In today’s complex business landscape, companies face a multitude of challenges, including environmental, social, and governance (ESG) issues. These non-financial factors can significantly impact a company’s success. However, it’s unrealistic for any organization to address every issue equally. Instead, businesses must prioritize their efforts by identifying and focusing on material issues—those that are most significant or critical to their operations.

What is Materiality Assessment?

Materiality assessment plays a crucial role in this process as it is the most effective way of determining which ESG issues are most important for organization. By adopting this, companies can ensure that their resources are directed toward addressing the most relevant and impactful issues. Whether you’re an accountant or a business leader, understanding materiality helps guide decision-making and ensures that the company remains aligned with its core objectives.

Materiality Assessment looking at various factors through two lenses: importance of ESG issues to the organization and to the stakeholders.

Importance to the organization:

Companies evaluate how significant an ESG issue is in the context of their operations. Is it directly tied to their success? Does it impact their bottom line or long-term sustainability?

Importance to the stakeholder:

Materiality also considers the importance of an issue to stakeholders. Who are the key players affected by this issue? Investors, employees, customers, or the broader community?

In assessing materiality, consider both the severity of an ESG issue and the likelihood of its occurrence to prioritize preventive measures effectively.

How to Conduct Materiality Assessment?

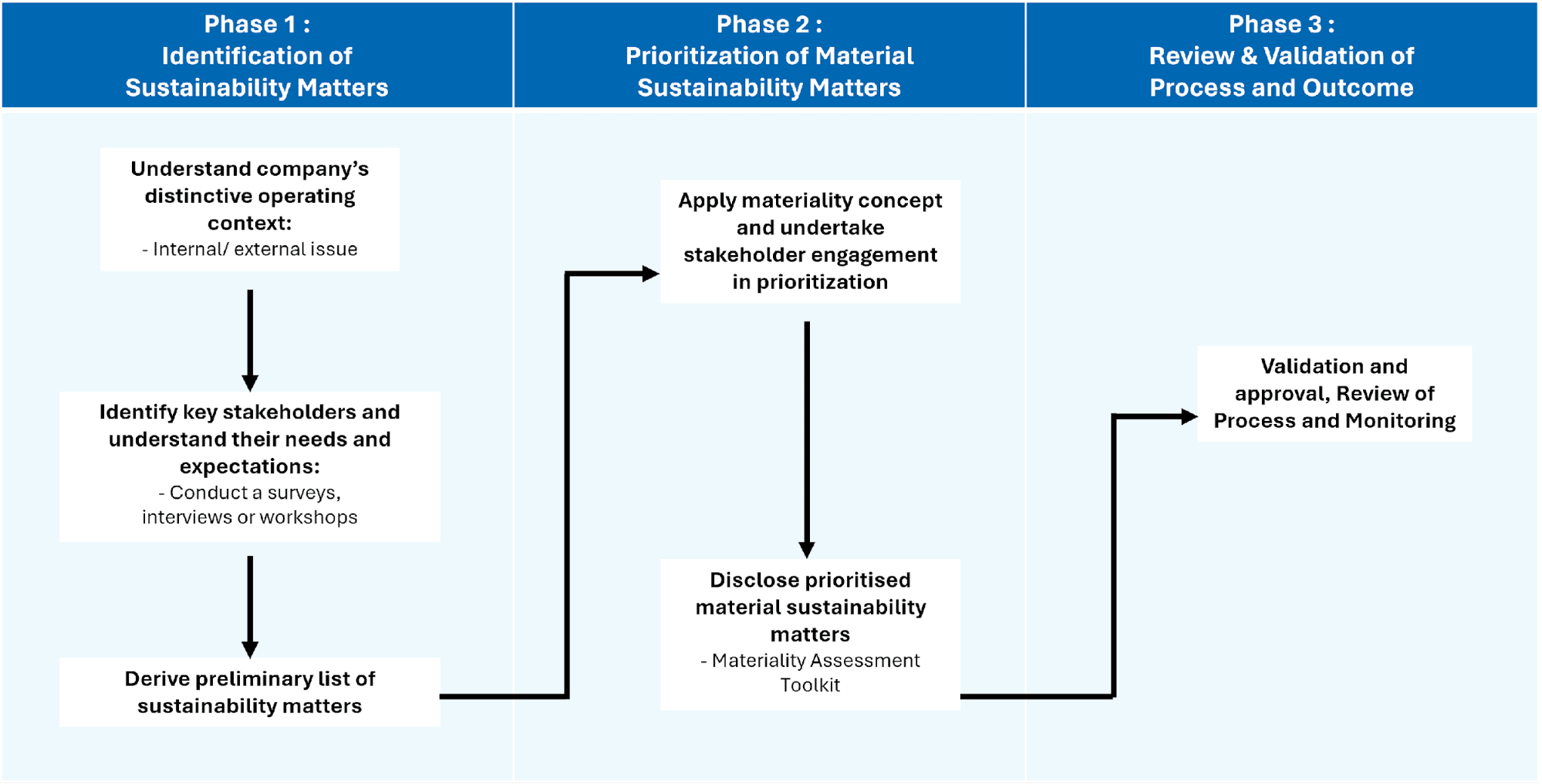

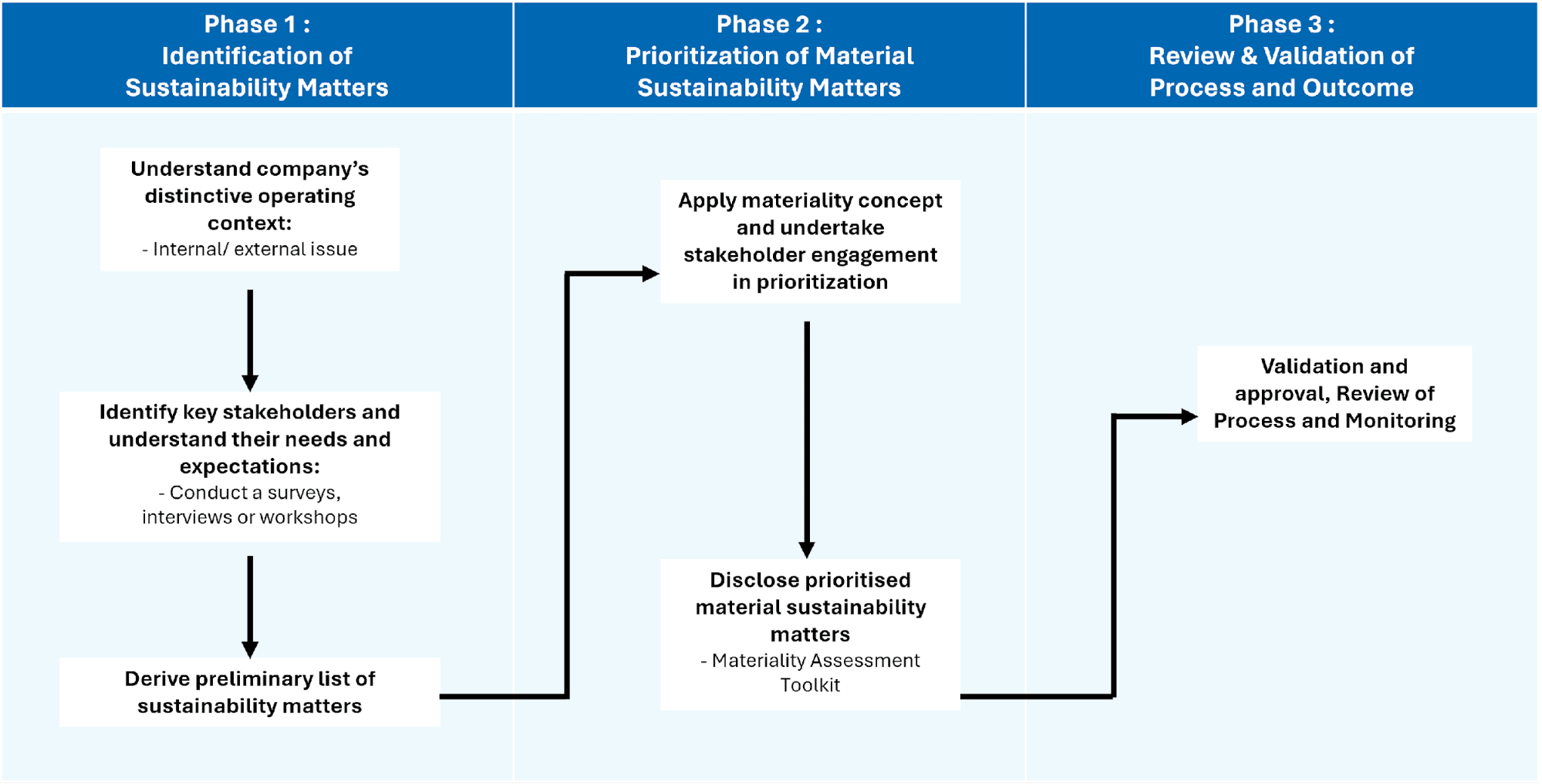

Identification of Sustainability Matters

During the initial phase of materiality assessment, the primary objective is to identify the sustainability matters that hold true significance for the business. The philosophy of Environmental, Social, and Governance (ESG) centers around stakeholders—the individuals and groups impacted by the company’s actions. Therefore, engaging with stakeholders is not only valuable but essential. While board directors are important stakeholders, their viewpoints alone do not encompass the entire spectrum of stakeholder interests. Relying solely on internal or senior management perspectives may inadvertently limit the accuracy of the assessment.

Prioritization of Sustainability Matters

During this phase, your company evaluates the relative importance or materiality of the sustainability matters identified in the initial phase. Consider two critical factors:

Review & Validation of Process and Outcome

After prioritization, the organization should develop and conduct relevant review and validation exercises. This step ensures accountability and validates the outcomes of the materiality assessment.

Click here to read more about Materiality Assessment.

You are about to enter a third party website and RHB Banking Group's privacy policy will cease to apply.

This link is provided for your convenience only, and shall not be considered or construed as an endorsement or verification of such linked website or its contents by RHB Banking Group.

RHB Banking Group also makes no warranties as to the status of this link or information contained in the website you are about to access.

PIDM Membership Representation

You are about to enter a third party website and RHB Banking Group's privacy policy will cease to apply.

This link is provided for your convenience only, and shall not be considered or construed as an endorsement or verification of such linked website or its contents by RHB Banking Group.

RHB Banking Group also makes no warranties as to the status of this link or information contained in the website you are about to access.

We used cookies to improve your experience on our website. By continuing to use our website and/or accepting this message, you agree to our use of cookies. Please refer to our Privacy Policy for more information.