Applicable for existing accountholders.

Applicable for existing accountholders.

Applicable for existing accountholders.

Applicable for existing accountholders.

Applicable for existing accountholders.

*First RM20,000 in MaxCash Account is non-interest bearing irrespective of account balance.

Applicable for existing accountholders.

*No interest is paid on the first RM5,000 of your total balances

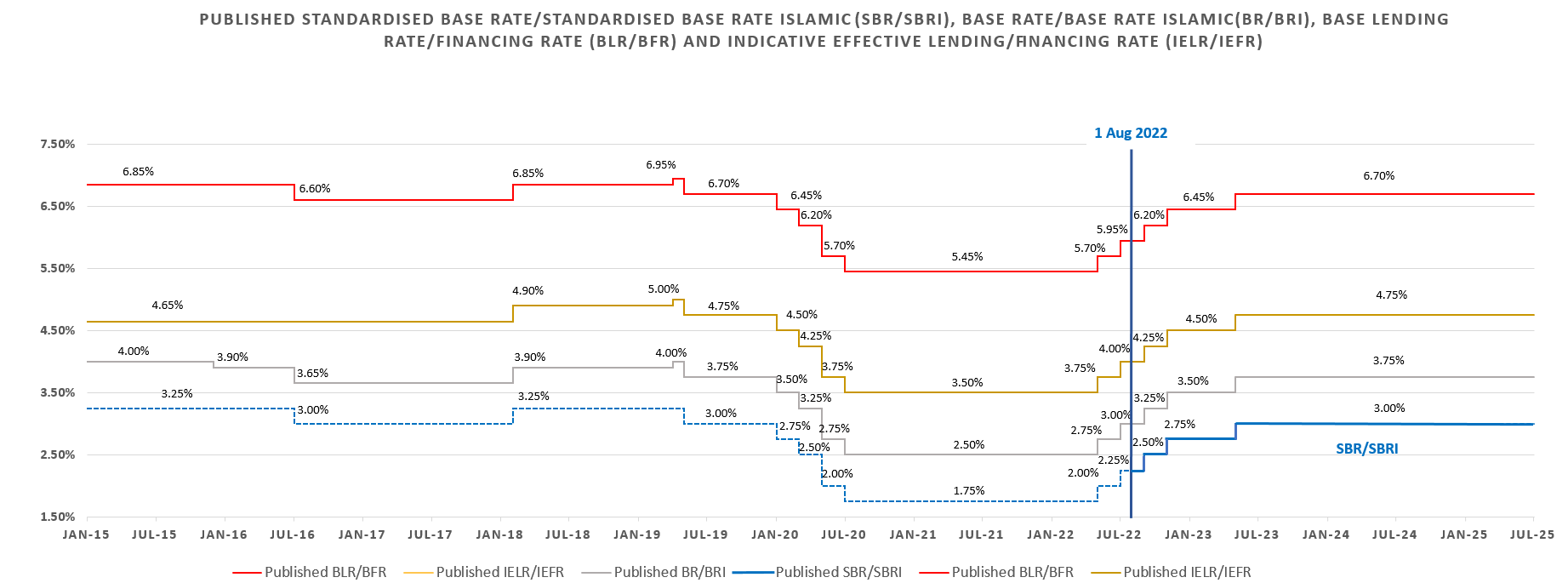

Rujukan / Reference:

Kadar Asas Standard (KAS) / Standardised Base Rate (SBR), Kadar Asas (KA) / Base Rate (BR), Kadar Pinjaman Asas (KPA) / Base Lending Rate (BLR), Petunjuk Kadar Efektif Pinjaman (PKEP) / Indicative Effective Lending Rate (IELR)

Catatan:

Note:

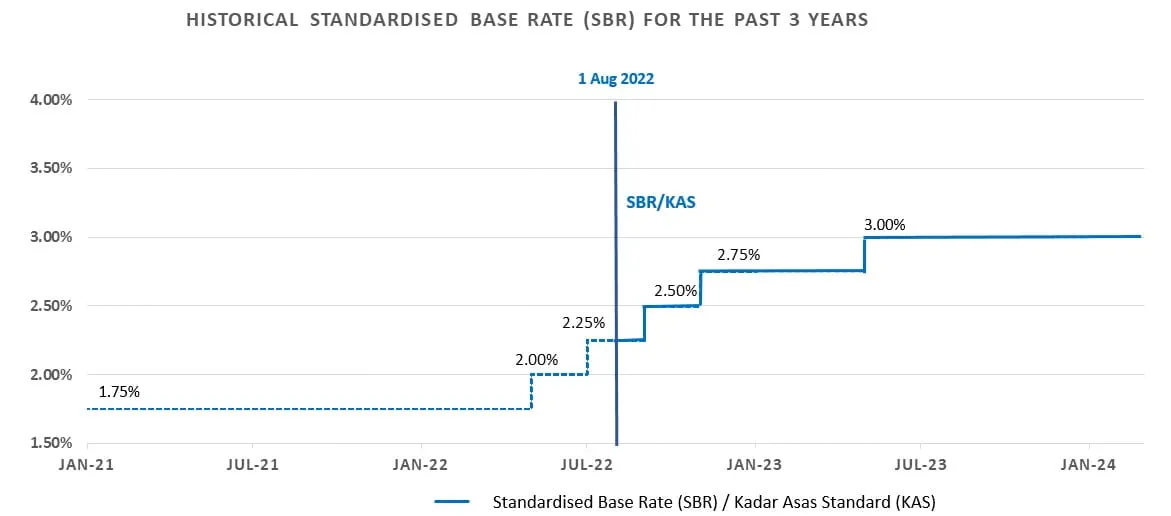

Catatan: KAS telah diperkenalkan pada 1 Ogos 2022. Garis putus-putus menunjukkan data OPR yang terdahulu, iaitu kadar penanda aras KAS.

Note: The SBR was introduced on 1 August 2022. The dotted line shows the historical series of the OPR, which is the benchmark rate of the SBR.

A guide to our charges & rates offered

Term Deposit

For other information, please refer to the counters.

Rates for Commodity Murabahah (CM) Deposit products

Reliable, up-to-date and competitive.

Standardised Base Rate Islamic

Base Rate Islamic

Base Financing Rate

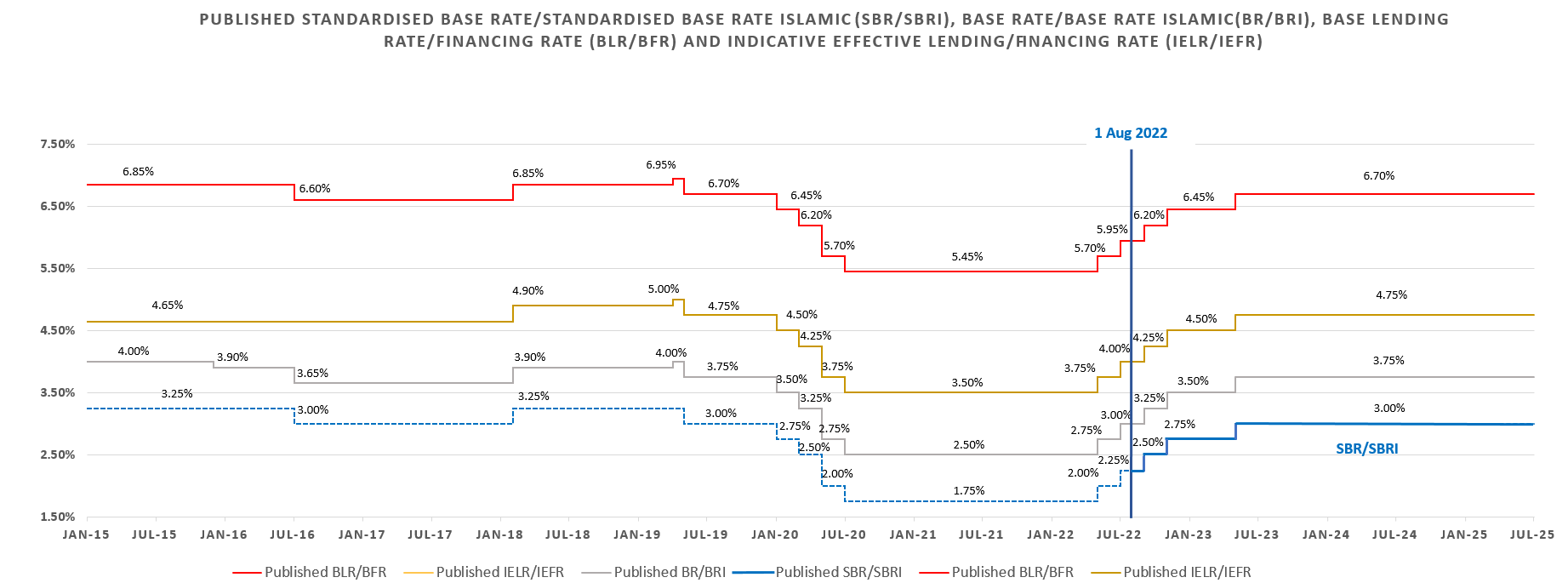

Rujukan / Reference:

Kadar Asas Standard (KAS) / Standardised Base Rate (SBR), Kadar Asas (KA) / Base Rate (BR), Kadar Pinjaman Asas (KPA) / Base Lending Rate (BLR), Petunjuk Kadar Efektif Pinjaman (PKEP) / Indicative Effective Lending Rate (IELR)

Catatan:

Note:

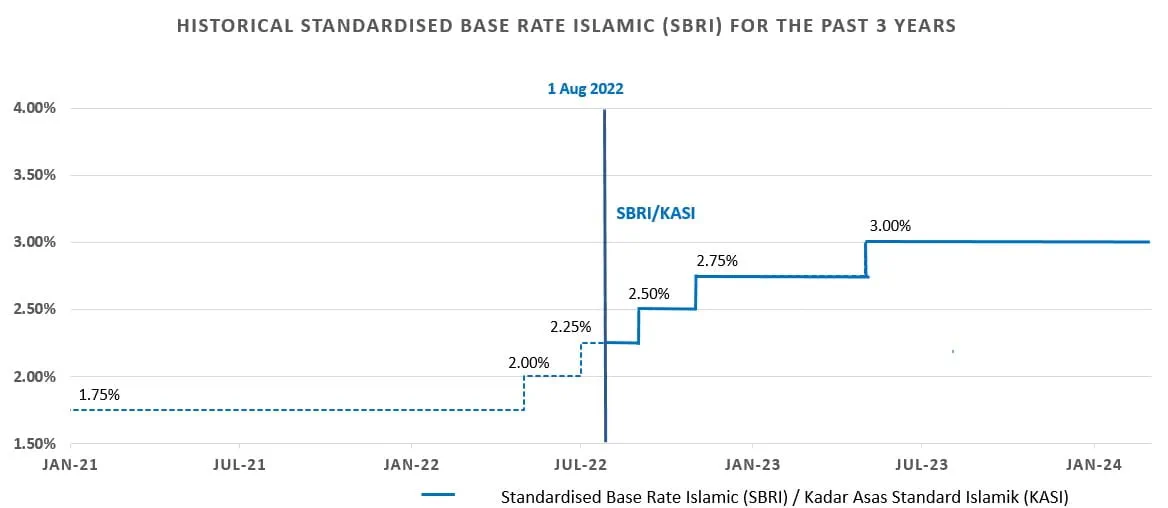

Catatan: KASI telah diperkenalkan pada 1 Ogos 2022. Garis putus-putus menunjukkan data OPR yang terdahulu, iaitu kadar penanda aras KASI.

Note: The SBRI was introduced on 1 August 2022. The dotted line shows the historical series of the OPR, which is the benchmark rate of the SBRI.