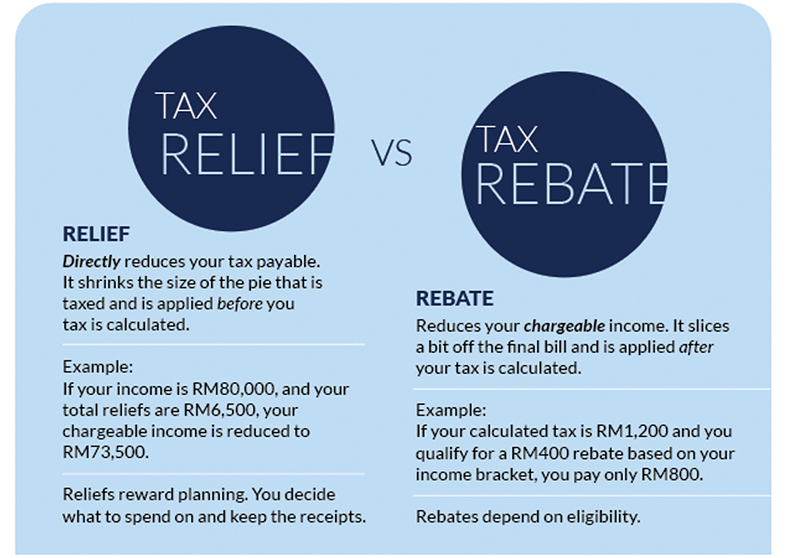

It’s important to distinguish between tax reliefs and tax rebates so you can benefit from both.

Fresh 2026 Incentives

- RM1,000 tax relief for local tourism (including entry fees for domestic attractions).

- RM4,000 vehicle upgrade incentive2 for trading in cars older than 20 years for a new national vehicle.

- Stamp duty exemption on property and loan instruments3 for first-time homebuyers up to RM500,000, extended until 31 December 2027.

If you’re considering a major purchase — say, a new laptop for work, home gym equipment, or even breastfeeding supplies — timing it after the Budget announcement could earn you new reliefs.

Step 3: Track the Digital and Green Transitions

Two words define this budget: Digitalisation and Sustainability.

For Individuals

- Expect continued micro-credential incentives and digital skill training support.

- Watch for tax reliefs on energy-efficient home improvements from solar water heaters to low-energy appliances.

- Professionals might also see tax reliefs for sustainability-related certifications. This is an emerging area as more employers prioritise green credentials.

For Businesses and Side Hustlers

- RM1 billion in green financing has been allocated to help MSMEs transition towards sustainable practices.

- New tax deductions for AI and cybersecurity training ensure digital resilience.

- The 100% Green Investment Tax Allowance (GITA) for companies adopting green technologies continues — another sign that sustainability is now a business imperative.

- New food production projects will enjoy up to 10 years of income tax exemption, while automation tax incentives for closed-house livestock systems aim to strengthen agritech innovation and reduce food imports.

PRO TIP: If you’re an SME, explore the RHB SME Green Renewable Energy and CAPEX Financing programme to leverage these incentives.

Step 4: Prepare for Policy Shifts

Budgets aren’t always generous. That’s why they are called budgets and not annual bonanzas. Sometimes, budgets introduce rationalisations, or cuts. Thinking ahead can shield you from unexpected shocks.

- If subsidies shrink (fuel, electricity, water), start an Energy Buffer Fund to cushion the higher monthly expenses.

- If SST expands, the cost of goods and services will rise. Consider making major purchases before this kicks in.

- Aim for a policy-proof investment portfolio that won’t rely on any single incentive or tax break. We’ve said this countless times before, but diversification remains the best defence against uncertainty.

The game plan

NOW (Q4 2025)

- Audit your finances and debts.

- Identify 3-5 budget measures that apply to you or your business.

- Start tracking legible expenses and keep your receipts.

NEXT YEAR (2026 – 2027)

- Use the incentives to upskill, invest sustainably, and plan major purchases strategically.

- Claim EVERY rebate and relief when filing your taxes.

Ultimately, don’t treat the Budget as something that happens to you. Treat it as something you can work with. Every tax break, training grant, and financing incentive is a small lever. When you pull the right ones, they move your financial future in the right direction.

2 The Star, Budget 2026: RM4,000 Grant for upgrading to new national cars, 10 October 2025.

3 PwC, Statement: Budget 2026, 10 October 2025.