With effect from 1 January 2026

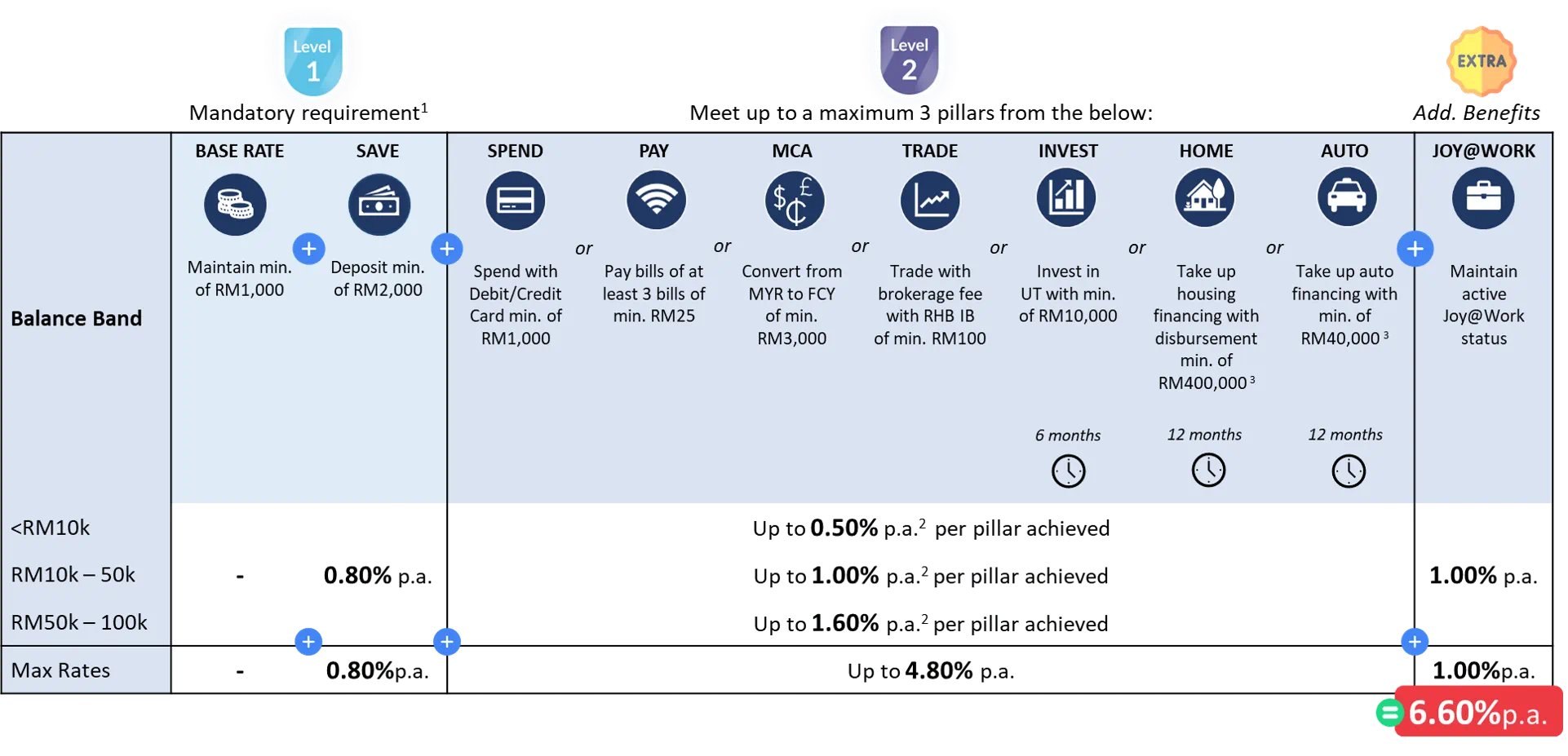

1Mandatory requirement to unlock for other bonus payouts to qualify for level 2

With effect from 1 January 2026

1Mandatory requirement to unlock for other bonus payouts to qualify for level 2

Cashback

0.5% on overseas transaction

Benefits

Issuance Fee

RM12.00

Annual Fee

RM12.00

RHB Smart Account and RHB Smart Account-i are accounts that reward a customer based on the banking transactions that the customer performs (“Account”).

RHB Smart Account is a conventional current account, whereas, RHB Smart Account-i is an Islamic current account under the Commodity Murabahah (cost plus profit) via Tawarruq Arrangement concept.

The Account is available to all Residents and Non Residents, aged 18 years and above and under single name only. Joint account is not allowed for this Account.

Yes, the minimum initial deposit is RM1,000.

There are 2 options available to earn from the account:

Formula of calculation for Monthly Average Balance (“MAB”)

= Total Daily End Balance

Actual Number of Days for the Month

BONUS Interest/Profit Rate

*Customers who increased on their balances of more than RM1,000 compared to previous month to entitle for an additional 0.20% p.a.

*Note: Interest/ profit rate is subject to changes.

The requirements are as follows:

Bonus Rates:

The requirements are as follows:

The requirements are as follows:

The requirements are as follows:

More details may refers to RHB Personal Banking Standard Terms & Conditions – RHB Smart Account/-i.

Bonus Rates:

Loyalty Points:

More details may refers to RHB Personal Banking Standard Terms & Conditions – RHB Smart Account/-i.

In order to enjoy PAY Bonus Rate, you must meet SAVE criteria as per below first before you are entitled for the PAY Bonus rate:-

Yes, included under PAY Bonus Rate

Yes, spend made under JomPAY of the Credit Card’s Accountholder are included under SPEND Bonus Rate.

Overdraft facility is NOT available for this Account.

Cheque book facility is available upon request and subject to cheque book Terms and Conditions.

No. You can only maintain one (1) Account at any one time, either RHB Smart Account or RHB Smart Account-i.

Yes. Only RHB Smart Account can be tagged to conventional RHB Debit Card and RHB Smart Account-i can be linked to RHB Islamic Debit Card-i.

Monthly Account Statement for this Account can be viewed via RHB Online Banking.

Yes. Please refer to RHB Bank and/or RHB Islamic Bank’ Standard Fee & Service Charges

You can contact our Customer Care Centre at 03-9206 8118