Islamic SILX is a Shariah-compliant and principal-protected structured investment product primarily based on the Islamic concepts of Musawamah, Wa’d, Commodity Murabahah, Ibra’, and Wakalah that delivers principal protection and returns.

This structured product to be offered to Retail and Wholesale Investors with the following features:

This product will provide investors access to global multi-asset classes and investment strategies tied to the underlying performance of a reference index, with a maturity of between three to ten years.

Through the product, institutional investors can benefit from portfolio diversification which includes proprietary multi-asset indices with Environmental, Social, and Governance considerations, foreign exchange, commodities, and other global indices, in addition to traditional cash assets such as equities and fixed income.

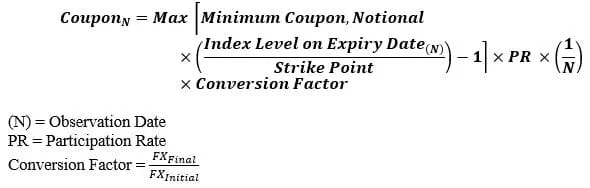

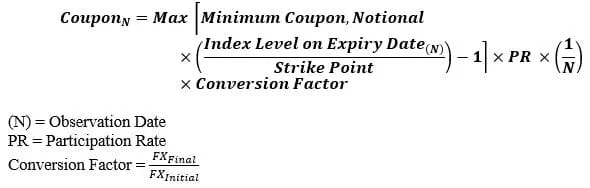

Single or series of Undertaking to enter into CM (Options) benchmark against reference index level. The Islamic SILX returns are derived from amount received from Undertaking to enter into CM (options). The Undertaking to enter into CM (options) will provide returns via referencing the index’s level on expiry date of the Undertaking to enter into CM (options) based on the following payoff conditions:

This product may be suitable for clients who:

Islamic SILX can be structured as the following example:

| Currency | MYR | ||||||

| Principal / Notional Amount | MYR 100,000.00 | ||||||

| Tenor | 24 Months | ||||||

| Underlying Index | [Example Bank Of America FX & Commodities Alpha Basket] | ||||||

| Coupon (N) |  |

||||||

| Minimum Coupon | 0% | ||||||

| Strike Point | 100%, being the initial reference level of the Index | ||||||

| Participation Rate | 120% | ||||||

| Conversion Factor | Not applicable due to same currency (to use 1.00 value) | ||||||

| Coupon Payment Frequency | Annual | ||||||

| Observation Dates |

|

The following scenarios are meant for illustration purposes.

| Observation Date | 12 months |

| N | 1 |

| Index Level @ N=1 | 98.00% |

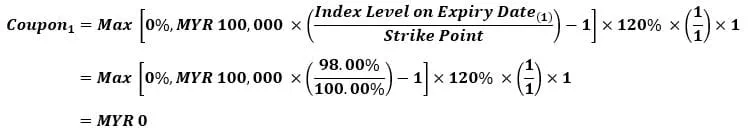

The index level on 1st Observation date is lower than Strike Point (i.e. 100%). Hence, investor will not receive any coupon on the 1st Observation Date.

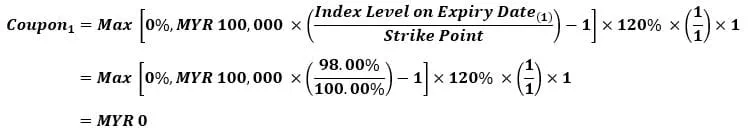

The calculation of coupon will be as the following:

| Observation Date | 24 months |

| N | 2 |

| Index Level @ N=2 | 118.52% |

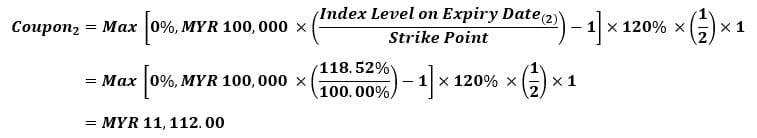

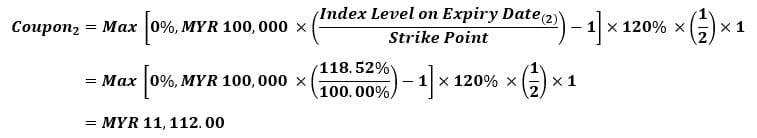

The index level on 2nd Observation date is higher than Strike Point (i.e. 100%). Hence, investor will receive MYR 11,112.00 as coupon/profit on the 2nd Observation Date. (Refer Appendix 1 for illustration of Payoff graph).

The calculation of coupon will be as the following:

If Investor early terminates after 1 year, the actual amount to be returned to investor will be adjusted for any unwinding cost payable arising from early termination. The investor may receive an amount less than their initial investment amount depending on unwinding cost.

| Early termination date | 12 months after placement date |

| Investment amount | MYR100,000 |

| Unwinding Cost (The cost of terminating, liquidating, or re-establishing any hedge or trading position related to the embedded reference options) |

(MYR2,300) |

| Total amount redeemed (MYR100,000 – MYR2,300) | MYR97,700 |

* The actual amount to be returned to the Investor due to deduction on unwinding costs will always be paid in the Base Currency.

PLEASE TAKE NOTE:

The above simulations are being provided for illustrative purposes only and are not a forecast or indication of any expectation or performance. It does not represent actual termination or unwind cost that may be available to you. It does not present all possible outcomes or describe all factors that may affect the value of the transaction.

Product Highlight Sheet - Islamic SILX

Term Sheet - Islamic SILX

Index Risk Disclosure - Islamic SILX

Islamic SILX can be structured as the following example:

| Currency | MYR | ||||||

| Principal / Notional Amount | MYR 100,000.00 | ||||||

| Tenor | 24 Months | ||||||

| Underlying Index | [Example Bank Of America FX & Commodities Alpha Basket] | ||||||

| Coupon (N) |  |

||||||

| Minimum Coupon | 0% | ||||||

| Strike Point | 100%, being the initial reference level of the Index | ||||||

| Participation Rate | 120% | ||||||

| Conversion Factor | Not applicable due to same currency (to use 1.00 value) | ||||||

| Coupon Payment Frequency | Annual | ||||||

| Observation Dates |

|

The following scenarios are meant for illustration purposes.

| Observation Date | 12 months |

| N | 1 |

| Index Level @ N=1 | 98.00% |

The index level on 1st Observation date is lower than Strike Point (i.e. 100%). Hence, investor will not receive any coupon on the 1st Observation Date.

The calculation of coupon will be as the following:

| Observation Date | 24 months |

| N | 2 |

| Index Level @ N=2 | 118.52% |

The index level on 2nd Observation date is higher than Strike Point (i.e. 100%). Hence, investor will receive MYR 11,112.00 as coupon/profit on the 2nd Observation Date. (Refer Appendix 1 for illustration of Payoff graph).

The calculation of coupon will be as the following:

If Investor early terminates after 1 year, the actual amount to be returned to investor will be adjusted for any unwinding cost payable arising from early termination. The investor may receive an amount less than their initial investment amount depending on unwinding cost.

| Early termination date | 12 months after placement date |

| Investment amount | MYR100,000 |

| Unwinding Cost (The cost of terminating, liquidating, or re-establishing any hedge or trading position related to the embedded reference options) |

(MYR2,300) |

| Total amount redeemed (MYR100,000 – MYR2,300) | MYR97,700 |

* The actual amount to be returned to the Investor due to deduction on unwinding costs will always be paid in the Base Currency.

PLEASE TAKE NOTE:

The above simulations are being provided for illustrative purposes only and are not a forecast or indication of any expectation or performance. It does not represent actual termination or unwind cost that may be available to you. It does not present all possible outcomes or describe all factors that may affect the value of the transaction.

Product Highlight Sheet - Islamic SILX

Term Sheet - Islamic SILX

Index Risk Disclosure - Islamic SILX

Please fill in the fields below so we can get in touch with you.

You are about to enter a third party website and RHB Banking Group's privacy policy will cease to apply.

This link is provided for your convenience only, and shall not be considered or construed as an endorsement or verification of such linked website or its contents by RHB Banking Group.

RHB Banking Group also makes no warranties as to the status of this link or information contained in the website you are about to access.

PIDM Membership Representation

You are about to enter a third party website and RHB Banking Group's privacy policy will cease to apply.

This link is provided for your convenience only, and shall not be considered or construed as an endorsement or verification of such linked website or its contents by RHB Banking Group.

RHB Banking Group also makes no warranties as to the status of this link or information contained in the website you are about to access.

We used cookies to improve your experience on our website. By continuing to use our website and/or accepting this message, you agree to our use of cookies. Please refer to our Privacy Policy for more information.