.jpg)

.jpg)

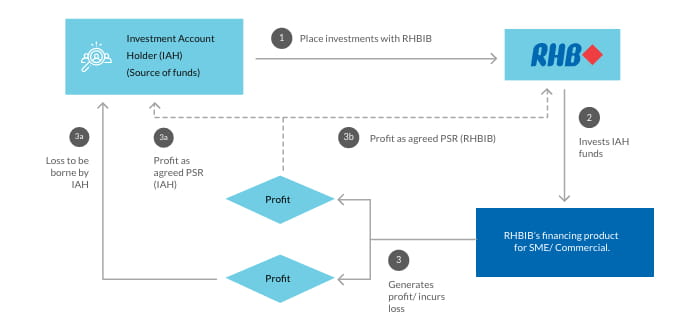

“Restricted Investment Account-i" or “RIA-i” is a type of restricted investment account based on the Mudarabah contract where the

Investment Account Holder (IAH) and RHB Islamic Bank (Bank) agree to share the profit generated from the assets funded by the RIA-i

based on an agreed profit sharing ratio (PSR), while losses shall be borne by the IAH.

Key Features

| Step | Explanation |

| 1 | RHBIB approved a financing deal to be funded via RIA-i and source for the funds through respective channel (e.g. Investment Account Platform (IAP)) |

| 2 | Investment Account Holder (IAH) or the provider of capital places fund in Investment Account with RHBIB. |

| 3 | RHBIB as the entrepreneur (mudarib) accepts the funds from the IAH based on Mudarabah concept and invest/ channelled the fund to selected SMEs to finance their requirements for working capital or capital expenditures. The profit between IAH and the Bank is determined based on the Profit Sharing Ratio (PSR) at inception. |

| 3 a) & b) | Profit generated (if any) from the business activities will be shared between IAH and RHBIB according to the agreed PSR. The profit is calculated on daily basis. Profit will be credited into IAH’s account based on the payment structure of the tagged financing. |

| 3 c) |

Losses (if any) will solely be borne by the IAH unless such losses are due to RHBIB’s misconduct, negligence or breach of specified terms in the contract. |

1. What is Investment Account (IA)?

Investment Account is defined by the application of Shariah contracts with non-principal guarantee feature for the purpose of investment. Investment account divided into 2 types namely Restricted Investment Account (RA) and Unrestricted Investment Account (UA).

Restricted Investment Account (RA) refers to a type of investment account where the IAH provides a specific investment mandate to the IFI such as purpose, asset class, economic sector and period for investment.

Unrestricted Investment Account (UA) refers to a type of investment account where the IAH provides the IFI with the mandate to make the ultimate investment decision without specifying any particular restrictions or conditions.

2. What is Restricted Investment Account-i (RIA-i)?

RIA-i is a type of restricted investment account based on the Mudarabah contract where the Investment Account Holder (IAH) and RHB Islamic Bank (Bank) agree to share the profit generated from the assets funded by the RIA-i based on an agreed profit sharing ratio (PSR), while losses shall be borne by the IAH.

3. What is shariah concept of Mudharabah?

Mudarabah is a contract between a capital provider (rabbul mal) and an entrepreneur (mudarib) under which the rabbul mal provides capital to be managed by the mudarib and any profit generated from the capital is shared between the rabbul mal and mudarib according to a mutually agreed profit sharing ratio (PSR) whilst financial losses are borne by the rabbul mal provided that such losses are not due to the mudarib’s misconduct (ta`addi), negligence (taqsir) or breach of specified terms (mukhalafah al-shurut).

4. What is shariah concept of Mudharabah?

Key salient features are:

| Investment Objective | To finance selected commercial or SME clients who require working capital and funding for capital expenditure in expanding their businesses. |

| Investment Strategy | The fund will be invested in a specific asset to the investment funds via matched tagging. |

| Risk Assessment on the Performance of the Investment Assets | Via management of the underlying asset portfolio and quarterly performance reports of the investment fund. |

| Profit Payment Frequency |

Profit will be paid monthly within 15 working days after receiving instalment payment from the Financing Customers. |

| Profit Payment Method |

Payment of profit and principal will be credited into IAH’s affiliate account maintain with the Bank. |

| Key Terms and Conditions |

Redemption by IAH is allowed only upon maturity of the relevant underlying asset. For the purpose of redemption at maturity of the underlying asset, the principal and profit will be credited into IAH’s affiliate account maintained with the Bank. The RIA-i will be zerorised during the final payment of the principal and profit.

Reinvestment is not allowed under RIA-i. |

5. What is minimum investment amount for RIA-i?

RM10,000.00 (the amount may vary on case to case basis).

6. Is RIA-i protected under PIDM?

RIA-i is not protected under PIDM

1. How can I obtain the information relating to the investment project for RIA-i?

IAP may obtain from IAPlatform and/or RHB Group website. The IAPlatform can be login at https://iaplatform.com and RHB website can be login at https://www.rhbgroup.com

2. What is the pre requisite requirement to perform the investment?

Investor is required to perform Customer Suitability Assessment prior to perform the investment in RIA-i. Only investor who are match it risk profile with the investment’s risk profile will be able to proceed with the investment. In the event the risk profile is not matched and investor wants to invest in particular investment project of RIA-i, investor is required to fill in Investor’s Declaration Form.

3. How to subscribe for an investment project under RIA-i?

Investor will require to register for an account in IAPlatform. The investor will be informed from time to time on new investment project floated in IAPlatform.

4. Is there any investment window?

Investor is required to subscribe and perform the placement within campaign period. Campaign period may vary subject to each investment project. However, the campaign period will be closed upon full subscription.

5. How do I make an investment placement?

Investor is required to go to any of RHB’s branches and open the following accounts:

a. RIA-i Account for investment purposes

b. Current & Saving Account / Affiliate Account for the purpose of principal and/or profit payment (for new RHBIB customer only)

6. What is the document required for account opening?

Investor is required to furnish the following:

Individual

a. IAP Confirmation Slip

b. Mykad / MyTentera / MyPR / Army ID / Police ID

Non-Individual

a. IAP Confirmation Slip

b. Business / Organisation Registration Number

c. Board of Directors’ Resolution

Note: IAP Confirmation slip will be given to investor upon subscription in IAPlatform.

1. How do I know the performance of the investment?

The performance of the investment will be published via Fund Performance Report on quarterly basis. The Fund Performance Report will be sent to respective investor’s email or any other written medium of communication that will be determined by RHBIB from time to time. Investor may request Fund Performance Report by ad-hoc basis at RM50 per request.

2. What are the fees and charges involved?

| No. | Items | Amount |

| 1. | Stamp duty on RIA-i agreement/ documents |

RM10 nominal fee per document. |

| 2. | Processing Fee |

No Charges |

| 3. | Ad-hoc Fund Performance Report |

RM50 per request. |

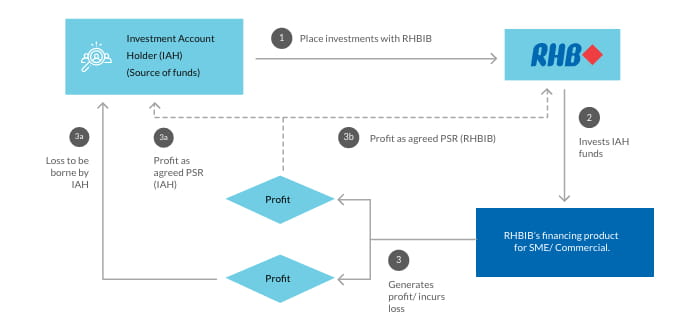

| Step | Explanation |

| 1 | RHBIB approved a financing deal to be funded via RIA-i and source for the funds through respective channel (e.g. Investment Account Platform (IAP)) |

| 2 | Investment Account Holder (IAH) or the provider of capital places fund in Investment Account with RHBIB. |

| 3 | RHBIB as the entrepreneur (mudarib) accepts the funds from the IAH based on Mudarabah concept and invest/ channelled the fund to selected SMEs to finance their requirements for working capital or capital expenditures. The profit between IAH and the Bank is determined based on the Profit Sharing Ratio (PSR) at inception. |

| 3 a) & b) | Profit generated (if any) from the business activities will be shared between IAH and RHBIB according to the agreed PSR. The profit is calculated on daily basis. Profit will be credited into IAH’s account based on the payment structure of the tagged financing. |

| 3 c) |

Losses (if any) will solely be borne by the IAH unless such losses are due to RHBIB’s misconduct, negligence or breach of specified terms in the contract. |

1. What is Investment Account (IA)?

Investment Account is defined by the application of Shariah contracts with non-principal guarantee feature for the purpose of investment. Investment account divided into 2 types namely Restricted Investment Account (RA) and Unrestricted Investment Account (UA).

Restricted Investment Account (RA) refers to a type of investment account where the IAH provides a specific investment mandate to the IFI such as purpose, asset class, economic sector and period for investment.

Unrestricted Investment Account (UA) refers to a type of investment account where the IAH provides the IFI with the mandate to make the ultimate investment decision without specifying any particular restrictions or conditions.

2. What is Restricted Investment Account-i (RIA-i)?

RIA-i is a type of restricted investment account based on the Mudarabah contract where the Investment Account Holder (IAH) and RHB Islamic Bank (Bank) agree to share the profit generated from the assets funded by the RIA-i based on an agreed profit sharing ratio (PSR), while losses shall be borne by the IAH.

3. What is shariah concept of Mudharabah?

Mudarabah is a contract between a capital provider (rabbul mal) and an entrepreneur (mudarib) under which the rabbul mal provides capital to be managed by the mudarib and any profit generated from the capital is shared between the rabbul mal and mudarib according to a mutually agreed profit sharing ratio (PSR) whilst financial losses are borne by the rabbul mal provided that such losses are not due to the mudarib’s misconduct (ta`addi), negligence (taqsir) or breach of specified terms (mukhalafah al-shurut).

4. What is shariah concept of Mudharabah?

Key salient features are:

| Investment Objective | To finance selected commercial or SME clients who require working capital and funding for capital expenditure in expanding their businesses. |

| Investment Strategy | The fund will be invested in a specific asset to the investment funds via matched tagging. |

| Risk Assessment on the Performance of the Investment Assets | Via management of the underlying asset portfolio and quarterly performance reports of the investment fund. |

| Profit Payment Frequency |

Profit will be paid monthly within 15 working days after receiving instalment payment from the Financing Customers. |

| Profit Payment Method |

Payment of profit and principal will be credited into IAH’s affiliate account maintain with the Bank. |

| Key Terms and Conditions |

Redemption by IAH is allowed only upon maturity of the relevant underlying asset. For the purpose of redemption at maturity of the underlying asset, the principal and profit will be credited into IAH’s affiliate account maintained with the Bank. The RIA-i will be zerorised during the final payment of the principal and profit.

Reinvestment is not allowed under RIA-i. |

5. What is minimum investment amount for RIA-i?

RM10,000.00 (the amount may vary on case to case basis).

6. Is RIA-i protected under PIDM?

RIA-i is not protected under PIDM

1. How can I obtain the information relating to the investment project for RIA-i?

IAP may obtain from IAPlatform and/or RHB Group website. The IAPlatform can be login at https://iaplatform.com and RHB website can be login at https://www.rhbgroup.com

2. What is the pre requisite requirement to perform the investment?

Investor is required to perform Customer Suitability Assessment prior to perform the investment in RIA-i. Only investor who are match it risk profile with the investment’s risk profile will be able to proceed with the investment. In the event the risk profile is not matched and investor wants to invest in particular investment project of RIA-i, investor is required to fill in Investor’s Declaration Form.

3. How to subscribe for an investment project under RIA-i?

Investor will require to register for an account in IAPlatform. The investor will be informed from time to time on new investment project floated in IAPlatform.

4. Is there any investment window?

Investor is required to subscribe and perform the placement within campaign period. Campaign period may vary subject to each investment project. However, the campaign period will be closed upon full subscription.

5. How do I make an investment placement?

Investor is required to go to any of RHB’s branches and open the following accounts:

a. RIA-i Account for investment purposes

b. Current & Saving Account / Affiliate Account for the purpose of principal and/or profit payment (for new RHBIB customer only)

6. What is the document required for account opening?

Investor is required to furnish the following:

Individual

a. IAP Confirmation Slip

b. Mykad / MyTentera / MyPR / Army ID / Police ID

Non-Individual

a. IAP Confirmation Slip

b. Business / Organisation Registration Number

c. Board of Directors’ Resolution

Note: IAP Confirmation slip will be given to investor upon subscription in IAPlatform.

1. How do I know the performance of the investment?

The performance of the investment will be published via Fund Performance Report on quarterly basis. The Fund Performance Report will be sent to respective investor’s email or any other written medium of communication that will be determined by RHBIB from time to time. Investor may request Fund Performance Report by ad-hoc basis at RM50 per request.

2. What are the fees and charges involved?

| No. | Items | Amount |

| 1. | Stamp duty on RIA-i agreement/ documents |

RM10 nominal fee per document. |

| 2. | Processing Fee |

No Charges |

| 3. | Ad-hoc Fund Performance Report |

RM50 per request. |

Please fill in the fields below so we can get in touch with you.

You are about to enter a third party website and RHB Banking Group's privacy policy will cease to apply.

This link is provided for your convenience only, and shall not be considered or construed as an endorsement or verification of such linked website or its contents by RHB Banking Group.

RHB Banking Group also makes no warranties as to the status of this link or information contained in the website you are about to access.

PIDM Membership Representation

You are about to enter a third party website and RHB Banking Group's privacy policy will cease to apply.

This link is provided for your convenience only, and shall not be considered or construed as an endorsement or verification of such linked website or its contents by RHB Banking Group.

RHB Banking Group also makes no warranties as to the status of this link or information contained in the website you are about to access.

We used cookies to improve your experience on our website. By continuing to use our website and/or accepting this message, you agree to our use of cookies. Please refer to our Privacy Policy for more information.