BY RHB WEALTH RESEARCH

The ongoing trade tensions have resulted in volatility and uncertainty in global markets, impacting asset classes from bonds and stocks to currencies. In turn, this has also affected Malaysians who want to send their children abroad to study.

Many parents only convert their savings in Malaysian ringgit to the target currency right before their children leave the country. But with all the fluctuations in the currency market, this might be risky.

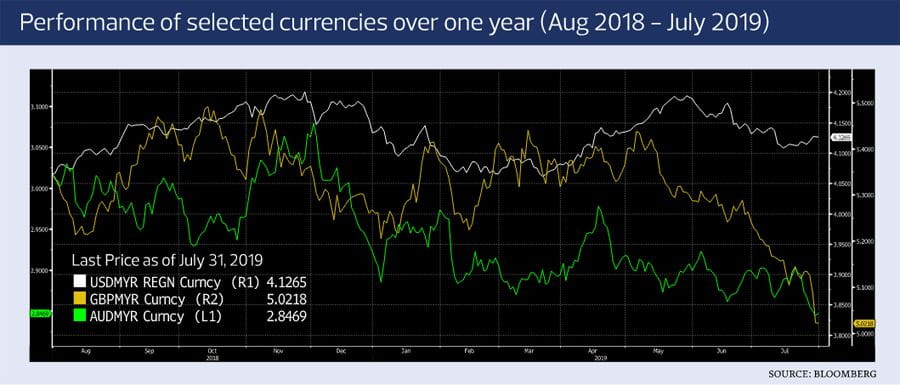

In the past year, the ringgit has been hit by factors such as the crude oil price movement and uncertainties in emerging markets. The ringgit became Asia’s worst currency in April this year, according to reports. In the same month, Norway said its sovereign wealth fund will cut emerging market debts, including those from Malaysia, from its index, while FTSE Russell also announced it would drop Malaysian debt from the FTSE World Government Bond Index due to concerns about market liquidity.

On the other hand, the currencies of the three most popular study destinations for Malaysian students — the UK, Australia, and the US also continue to be impacted by unpredictable global events.

As China is Australia’s largest trading partner, the volatility of the Australian dollar has been mainly driven by the country’s close links to the Chinese economy. Australia’s mineral and mining exports to China tend to be affected when the Chinese economy slows down.

In January, the Australian dollar fell to its lowest level in 10 years against the US dollar due to weak manufacturing results in China and concerns about global growth. The currency was further impacted in June when the Reserve Bank of Australia cut its interest rates for the first time in almost three years to a record low of 1.25%. This caused the Australian dollar to depreciate by 1% against the ringgit on a year-to-date basis (as at June 30, 2019) and 3.03% over one year (as at June 30, 2019).

On the other hand, investors have flocked to the US dollar as a safe haven amid the trade tariffs and the ongoing tensions with China. But when the trade issues taper off, its appeal as a safe haven might fade away as well. Right now, the volatility of the US dollar is amplified by the fluid movement of negotiations between Beijing and Washington.

In particular, the news flow and US President Donald Trump’s Twitter remarks are a source of volatility for the currency. For example, the US dollar fell in July after Trump tweeted that the US should manipulate its currency. The US Federal Reserve recently signalled a potential interest rate cut in the future, driving the US dollar down compared to other currencies.

For the British pound, Brexit remains the main issue. The ongoing developments will keep the pound on an elevated volatility curve, even as the new prime minister takes over at 10 Downing Street. As historical data indicates, the pound is heavily influenced by the daily dose of Brexit news. This makes it hard to trade the pound based on the news flow, resulting in it becoming the most volatile currency among the G10 pairs.

Of course, the news of lower interest rates in some of these developed markets may benefit parents who want to send their children to study abroad, as this could translate to a stronger ringgit. However, as illustrated in the examples above, the ongoing political issues will result in volatility in the currencies, thus creating uncertainties in the near term.

Preparing ahead for your children’s future

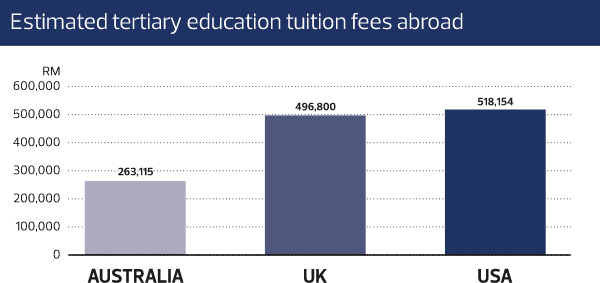

A foreign degree can open many career opportunities for the young and ambitious graduate. But it can come with a huge price tag for the parents, who have to pay for the higher fees that universities tend to charge international students. The parents also have to pay heed to the currency conversion rates.

According to Times Higher Education’s data in 2017, an international undergraduate student will need to pay on average A$87,705 in fees to study in Australia, US$132,860 for a typical US university, and up to £35,000 annually to study in the UK.

The volatility in global currency markets means that parents may not be able to get a beneficial currency conversion. Therefore, it is advisable for them to plan ahead and open a multi-currency account (MCA) to accumulate the currency needed for their children.

For instance, RHB Bank’s MCA offers time deposit and call deposit accounts with interest for parents who are accumulating a foreign currency. The monies deposited into these accounts can be held in 17 multiple currencies. There is low currency risk to MCA as the currencies are only converted when needed.

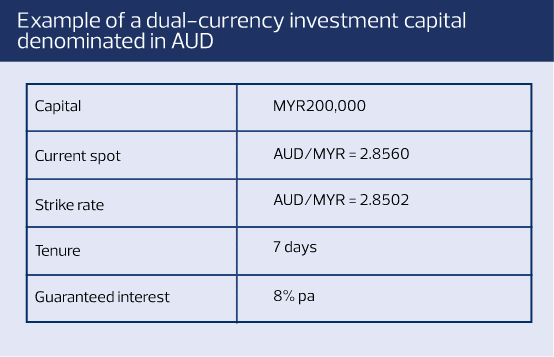

The challenge, however, is to convert at the right time, since currency movements can be volatile. In this case, it is best to convert the currency with different spreads to average the cost down while also earning interest. The parents can pair MCA with another structured product called dual currency investment (DCI) during the planning period for their children’s education. They can use DCI to potentially earn better yields via investments before converting the ringgit into the currency in demand.

The DCI provides flexibility for the parent to choose the currency pairing that they prefer. The base currency would be ringgit, while the target currency would be that of the country the child is heading to. The tenure can range from one week to three months. The parent can decide on the conversion rate, also known as the strike rate, that they feel comfortable with.

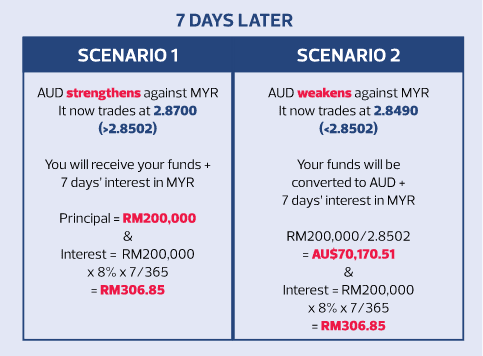

During the tenure, if the target currency strengthens, the entire investment amount and the fixed yield will be given back to the account holder in the base currency. But if the target currency weakens, the investment amount will be converted to the target currency and a fixed yield will be paid to the account holder in base currency.

Parents can use the DCI to pair their intended foreign currency closer to the spot rate in order to potentially obtain better yields. When the conversion happens upon maturity, parents can transfer the money to the MCA account and earn from the interest rate.

For example, if a parent is planning to send their children to study in Australia, they can start accumulating the Australian dollar via a DCI investment. They will use the ringgit to pair with the Australian dollar at specific spot or strike rates and determine the tenure of the investment.

One of the risks with DCI is that if the target currency keeps strengthening, the ringgit will not be converted into the target currency. However, during this period, parents can still enjoy potentially better yields from this investment compared to MCA’s interest rates.

Another benefit of using RHB’s service is the MCA Visa Debit Card, which is the first-of-its-kind in Malaysia. The debit card utilises money in the MCA account and allows the user to transact in 13 foreign currencies, on top of the ringgit. Children can pay for their school fees in foreign currencies without the inconvenience of transferring money to another bank account, which would take time.

The card also allows the children and other family members to use the MCA Visa Debit Card overseas. Using the card results in cost savings, since there is no currency conversion fee usually associated with credit cards and overseas bank transfers. The RHB MCA Visa Debit Card does not have currency conversion fees on 13 foreign currencies when customers transact in overseas retail spend*.

With geopolitical tensions and economic growth concerns continuing to cloud the global market outlook, parents can opt to utilise this strategy to prepare their finances and offset the cost of sending their children abroad to study.

“If there are insufficient funds in

the transaction fund, the money

will be deducted from the

ringgit account and a 1%

conversion fee will apply.”