With effect from 1 January 2026

With effect from 1 January 2026

Cashback

0.5% on overseas transaction

Benefits

Issuance Fee

RM15.00

Annual Fee

RM12.00

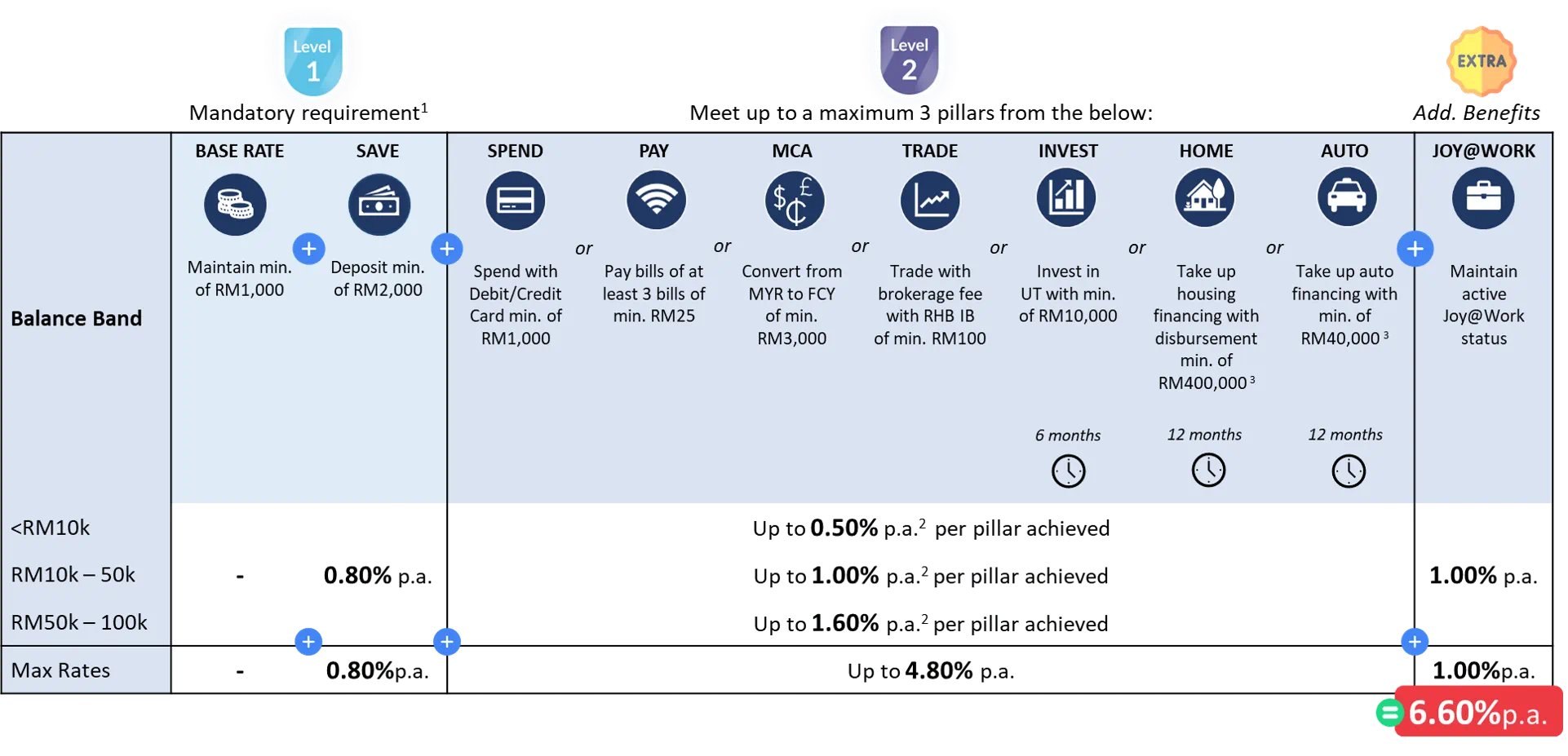

RHB Smart Account and RHB Smart Account-i are accounts that reward a customer based on the banking transactions that the customer performs (“Account”).

RHB Smart Account is a conventional current account, whereas, RHB Smart Account-i is an Islamic current account under the Commodity Murabahah (cost plus profit) via Tawarruq Arrangement concept.

There are 2 options available to earn from the account:

BONUS Interest/Profit Rate

*Customers who increased on their balances of more than RM1,000 compared to previous month to entitle for an additional 0.20% p.a.

*Note: Interest/ profit rate is subject to changes.

The requirements are as follows:

Bonus Rates:

The requirements are as follows:

The requirements are as follows:

The requirements are as follows:

More details may refers to RHB Personal Banking Standard Terms & Conditions – RHB Smart Account/-i.

Bonus Rates:

Loyalty Points:

More details may refers to RHB Personal Banking Standard Terms & Conditions – RHB Smart Account/-i.

In order to enjoy PAY Bonus Rate, you must meet SAVE criteria as per below first before you are entitled for the PAY Bonus rate:-