Qard Multi Currency Current Account-i is based on the Shariah contract of Qard.

Qard refers to a contract of lending money by a lender (customer) to a borrower (bank) where the latter is bound to repay an equivalent replacement amount to the lender.

Manage a diversified currency portfolio in Malaysia with ability for conversion from one foreign currency to another foreign currency.

Enjoy a world of banking features and solutions anytime, anywhere such as managing your finances, paying bills, transfer funds and more.

All buying and selling of foreign currencies can be performed anytime, anywhere via RHB Online Banking or at any RHB branch.

Minimize the risk of currency fluctuations with up to 33 foreign currencies available.

Avoid double conversions for receivables and remittances to and from other countries.

|

US Dollar (USD) |

|

Euro (EUR) |

|

Singapore Dollar (SGD) |

|

New Zealand Dollar (NZD) |

|

Indonesia Rupiah (IDR) |

|

Chinese Renminbi (CNY) |

|

Japanese Yen (JPY) |

|

Australian Dollar (AUD) |

|

Swiss Franc (CHF) |

|

South African Rand (ZAR) |

|

Arab Emirates Dirham (AED) |

|

Brunei Dollar (BND) |

|

Pound Sterling (GBP) |

|

Hong Kong Dollar (HKD) |

|

Canadian Dollar (CAD) |

|

Thai Baht (THB) |

|

Saudi Riyal (SAR) |

|

Bangladeshi Taka (BDT) |

|

Pakistani Rupee (PKR) |

|

Philippine Peso (PHP) |

|

Qatar Riyal (QAR) |

|

Danish Krone (DKK) |

|

Norwegian Krone (NOK) |

|

Swedish Krona (SEK) |

|

Jordanian Dinar (JOD) |

|

Cambodian Riel (KHR) |

|

Bahraini Dinar (BHD) |

|

Indian Rupee (INR) |

|

Vietnamese Dong (VND) |

|

Turkish Lira (TRY) |

|

Mexican Peso (MXN) |

|

Polish Zloty (PLN) |

|

Korean Won (KRW) |

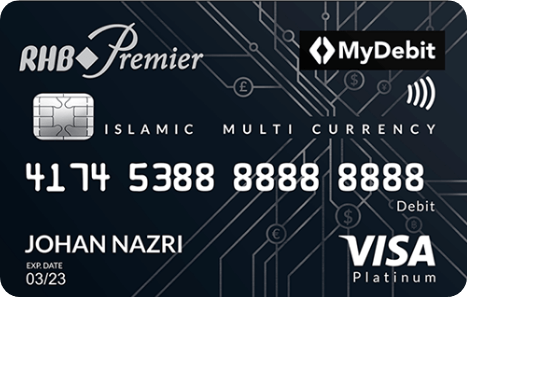

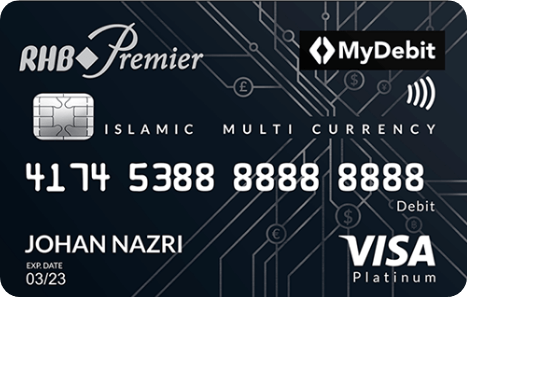

Do you have Multi Currency Visa Debit Card/-i?

Conversion Fee: 0.00 MYR

Updated Date:

The rates quoted are indicative exchange rates and used for informational purposes only. Check out the latest Multi Currency Account conversion rates.

For resident/non-resident individuals to:

For resident/non-resident individuals to:

To open a Qard Multi Currency Current Account-i, it is compulsory to open a Ringgit Savings or Current Account-i.

All buying and selling of foreign currencies and precious metals can be performed via RHB Online Banking or at any RHB branch.

Provide the relevant enrolment letter from an educational institution.

Please share your details and we’ll get back to you. Or download our QMS app to make an appointment at your preferred branch. Learn More.

You are about to enter a third party website and RHB Banking Group's privacy policy will cease to apply.

This link is provided for your convenience only, and shall not be considered or construed as an endorsement or verification of such linked website or its contents by RHB Banking Group.

RHB Banking Group also makes no warranties as to the status of this link or information contained in the website you are about to access.

PIDM Membership Representation

You are about to enter a third party website and RHB Banking Group's privacy policy will cease to apply.

This link is provided for your convenience only, and shall not be considered or construed as an endorsement or verification of such linked website or its contents by RHB Banking Group.

RHB Banking Group also makes no warranties as to the status of this link or information contained in the website you are about to access.

We used cookies to improve your experience on our website. By continuing to use our website and/or accepting this message, you agree to our use of cookies. Please refer to our Privacy Policy for more information.