Dependable range of plans that provide extensive coverage.

Choose what suits you.

Solid, reliable and affordable plans up for offer.

Choose what suits you.

Renovations. Furnishings. Improvements. Tips & Guides.

Enjoy greater access to new possibilities

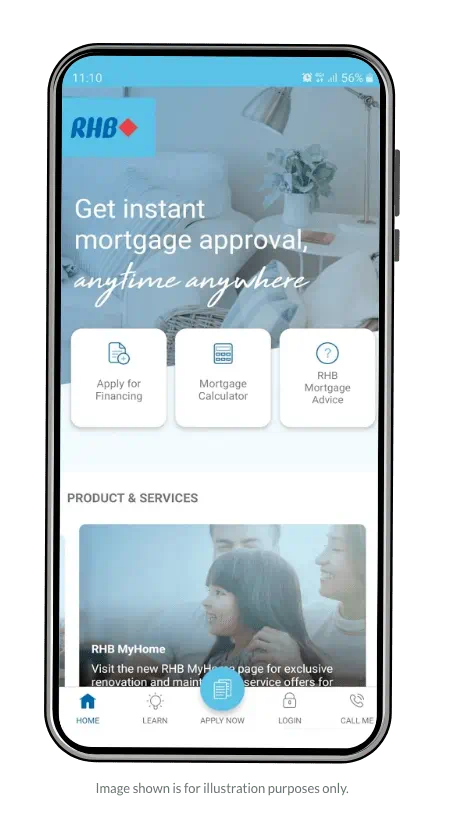

Say hello to the all-in-one space for your financing application.

Within just a few taps, you

can apply, track and stay updated.

Download the app today and get started

with your financing application!

Please share your details and we’ll get back to you. Or visit us at your nearest RHB Branch.