Competitive, flexible and convenient solutions at your service.

Take your pick.

Dependable solutions you can count on.

Explore what’s on offer. Get one step closer to your perfect commercial space.

Please share your details and we’ll get back to you. Or visit us at your nearest RHB Branch.

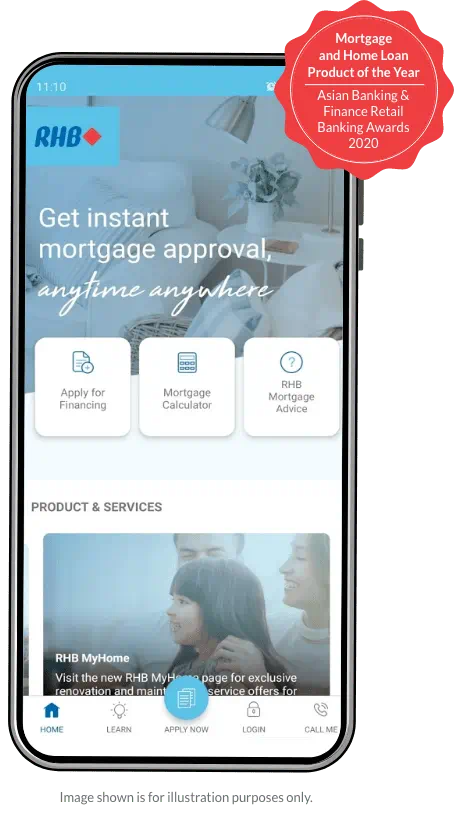

Say hello to the all-in-one space for your financing application.

Within just a few taps, you

can apply, track and stay updated.

Download the app today and get started

with your financing application!

RHB Credit Cards/-i bring you amazing deals from

our partners to pamper your car and elevate your home.